概述

该策略采用跨时间框架的移动平均线组合,识别大中小时图上的趋势轮换,实现低风险趋势跟踪交易。策略具有配置灵活、实现简单、资金效率高等优点,适合中长线持仓追趋势的交易者。

原理解析

策略使用5日、20日、40日三条移动平均线,判断不同时间框架下趋势的排列组合。根据大中小时图趋势一致性原理,确定多空周期。

具体来说,5日快线上穿20日中线视为短线上涨信号,20日中线上穿40日慢线视为中线上涨信号。当快中慢3线正排时(5日>20日>40日),判断为多头周期;当快中慢3线倒排时(5日<20日<40日),判断为空头周期。

这样,根据大周期趋势判断方向,再结合小周期力度检测具体入场。即只在大趋势同向且小周期有力的情况下开仓,能有效过滤反转假突破,实现高胜率操作。

此外,策略还运用ATR止损来控制单笔风险,进一步提高盈利率。

优势分析

配置灵活,用户可自行调整移动平均线参数,适应不同品种和交易偏好

实现简单,新手用户也能轻松使用

资金使用效率高,可充分发挥资金杠杆效应

风险可控,止损机制有效避免重大损失

追趋势能力强,大周期确定方向后持续盈利

胜率较高,交易信号质量好,少换轨误操作

风险及改进

大周期判断依赖移均线排列,存在滞后误判风险

小周期力度检测仅用一根K线,可能提前触发,可适当 relax

止损幅度固定,可优化为动态止损

可考虑加入附加过滤条件,如交易量能量等

可尝试不同移动平均线参数组合,优化策略

总结

本策略整合多时间框架分析和止损管理,实现了低风险的趋势跟踪交易。通过调整参数,可以适用于不同品种,满足趋势跟随者的需求。与传统单一时间框架系统相比,其交易决策更稳健,信号更高效。总体来说,该策略具有良好的市场适应性和发展前景。

Overview

This strategy uses a combination of moving averages across timeframes to identify trend rotations on the hourly, daily and weekly charts. It allows low-risk trend following trading. The strategy is flexible, simple to implement, capital efficient and suitable for medium-long term trend traders.

Trading Logic

The strategy employs 5, 20 and 40-day moving averages to determine the alignment of trends across different timeframes. Based on the consistency between larger and smaller timeframes, it identifies bullish and bearish cycles.

Specifically, the crossing of 5-day fast MA above 20-day medium MA indicates an uptrend in the short term. The crossing of 20-day medium MA above 40-day slow MA signals an uptrend in the medium term. When the fast, medium and slow MAs are positively aligned (5-day > 20-day > 40-day), it is a bull cycle. When they are negatively aligned (5-day < 20-day < 40-day), it is a bear cycle.

By determining direction from the larger cycles and confirming strength on the smaller cycles, this strategy opens positions only when major trend and minor momentum align. This effectively avoids false breakouts and achieves high win rate.

The strategy also utilizes ATR trailing stops to control single trade risks and further improve profitability.

Advantages

Flexible configurations to suit different instruments and trading styles

Simple to implement even for beginner traders

High capital efficiency to maximize leverage

Effective risk control to avoid significant losses

Strong trend following ability for sustained profits

High win rate due to robust signals and fewer whipsaws

Risks and Improvements

MA crossovers may lag and cause late trend detection

Single candle strength detection could trigger premature entry, relax condition

Fixed ATR stop loss, optimize to dynamic stops

Consider adding supplementary filters like volume

Explore different MA parameters for optimization

Conclusion

This strategy integrates multiple timeframe analysis and risk management for low-risk trend following trading. By adjusting parameters, it can be adapted to different instruments to suit trend traders. Compared to single timeframe systems, it makes more robust trading decisions and generates higher efficiency signals. In conclusion, this strategy has good market adaptiveness and development potential.

