Dual Moving Average Reversal Tracking System

Author: ChaoZhang, Date: 2023-11-07 16:00:33Tags:

Overview

The Dual Moving Average Reversal Tracking System integrates the 123 reversal pattern strategy and the Ichimoku strategy to identify reversal opportunities and track trends for excess returns.

Strategy Logic

The strategy consists of two sub-strategies:

- 123 Reversal Pattern Strategy

This strategy trades based on price patterns. The logic is:

-

Go long when the close price rises for two consecutive days and the 9-day slow stochastic is below 50.

-

Go short when the close price falls for two consecutive days and the 9-day fast stochastic is above 50.

It uses the breakout of previous day’s close to determine reversals and uses stochastics to filter noise.

- Ichimoku Strategy

This strategy trades based on the five lines crossover of Ichimoku. The logic is:

-

Go long when close price is above the baseline.

-

Go short when close price is below the conversion line.

Where the baseline is the midpoint of the highest high and lowest low over the past 26 days, and the conversion line is the midpoint of the highest high and lowest low over the past 9 days. It uses moving average crossovers to identify trends.

The final strategy combines the signals from the two sub-strategies, entering when both signal long or short and exiting when they disagree.

Advantage Analysis

-

Combines reversal and trend-following, flexible in catching reversals and trends.

-

123 pattern is simple and effective in identifying reversals.

-

Ichimoku parameters are optimized, with lower breakout risk.

-

Combining two different strategies can achieve optimization.

Risk Analysis

-

Reversal strategies are prone to traps and losses. Consider shorter holding periods or add stop loss to control risks.

-

Ichimoku can experience whipsaws in range-bound markets. Fine-tune parameters or add filters to reduce unnecessary trades.

-

Incompatible parameters when combining strategies may lead to too frequent or sparse signals. Require careful testing and optimization.

Optimization Directions

-

Test more indicators for better filters, e.g. incorporating volume.

-

Optimize Ichimoku parameters to fit instrument characteristics.

-

Add stop loss mechanisms, e.g. set exits based on ATR.

-

Add money management module for risk control.

-

Collect more data for robust backtesting, discover issues and iterate.

Conclusion

The Dual Moving Average Reversal Tracking System combines the strengths of reversal and trend-following strategies through optimization and combination for alpha generation. It has trading merits but risks like whipsaws and stop loss exist. We need to keep improving the logic in backtests and implement proper risk control for stability and real-world performance. Overall it provides a good approach of combining different strategies for better overall results.

