Bottom Catching Strategy

Author: ChaoZhang, Date: 2023-11-22 15:46:19Tags:

Overview

This strategy utilizes the RSI and EMA indicators to determine entries and exits. It performs well in bear markets and can catch bottom rebound opportunities.

Strategy Logic

The strategy is based on the following entry and exit conditions:

Entry conditions:

- RSI < 40

- RSI is 3 points lower than previous day

- 50-day EMA crosses below 100-day EMA

Exit conditions:

- RSI > 65

- 9-day EMA crosses above 50-day EMA

This allows buying on dips and selling at highs during bounces, catching bottom rebound opportunities.

Advantage Analysis

The strategy has the following advantages:

- Utilize RSI to catch oversold opportunities

- EMA patterns to spot trend change points

- Good backtesting results, especially resilience in bear markets

- Configurable parameters to adjust strategy

Risk Analysis

The strategy also has the following risks:

- Improper parameter tuning may cause premature entries or delayed exits

- Rebounds may not materialize or sustain

- Trading fees and slippage also affect actual profit

Parameters can be optimized, or other indicators combined to determine market structure.

Optimization Directions

The strategy can be improved in the following ways:

- Test parameter combinations separately for different coins

- Incorporate volume changes to confirm signals

- Add stop loss to limit single trade loss

- Consider dynamic position sizing

Conclusion

The bottom catching strategy has clear logic and works well in bear markets. More parameter tuning and optimizations can lead to better backtest results. But risks need to be monitored in live trading, and losses cannot be entirely avoided.

