Adaptive Bollinger Trend Tracking Strategy

Author: ChaoZhang, Date: 2023-11-16 16:35:01Tags:

Overview

This strategy is based on the Bollinger Bands indicator, combined with an adaptive moving average, to accurately judge and track trends. By dynamically adjusting parameters, the strategy can adapt to different products and market environments, with strong stability and adaptability.

Strategy Logic

The strategy consists of the following main parts:

-

Calculate adaptive moving average. Use linear regression indicator to calculate linear regression curve over a certain period as moving average.

-

Calculate Bollinger Bands. Use adaptive ATR indicator to calculate bands, combined with user specified ratio2 parameter, to get upper and lower bands.

-

Determine entries and exits. Judge trend direction and entries/exits based on price breaking through Bollinger Bands. Breaking upper band signals sell entry while breaking lower band signals buy entry.

-

Set stop loss and take profit. Use fixed points stop loss to control risks and trailing stop profit to maximize trend profits.

-

Combine with backtesting time window for strategy optimization and verification.

Advantages

-

Adaptive parameters. Adaptive moving average and bands design adapts to market changes.

-

Clear breakout signals. Bollinger Bands breakouts offer clear trend reversal signals.

-

Reasonable stops setting. Fixed stop loss controls risks and trailing stop profit aims to maximize trend profits.

-

Validated by backtesting. Backtesting window verifies strategy effectiveness.

-

Easy to understand and implement. The logic is clear and code is concise for easy understanding.

Risks

-

Bollinger Bands need parameters tuning. Band width and period may need optimization for different products. Improper parameters lead to missing signals or false triggers.

-

Limited backtest period. Recent backtest range may be insufficient to fully verify stability across comprehensive historical data.

-

Overfitting risk. Current optimized parameters may overfit recent specific market conditions.

-

Stop loss level needs evaluation. Small stop loss may be too sensitive and get stopped out by small fluctuations. Suitable stop loss needs assessed.

-

Lack of quantifiable validation. Currently only use graphical breakout for trade signals without quantifiable metrics validation.

Improvement Directions

-

Introduce more adaptive indicators. Test combinations of various adaptive moving averages and channels to build robust trend tracking system.

-

Parameter optimization. Use more systematic methods like genetic algorithms to find optimal parameters combination.

-

Expand backtest period. Test on wider historical data to examine parameter stability. Incorporate transaction costs for more realistic backtest.

-

Introduce quantitative filters. Set up filters like volume breakout, MACD histogram gap to avoid false breakouts.

-

Optimize stops. Evaluate different fixed stop loss levels and trailing stop methods to find optimal stops.

-

Live validation. Run optimized strategy live to record performance for further improvements.

Conclusion

The strategy has clear logic using Bollinger Bands to determine trend direction and capture breakout signals, with moving average defining overall trend. With proper optimizations, it can become a stable and reliable trend following strategy. But key considerations include backtest representativeness, quantitative filters, and stop loss tuning. If these aspects are handled well, the strategy can achieve steady and considerable profits in live trading.

