Trend Reversal Strategy Based on Multiple Moving Averages

Author: ChaoZhang, Date: 2023-11-21 14:53:48Tags:

Overview

This strategy generates buy and sell signals based on reversals of multiple trend indicators including TDI, TCF, TTF and TII. The strategy allows selecting which indicator signal to use for entries and exits.

Strategy Logic

-

TDI Indicator

The TDI indicator is constructed using price momentum with summing and smoothing techniques. It goes long when TDI direction crosses above TDI line and exits when crossing below.

-

TCF Indicator

TCF indicator measures positive and negative price changes to gauge bullish and bearish forces. It goes long when positive change is greater than negative change, otherwise it exits.

-

TTF Indicator

TTF indicator compares the power of highest and lowest prices to determine trend. The long signal is when TTF crosses above 100 and exit is when crossing below -100.

-

TII Indicator

The TII combines moving average and price bands to identify trend reversals. It considers both short and long term trends. The long signal is above 80 and exit is below 80.

The entry long and close logic selects appropriate signals based on configured indicator.

Advantages

The strategy incorporates several commonly used trend trading indicators, which allows flexibility to adapt to changing market conditions. Specific advantages:

- Captures trend reversal opportunities in a timely manner using reversal signals

- Optimizable through configuring different indicators

- Rich indicator combinations can be used to confirm signals

Risks

The main risks this strategy faces:

- Indicator signals may have false signals resulting in losses

- Individual indicators cannot fully judge trends and are susceptible to market noise

- Incorrect configurations of indicators and trading parameters can misinterpret the market and generate erroneous trades

Risks can be reduced by:

- Optimizing indicator parameters to find best combinations

- Requiring multiple indicator signal confirmations to improve quality

- Adjusting position sizing to control single trade loss

Enhancement Opportunities

The strategy can be enhanced in several areas:

- Test optimal indicators and parameters across different market cycles

- Add or reduce indicators to find best combinations

- Filter out false signals

- Optimize position sizing strategies e.g. variable size, trailing stop loss

- Incorporate machine learning scoring to assist with signal quality

Conclusion

By combining multiple trend reversal indicators and optimizing configurations, this strategy is adaptable to varying market environments foroperating at trend turning points. The key is finding the optimum parameters and indicators while controlling risk. Continued optimizations and validations can build a steady alpha strategy.