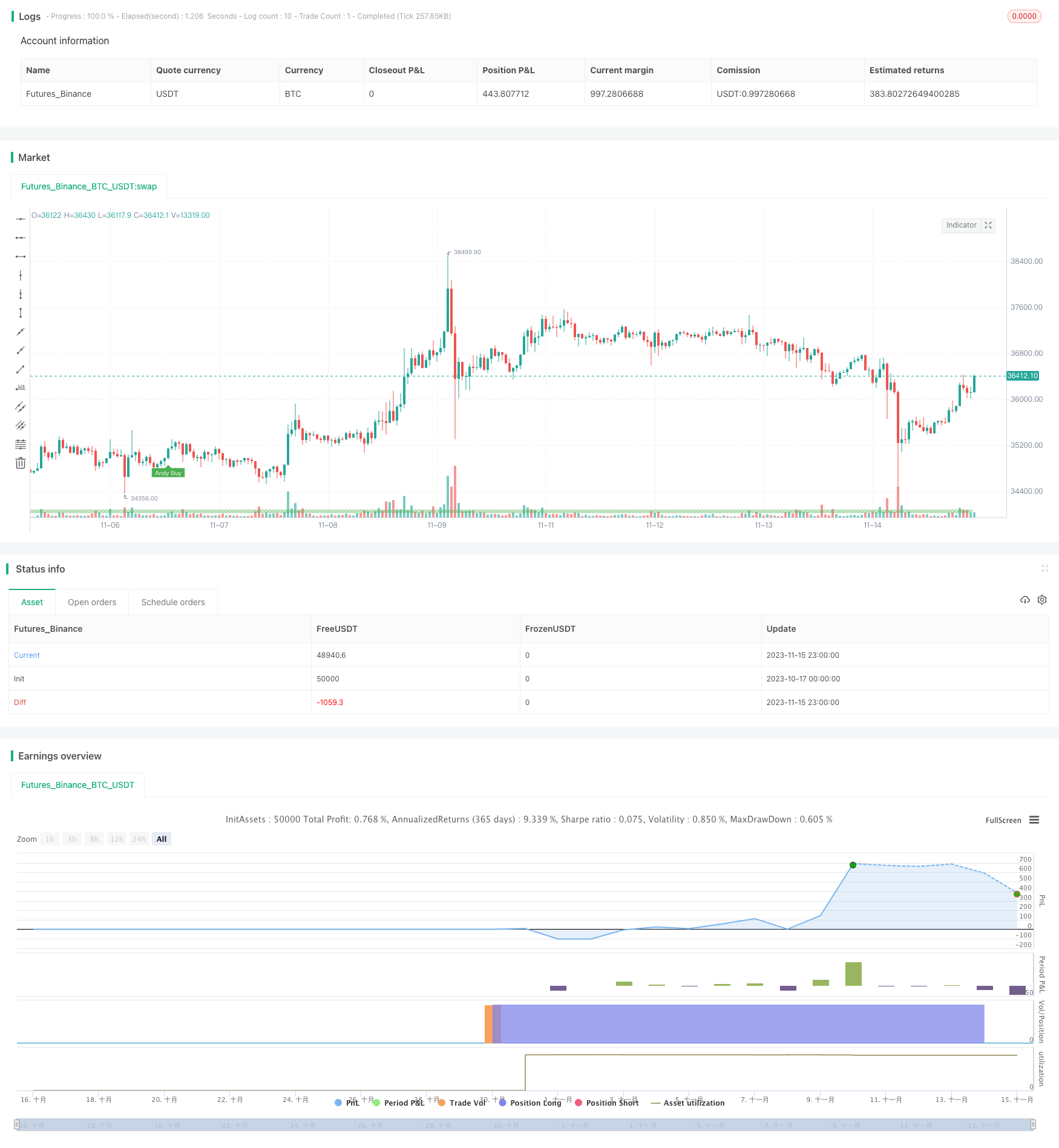

/*backtest

start: 2023-10-17 00:00:00

end: 2023-11-16 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © kgynofomo

//@version=5

strategy(title="[Salavi] | Andy Advance Pro Strategy [BTC|M15]",overlay = true, pyramiding = 1,initial_capital = 10000, default_qty_type = strategy.cash,default_qty_value = 10000)

ema_short = ta.ema(close,5)

ema_middle = ta.ema(close,20)

ema_long = ta.ema(close,40)

cycle_1 = ema_short>ema_middle and ema_middle>ema_long

cycle_2 = ema_middle>ema_short and ema_short>ema_long

cycle_3 = ema_middle>ema_long and ema_long>ema_short

cycle_4 = ema_long>ema_middle and ema_middle>ema_short

cycle_5 = ema_long>ema_short and ema_short>ema_middle

cycle_6 = ema_short>ema_long and ema_long>ema_middle

bull_cycle = cycle_1 or cycle_2 or cycle_3

bear_cycle = cycle_4 or cycle_5 or cycle_6

// label.new("cycle_1")

