Overview

The Comprehensive Automated Trading Moving Average Rainbow Strategy is a typical multi-timeframe moving average combination strategy. It uses 12 moving averages with different periods to determine the trend direction and define entry, stop loss and take profit conditions to implement automated trading. This strategy can automatically identify trends and has a complete stop loss mechanism to control risks.

Principles

This strategy uses 12 moving averages, including periods of 3, 5, 8 all the way to 55. The moving average type can be selected from EMA, SMA, RMA, etc. The strategy first judges the arrangement relationship between the short and long period moving averages (1-4 period Lines and 5-8 period Lines) to determine if it is an uptrend or downtrend environment.

In an uptrend, if the price breaks through the moving average corresponding to the previous low point, it is determined as a signal to go long. The stop loss is placed at the moving average corresponding to the previous low point, and the take profit is 1.6 times the stop loss. In a downtrend, if the price breaks through the moving average corresponding to the previous high point, it is determined as a signal to go short. The stop loss is placed at the moving average corresponding to the previous high point, and the take profit is 1.6 times the stop loss.

This strategy also has a trend reversal detection feature. During the holding period, if the short period moving average arrangement changes, and the price exceeds the most recent high or low point, it is determined that a trend reversal may have occurred. At this point it will exit the current position and enter a position in the opposite direction, using the new high or low point as the stop loss and take profit.

Advantages

This strategy comprehensively applies multi-timeframe analysis to better determine the trend direction.

The addition of moving average sequential/reverse arrangement helps avoid being misled by ranging markets.

The strategy has a complete stop loss mechanism to effectively control the risk of each trade.

The strategy has trend reversal detection to capture reversal opportunities and reduce systemic risks.

The strategy has flexible parameter settings where moving average periods and types can be customized.

The strategy uses a trailing stop loss to lock in maximum profits.

Risks

Multi-moving average combination strategies, parameter settings will affect performance and need optimization testing.

Moving averages may give false signals in ranging markets, parameters should be adjusted or stop trading temporarily.

There is some lag, risks of missing opportunities around trend turning points.

Need to watch other technical indicators, avoid going short near important support levels.

Systemic risks need monitoring, reversal detection cannot completely avoid such risks.

Drawdown control needs additional mechanisms, consider dynamic position sizing.

Optimization Directions

Test different moving average types and parameter settings to find the optimal combination.

Optimize the reversal detection mechanism, set more precise reversal trigger conditions.

Add dynamic position sizing to reduce position size when drawdown gets too high.

Consider incorporating machine learning algorithms, using big data to train judgement of key points.

Incorporate other indicator signals for combined judgement to improve accuracy.

Build a multi-instrument trading portfolio to diversify risks using low correlations.

Summary

The Comprehensive Automated Trading Moving Average Rainbow Strategy is overall a solid trend following strategy, with strong abilities in trend identification and risk control. With further optimizations such as parameter tuning, adding dynamic position sizing etc., it can become a very practical quantitative trading strategy. The strategy logic is clear and easy to understand, while also having certain flexibility, making it worthwhile for in-depth research, usage and continuous improvement.

