概述

本策略运用玻尔布林带指标判断行情趋势,结合带宽信号寻找交易机会,旨在持续稳定增长投资组合。根据去年数据回测,该策略盈利率达78.95%,最大回撤仅-4.02%。这是我的一系列自动化策略之一,可助力投资组合稳步增长。

欢迎调整参数进行回测,也欢迎提供宝贵意见。如果满意当前结果,可将其转为学习并添加警报,实现策略自动化。这需要编码里增加警报机制。如果您对此感兴趣,我可以基于该策略创建相关学习。

策略原理

该策略使用玻尔布林带和带宽判断入场和出场时机。

玻尔布林带包括上线、中线和下线。中线是n日简单移动平均线,参数n默认为16。上限是中线+ k *标准偏差,下限是中线- k *标准偏差,参数k默认为3。当价格接近上限时,代表股价过高或超买。当价格接近下限时,代表股价过低或超卖。

带宽指标显示价格相对中线的波动情况。它由(上线-下线)/中线*1000计算得出。当带宽低于20时,代表行情平静或盘整;当带宽超过50时,代表波动加大。

该策略在带宽处于20-50之间时,寻找突破下限的机会做多。做多后,止盈线设置为开仓价格的108%,或在突破上限时止损出场。

优势分析

该策略具有以下优势:

使用玻尔布林带判断行情趋势方向,可减少假突破带来的风险

带宽信号可准确定位震荡行情,避免大幅波动带来的亏损

回测数据显示,在一年时间里可获得近80%的盈利率,风险收益比极高

最大回撤不到5%,可有效控制风险,保持组合稳定增长

策略逻辑清晰简单,容易理解实现,可广泛应用于各类数字资产

风险分析

该策略也存在以下风险:

玻尔布林带参数设置不当,可能错过较好交易机会

市场持续疯牛或熊市时,交易频率可能过低,盈利能力受限

回测数据不足,实际应用中可能无法复制回测指标

极端市场条件下,止损点可能被突破,造成较大亏损

交易费用过高也会减少实际盈利

对应解决方法:

优化参数,针对不同市场调整布林带周期等

额外引入其他指标判断趋势,应对异常行情

收集充分数据进行多种市场回测,验证策略稳定性

适当调整止损点,防止极端行情巨亏

选择手续费低廉的交易平台,减少交易费用

优化方向

该策略可从以下方面进行优化:

增加量价确认,避免假突破 Bring in volume confirmation to avoid false breakouts

结合趋势指标,识别趋势方向 Combine with trend indicators to identify trend direction

使用机器学习调整参数,自动适应市场 Use machine learning to tune parameters and auto-adapt to market

增加相关性过滤,避免非相关资产交易 Add correlation filter to avoid trading uncorrelated assets

优化止盈止损策略,在拉升阶段获得更多利润 Optimize take profit/stop loss for more gains during uptrends

引入更多条件过滤交易信号,提高成功率 Introduce more condition filters to increase win rate

测试多时间周期组合,利用多周期获利 Test multi-timeframe combinations to profit from multiple cycles

构建指数化组合,扩大投资范围 Build indexed portfolio to expand exposure

利用机器学习自动生成并验证新策略 Use machine learning to auto generate & validate new strategies

总结

该玻尔布林震荡突破策略总体回测效果良好,可在震荡行情中获得较稳定收益。策略核心思路简单清晰,容易掌握运用。但参数优化、风险控制和组合管理还需进一步提升,才能在复杂多变的市场中稳定盈利。此策略为基础型趋势跟随策略,可在其基础上引入更多技术指标和风控机制进行优化,也可与机器学习相结合实现自动化管理。整体而言,该策略为初学者打开了量化交易之门,也为专业人士提供了策略优化的可能性。