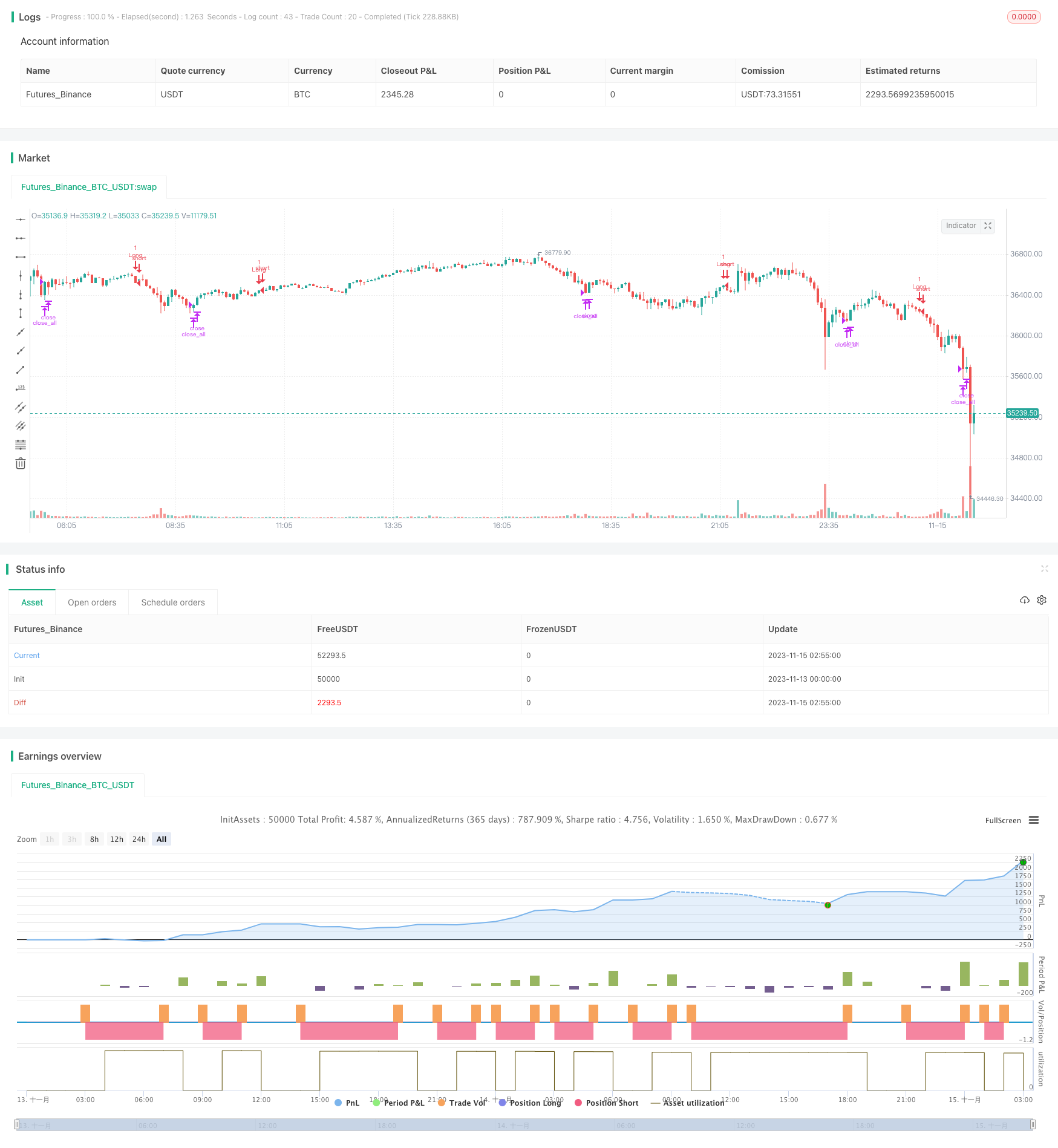

/*backtest

start: 2023-11-13 00:00:00

end: 2023-11-15 03:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © kruskakli

//

// Here is a collection of Trend Indicators as defined by M.H Pee and presented

// in various articles of the "STOCKS & COMMODITIES Magazine"

//

// The actual implementation of the indicators here are made by: everget

//

// I have gather them here so that they easily can be tested.

//

// My own test was made using 15 companies from the OMXS30 list

// during the time period of 2016-2018, and I only went LONG.

//

// The result was as follows:

//

// Average Std.Dev

// profit

// TDI 3.04% 5.97

// TTF 1.22%. 5.73

// TII 1.07% 6.2

// TCF 0.32% 2.68

//

strategy("M.H Pee indicators", overlay=true)

use = input(defval="TDI", title="Use Indicator", type=input.string,

options=["TDI","TCF","TTF","TII"])

src = close

//

// TDI

//

length = input(title="Length", type=input.integer, defval=20)

mom = change(close, length)

tdi = abs(sum(mom, length)) - sum(abs(mom), length * 2) + sum(abs(mom), length)

// Direction Indicator

tdiDirection = sum(mom, length)

tdiLong = crossover(tdiDirection, tdi)

tdiXLong = crossunder(tdiDirection, tdi)

//

// TCF

//

tcflength = input(title="Length", type=input.integer, defval=35)

plusChange(src) =>

change_1 = change(src)

change(src) > 0 ? change_1 : 0.0

minusChange(src) =>

change_1 = change(src)

change(src) > 0 ? 0.0 : -change_1

plusCF = 0.0

plusChange__1 = plusChange(src)

plusCF := plusChange(src) == 0 ? 0.0 : plusChange__1 + nz(plusCF[1])

minusCF = 0.0

minusChange__1 = minusChange(src)

minusCF := minusChange(src) == 0 ? 0.0 : minusChange__1 + nz(minusCF[1])

plusTCF = sum(plusChange(src) - minusCF, tcflength)

minusTCF = sum(minusChange(src) - plusCF, tcflength)

tcfLong = plusTCF > 0

tcfXLong = plusTCF < 0

//

// TTF

//

ttflength = input(title="Lookback Length", type=input.integer, defval=15)

hh = highest(length)

ll = lowest(length)

buyPower = hh - nz(ll[length])

sellPower = nz(hh[length]) - ll

ttf = 200 * (buyPower - sellPower) / (buyPower + sellPower)

ttfLong = crossover(ttf, 100)

ttfXLong = crossunder(ttf, -100)