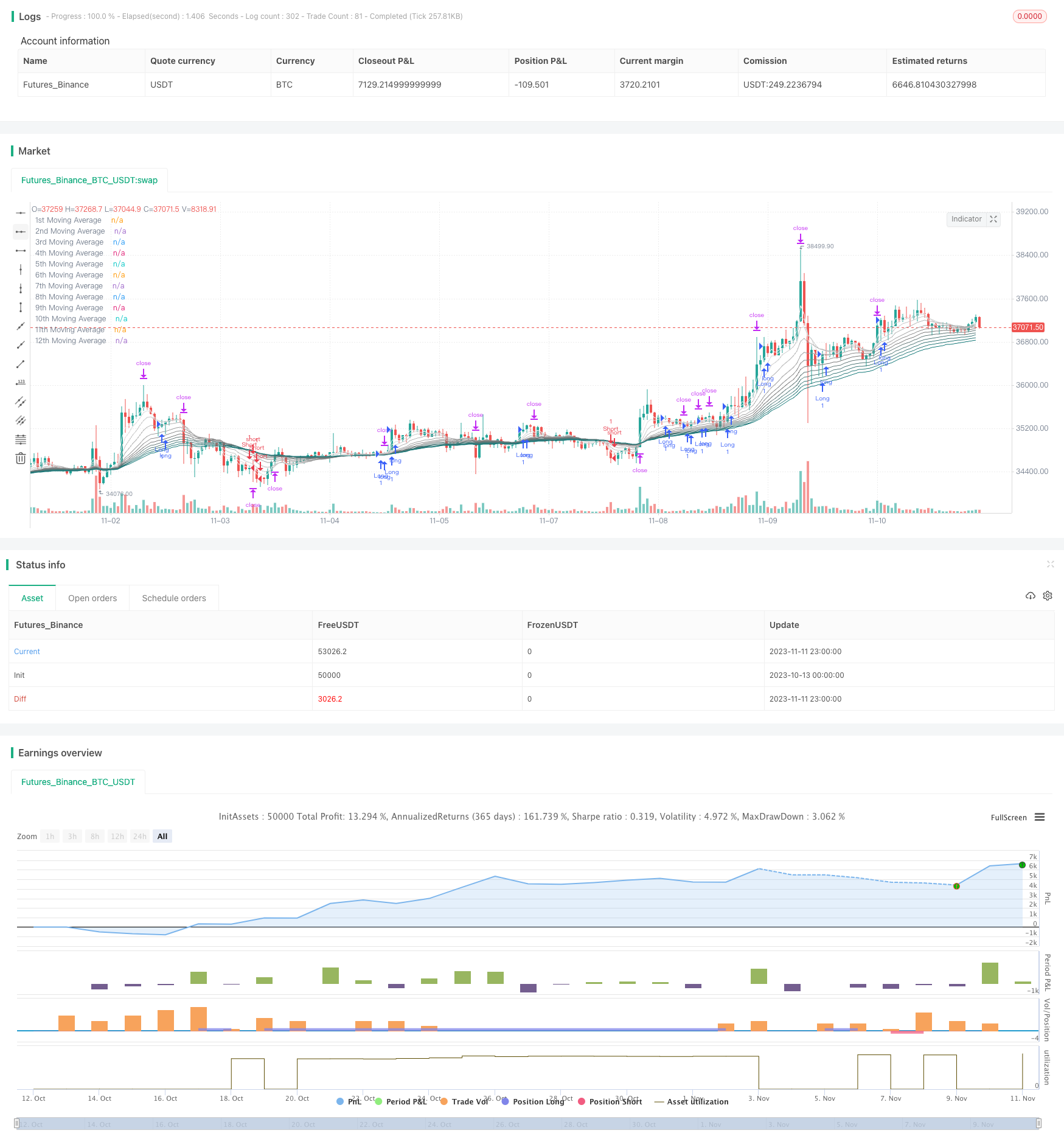

/*backtest

start: 2023-10-13 00:00:00

end: 2023-11-12 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © AugustoErni

//@version=5

strategy('Moving Average Rainbow (Stormer)', overlay=true)

maType = input.string('EMA', title='Moving Average Type/Tipo de Média Móvel', options=['EMA', 'SMA', 'RMA', 'WMA', 'HMA', 'VWMA'], tooltip='This option is to select the type of Moving Average that the Rainbow will use./Esta opção é para selecionar o tipo de Média Móvel que o Rainbow utilizará.', group='Moving Averages/Médias Móveis')

maLengthFirst = input.int(3, title='MA #1', minval=1, step=1, tooltip='First MA length./Comprimento da primeira MA.', group='Moving Averages/Médias Móveis')

maLengthSecond = input.int(5, title='MA #2', minval=1, step=1, tooltip='Second MA length./Comprimento da segunda MA.', group='Moving Averages/Médias Móveis')

maLengthThird = input.int(8, title='MA #3', minval=1, step=1, tooltip='Third MA length./Comprimento da terceira MA.', group='Moving Averages/Médias Móveis')

maLengthFourth = input.int(13, title='MA #4', minval=1, step=1, tooltip='Fourth MA length./Comprimento da quarta MA.', group='Moving Averages/Médias Móveis')

maLengthFifth = input.int(20, title='MA #5', minval=1, step=1, tooltip='Fifth MA length./Comprimento da quinta MA.', group='Moving Averages/Médias Móveis')

