Overview

This strategy integrates time series decomposition, volume weighted average price, Bollinger Bands and delta(OBV-PVT) 4 technical indicators to make multidimensional judgments on price trends, overbought and oversold conditions.

Principles

- Use time series decomposition to remove noise and periodicity in prices for more accurate trend judgment;

- Calculate volume weighted new price based on the trend line;

- Calculate the Bollinger Bands Percentage Width (BB%B) of closing price to determine overbought and oversold conditions;

- Calculate the BB%B of Delta(OBV-PVT) as a measure of price-volume divergence;

- Generate trading signals based on price-volume indicators crosses and Bollinger Bands overshoots and undershoots.

Advantages

- Combines price, volume and statistical features for robust judgments;

- BB%B combined with Delta(OBV-PVT) better identifies short-term overbought/oversold conditions;

- Price-volume crossover signals filter out some false signals.

Risks

- Too complex parameter tuning;

- Short-term choppiness may increase losses;

- Price-volume divergences do not completely filter false signals.

Parameters like moving averages, Bollinger Bands widths and risk-reward ratios can be optimized to reduce trading frequency while improving risk-adjusted returns per trade.

Conclusion

Integrating tools like time series decomposition, Bollinger Bands, OBV indicators, this strategy combines price-volume relationships, statistical properties and trend analysis to identify short-term reversals and catch major trends. There are also certain risks that need to be addressed through parameter tuning for optimal performance.

