Overview

The Donchian channel breakout trading strategy judges current price trends by calculating the channel of highest and lowest prices over a certain period and trades long and short based on channel breakouts. This strategy is suitable for highly volatile stocks and cryptocurrencies.

Strategy Logic

This strategy constructs a channel by calculating the highest price pcmax and lowest price pcmin over the last history periods. The calculation methods for the upper and lower rail of the channel are:

Upper rail yh = pcmax - (pcmax - pcmin) * (100 - percentDev)/100

Lower rail yl = pcmin + (pcmax - pcmin) * percentDev/100

where percentDev defaults to 13.

A long signal is generated when the price breaks through the upper rail. A short signal is generated when the price breaks through the lower rail.

The specific logic to generate trading signals is:

boundup = high > yh to determine if the upper rail is broken

bounddn = low < yl to determine if the lower rail is broken

upsign = sma(bounddn, 2) == 1 uses sma of bounddn to determine persistent breakout of lower rail

dnsign = sma(boundup, 2) == 1 uses sma of boundup to determine persistent breakout of upper rail

exitup = dnsign breakout of upper rail generates exit signal

exitdn = upsign breakout of lower rail generates exit signal

if upsign breakout of lower rail generates long signal

if dnsign breakout of upper rail generates short signal

The strategy also sets start and end trading times to avoid unnecessary overnight positions.

Advantages of the Strategy

Uses Donchian channel to determine trends, good backtest results

Has both long and short signals, allows two-way trading

Uses SMA to filter signals and avoid bad trades

Optional stop loss to control risks

Sets start and end trading times to avoid overnight risks

Risks of the Strategy

Sensitive to history and percentDev parameters, needs optimization for different products

