Dual EMA Golden Cross Trend Tracking Strategy

Author: ChaoZhang, Date: 2023-11-21 15:10:54Tags:

Overview

This strategy calculates fast EMA line and slow EMA line and compares the size relationship between the two EMAs to determine the trend direction of the market. It belongs to a simple trend tracking strategy. When the fast EMA crosses above the slow EMA, go long. When the fast EMA crosses below the slow EMA, go short. It is a typical dual EMA golden cross strategy.

Strategy Logic

The core indicators of this strategy are fast EMA and slow EMA. The fast EMA length is set to 21 periods and the slow EMA length is set to 55 periods. The fast EMA can respond to price changes faster, reflecting the recent short-term trend; the slow EMA responds more slowly to price changes, filtering out some noise and reflecting the medium-to-long term trend.

When the fast EMA crosses above the slow EMA, it indicates that the short-term trend has turned upward and the medium-to-long term trend may have reversed, which is a signal to go long. When the fast EMA crosses below the slow EMA, it indicates that the short-term trend has turned downward and the medium-to-long term trend may have reversed, which is a signal to go short.

By comparing fast and slow EMAs, it captures trend reversal points on two timescales, short-term and medium-to-long term, which is a typical trend tracking strategy.

Advantages

- Simple and clear logic, easy to understand and implement

- Flexible parameter tuning, fast and slow EMA periods can be customized

- Configurable ATR stop loss and take profit for controllable risks

Risks

- Inappropriate timing of EMA crossovers, risk of missing best entry point

- Frequent invalid signals during market consolidation, causing losses

- Improper ATR parameter setting, leading to too loose or too aggressive stops

Risk Management:

- Optimize EMA fast and slow line parameters to find optimal combinations

- Add filtering mechanisms to avoid invalid signals from market consolidation

- Test and optimize ATR parameters to ensure reasonable stop loss and take profit

Enhancement Areas

- Test stability of different EMA period parameters based on statistical methods

- Add filtering conditions combined with other indicators to avoid invalid signals

- Optimize ATR parameters to get best stop loss/take profit ratio

Summary

This strategy judges trend based on EMA crossovers, which is simple and clear to implement. With ATR-based stops, risks are controllable. Further improvements on stability and profitability can be made through parameter optimization and filtering conditions.

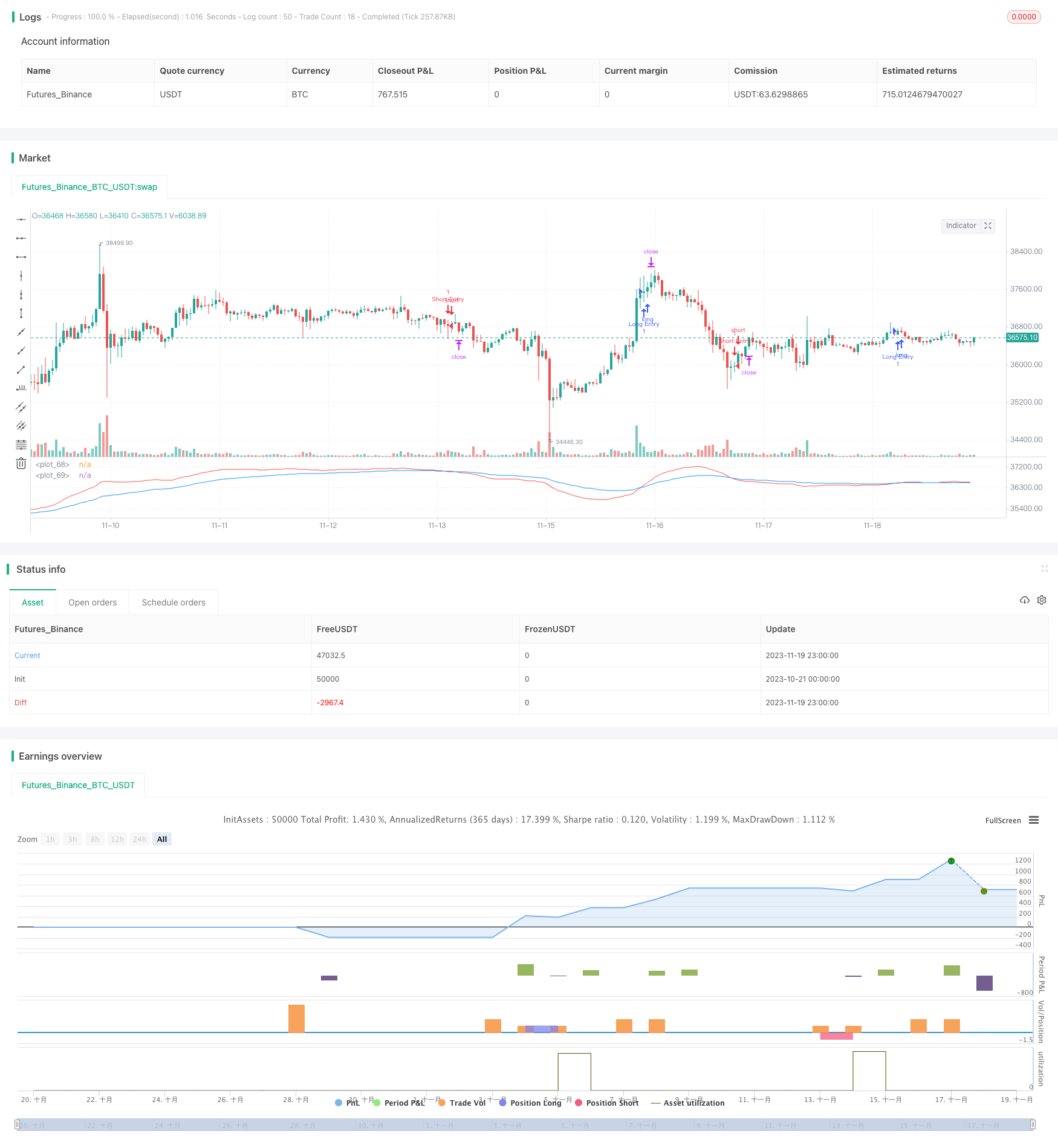

/*backtest

start: 2023-10-21 00:00:00

end: 2023-11-20 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy(title = "VP Backtester", overlay=false)

