Overview

This strategy is based on the Z-distance from VWAP indicator by LazyBear. It uses the Z-distance between price and VWAP to determine overbought and oversold conditions, as well as entries and exits. The strategy incorporates EMA lines and Z-distance crossing 0 level to filter out some noise.

Strategy Logic

- Calculate VWAP value

- Calculate Z-distance between price and VWAP

- Set overbought line (2.5) and oversold line (-0.5)

- Go long when fast EMA > slow EMA, Z-distance < oversold line and Z-distance crosses above 0

- Close position when Z-distance > overbought line

- Incorporate stop loss logic

Key Functions:

- calc_zvwap: Calculate Z-distance between price and VWAP

- VWAP value: vwap(hlc3)

- Fast EMA: ema(close,fastEma)

- Slow EMA: ema(close,slowEma)

Advantage Analysis

- Z-distance intuitively shows overbought/oversold levels

- EMA filters out false breakouts

- Allows pyramiding to capitalize on trends

- Has stop loss logic to control risk

Risk Analysis

- Need to ensure parameters like lines, EMA periods are set properly

- Z-distance indicator lags, may miss key turning points

- Pyramiding can increase loss if trend reverses

- Stop loss needs to be set reasonably

Solutions: 1. Optimize parameters via backtesting 2. Add other indicators to filter signals 3. Set proper conditions for pyramiding 4. Use dynamic stop loss

Optimization Directions

- Optimize EMA periods

- Test different overbought/oversold criteria

- Add other indicators to filter noise

- Test different stop loss techniques

- Optimize entry, pyramiding and stop loss logic

Summary

The strategy uses Z-distance to determine price-VWAP relationship and adds EMA to filter signals, aiming to capture trend opportunities. It allows pyramiding to follow trends and has a stop loss to control risk. Optimization and adding other indicators can improve robustness. However, lagging issue of Z-distance should be considered during optimization. Overall, this is a trend-following strategy with simple, clear logic. When fully optimized, it can be an efficient tool to trade trends.

