VWMA and ATR Trend Following Strategy

Author: ChaoZhang, Date: 2023-11-07 16:39:47Tags:

Overview

This strategy uses VWMA to determine the trend direction and sets stop loss with ATR to follow the trend. It is suitable for markets with obvious trends.

Strategy Logic

-

Use VWMA to determine the trend direction. Go long when price is above VWMA, go short when price is below VWMA.

-

Add RSI oscillator filter to avoid false breakout signals. Only take long signal when RSI is above 30.

-

Use ATR to calculate the stop loss line. ATR length is set to be the same as VWMA, multiplier is 3.5. Stop loss line updates in real time.

-

The ATR multiplier controls the tightness of the stop loss line. Larger multiplier means less frequent update, which is better for following the trend.

-

Position size is calculated based on account equity and stop loss percentage.

-

Exit long position when price breaks below the stop loss line.

Advantages

-

Using VWMA to determine trend catches trend opportunities persistently.

-

RSI filter avoids some false breakout signals.

-

ATR trailing stop follows the trend and avoids being stopped out by reversals.

-

Position sizing based on account equity and stop loss favors risk management.

Risks

-

Potential loss at trend turning points. Should reduce position size to limit losses.

-

Improper ATR parameter setting leads to too tight or loose stop loss line. Parameters should be tested.

-

Fast trend reversal may cause stop loss update to lag, increasing losses.

-

In low volatility environments, reduce position size and increase stop loss update frequency.

Enhancement

-

Test different VWMA parameter combinations to find optimal signal parameters.

-

Test other RSI settings like overbought/oversold lines.

-

Test ATR multiplier to find optimal balance between drawdown and tracking ability.

-

Add other filters like MACD, KD to improve signal quality.

-

Optimize position sizing and stop loss percentage based on market volatility.

Summary

The strategy has an overall trend-following bias and catches obvious price trends well. It has advantages in trend determination, signal filtering, stop loss trailing etc. It also has risks in trend reversal. Fine tuning parameters and position sizing can lead to better performance.

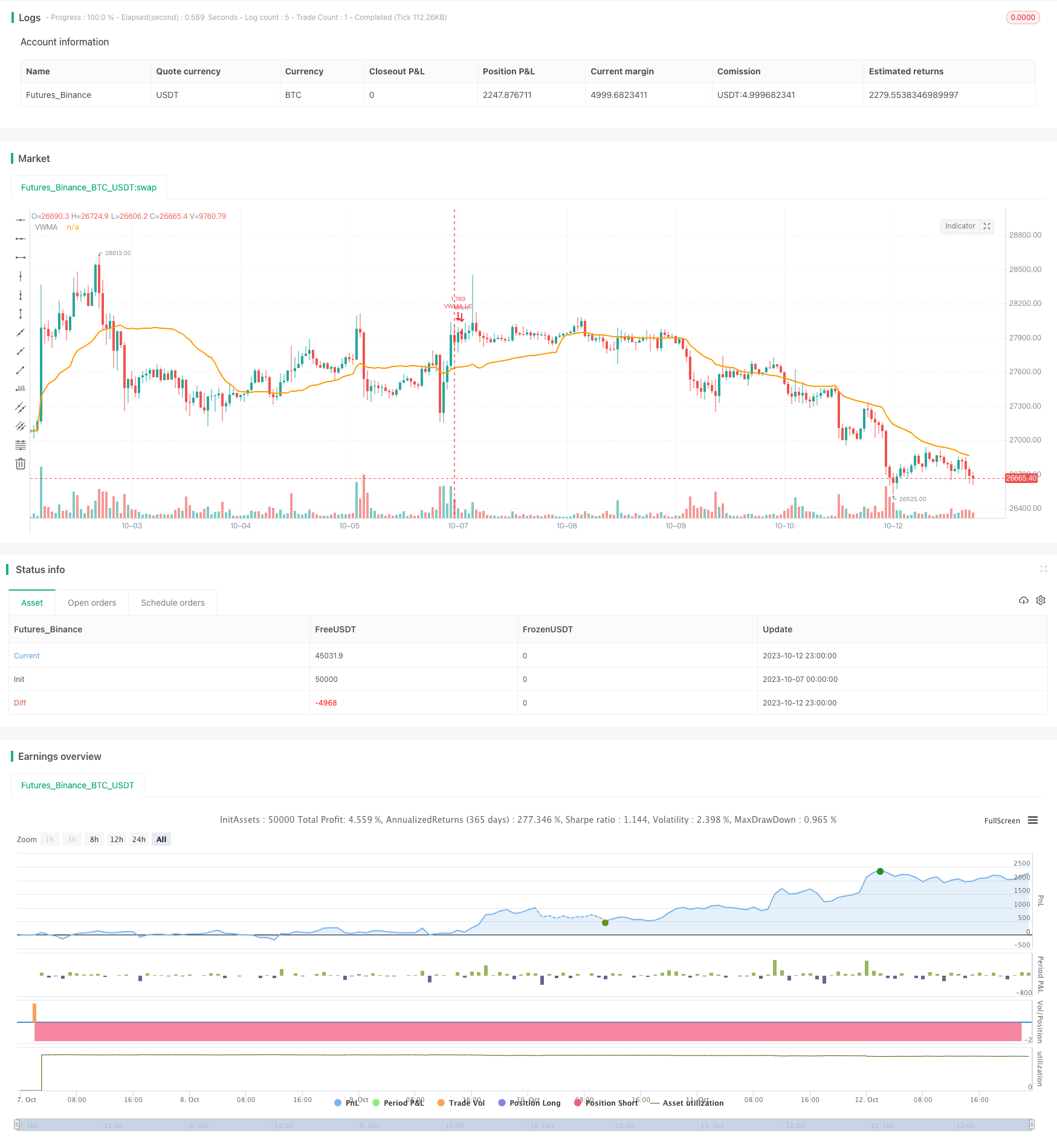

/*backtest

start: 2023-10-07 00:00:00

end: 2023-10-13 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © mohanee

//@version=4

//strategy("", overlay=true)