maLengthSixth = input.int(25, title='MA #6', minval=1, step=1, tooltip='Sixth MA length./Comprimento da sexta MA.', group='Moving Averages/Médias Móveis')

maLengthSeventh = input.int(30, title='MA #7', minval=1, step=1, tooltip='Seventh MA length./Comprimento da sétima MA.', group='Moving Averages/Médias Móveis')

maLengthEighth = input.int(35, title='MA #8', minval=1, step=1, tooltip='Eighth MA length./Comprimento da oitava MA.', group='Moving Averages/Médias Móveis')

maLengthNineth = input.int(40, title='MA #9', minval=1, step=1, tooltip='Nineth MA length./Comprimento da nona MA.', group='Moving Averages/Médias Móveis')

maLengthTenth = input.int(45, title='MA #10', minval=1, step=1, tooltip='Tenth MA length./Comprimento da décima MA.', group='Moving Averages/Médias Móveis')

maLengthEleventh = input.int(50, title='MA #11', minval=1, step=1, tooltip='Eleventh MA length./Comprimento da décima primeira MA.', group='Moving Averages/Médias Móveis')

maLengthTwelveth = input.int(55, title='MA #12', minval=1, step=1, tooltip='Twelveth MA length./Comprimento da décima segunda MA.', group='Moving Averages/Médias Móveis')

targetFactor = input.float(1.6, title='Target Take Profit/Objetivo de Lucro Alvo', minval=0.1, step=0.1, tooltip='Calculate the take profit factor when entry position./Calcula o fator do alvo lucro ao entrar na posição.', group='Risk Management/Gerenciamento de Risco')

verifyTurnoverTrend = input.bool(true, title='Verify Turnover Trend/Verificar Tendência de Rotatividade', tooltip='This option checks for a supposedly turnover trend and setup new target (for long is the highest high and for short is the lowest low identified)./Esta opção verifica uma suposta tendência de rotatividade e estabelece um novo objetivo (para long é a máxima mais alta, para short é a mínima mais baixa identificados).', group='Turnover Trend/Rotatividade Tendência')

verifyTurnoverSignal = input.bool(false, title='Verify Turnover Signal/Verificar Sinal de Rotatividade', tooltip='This option checks for a supposedly turnover signal, closing the current position and opening a new one (for long it will close and open a new for short, for short it will close and open a new for long)./Essa opção verifica um sinal de possível reversão, fechando a posição atual e abrindo uma nova (para long fechará e abrirá uma nova para short, para short fechará e abrirá uma nova para long).', group='Turnover Signal/Rotatividade Sinal')

verifyTurnoverSignalPriceExit = input.bool(false, title='Verify Price Exit Turnover Signal/Verificar Saída de Preço Sinal de Rotatividade', tooltip='This option complements "turnover signal" by veryfing the price if profitable before exiting the current position./Esta opção complementa o "sinal de rotatividade" verificando o preço do lucro antes de sair da posição atual.', group='Turnover Signal/Rotatividade Sinal')

mas(maType, maLengthFirst, maLengthSecond, maLengthThird, maLengthFourth, maLengthFifth, maLengthSixth, maLengthSeventh, maLengthEighth, maLengthNineth, maLengthTenth, maLengthEleventh, maLengthTwelveth) =>

if (maType == 'SMA')

[ta.sma(close, maLengthFirst), ta.sma(close, maLengthSecond), ta.sma(close, maLengthThird), ta.sma(close, maLengthFourth), ta.sma(close, maLengthFifth), ta.sma(close, maLengthSixth), ta.sma(close, maLengthSeventh), ta.sma(close, maLengthEighth), ta.sma(close, maLengthNineth), ta.sma(close, maLengthTenth), ta.sma(close, maLengthEleventh), ta.sma(close, maLengthTwelveth)]

else if (maType == 'RMA')

[ta.rma(close, maLengthFirst), ta.rma(close, maLengthSecond), ta.rma(close, maLengthThird), ta.rma(close, maLengthFourth), ta.rma(close, maLengthFifth), ta.rma(close, maLengthSixth), ta.rma(close, maLengthSeventh), ta.rma(close, maLengthEighth), ta.rma(close, maLengthNineth), ta.rma(close, maLengthTenth), ta.rma(close, maLengthEleventh), ta.rma(close, maLengthTwelveth)]

else if (maType == 'WMA')