//

// TII

//

majorLength = input(title="Major Length", type=input.integer, defval=60)

minorLength = input(title="Minor Length", type=input.integer, defval=30)

upperLevel = input(title="Upper Level", type=input.integer, defval=80)

lowerLevel = input(title="Lower Level", type=input.integer, defval=20)

sma = sma(src, majorLength)

positiveSum = 0.0

negativeSum = 0.0

for i = 0 to minorLength - 1 by 1

price = nz(src[i])

avg = nz(sma[i])

positiveSum := positiveSum + (price > avg ? price - avg : 0)

negativeSum := negativeSum + (price > avg ? 0 : avg - price)

negativeSum

tii = 100 * positiveSum / (positiveSum + negativeSum)

tiiLong = crossover(tii, 80)

tiiXLong = crossunder(tii,80)

//

// LOGIC

//

enterLong = (use == "TDI" and tdiLong) or (use == "TCF" and tcfLong) or (use == "TTF" and ttfLong) or (use == "TII" and tiiLong)

exitLong = (use == "TDI" and tdiXLong) or (use == "TCF" and tcfXLong) or (use == "TTF" and ttfXLong) or (use == "TII" and tiiXLong)

// Time range for Back Testing

btStartYear = input(title="Back Testing Start Year", type=input.integer, defval=2016)

btStartMonth = input(title="Back Testing Start Month", type=input.integer, defval=1)

btStartDay = input(title="Back Testing Start Day", type=input.integer, defval=1)

startTime = timestamp(btStartYear, btStartMonth, btStartDay, 0, 0)

btStopYear = input(title="Back Testing Stop Year", type=input.integer, defval=2028)

btStopMonth = input(title="Back Testing Stop Month", type=input.integer, defval=12)

btStopDay = input(title="Back Testing Stop Day", type=input.integer, defval=31)

stopTime = timestamp(btStopYear, btStopMonth, btStopDay, 0, 0)

window() => time >= startTime and time <= stopTime ? true : false

riskPerc = input(title="Max Position %", type=input.float, defval=20, step=0.5)

maxLossPerc = input(title="Max Loss Risk %", type=input.float, defval=5, step=0.25)

// Average True Range (ATR) measures market volatility.

// We use it for calculating position sizes.

atrLen = input(title="ATR Length", type=input.integer, defval=14)

stopOffset = input(title="Stop Offset", type=input.float, defval=1.5, step=0.25)

limitOffset = input(title="Limit Offset", type=input.float, defval=1.0, step=0.25)

atrValue = atr(atrLen)

// Calculate position size

maxPos = floor((strategy.equity * (riskPerc/100)) / src)

// The position sizing algorithm is based on two parts:

// a certain percentage of the strategy's equity and

// the ATR in currency value.

riskEquity = (riskPerc / 100) * strategy.equity

// Translate the ATR into the instrument's currency value.

atrCurrency = (atrValue * syminfo.pointvalue)

posSize0 = min(floor(riskEquity / atrCurrency), maxPos)

posSize = posSize0 < 1 ? 1 : posSize0

if (window())

strategy.entry("Long", long=true, qty=posSize0, when=enterLong)

strategy.close_all(when=exitLong)

- Multi-timeframe RSI+CCI+Bollinger Band DCA Strategy

- Fibonacci Retracement Quantitative Trading Strategy

- Dual Indicator Oscillation Strategy

- Dual Moving Average Price Breakthrough Strategy

- Dynamic Stop Loss Trail Strategy

- Aligned Moving Average and Cumulative High Low Index Combination Strategy

- Dual EMA Williams Indicator Trend Tracking Strategy

- Dual EMA Golden Cross Trend Tracking Strategy

- Momentum Breakthrough TTM Strategy

- Dynamic Range Breakout Strategy

- Bitcoin Trading Strategy Based on Chinese Zodiac Calendar

- Inverse Fisher RSI Moving Average Multi Timeframe Strategy

- Quantitative Trading Strategy Based on Daily Close Price Comparison

- Dual Moving Average Price Leaping Strategy

- Connors Dual Moving Average RSI Reversal Trading Strategy

- Super Guppy Moving Average Trading Strategy

- Moonshot Dual Triangle Breakout Strategy

- Fibonacci Band Oscillation Strategy

- Quantitative Zigzag Strategy

- Cross Moving Average Strategy