May generate false signals in range-bound markets

Does not consider order management, may impact profitability in live trading

Does not consider position sizing, risks of oversized positions

Does not consider money management, needs reasonable trading capital

Enhancement Ideas

Optimize history and percentDev parameters for different products

Add filters to avoid false signals in ranging markets

Add position sizing module to control single position size

Add money management module to limit total position size

Add order management for optimal order execution

Conclusion

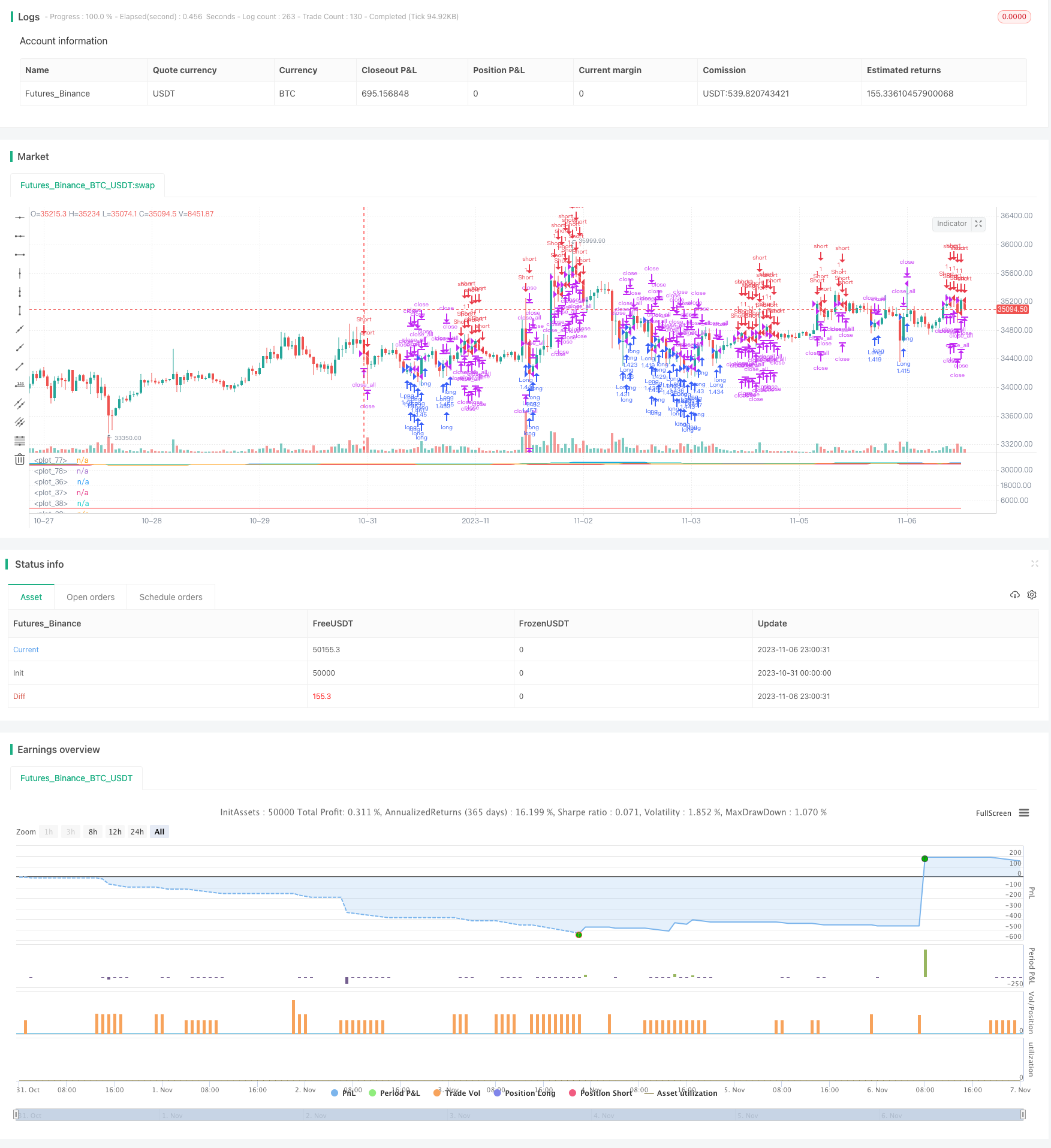

The Donchian channel breakout strategy uses channel breakouts to determine trends and trading signals, with good backtest results and ability to trade both long and short. However, risks exist regarding parameter optimization, filters, position sizing, money management, order management etc. Proper enhancements in these areas are needed before stable live trading. Overall, it is a traditional trend following strategy, and with optimizations can become a reliable quantitative trading strategy.

/*backtest

start: 2023-10-31 00:00:00

end: 2023-11-07 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

////////////////////////////////////////////////////////////

// Copyright by AlexInc v1.0 02/07/2018 @aav_1980

// PriceChannel strategy

// If you find this script helpful, you can also help me by sending donation to

// BTC 16d9vgFvCmXpLf8FiKY6zsy6pauaCyFnzS

// LTC LQ5emyqNRjdRMqHPHEqREgryUJqmvYhffM

////////////////////////////////////////////////////////////

//@version=3

strategy("AlexInc PriceChannel Str", overlay=false)

history = input(20)

percentDev = input(13)

capital = input(100)

needlong = input(true, defval = true, title = "Long")

needshort = input(true, defval = true, title = "Short")

usestoploss = input(true, defval = true, title = "Stop Loss")

stoplossmult = input(3.8, defval = 3.8, minval = 1, maxval = 10, title = "Stop loss multiplicator")

fromyear = input(2018, defval = 2018, minval = 1900, maxval = 2100, title = "From Year")

toyear = input(2100, defval = 2100, minval = 1900, maxval = 2100, title = "To Year")

frommonth = input(01, defval = 01, minval = 01, maxval = 12, title = "From Month")

tomonth = input(12, defval = 12, minval = 01, maxval = 12, title = "To Month")

fromday = input(01, defval = 01, minval = 01, maxval = 31, title = "From day")

today = input(31, defval = 31, minval = 01, maxval = 31, title = "To day")

bodymin = min( open, close)

bodymax = max(open, close)

pcmax = highest(bodymax, history)

pcmin = lowest(bodymin, history)

yh = ((pcmax - pcmin) / 100 * (100 - percentDev)) + pcmin

yl = ((pcmax - pcmin) / 100 * percentDev) + pcmin

plot(pcmax)

plot(pcmin)

plot(yh)

plot(yl)

//1

bounddn = low < yl ? 1 : 0

boundup = high > yh ? 1 : 0

upsign = sma(bounddn, 2) == 1

dnsign = sma(boundup, 2) == 1

//2

//upsign = crossover(bodymin, yl)

//dnsign = crossunder(bodymax , yh)

exitup = dnsign

exitdn = upsign

lot = strategy.equity / close * capital / 100

xATR = atr(history)

nLoss = usestoploss ? stoplossmult * xATR : na

stop_level_long = 0.0

stop_level_long := nz(stop_level_long[1])

stop_level_short = 0.0

stop_level_short := nz(stop_level_short[1])

pos = strategy.position_size

if pos >0 and pos[1] <= 0 //crossover(pos, 0.5)

stop_level_long = strategy.position_avg_price - nLoss

if pos < 0 and pos[1] >= 0 //crossunder(pos, -0.5)

stop_level_short = strategy.position_avg_price + nLoss

if pos == 0

stop_level_long = bodymin - nLoss

stop_level_short = bodymax + nLoss

//plot(bodymax + nLoss, color=red)

//plot(bodymin - nLoss, color=red)

plot(stop_level_long, color=red)

plot(stop_level_short, color=red)

if upsign

strategy.entry("Long", strategy.long, needlong == false ? 0 : lot)

if dnsign

strategy.entry("Short", strategy.short, needshort == false ? 0 : na)

if true

strategy.close_all()

//if strategy.position_size != 0

// strategy.exit("Exit Long", from_entry = "Long", stop = stop_level_long)

// strategy.exit("Exit Short", from_entry = "Short", stop = stop_level_short)