Golden Cross with Bollinger Bands Momentum Strategy

Author: ChaoZhang, Date: 2023-11-21 12:01:25Tags:

Overview

This strategy combines moving average, Bollinger bands and volume weighted average price (VWAP) indicators. It enters long positions when the golden cross forms and the fast moving average breaks above the slow one. The strategy also utilizes the Bollinger band channel and only considers entering when the price touches the lower band, thus avoiding frequent entries and exits amid market fluctuations.

Strategy Logic

The core logic relies on moving averages to determine the trend direction, and Bollinger bands to locate the fluctuation range for buying signals. Specifically, it has the following key rules:

-

Construct the golden cross system using 50-day EMA and 200-day EMA. An up trend is identified when the fast EMA crosses above the slow EMA.

-

When the price is above VWAP, it indicates the price is in an upward phase which favors long positions.

-

When the price just touches or breaks the Bollinger lower band, it suggests the price may be near a rebound point thus providing a good opportunity.

-

Exit long positions with profit when the price exceeds the Bollinger upper band.

By combining these rules, the strategy is able to locate appropriate long entries in bull markets and set stop loss/profit taking to secure returns.

Advantages

-

The golden cross system determines the major trend direction, avoiding small wins and losses amid consolidations.

-

VWAP gauges the price wave direction for more precise buying signals.

-

The Bollinger bands add resilience by locating buys while setting stop loss/profit taking locks in gains.

-

Multiple confirming indicators enhance reliability.

Risks and Solutions

-

The golden cross may give false signals. Fine tune the MA periods and add other confirmations.

-

Improper Bollinger parameters could render the strategy ineffective. Optimize periods and standard deviation.

-

A stop loss threshold too wide fails to effectively limit losses. Tighten the stop loss range to ensure controllable risks.

Optimization Directions

-

Optimize MA combinations by testing different parameters to find the best.

-

Test Bollinger periods and parameter sets for better bandwidth and volatility.

-

Test and tune stop loss ranges for balancing risk control and avoiding premature triggering.

Conclusion

This strategy strikes a balance between discovering opportunities and controlling risks by integrating MA, Bollinger and VWAP analysis for entries. Continuous fine tuning and optimization will allow it to capitalize on sector and market trends over time.