// bgcolor(color=cycle_1?color.rgb(82, 255, 148, 60):na)

// bgcolor(color=cycle_2?color.rgb(82, 255, 148, 70):na)

// bgcolor(color=cycle_3?color.rgb(82, 255, 148, 80):na)

// bgcolor(color=cycle_4?color.rgb(255, 82, 82, 80):na)

// bgcolor(color=cycle_5?color.rgb(255, 82, 82, 70):na)

// bgcolor(color=cycle_6?color.rgb(255, 82, 82, 60):na)

// Inputs

a = input(2, title='Key Vaule. \'This changes the sensitivity\'')

c = input(7, title='ATR Period')

h = false

xATR = ta.atr(c)

nLoss = a * xATR

src = h ? request.security(ticker.heikinashi(syminfo.tickerid), timeframe.period, close, lookahead=barmerge.lookahead_off) : close

xATRTrailingStop = 0.0

iff_1 = src > nz(xATRTrailingStop[1], 0) ? src - nLoss : src + nLoss

iff_2 = src < nz(xATRTrailingStop[1], 0) and src[1] < nz(xATRTrailingStop[1], 0) ? math.min(nz(xATRTrailingStop[1]), src + nLoss) : iff_1

xATRTrailingStop := src > nz(xATRTrailingStop[1], 0) and src[1] > nz(xATRTrailingStop[1], 0) ? math.max(nz(xATRTrailingStop[1]), src - nLoss) : iff_2

pos = 0

iff_3 = src[1] > nz(xATRTrailingStop[1], 0) and src < nz(xATRTrailingStop[1], 0) ? -1 : nz(pos[1], 0)

pos := src[1] < nz(xATRTrailingStop[1], 0) and src > nz(xATRTrailingStop[1], 0) ? 1 : iff_3

xcolor = pos == -1 ? color.red : pos == 1 ? color.green : color.blue

ema = ta.ema(src, 1)

above = ta.crossover(ema, xATRTrailingStop)

below = ta.crossover(xATRTrailingStop, ema)

buy = src > xATRTrailingStop and above

sell = src < xATRTrailingStop and below

barbuy = src > xATRTrailingStop

barsell = src < xATRTrailingStop

atr = ta.atr(14)

atr_length = input.int(25)

atr_rsi = ta.rsi(atr,atr_length)

atr_valid = atr_rsi>50

long_condition = buy and bull_cycle and atr_valid

short_condition = sell and bear_cycle and atr_valid

Exit_long_condition = short_condition

Exit_short_condition = long_condition

if long_condition

strategy.entry("Andy Buy",strategy.long, limit=close,comment="Andy Buy Here")

if Exit_long_condition

strategy.close("Andy Buy",comment="Andy Buy Out")

// strategy.entry("Andy fandan Short",strategy.short, limit=close,comment="Andy 翻單 short Here")

// strategy.close("Andy fandan Buy",comment="Andy short Out")

if short_condition

strategy.entry("Andy Short",strategy.short, limit=close,comment="Andy short Here")

// strategy.exit("STR","Long",stop=longstoploss)

if Exit_short_condition

strategy.close("Andy Short",comment="Andy short Out")

// strategy.entry("Andy fandan Buy",strategy.long, limit=close,comment="Andy 翻單 Buy Here")

// strategy.close("Andy fandan Short",comment="Andy Buy Out")

inLongTrade = strategy.position_size > 0

inLongTradecolor = #58D68D

notInTrade = strategy.position_size == 0

inShortTrade = strategy.position_size < 0

// bgcolor(color = inLongTrade?color.rgb(76, 175, 79, 70):inShortTrade?color.rgb(255, 82, 82, 70):na)

plotshape(close!=0,location = location.bottom,color = inLongTrade?color.rgb(76, 175, 79, 70):inShortTrade?color.rgb(255, 82, 82, 70):na)

plotshape(long_condition, title='Buy', text='Andy Buy', style=shape.labelup, location=location.belowbar, color=color.new(color.green, 0), textcolor=color.new(color.white, 0), size=size.tiny)

plotshape(short_condition, title='Sell', text='Andy Sell', style=shape.labeldown, location=location.abovebar, color=color.new(color.red, 0), textcolor=color.new(color.white, 0), size=size.tiny)