[ta.wma(close, maLengthFirst), ta.wma(close, maLengthSecond), ta.wma(close, maLengthThird), ta.wma(close, maLengthFourth), ta.wma(close, maLengthFifth), ta.wma(close, maLengthSixth), ta.wma(close, maLengthSeventh), ta.wma(close, maLengthEighth), ta.wma(close, maLengthNineth), ta.wma(close, maLengthTenth), ta.wma(close, maLengthEleventh), ta.wma(close, maLengthTwelveth)]

else if (maType == 'HMA')

[ta.hma(close, maLengthFirst), ta.hma(close, maLengthSecond), ta.hma(close, maLengthThird), ta.hma(close, maLengthFourth), ta.hma(close, maLengthFifth), ta.hma(close, maLengthSixth), ta.hma(close, maLengthSeventh), ta.hma(close, maLengthEighth), ta.hma(close, maLengthNineth), ta.hma(close, maLengthTenth), ta.hma(close, maLengthEleventh), ta.hma(close, maLengthTwelveth)]

else if (maType == 'VWMA')

[ta.vwma(close, maLengthFirst), ta.vwma(close, maLengthSecond), ta.vwma(close, maLengthThird), ta.vwma(close, maLengthFourth), ta.vwma(close, maLengthFifth), ta.vwma(close, maLengthSixth), ta.vwma(close, maLengthSeventh), ta.vwma(close, maLengthEighth), ta.vwma(close, maLengthNineth), ta.vwma(close, maLengthTenth), ta.vwma(close, maLengthEleventh), ta.vwma(close, maLengthTwelveth)]

else

[ta.ema(close, maLengthFirst), ta.ema(close, maLengthSecond), ta.ema(close, maLengthThird), ta.ema(close, maLengthFourth), ta.ema(close, maLengthFifth), ta.ema(close, maLengthSixth), ta.ema(close, maLengthSeventh), ta.ema(close, maLengthEighth), ta.ema(close, maLengthNineth), ta.ema(close, maLengthTenth), ta.ema(close, maLengthEleventh), ta.ema(close, maLengthTwelveth)]

[ma1, ma2, ma3, ma4, ma5, ma6, ma7, ma8, ma9, ma10, ma11, ma12] = mas(maType, maLengthFirst, maLengthSecond, maLengthThird, maLengthFourth, maLengthFifth, maLengthSixth, maLengthSeventh, maLengthEighth, maLengthNineth, maLengthTenth, maLengthEleventh, maLengthTwelveth)

maTouchPriceTrend(ma1, ma2, ma3, ma4, ma5, ma6, ma7, ma8, ma9, ma10, ma11, ma12, trend) =>

var float touchPrice = na

if (trend == 'UPTREND')

if (low <= ma1 and low >= ma2)

touchPrice := ma2

else if (low <= ma2 and low >= ma3)

touchPrice := ma3

else if (low <= ma3 and low >= ma4)

touchPrice := ma4

else if (low <= ma4 and low >= ma5)

touchPrice := ma5

else if (low <= ma5 and low >= ma6)

touchPrice := ma6

else if (low <= ma6 and low >= ma7)

touchPrice := ma7

else if (low <= ma7 and low >= ma8)

touchPrice := ma8

else if (low <= ma8 and low >= ma9)

touchPrice := ma9

else if (low <= ma9 and low >= ma10)

touchPrice := ma10

else if (low <= ma10 and low >= ma11)

touchPrice := ma11

else if (low <= ma11 and low >= ma12)

touchPrice := ma12

else

touchPrice := na

else if (trend == 'DOWNTREND')

if (high >= ma1 and high <= ma2)

touchPrice := ma2

else if (high >= ma2 and high <= ma3)

touchPrice := ma3

else if (high >= ma3 and high <= ma4)

touchPrice := ma4

else if (high >= ma4 and high <= ma5)

touchPrice := ma5

else if (high >= ma5 and high <= ma6)

touchPrice := ma6

else if (high >= ma6 and high <= ma7)

touchPrice := ma7

else if (high >= ma7 and high <= ma8)

touchPrice := ma8

else if (high >= ma8 and high <= ma9)