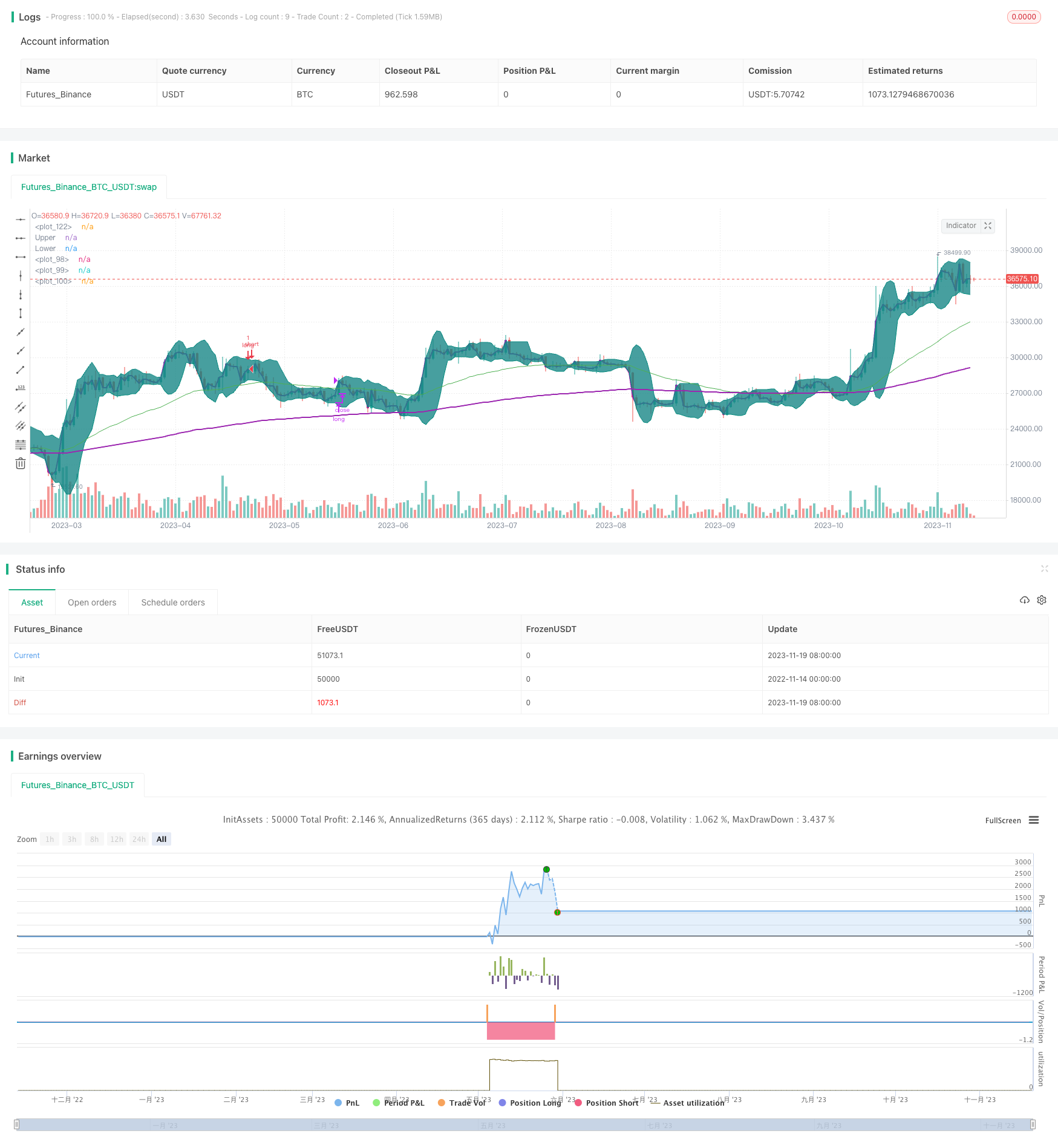

/*backtest

start: 2022-11-14 00:00:00

end: 2023-11-20 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © mohanee

//@version=4

strategy(title="VWAP and BB strategy [$$]", overlay=true,pyramiding=2, default_qty_value=1, default_qty_type=strategy.fixed, initial_capital=10000, currency=currency.USD)

fromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

fromMonth = input(defval = 6, title = "From Month", minval = 1, maxval = 12)

fromYear = input(defval = 2020, title = "From Year", minval = 1970)

// To Date Inputs

toDay = input(defval = 1, title = "To Day", minval = 1, maxval = 31)

toMonth = input(defval = 8, title = "To Month", minval = 1, maxval = 12)

toYear = input(defval = 2020, title = "To Year", minval = 1970)

// Calculate start/end date and time condition

DST = 1 //day light saving for usa

//--- Europe

London = iff(DST==0,"0000-0900","0100-1000")

//--- America

NewYork = iff(DST==0,"0400-1300","0500-1400")

//--- Pacific

Sydney = iff(DST==0,"1300-2200","1400-2300")

//--- Asia

Tokyo = iff(DST==0,"1500-2400","1600-0100")

//-- Time In Range

timeinrange(res, sess) => time(res, sess) != 0

london = timeinrange(timeframe.period, London)

newyork = timeinrange(timeframe.period, NewYork)

startDate = timestamp(fromYear, fromMonth, fromDay, 00, 00)

finishDate = timestamp(toYear, toMonth, toDay, 00, 00)

time_cond = time >= startDate and time <= finishDate

is_price_dipped_bb(pds,source1) =>

t_bbDipped=false

for i=1 to pds

t_bbDipped:= (t_bbDipped or close[i]<source1) ? true : false

if t_bbDipped==true

break

else

continue

t_bbDipped

is_bb_per_dipped(pds,bbrSrc) =>

t_bbDipped=false

for i=1 to pds

t_bbDipped:= (t_bbDipped or bbrSrc[i]<=0) ? true : false

if t_bbDipped==true

break

else

continue

t_bbDipped

// variables BEGIN

shortEMA = input(50, title="fast EMA", minval=1)

longEMA = input(200, title="slow EMA", minval=1)

//BB

smaLength = input(7, title="BB SMA Length", minval=1)

bbsrc = input(close, title="BB Source")

strategyCalcOption = input(title="strategy to use", type=input.string, options=["BB", "BB_percentageB"], defval="BB")