//atr > close *0.01* parameter

// MONTHLY TABLE PERFORMANCE - Developed by @QuantNomad

// *************************************************************************************************************************************************************************************************************************************************************************

show_performance = input.bool(true, 'Show Monthly Performance ?', group='Performance - credits: @QuantNomad')

prec = input(2, 'Return Precision', group='Performance - credits: @QuantNomad')

if show_performance

new_month = month(time) != month(time[1])

new_year = year(time) != year(time[1])

eq = strategy.equity

bar_pnl = eq / eq[1] - 1

cur_month_pnl = 0.0

cur_year_pnl = 0.0

// Current Monthly P&L

cur_month_pnl := new_month ? 0.0 :

(1 + cur_month_pnl[1]) * (1 + bar_pnl) - 1

// Current Yearly P&L

cur_year_pnl := new_year ? 0.0 :

(1 + cur_year_pnl[1]) * (1 + bar_pnl) - 1

// Arrays to store Yearly and Monthly P&Ls

var month_pnl = array.new_float(0)

var month_time = array.new_int(0)

var year_pnl = array.new_float(0)

var year_time = array.new_int(0)

last_computed = false

if (not na(cur_month_pnl[1]) and (new_month or barstate.islastconfirmedhistory))

if (last_computed[1])

array.pop(month_pnl)

array.pop(month_time)

array.push(month_pnl , cur_month_pnl[1])

array.push(month_time, time[1])

if (not na(cur_year_pnl[1]) and (new_year or barstate.islastconfirmedhistory))

if (last_computed[1])

array.pop(year_pnl)

array.pop(year_time)

array.push(year_pnl , cur_year_pnl[1])

array.push(year_time, time[1])

last_computed := barstate.islastconfirmedhistory ? true : nz(last_computed[1])

// Monthly P&L Table

var monthly_table = table(na)

if (barstate.islastconfirmedhistory)

monthly_table := table.new(position.bottom_center, columns = 14, rows = array.size(year_pnl) + 1, border_width = 1)

table.cell(monthly_table, 0, 0, "", bgcolor = #cccccc)

table.cell(monthly_table, 1, 0, "Jan", bgcolor = #cccccc)

table.cell(monthly_table, 2, 0, "Feb", bgcolor = #cccccc)

table.cell(monthly_table, 3, 0, "Mar", bgcolor = #cccccc)

table.cell(monthly_table, 4, 0, "Apr", bgcolor = #cccccc)

table.cell(monthly_table, 5, 0, "May", bgcolor = #cccccc)

table.cell(monthly_table, 6, 0, "Jun", bgcolor = #cccccc)

table.cell(monthly_table, 7, 0, "Jul", bgcolor = #cccccc)

table.cell(monthly_table, 8, 0, "Aug", bgcolor = #cccccc)

table.cell(monthly_table, 9, 0, "Sep", bgcolor = #cccccc)

table.cell(monthly_table, 10, 0, "Oct", bgcolor = #cccccc)

table.cell(monthly_table, 11, 0, "Nov", bgcolor = #cccccc)

table.cell(monthly_table, 12, 0, "Dec", bgcolor = #cccccc)

table.cell(monthly_table, 13, 0, "Year", bgcolor = #999999)

for yi = 0 to array.size(year_pnl) - 1

table.cell(monthly_table, 0, yi + 1, str.tostring(year(array.get(year_time, yi))), bgcolor = #cccccc)

y_color = array.get(year_pnl, yi) > 0 ? color.new(color.teal, transp = 40) : color.new(color.gray, transp = 40)

table.cell(monthly_table, 13, yi + 1, str.tostring(math.round(array.get(year_pnl, yi) * 100, prec)), bgcolor = y_color, text_color=color.new(color.white, 0))

for mi = 0 to array.size(month_time) - 1

m_row = year(array.get(month_time, mi)) - year(array.get(year_time, 0)) + 1

m_col = month(array.get(month_time, mi))

m_color = array.get(month_pnl, mi) > 0 ? color.new(color.teal, transp = 40) : color.new(color.gray, transp = 40)

table.cell(monthly_table, m_col, m_row, str.tostring(math.round(array.get(month_pnl, mi) * 100, prec)), bgcolor = m_color, text_color=color.new(color.white, 0))