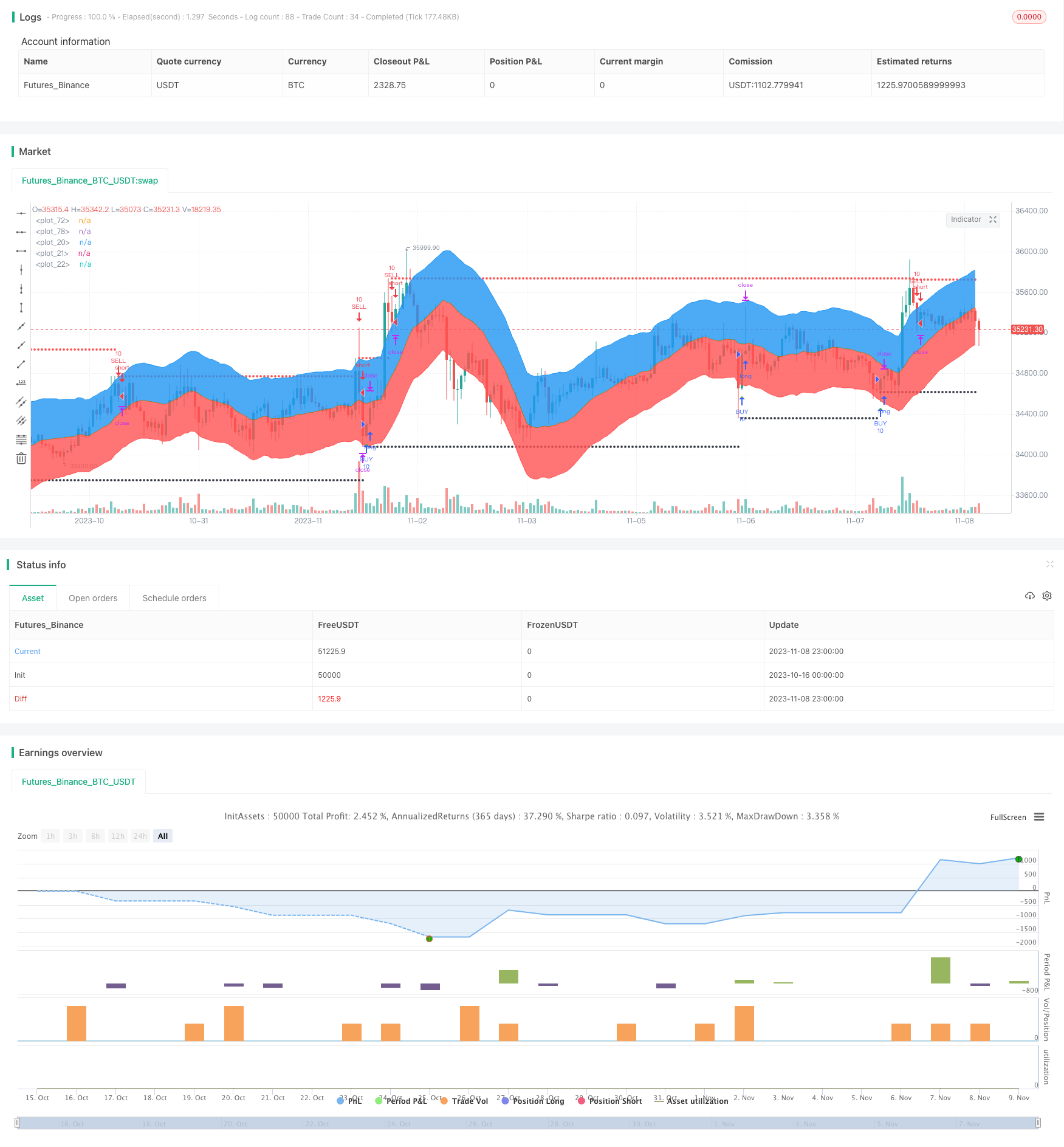

/*backtest

start: 2023-10-16 00:00:00

end: 2023-11-09 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Linear Regression (Backtest / Trailing Stop)",overlay=true)

close_price = close[0]

len = input(40)

linear_reg = linreg(close_price, len, 0)

calculationToPlotAverageMeanLine=linear_reg

useUpperDeviation = input(true, "Upper Deviation", bool)

useLowerDeviation = input(true, "Lower Deviation", bool)

ratio2=input(defval=2,title=" Ratio 2")

avg=atr(len)

r2=avg*ratio2

top=linear_reg+r2

bott=linear_reg-r2

calculationToPlotUpperLine=top

calculationToPlotLowerLine=bott

plotUpperDeviationLine = plot(not useUpperDeviation ? na : calculationToPlotUpperLine, color=color(blue,0))

plotAverageMeanLine = plot(calculationToPlotAverageMeanLine, color=color(olive,0))

plotLowererDeviationLine = plot(not useLowerDeviation ? na : calculationToPlotLowerLine, color=color(red,0))

fill(plotUpperDeviationLine, plotAverageMeanLine, color=color(blue,85))

fill(plotLowererDeviationLine, plotAverageMeanLine, color=color(red,85))

//

length = input(title="linear Length", defval=40, minval=1)

multiplier = input(title="linear Deviation", type=float, defval=2, minval=1)

overbought = input(title="Overbought", defval=1, minval=1)

oversold = input(title="Oversold", defval=0, minval=1)

custom_timeframe = input(title="Use another Timeframe?", type=bool, defval=false)

highTimeFrame = input(title="Select The Timeframe", defval="60")

res1 = custom_timeframe ? highTimeFrame : timeframe.period

fixedSL = input(title="SL Activation", defval=70)

trailSL = input(title="SL Trigger", defval=10)

fixedTP = input(title="TP Activation", defval=50)

trailTP = input(title="TP Trigger", defval=10)