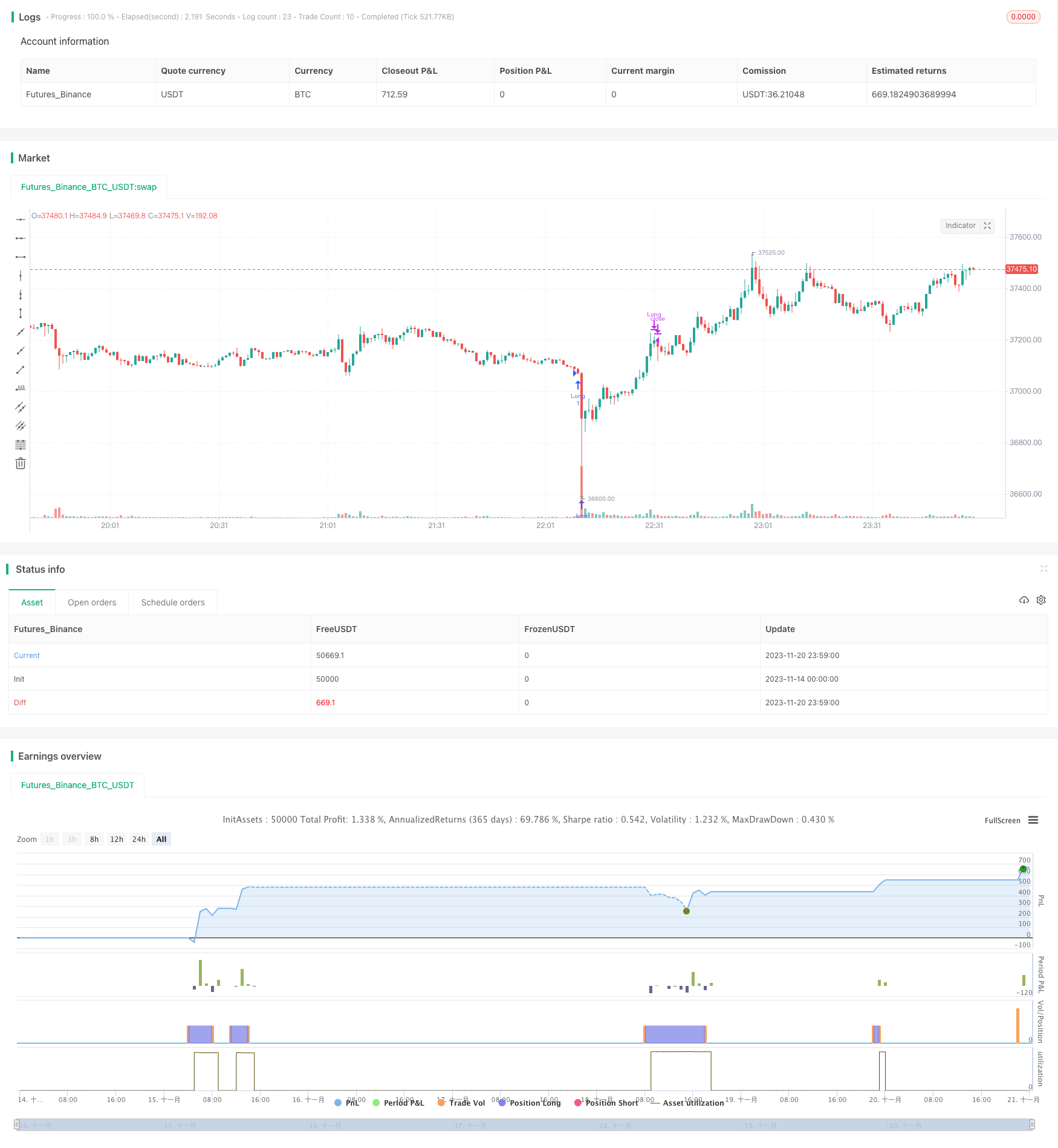

/*backtest

start: 2023-11-14 00:00:00

end: 2023-11-21 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © Coinrule

//@version=5

strategy("V3 - Catching the Bottom",

overlay=true)

showDate = input(defval=true, title='Show Date Range')

timePeriod = time >= timestamp(syminfo.timezone, 2022, 4, 1, 0, 0)

notInTrade = strategy.position_size <= 0

//==================================Buy Conditions============================================

//RSI

length = input(14)

vrsi = ta.rsi(close, length)

buyCondition1 = vrsi < 40

//RSI decrease

decrease = 3

buyCondition2 = (vrsi < vrsi[1] - decrease)

//sellCondition1 = request.security(syminfo.tickerid, "15", buyCondition2)

//EMAs

fastEMA = ta.sma(close, 50)

slowEMA = ta.sma(close, 100)

buyCondition3 = ta.crossunder(fastEMA, slowEMA)

//buyCondition2 = request.security(syminfo.tickerid, "15", buyCondition3)

if(buyCondition1 and buyCondition2 and buyCondition3 and timePeriod)

strategy.entry(id='Long', direction = strategy.long)

//==================================Sell Conditions============================================

sellCondition1 = vrsi > 65

EMA9 = ta.sma(close, 9)

EMA50 = ta.sma(close, 50)

sellCondition2 = ta.crossover(EMA9, EMA50)

if(sellCondition1 and sellCondition2 and timePeriod)

strategy.close(id='Long')

//Best on: ETH 5mins (7.59%), BNB 5mins (5.42%), MATIC 30mins (15.61%), XRP 45mins (10.14%) ---> EMA

//Best on: MATIC 2h (16.09%), XRP 15m (5.25%), SOL 15m (4.28%), AVAX 5m (3.19%)

- Dual Moving Average Crossover Trend Strategy

- Bollinger Band Trend Chaser

- Moving Average Crossover Strategy

- Kairou Strategy

- Trend Following Strategy Based on Stochastic and CCI

- DPD-RSI-BB Quantitative Strategy

- Dual Moving Average Crossover Strategy

- Reverse Opening Engulfing Strategy

- multiple technical indicators Momentum Breakout Strategy

- Trend Following Strategy Based on Trend Confidence

- SMA Based Dual Thrust Strategy

- GetString Momentum Breakthrough Strategy

- Dual-track System Momentum Trading Strategy

- Cross Period Breakthrough System

- Dual Trend Lines Intelligent Tracking BTC Investment Strategy

- PMax Breakout Strategy Based on RSI and T3 Indicators

- RSI Dual Cross Reversal Strategy

- 123 Reversal Moving Average Convergence Divergence Combination Strategy

- Heikin Ashi HighLow Channel Dynamic Moving Average Trading Strategy

- Quantitative Golden Cross Strategy