//addOnDivergence = input(true,title="Add to existing on Divergence")

//exitOption = input(title="exit on RSI or BB", type=input.string, options=["RSI", "BB"], defval="BB")

//bbSource = input(title="BB source", type=input.string, options=["close", "vwap"], defval="close")

//vwap_res = input(title="VWAP Resolution", type=input.resolution, defval="session")

stopLoss = input(title="Stop Loss%", defval=1, minval=1)

//variables END

longEMAval= ema(close, longEMA)

shortEMAval= ema(close, shortEMA)

ema200val = ema(close, 200)

vwapVal=vwap(close)

// Drawings

//plot emas

plot(shortEMAval, color = color.green, linewidth = 1, transp=0)

plot(longEMAval, color = color.orange, linewidth = 1, transp=0)

plot(ema200val, color = color.purple, linewidth = 2, style=plot.style_line ,transp=0)

//bollinger calculation

mult = input(2.0, minval=0.001, maxval=50, title="StdDev")

basis = sma(bbsrc, smaLength)

dev = mult * stdev(bbsrc, smaLength)

upperBand = basis + dev

lowerBand = basis - dev

offset = input(0, "Offset", type = input.integer, minval = -500, maxval = 500)

bbr = (bbsrc - lowerBand)/(upperBand - lowerBand)

//bollinger calculation

//plot bb

//plot(basis, "Basis", color=#872323, offset = offset)

p1 = plot(upperBand, "Upper", color=color.teal, offset = offset)

p2 = plot(lowerBand, "Lower", color=color.teal, offset = offset)

fill(p1, p2, title = "Background", color=#198787, transp=95)

plot(vwapVal, color = color.purple, linewidth = 2, transp=0)

// Colour background

//barcolor(shortEMAval>longEMAval and close<=lowerBand ? color.yellow: na)

//longCondition= shortEMAval > longEMAval and close>open and close>vwapVal

longCondition= ( shortEMAval > longEMAval and close>open and close>vwapVal and close<upperBand ) //and time_cond // and close>=vwapVal

//Entry

strategy.entry(id="long", comment="VB LE" , long=true, when= longCondition and ( strategyCalcOption=="BB"? is_price_dipped_bb(10,lowerBand) : is_bb_per_dipped(10,bbr) ) and strategy.position_size<1 ) //is_price_dipped_bb(10,lowerBand)) //and strategy.position_size<1 is_bb_per_dipped(15,bbr)

//add to the existing position

strategy.entry(id="long", comment="Add" , long=true, when=strategy.position_size>=1 and close<strategy.position_avg_price and close>vwapVal) //and time_cond)

barcolor(strategy.position_size>=1 ? color.blue: na)

strategy.close(id="long", comment="TP Exit", when=crossover(close,upperBand) )

//stoploss

stopLossVal = strategy.position_avg_price * (1-(stopLoss*0.01) )

//strategy.close(id="long", comment="SL Exit", when= close < stopLossVal)

//strategy.risk.max_intraday_loss(stopLoss, strategy.percent_of_equity)

- Dual Moving Average Price Leaping Strategy

- Connors Dual Moving Average RSI Reversal Trading Strategy

- Super Guppy Moving Average Trading Strategy

- Moonshot Dual Triangle Breakout Strategy

- Fibonacci Band Oscillation Strategy

- Quantitative Zigzag Strategy

- Cross Moving Average Strategy

- Dual Moving Average Crossover Trading Strategy

- Dual Moving Average Crossover Combined with RSI Indicator Quantitative Trading Strategy

- Dual-direction Volatility Swallowing Strategy

- Quantitative Trading Strategy Based on Double EMA Crossover

- Elder Ray Bull Power Combo Strategy

- Dual Moving Average Crossover Strategy

- Dual Cross Moving Average Reversal Strategy

- Multi-factor Momentum Reversal Combo Strategy

- Trading Strategy Based on Standard Deviation of Trading Volume

- Multi-timeframe Adaptive Tracking Stop Loss Strategy

- Double Strong Indicators Strategy

- Trend Tracking Strategy Based on Bollinger Bands and Exponential Moving Average

- Momentum Rotation Across Timeframes Trend Following Strategy