strategy(title="VWMA_withATRstops_strategy V2", overlay=true, pyramiding=1, default_qty_type=strategy.percent_of_equity, default_qty_value=20, initial_capital=10000, currency=currency.USD) //default_qty_value=10, default_qty_type=strategy.fixed,

float xATRTrailingStop=na

int pos=na

vwmalength = input(33, title="VWMA Length", minval=1, maxval=365)

//vwmalength2 = input(9, title="VWAM Short Term Length", minval=1, maxval=365)

nATRPeriod = input(33, title="ATR length", minval=1, maxval=365)

nATRMultip = input(3.5, title="ATR Multiplier")

rsiofVwmaLength=input(14, title="RSI of VWMA Length")

riskCapital = input(title="Risk % of capital", defval=10, minval=1)

stopLoss=input(5,title="Stop Loss",minval=1)

vwmaVal=vwma(close, vwmalength)

//vwmaVal2=vwma(close, vwmalength2)

//maVal=sma(close, vwmalength)

plot(vwmaVal, color=color.orange, linewidth=2, title="VWMA")

//plot(vwmaVal2, color=color.blue, title="VWMA Short Term")

//plot(maVal, color=color.blue, title="MA")

//rsi of vwma Longterm

rsiofVwmaVal=rsi(vwmaVal,rsiofVwmaLength)

xATR = atr(nATRPeriod)

nLoss = nATRMultip * xATR

xATRTrailingStop:= iff(close > nz(xATRTrailingStop[1], 0) and close[1] > nz(xATRTrailingStop[1], 0), max(nz(xATRTrailingStop[1]), close - nLoss), iff(close < nz(xATRTrailingStop[1], 0) and close[1] < nz(xATRTrailingStop[1], 0), min(nz(xATRTrailingStop[1]), close + nLoss), iff(close > nz(xATRTrailingStop[1], 0), close - nLoss, close + nLoss)))

pos:= iff(close[1] < nz(xATRTrailingStop[1], 0) and close > nz(xATRTrailingStop[1], 0), 1, iff(close[1] > nz(xATRTrailingStop[1], 0) and close < nz(xATRTrailingStop[1], 0), -1, nz(pos[1], 0)))

color1 = pos == -1 ? color.red: pos == 1 ? color.green : color.blue

//plot(xATRTrailingStop, color=color1, title="ATR Trailing Stop")

//Entry--

//Echeck how many units can be purchased based on risk manage ment and stop loss

qty1 = (strategy.equity * riskCapital / 100 ) / (close*stopLoss/100)

//check if cash is sufficient to buy qty1 , if capital not available use the available capital only

qty1:= (qty1 * close >= strategy.equity ) ? (strategy.equity / close) : qty1

//Long Entry

//strategy.entry(id="VWMA LE", long=true, qty=qty1, when= close >vwmaVal and open>vwmaVal and close>open and close > xATRTrailingStop and xATRTrailingStop> vwmaVal)

strategy.entry(id="VWMA LE", long=true, qty=qty1, when= rsiofVwmaVal>=30 and close>open and close>vwmaVal and pos == 1 ) ///pos == 1 means ATRStop line is green

//vwmaVal2>vwmaVal and

plot(strategy.position_size>=1 ? xATRTrailingStop : na, color=color1, style=plot.style_linebr, title="ATR Trailing Stop")

bgcolor(strategy.position_size>=1 ? color.blue : na )

//Exit

strategy.close(id="VWMA LE", when= strategy.position_size>=1 and crossunder(close, xATRTrailingStop) )

//strategy.close(id="VWMA LE", when= strategy.position_size>=1 and close<vwmaVal and open<vwmaVal and close<open )

- SMA Crossover Strategy

- Volatility Adjusted Moving Average Trading Strategy

- Momentum Breakout Strategy

- Short Trading Strategy in Downtrend

- Volume Price Trend Reversal Forex Trading Strategy Based on Stairstep EMA

- Dual Shadow Reversal Strategy

- Double Fast RSI Breakthrough Strategy

- Cross Timeframe Hull Moving Average Buy Sell Strategy

- Momentum Trend Tracking Strategy

- Chaotic Trading Rules Stop Loss Strategy

- KST EMA Momentum Trend Following Strategy

- RSI Trend Following Strategy

- Dual Timeframe DI Trend Following Strategy

- Multi Indicator Scoring Trading Strategy

- Trend Reversal and Ehlers Leading Indicator Combo Strategy

- Dual Moving Average Reversal Tracking System

- Moving Average Crossover Strategy

- RSI Momentum Reversal Strategy

- Turtle Breakout EMA Cross Strategy

- RSI Moving Average Crossover Strategy