// Create General Strategy Inputs

st_yr_inp = input(defval=2017, title='Backtest Start Year')

st_mn_inp = input(defval=01, title='Backtest Start Month')

st_dy_inp = input(defval=01, title='Backtest Start Day')

en_yr_inp = input(defval=2025, title='Backtest End Year')

en_mn_inp = input(defval=01, title='Backtest End Month')

en_dy_inp = input(defval=01, title='Backtest End Day')

// Default Stop Types

fstp = input(defval=false, title="Fixed Perc stop")

fper = input(defval=0.1, title='Percentage for fixed stop', type=float)

atsp = input(defval=true, title="ATR Based stop")

atrl = input(defval=14, title='ATR Length for stop')

atrmsl = input(defval=1.5, title='ATR Multiplier for stoploss')

atrtpm = input(defval=1, title='ATR Multiplier for profit')

// Sessions

asa_inp = input(defval=true, title="Trade the Asian Session")

eur_inp = input(defval=true, title="Trade the European Session")

usa_inp = input(defval=true, title="Trade the US session")

ses_cls = input(defval=true, title="End of Session Close Out?")

// Session Start / End times (In exchange TZ = UTC-5)

asa_ses = "1700-0300"

eur_ses = "0200-1200"

usa_ses = "0800-1700"

in_asa = time(timeframe.period, asa_ses)

in_eur = time(timeframe.period, eur_ses)

in_usa = time(timeframe.period, usa_ses)

strategy.risk.allow_entry_in(strategy.direction.all)

// Set start and end dates for backtest

start = timestamp(st_yr_inp, st_mn_inp, st_dy_inp,00,00)

end = timestamp(en_yr_inp, en_mn_inp, en_dy_inp,00,00)

window() => time >= start and time <= end ? true : false // create function "within window of time"

// Check if we are in a sessions we want to trade

can_trade = asa_inp and not na(in_asa) ? true :

eur_inp and not na(in_eur) ? true :

usa_inp and not na(in_usa) ? true :

false

// atr calc for stop and profit

atr = atr(atrl)

atr_stp_dst_sl = atr * atrmsl

atr_stp_dst_tp = atr * atrtpm

//*************************************************************************************

// Put your strategy/indicator code below

// and make sure to set long_condition=1 for opening a buy trade

// and short_condition for opening a sell trade

//*************************************************************************************

fastInput = input(21)

slowInput = input(55)

fast = ema(close, fastInput)

slow = ema(close, slowInput)

plot(fast, color = red)

plot(slow, color = blue)

long_condition = crossover(fast, slow)

short_condition = crossunder(fast, slow)

//*************************************************************************************

// Trade management with ATR based stop & profit

//*************************************************************************************

if (long_condition and window() )

strategy.entry("Long Entry", strategy.long)

if strategy.position_size <= 0 // Less than as in both direction strat - Could be long before switching

if atsp

atr_stop = open - atr_stp_dst_sl

atr_profit = open + atr_stp_dst_tp

strategy.exit('ATR Long Exit', "Long Entry", stop=atr_stop, limit = atr_profit)

if fstp

stop = open - (open * fper)

strategy.exit('Perc Fixed Long Stop Exit', "Long Entry", stop=stop)

if (short_condition and window() )

strategy.entry("Short Entry",strategy.short)

if strategy.position_size >= 0 // Greater than as in both direction strat - Could be long before switching

if atsp

atr_stop = open + atr_stp_dst_sl

atr_profit = open - atr_stp_dst_tp

strategy.exit('ATR Short Exit', "Short Entry", stop=atr_stop, limit = atr_profit)

if fstp

stop = open + (open * fper)

strategy.exit('Perc Fixed Short Stop Exit', "Short Entry", stop=stop)

strategy.close_all(when=not can_trade and ses_cls)

- Reversal Short-term Breakout Trading Strategy

- Dual Moving Average Crossover Arrow Strategy

- Momentum Oscillation Trading Strategy

- Multi-timeframe RSI+CCI+Bollinger Band DCA Strategy

- Fibonacci Retracement Quantitative Trading Strategy

- Dual Indicator Oscillation Strategy

- Dual Moving Average Price Breakthrough Strategy

- Dynamic Stop Loss Trail Strategy

- Aligned Moving Average and Cumulative High Low Index Combination Strategy

- Dual EMA Williams Indicator Trend Tracking Strategy

- Momentum Breakthrough TTM Strategy

- Dynamic Range Breakout Strategy

- Trend Reversal Strategy Based on Multiple Moving Averages

- Bitcoin Trading Strategy Based on Chinese Zodiac Calendar

- Inverse Fisher RSI Moving Average Multi Timeframe Strategy

- Quantitative Trading Strategy Based on Daily Close Price Comparison

- Dual Moving Average Price Leaping Strategy

- Connors Dual Moving Average RSI Reversal Trading Strategy

- Super Guppy Moving Average Trading Strategy

- Moonshot Dual Triangle Breakout Strategy