Overview

The main idea of this strategy is to profit from Monday’s intraday reversal using trend following.

Principles

The core logic is:

Check if it is Monday, if yes, continue to next steps;

Identify if an uptrend reversal pattern exists - Close[1] < Close[2] and Close[2] < Close[3];

If reversal pattern confirmed, go long at the close of 3rd bar to follow the trend;

Exit if today’s high is breached, or stop loss is hit;

Close position after 6 hours.

The strategy capitalizes on specific Monday reversal, identifies reversal patterns to go long at relative lows for profits. Stop loss in place to control risks.

Advantages

The biggest advantages are:

Profits from Monday reversals during specific periods;

Clear entry signals from reversal candlestick patterns;

Stop loss and take profit to control risks;

Trend following approach maximizes profits;

Simple and easy to understand logic;

Risks

There are some risks:

Losses if Monday reversals not significant;

Price may retrace after entry leading to stop loss;

Sudden market changes may result in large stop loss;

Holding too long may also lead to losses;

The solutions are optimizing stop loss, shortening holding time, and controlling single loss size.

Enhancements

The strategy can be improved by:

Using machine learning to identify reversals more accurately;

Optimizing stop loss strategies like trailing stop or partial stop loss;

Incorporating more factors to judge trend strength;

Dynamically adjusting holding time;

Using algorithms to find optimal parameters;

Adding position switching for two-way trading;

These can increase the win rate and profitability.

Conclusion

In conclusion, the strategy capitalizes on Monday reversals, with clear entry/exit rules, to implement a simple trend following strategy. It can achieve better results than fixed stop loss/take profit. Further optimizations are needed to address market uncertainty. The strategy provides a reference for intraday trading.

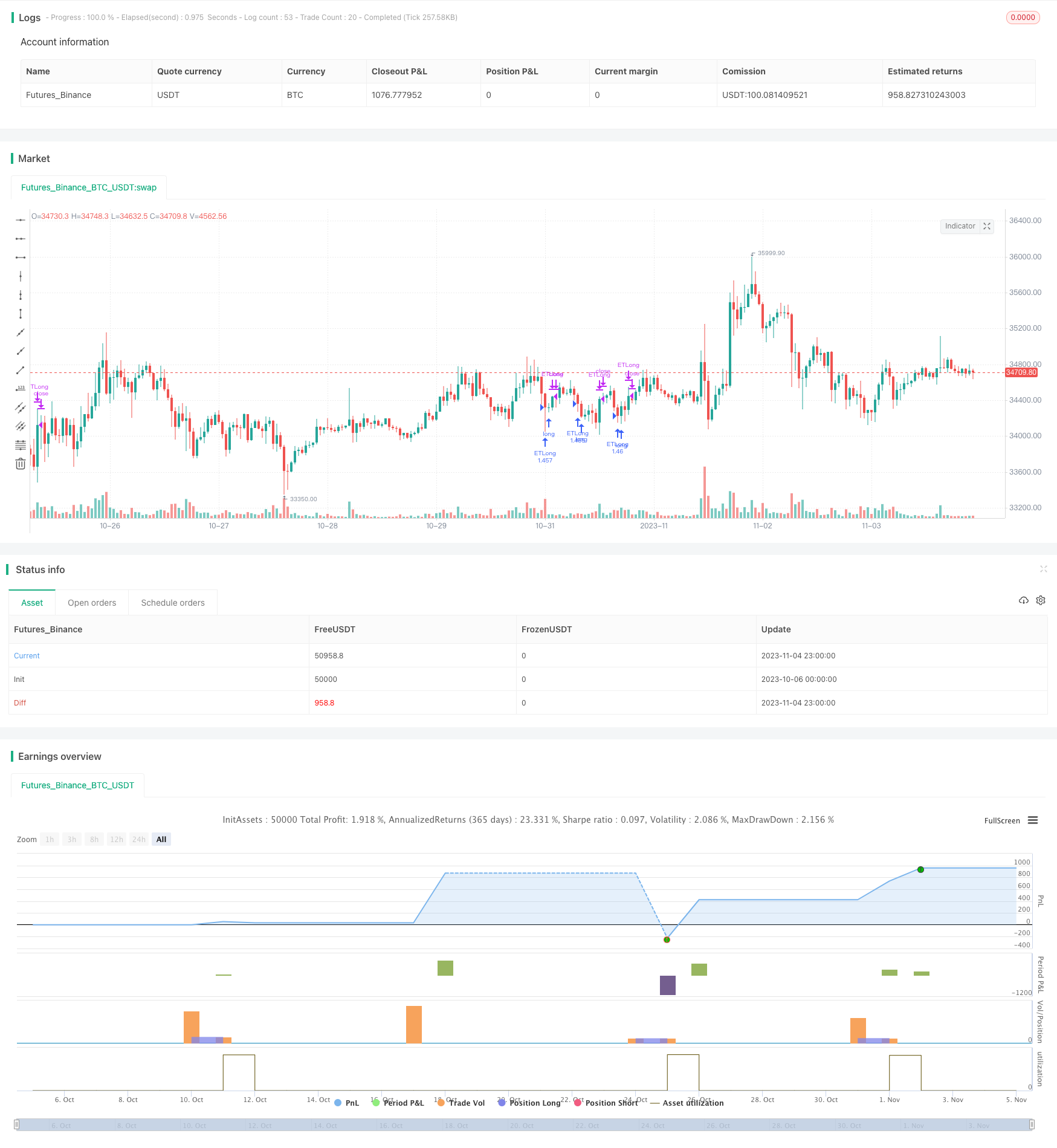

/*backtest

start: 2023-10-06 00:00:00

end: 2023-11-05 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("ET Forex TurnaroundMonday", overlay=true)

FirstYear = input(2018, minval=2000, maxval=2023, step=1)

FirstMonth = 1 //input(1, minval=1, maxval=12, step=1)

FirstDay = 1 //input(1, minval=1, maxval=31, step=1)

deltaDay = input(0)

StartHour = input(0)

f_barssince(_cond, _count) => _barssince=bar_index-valuewhen(_cond, bar_index, _count)

HoldTime = input(6, step=1)

MM = input(1)

startHour = input(-7, step=1)

endHour = input(34, step=1)

exitHour = input(30, step=1)

startdateCond = (year > FirstYear or (year == FirstYear and (month > FirstMonth or (month == FirstMonth and dayofmonth >= FirstDay))))

iHour = hour

if iHour > 19

iHour := iHour-20

else

iHour := iHour+4

timeCondition = true //(iHour>=startHour and iHour<=endHour and iHour<=exitHour)

since_flat_condition = strategy.position_size == 0

entryPrice=strategy.position_avg_price

EntryLongCondition = dayofweek == (dayofweek.monday+deltaDay) and close[0] < close[1] and close[1]<close[2] and startdateCond //and timeCondition and iHour > StartHour

ExitTimeCondition = false//(f_barssince(since_flat_condition, 0)>=HoldTime)

ExitLongCondition = strategy.position_size > 0 and (close[0] > high[1])// or close[0]< entryPrice-abs(close[1]-close[2])*0.2)//(ExitTimeCondition) //iHour >= exitHour or

strategy.initial_capital =50000

// MM Block

lots = if MM < 2

strategy.initial_capital

else

strategy.equity

lots := lots/close

entryPrice:=strategy.position_avg_price

strategy.close("ETLong",when=(ExitLongCondition==true))

strategy.entry("ETLong", strategy.long, qty=lots, comment="OpenLong",when=(EntryLongCondition==true))