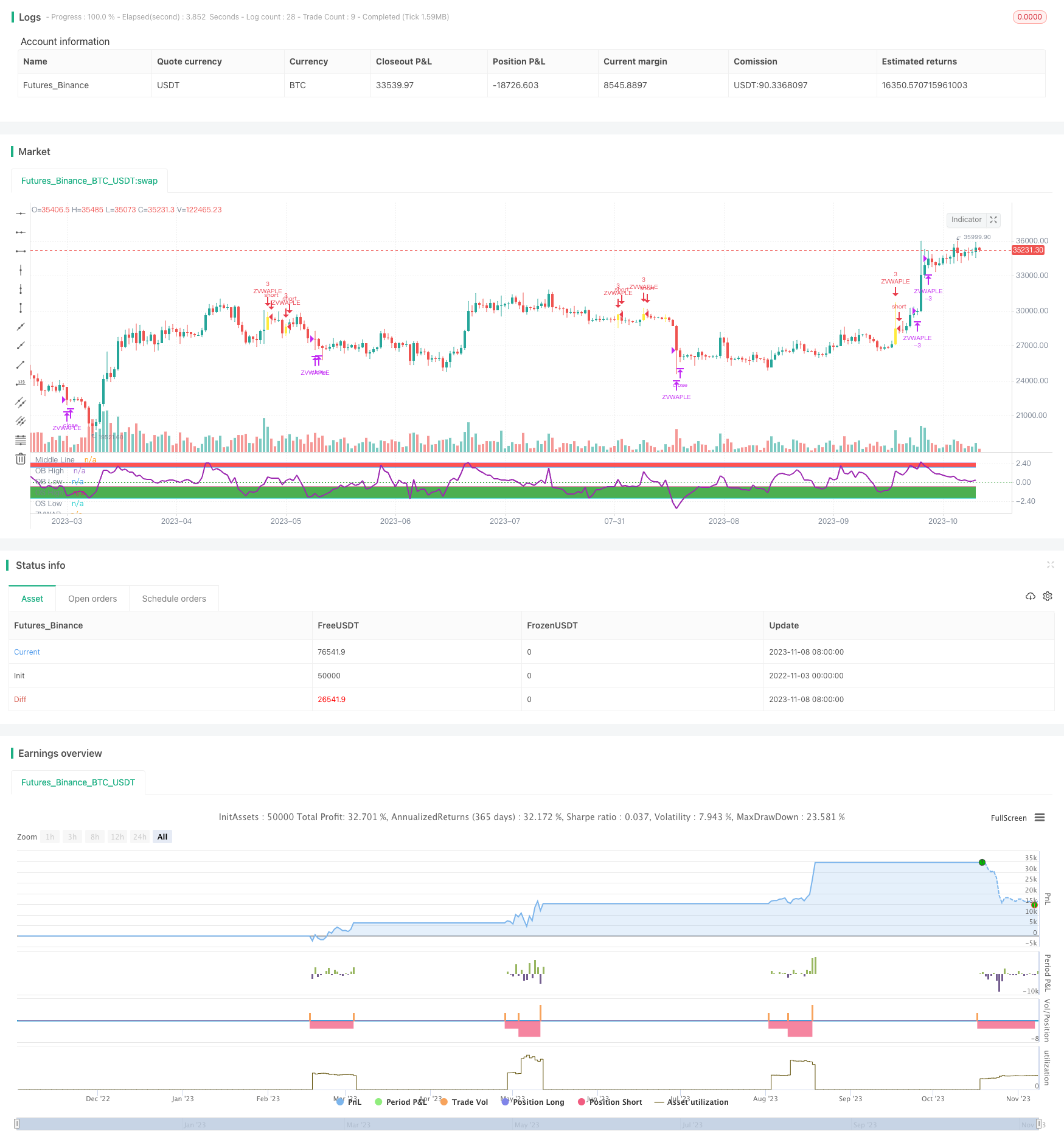

/*backtest

start: 2022-11-03 00:00:00

end: 2023-11-09 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © mohanee

//@version=4

//This is based on Z distance from VWAP by Lazybear

strategy(title="ZVWAP[LB] strategy", overlay=false,pyramiding=2, default_qty_type=strategy.fixed, default_qty_value=3, initial_capital=10000, currency=currency.USD)

length=input(13,"length")

calc_zvwap(pds, source1) =>

mean = sum(volume*source1,pds)/sum(volume,pds)

vwapsd = sqrt(sma(pow(source1-mean, 2), pds) )

(close-mean)/vwapsd

upperTop=2.5 //input(2.5)

upperBottom=2.0 //input(2.0)

lowerTop=-0.5 //input(-0.5)

lowerBottom=-2.0 //input(-2.0)

buyLine=input(-0.5, title="OverSold Line",minval=-2, maxval=3)

sellLine=input(2.0, title="OverBought Line",minval=-2, maxval=3)

fastEma=input(13, title="Fast EMA",minval=1, maxval=50)

slowEma=input(55, title="Slow EMA",minval=10, maxval=200)

stopLoss =input(5, title="Stop Loss",minval=1)

hline(0, title="Middle Line", linestyle=hline.style_dotted, color=color.green)

ul1=plot(upperTop, "OB High")

ul2=plot(upperBottom, "OB Low")

fill(ul1,ul2, color=color.red)

ll1=plot(lowerTop, "OS High")

ll2=plot(lowerBottom, "OS Low")

fill(ll1,ll2, color=color.green)

zvwapVal=calc_zvwap(length,close)

plot(zvwapVal,title="ZVWAP",color=color.purple, linewidth=2)

longEmaVal=ema(close,slowEma)

shortEmaVal=ema(close,fastEma)

vwapVal=vwap(hlc3)

zvwapDipped=false

for i = 1 to 10

zvwapDipped := zvwapDipped or zvwapVal[i]<=buyLine

longCondition= shortEmaVal > longEmaVal and zvwapDipped and crossover(zvwapVal,0)

barcolor(longCondition ? color.yellow: na)

strategy.entry(id="ZVWAPLE", long=true, when= longCondition and strategy.position_size<1)

//Add

strategy.entry(id="ZVWAPLE", comment="Add", long=true, when= strategy.position_size>1 and close<strategy.position_avg_price and crossover(zvwapVal,0))

//calculate stop Loss

stopLossVal = strategy.position_avg_price - (strategy.position_avg_price*stopLoss*0.01)

strategy.close(id="ZVWAPLE",comment="SL Exit", when=close<stopLossVal) //close all on stop loss

strategy.close(id="ZVWAPLE",comment="TPExitAll", qty=strategy.position_size , when= crossunder(zvwapVal,sellLine)) //close all zvwapVal>sellLine