touchPrice := ma9

else if (high >= ma9 and high <= ma10)

touchPrice := ma10

else if (high >= ma10 and high <= ma11)

touchPrice := ma11

else if (high >= ma11 and high <= ma12)

touchPrice := ma12

else

touchPrice := na

maMean = ((ma1 + ma2 + ma3 + ma4 + ma5 + ma6 + ma7 + ma8 + ma9 + ma10 + ma11 + ma12) / 12)

isMa1To4Above = ma1 > ma2 and ma2 > ma3 and ma3 > ma4 ? 1 : 0

isMa1To4Below = ma1 < ma2 and ma2 < ma3 and ma3 < ma4 ? 1 : 0

isMa5To8Above = ma5 > ma6 and ma6 > ma7 and ma7 > ma8 ? 1 : 0

isMa5To8Below = ma5 < ma6 and ma6 < ma7 and ma7 < ma8 ? 1 : 0

isCloseGreaterMaMean = close > maMean ? 1 : 0

isCloseLesserMaMean = close < maMean ? 1 : 0

isCurHighGreaterPrevHigh = high > high[1] ? 1 : 0

isCurLowLesserPrevLow = low < low[1] ? 1 : 0

isMaUptrend = isCloseGreaterMaMean and isMa5To8Above ? 1 : 0

isMaDowntrend = isCloseLesserMaMean and isMa5To8Below ? 1 : 0

isUptrend = isMaUptrend ? 'UPTREND' : na

isDowntrend = isMaDowntrend ? 'DOWNTREND' : na

curTouchPriceUptrend = maTouchPriceTrend(ma1, ma2, ma3, ma4, ma5, ma6, ma7, ma8, ma9, ma10, ma11, ma12, isUptrend)

prevTouchPriceUptrend = curTouchPriceUptrend[1]

curTouchPriceDowntrend = maTouchPriceTrend(ma1, ma2, ma3, ma4, ma5, ma6, ma7, ma8, ma9, ma10, ma11, ma12, isDowntrend)

prevTouchPriceDowntrend = curTouchPriceDowntrend[1]

isPrevTouchPriceUptrendTouched = prevTouchPriceUptrend > 0.0 or not na(prevTouchPriceUptrend) ? 1 : 0

isPrevTouchPriceDowntrendTouched = prevTouchPriceDowntrend > 0.0 or not na(prevTouchPriceDowntrend) ? 1 : 0

isPrevTouchedPriceUptrend = isPrevTouchPriceUptrendTouched and isMaUptrend ? 1 : 0

isPrevTouchedPriceDowntrend = isPrevTouchPriceDowntrendTouched and isMaDowntrend ? 1 : 0

isPositionFlat = strategy.position_size == 0 ? 1 : 0

var float positionEntryPrice = na

var bool positionIsEntryLong = false

var bool positionIsEntryShort = false

var float longPositionHighestHigh = na

var float shortPositionLowestLow = na

var float stopLossLong = na

var float stopLossShort = na

var float targetLong = na

var float targetShort = na

var bool isTurnoverTrendLongTrigger = na

var bool isTurnoverTrendShortTrigger = na

isPositionLongClose = na(positionEntryPrice) and not positionIsEntryLong ? 1 : 0

isPositionShortClose = na(positionEntryPrice) and not positionIsEntryShort ? 1 : 0

isLongCondition = isMaUptrend and isCurHighGreaterPrevHigh and isPrevTouchedPriceUptrend ? 1 : 0

isShortCondition = isMaDowntrend and isCurLowLesserPrevLow and isPrevTouchedPriceDowntrend ? 1 : 0

longTurnoverExit = verifyTurnoverSignal and verifyTurnoverSignalPriceExit ? (verifyTurnoverSignal and isLongCondition and positionIsEntryShort and close < positionEntryPrice) : verifyTurnoverSignal ? (verifyTurnoverSignal and isLongCondition and positionIsEntryShort) : na

shortTurnoverExit = verifyTurnoverSignal and verifyTurnoverSignalPriceExit ? (verifyTurnoverSignal and isShortCondition and positionIsEntryLong and close > positionEntryPrice) : verifyTurnoverSignal ? (verifyTurnoverSignal and isShortCondition and positionIsEntryLong) : na