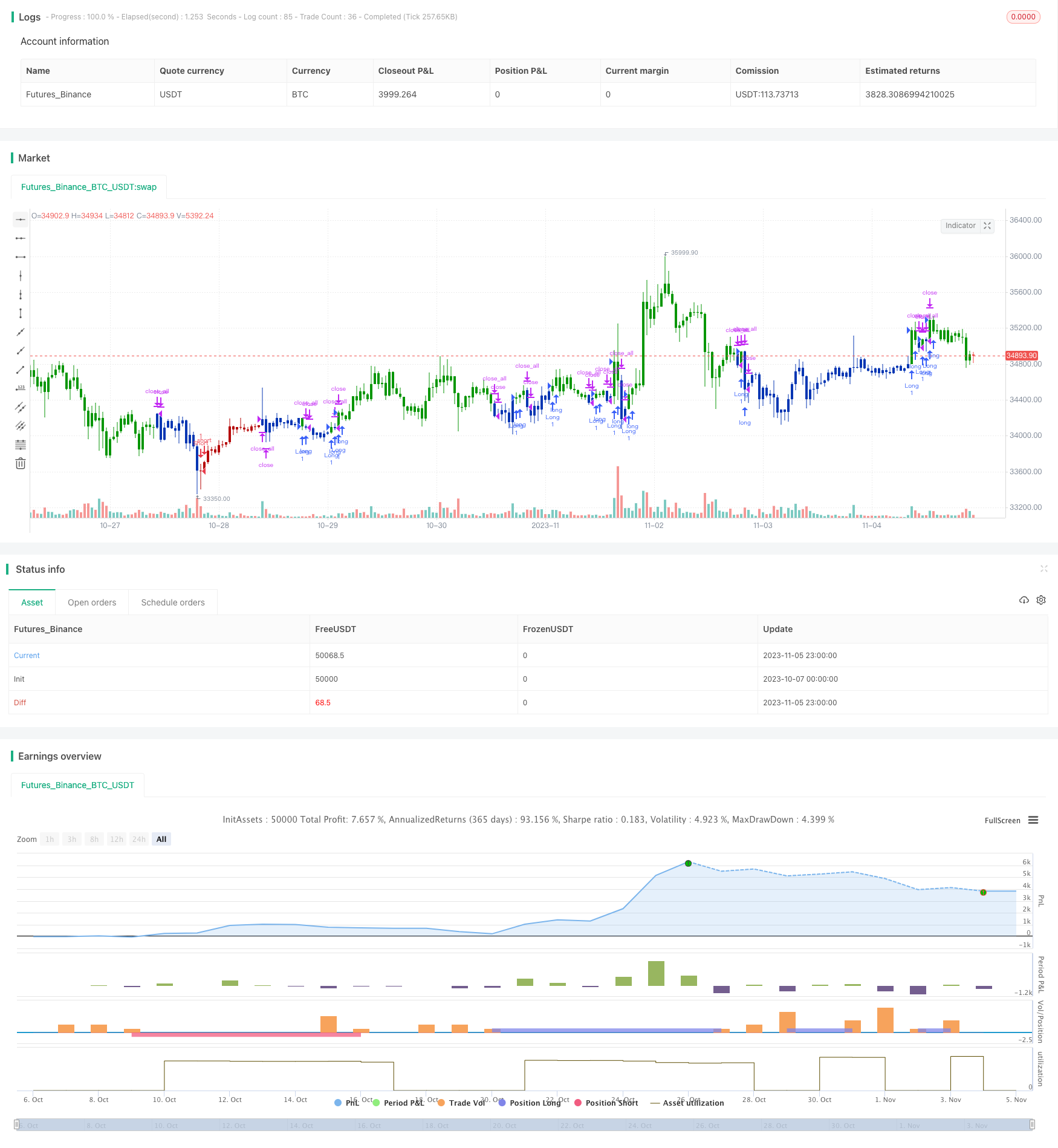

/*backtest

start: 2023-10-07 00:00:00

end: 2023-11-06 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 26/11/2020

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// Ichimoku Strategy

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

middleDonchian(Length) =>

lower = lowest(Length)

upper = highest(Length)

avg(upper, lower)

Ichimoku2c(conversionPeriods, basePeriods,laggingSpan2Periods,displacement) =>

pos = 0.0

Tenkan = middleDonchian(conversionPeriods)

Kijun = middleDonchian(basePeriods)

xChikou = close

SenkouA = middleDonchian(laggingSpan2Periods)

SenkouB = (Tenkan[basePeriods] + Kijun[basePeriods]) / 2

pos := iff(close < SenkouA[displacement], -1,

iff(close > SenkouB, 1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & Ichimoku2c", shorttitle="Combo", overlay = true)

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

conversionPeriods = input(9, minval=1),

basePeriods = input(26, minval=1)

laggingSpan2Periods = input(52, minval=1),

displacement = input(26, minval=1)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posIchimoku2c = Ichimoku2c(conversionPeriods, basePeriods,laggingSpan2Periods,displacement)

pos = iff(posReversal123 == 1 and posIchimoku2c == 1 , 1,

iff(posReversal123 == -1 and posIchimoku2c == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )

- Double Fast RSI Breakthrough Strategy

- Cross Timeframe Hull Moving Average Buy Sell Strategy

- Momentum Trend Tracking Strategy

- Chaotic Trading Rules Stop Loss Strategy

- VWMA and ATR Trend Following Strategy

- KST EMA Momentum Trend Following Strategy

- RSI Trend Following Strategy

- Dual Timeframe DI Trend Following Strategy

- Multi Indicator Scoring Trading Strategy

- Trend Reversal and Ehlers Leading Indicator Combo Strategy

- Moving Average Crossover Strategy

- RSI Momentum Reversal Strategy

- Turtle Breakout EMA Cross Strategy

- RSI Moving Average Crossover Strategy

- No Offset Ichimoku Cloud with RSI Filter Strategy

- Dual Stochastics Strategy

- EMAC Exponential Moving Average Cross Optimized Strategy

- Bollinger Band Breakout Strategy

- Gaussian Detrended Reversion Trading Strategy

- Flying Dragon Trend Strategy