// === INPUT BACKTEST RANGE ===

FromMonth = input(defval = 1, title = "From Month", minval = 1, maxval = 12)

FromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

FromYear = input(defval = 2019, title = "From Year", minval = 2015)

ToMonth = input(defval = 1, title = "To Month", minval = 1, maxval = 12)

ToDay = input(defval = 1, title = "To Day", minval = 1, maxval = 31)

ToYear = input(defval = 9999, title = "To Year", minval = 2015)

start = timestamp(FromYear, FromMonth, FromDay, 00, 00) // backtest start window

finish = timestamp(ToYear, ToMonth, ToDay, 23, 59) // backtest finish window

window() => time >= start and time <= finish ? true : false // create function "within window of time"

smabasis = linreg(close_price, length, 0)

stdev = stdev(close, length)

cierre = request.security(syminfo.tickerid, res1, close, false)

alta = request.security(syminfo.tickerid, res1, high, false)

baja = request.security(syminfo.tickerid, res1, low, false)

basis1 = request.security(syminfo.tickerid, res1, smabasis, false)

stdevb = request.security(syminfo.tickerid, res1, stdev, false)

dev = multiplier * stdevb // stdev(cierre, length)

upper = basis1 + dev

lower = basis1 - dev

bbr = (cierre - lower)/(upper - lower)

// plot(bbr)

// // MARCA LAS RESISTENCIAS

pintarojo = 0.0

pintarojo := nz(pintarojo[1])

pintarojo := bbr[1] > overbought and bbr < overbought ? alta[1] : nz(pintarojo[1])

p = plot(pintarojo, color = red, style=circles, linewidth=2)

// // MARCA LOS SOPORTES

pintaverde = 0.0

pintaverde := nz(pintaverde[1])

pintaverde := bbr[1] < oversold and bbr > oversold ? baja[1] : nz(pintaverde[1])

g = plot(pintaverde, color = black, style=circles, linewidth=2)

zz= crossover(pintaverde,pintaverde[1]) or crossunder(pintaverde,pintaverde[1])

kp= crossover(pintarojo,pintarojo[1]) or crossunder(pintarojo,pintarojo[1])

plotshape(zz, title="buy", style=shape.triangleup,location=location.belowbar, color=green, transp=0, size=size.small)

plotshape(kp, title="sell", style=shape.triangledown,location=location.abovebar, color=red, transp=0, size=size.small)

strategy.entry("BUY", strategy.long, qty=10, oca_name="BUY", when=zz and window())

strategy.exit("B.Exit", "BUY", qty_percent = 100, loss=fixedSL, trail_offset=trailTP, trail_points=fixedTP)

strategy.entry("SELL", strategy.short, qty=10, oca_name="SELL", when=kp and window())

strategy.exit("S.Exit", "SELL", qty_percent = 100, loss=fixedSL, trail_offset=trailSL, trail_points=fixedTP)

- MZ MA Cross Multiple TimeFrame Strategy

- Dual Moving Average Crossover Momentum Strategy

- Dual Moving Average Tracking Stop Loss Strategy

- Candlestick Body Based Dual Thrust Strategy

- Fixed Grid Trading Strategy

- Relative Strength Index Long/Short Strategy

- Dual Momentum Breakout Strategy

- Mean Reversion Trading Strategy Based on Bollinger Bands and Golden Ratio

- Momentum Trend Following Oscillation Strategy

- WaveTrend and CMF Based Trend Following Strategy

- Multi-Timeframe RSI Moving Average Crossover Strategy

- Trend Breakout Strategy Based on Bollinger Bands

- Adaptive Regularized Moving Average Cross-Market Arbitrage Strategy

- Dual Strong Trend Tracking Stop Loss Strategy

- Momentum Indicator Strategy

- Heikin-Ashi Reverse Strategy

- Dynamic Oscillation Breakout Strategy

- Trend Following 5-Minute EMA Crossover Strategy

- RSI Trend Following Strategy

- RSI Divergence Strategy