if (isPositionFlat)

positionEntryPrice := na

positionIsEntryLong := false

positionIsEntryShort := false

stopLossLong := na

targetLong := na

stopLossShort := na

targetShort := na

isTurnoverTrendLongTrigger := na

isTurnoverTrendShortTrigger := na

if ((isLongCondition and isPositionLongClose) or longTurnoverExit)

positionEntryPrice := close

positionIsEntryLong := true

positionIsEntryShort := false

longPositionHighestHigh := na

shortPositionLowestLow := na

isTurnoverTrendLongTrigger := na

isTurnoverTrendShortTrigger := na

stopLossLong := prevTouchPriceUptrend

if (isCurLowLesserPrevLow)

curLowToucedPrice = na(curTouchPriceUptrend) ? low : curTouchPriceUptrend

stopLossLong := na(curTouchPriceUptrend) ? ((stopLossLong + curLowToucedPrice) / 2) : curLowToucedPrice

targetLong := (positionEntryPrice + (math.abs(positionEntryPrice - stopLossLong) * targetFactor))

if (targetLong > 0 and stopLossLong > 0)

alertMessage = '{ "side/lado": "buy", "entry/entrada": ' + str.tostring(positionEntryPrice) + ', "stop": ' + str.tostring(stopLossLong) + ', "target/alvo": ' + str.tostring(targetLong) + ' }'

alert(alertMessage)

strategy.entry('Long', strategy.long)

strategy.exit('Exit Long', 'Long', stop=stopLossLong, limit=targetLong)

if ((isShortCondition and isPositionShortClose) or shortTurnoverExit)

positionEntryPrice := close

positionIsEntryLong := false

positionIsEntryShort := true

longPositionHighestHigh := na

shortPositionLowestLow := na

isTurnoverTrendLongTrigger := na

isTurnoverTrendShortTrigger := na

stopLossShort := prevTouchPriceDowntrend

if (isCurHighGreaterPrevHigh)

curHighToucedPrice = na(curTouchPriceDowntrend) ? high : curTouchPriceDowntrend

stopLossShort := na(curTouchPriceDowntrend) ? ((stopLossShort + curHighToucedPrice) / 2) : curHighToucedPrice

targetShort := (positionEntryPrice - (math.abs(positionEntryPrice - stopLossShort) * targetFactor))

if (targetShort > 0 and stopLossShort > 0)

alertMessage = '{ "side/lado": "sell", "entry/entrada": ' + str.tostring(positionEntryPrice) + ', "stop": ' + str.tostring(stopLossShort) + ', "target/alvo": ' + str.tostring(targetShort) + ' }'

alert(alertMessage)

strategy.entry('Short', strategy.short)

strategy.exit('Exit Short', 'Short', stop=stopLossShort, limit=targetShort)

if (verifyTurnoverTrend and positionIsEntryLong)

curHighestHigh = high

if (curHighestHigh > longPositionHighestHigh or na(longPositionHighestHigh))

longPositionHighestHigh := curHighestHigh

if (isMa1To4Below and isCloseLesserMaMean and longPositionHighestHigh > positionEntryPrice)

isTurnoverTrendLongTrigger := true

alertMessage = '{ "side/lado": "buy", "stop": ' + str.tostring(stopLossLong) + ', "target/alvo": ' + str.tostring(longPositionHighestHigh) + ', "new setup/nova definição": ' + str.tostring(isTurnoverTrendLongTrigger) + ' }'

alert(alertMessage)

strategy.exit('Exit Long', 'Long', stop=stopLossLong, limit=longPositionHighestHigh)

if (verifyTurnoverTrend and positionIsEntryShort)

curLowestLow = low

if (curLowestLow < shortPositionLowestLow or na(shortPositionLowestLow))

shortPositionLowestLow := curLowestLow

if (isMa1To4Above and isCloseGreaterMaMean and shortPositionLowestLow < positionEntryPrice)

isTurnoverTrendShortTrigger := true

alertMessage = '{ "side/lado": "sell", "stop": ' + str.tostring(stopLossShort) + ', "target/alvo": ' + str.tostring(shortPositionLowestLow) + ', "new setup/nova definição": ' + str.tostring(isTurnoverTrendShortTrigger) + ' }'