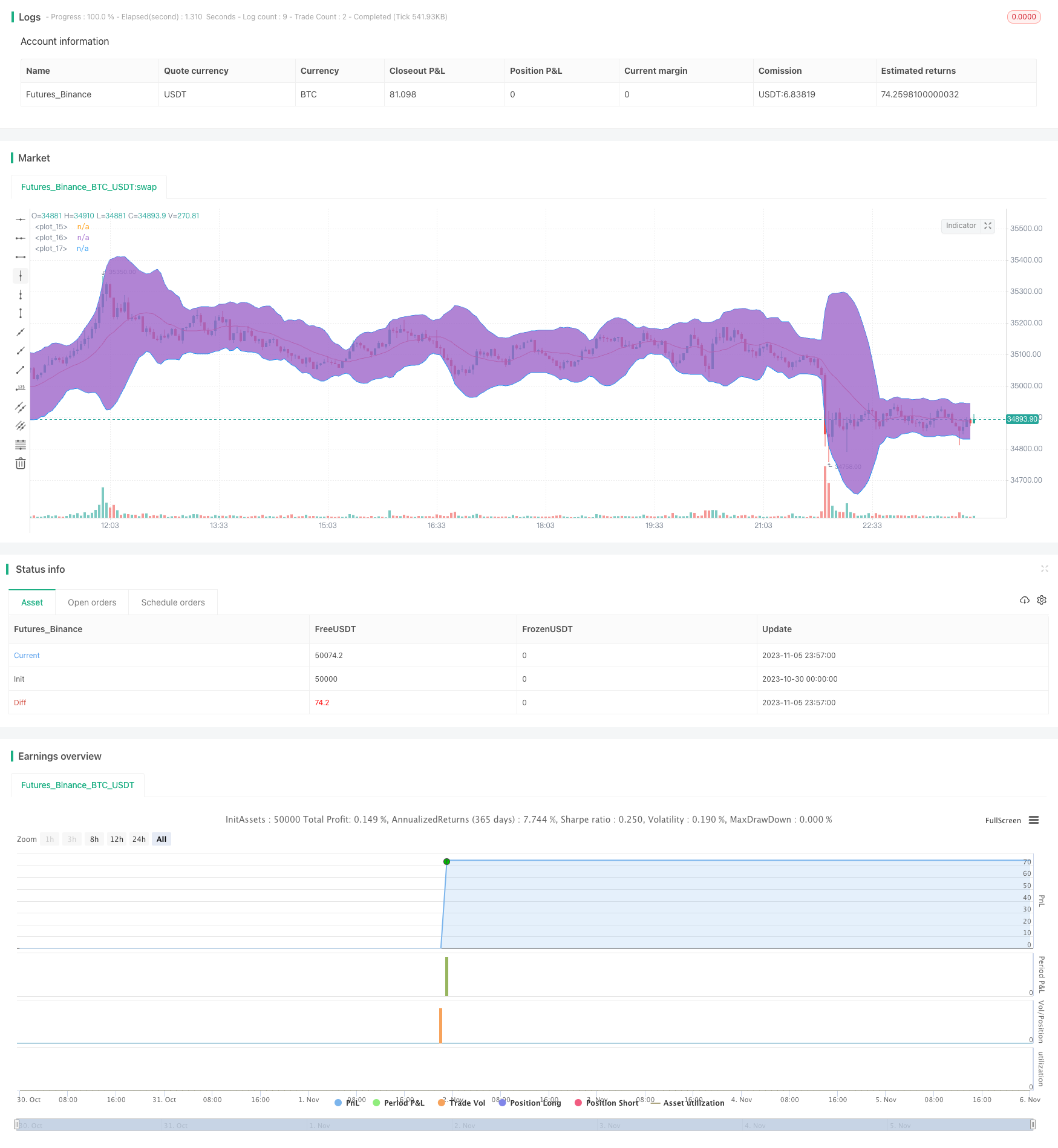

/*backtest

start: 2023-10-30 00:00:00

end: 2023-11-06 00:00:00

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Bollinger Bands BAT/USDT 30min", overlay=true )

/// Indicators

///Bollinger Bands

source = close

length = input(16, minval=1)

mult = input(3, step=0.1, minval=0.001, maxval=50)

basis = sma(source, length)

dev = mult * stdev(source, length)

upper = basis + dev

lower = basis - dev

plot(basis, color=color.red)

p1 = plot(upper, color=color.blue)

p2 = plot(lower, color=color.blue)

fill(p1, p2)

//Bollinger bands width

bbw = (upper-lower)/basis*1000

//plot(bbw, color=color.blue)

upper_bbw_input = input(title="BBW Upper Threshold", step=1, minval=0, defval=50)

lower_bbw_input = input(title="BBW Lower Threshold", step=1, minval=0, defval=20)

// Backtesting Period

testStartYear = input(2019, "Backtest Start Year")

testStartMonth = input(1, "Backtest Start Month")

testStartDay = input(1, "Backtest Start Day")

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

testStopYear = input(2020, "Backtest Stop Year")

testStopMonth = input(12, "Backtest Stop Month")

testStopDay = input(31, "Backtest Stop Day")

testPeriodStop = timestamp(testStopYear,testStopMonth,testStopDay,0,0)

testPeriod() => true

// Take Profit

tp_inp = input(8, title='Take Profit %', step=0.1)/100

take_level = strategy.position_avg_price * (1 + tp_inp)

//Entry Strategy

entry_long = crossover(source, lower) and (bbw < upper_bbw_input) and (bbw > lower_bbw_input)

exit_long = cross(high,upper) or close < lower

if testPeriod()

strategy.entry(id="LongBB", long=true, comment="LongBB", when=entry_long)

strategy.exit("Take Profit Long","LongBB",limit=take_level)

strategy.close(id="LongBB", when=exit_long )