alert(alertMessage)

strategy.exit('Exit Short', 'Short', stop=stopLossShort, limit=shortPositionLowestLow)

plot(ma1, title='1st Moving Average', color=color.rgb(240, 240, 240))

plot(ma2, title='2nd Moving Average', color=color.rgb(220, 220, 220))

plot(ma3, title='3rd Moving Average', color=color.rgb(200, 200, 200))

plot(ma4, title='4th Moving Average', color=color.rgb(180, 180, 180))

plot(ma5, title='5th Moving Average', color=color.rgb(160, 160, 160))

plot(ma6, title='6th Moving Average', color=color.rgb(140, 140, 140))

plot(ma7, title='7th Moving Average', color=color.rgb(120, 120, 120))

plot(ma8, title='8th Moving Average', color=color.rgb(100, 120, 120))

plot(ma9, title='9th Moving Average', color=color.rgb(80, 120, 120))

plot(ma10, title='10th Moving Average', color=color.rgb(60, 120, 120))

plot(ma11, title='11th Moving Average', color=color.rgb(40, 120, 120))

plot(ma12, title='12th Moving Average', color=color.rgb(20, 120, 120))

tablePosition = position.bottom_right

tableColumns = 2

tableRows = 7

tableFrameWidth = 1

tableBorderColor = color.gray

tableBorderWidth = 1

tableInfoTrade = table.new(position=tablePosition, columns=tableColumns, rows=tableRows, frame_width=tableFrameWidth, border_color=tableBorderColor, border_width=tableBorderWidth)

table.cell(table_id=tableInfoTrade, column=0, row=0)

table.cell(table_id=tableInfoTrade, column=1, row=0)

table.cell(table_id=tableInfoTrade, column=0, row=1, text='Entry Side/Lado da Entrada', text_color=color.white)

table.cell(table_id=tableInfoTrade, column=0, row=2, text=positionIsEntryLong ? 'LONG' : positionIsEntryShort ? 'SHORT' : 'NONE/NENHUM', text_color=color.yellow)

table.cell(table_id=tableInfoTrade, column=1, row=1, text='Entry Price/Preço da Entrada', text_color=color.white)

table.cell(table_id=tableInfoTrade, column=1, row=2, text=not na(positionEntryPrice) ? str.tostring(positionEntryPrice) : 'NONE/NENHUM', text_color=color.blue)

table.cell(table_id=tableInfoTrade, column=0, row=3, text='Take Profit Price/Preço Alvo Lucro', text_color=color.white)

table.cell(table_id=tableInfoTrade, column=0, row=4, text=positionIsEntryLong ? str.tostring(targetLong) : positionIsEntryShort ? str.tostring(targetShort) : 'NONE/NENHUM', text_color=color.green)

table.cell(table_id=tableInfoTrade, column=1, row=3, text='Stop Loss Price/Preço Stop Loss', text_color=color.white)

table.cell(table_id=tableInfoTrade, column=1, row=4, text=positionIsEntryLong ? str.tostring(stopLossLong) : positionIsEntryShort ? str.tostring(stopLossShort) : 'NONE/NENHUM', text_color=color.red)

table.cell(table_id=tableInfoTrade, column=0, row=5, text='New Target/Novo Alvo', text_color=color.white)

table.cell(table_id=tableInfoTrade, column=0, row=6, text=verifyTurnoverTrend and positionIsEntryLong and isTurnoverTrendLongTrigger ? str.tostring(longPositionHighestHigh) : verifyTurnoverTrend and positionIsEntryShort and isTurnoverTrendShortTrigger ? str.tostring(shortPositionLowestLow) : 'NONE/NENHUM', text_color=color.green)

table.cell(table_id=tableInfoTrade, column=1, row=5, text='Possible Market Turnover/Possível Virada do Mercado', text_color=color.white)

table.cell(table_id=tableInfoTrade, column=1, row=6, text=verifyTurnoverTrend and positionIsEntryLong and isTurnoverTrendLongTrigger ? 'YES/SIM (Possible long going short/Possível long indo short)' : verifyTurnoverTrend and positionIsEntryShort and isTurnoverTrendShortTrigger ? 'YES/SIM (Possible short going long/Possível short indo long)' : 'NONE/NENHUM', text_color=color.red)