Strategy source code

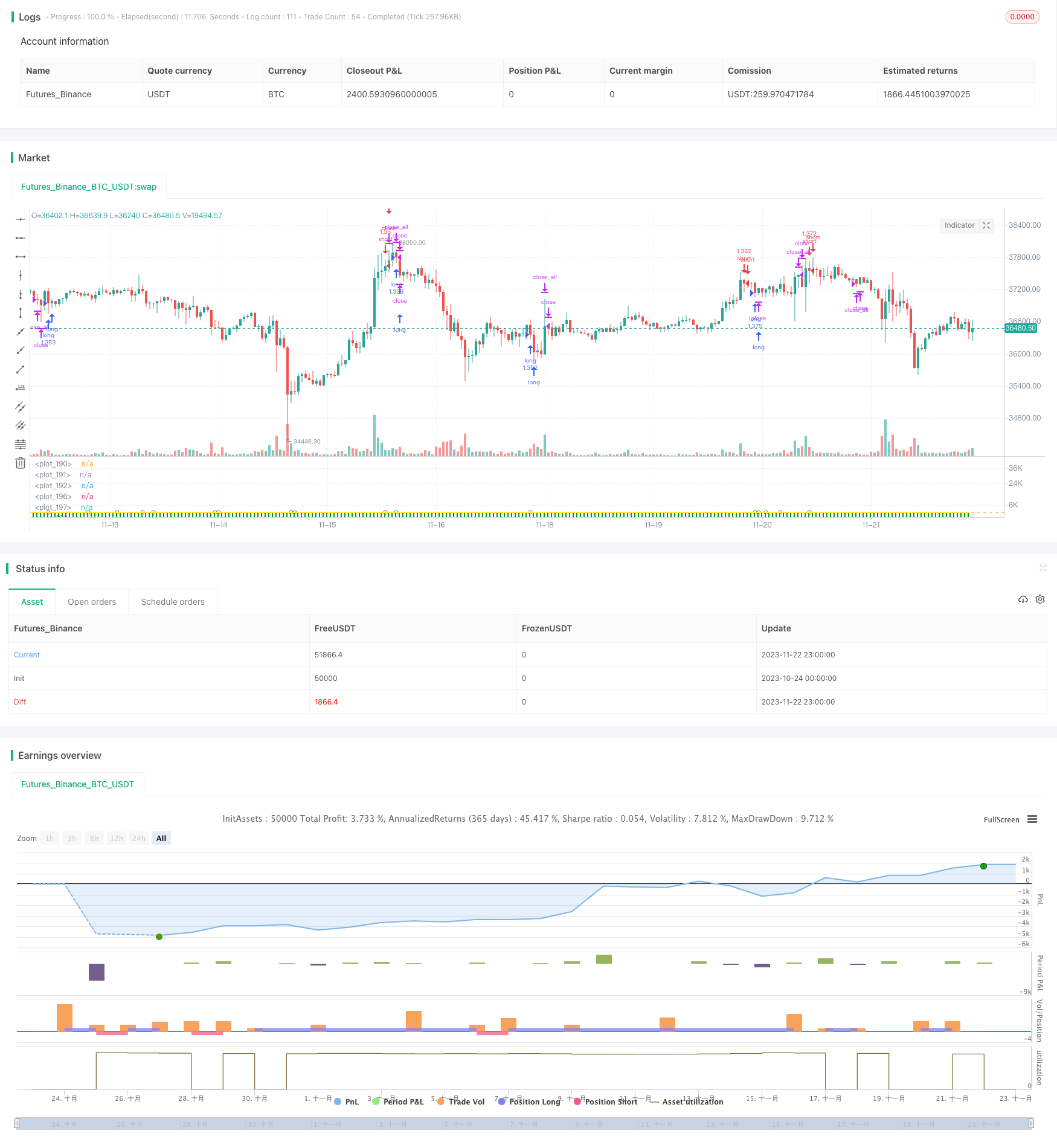

/*backtest

start: 2023-10-24 00:00:00

end: 2023-11-23 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

//// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © oakwhiz and tathal

//@version=4

strategy("BBPBΔ(OBV-PVT)BB", default_qty_type=strategy.percent_of_equity, default_qty_value=100)

startDate = input(title="Start Date", type=input.integer,

defval=1, minval=1, maxval=31)

startMonth = input(title="Start Month", type=input.integer,

defval=1, minval=1, maxval=12)

startYear = input(title="Start Year", type=input.integer,

defval=2010, minval=1800, maxval=2100)

endDate = input(title="End Date", type=input.integer,

defval=31, minval=1, maxval=31)

endMonth = input(title="End Month", type=input.integer,

defval=12, minval=1, maxval=12)

endYear = input(title="End Year", type=input.integer,

defval=2021, minval=1800, maxval=2100)

// Normalize Function

normalize(_src, _min, _max) =>

// Normalizes series with unknown min/max using historical min/max.

// _src : series to rescale.

// _min, _min: min/max values of rescaled series.

var _historicMin = 10e10

var _historicMax = -10e10

_historicMin := min(nz(_src, _historicMin), _historicMin)

_historicMax := max(nz(_src, _historicMax), _historicMax)

_min + (_max - _min) * (_src - _historicMin) / max(_historicMax - _historicMin, 10e-10)

// STEP 2:

// Look if the close time of the current bar

// falls inside the date range

inDateRange = true

// Stop loss & Take Profit Section

sl_inp = input(2.0, title='Stop Loss %')/100

tp_inp = input(4.0, title='Take Profit %')/100

stop_level = strategy.position_avg_price * (1 - sl_inp)

take_level = strategy.position_avg_price * (1 + tp_inp)

icreturn = false

innercandle = if (high < high[1]) and (low > low[1])

icreturn := true

src = close

float change_src = change(src)

float i_obv = cum(change_src > 0 ? volume : change_src < 0 ? -volume : 0*volume)

float i_pvt = pvt

float result = change(i_obv - i_pvt)

float nresult = ema(normalize(result, -1, 1), 20)

length = input(20, minval=1)

mult = input(2.0, minval=0.001, maxval=50, title="StdDev")

basis = ema(nresult, length)

dev = mult * stdev(nresult, length)

upper = basis + dev

lower = basis - dev

bbr = (nresult - lower)/(upper - lower)

////////////////INPUTS///////////////////

lambda = input(defval = 1000, type = input.float, title = "Smoothing Factor (Lambda)", minval = 1)

leng = input(defval = 100, type = input.integer, title = "Filter Length", minval = 1)

srcc = close

///////////Construct Arrays///////////////

a = array.new_float(leng, 0.0)

b = array.new_float(leng, 0.0)

c = array.new_float(leng, 0.0)

d = array.new_float(leng, 0.0)

e = array.new_float(leng, 0.0)

f = array.new_float(leng, 0.0)

/////////Initialize the Values///////////

//for more details visit:

// https://asmquantmacro.com/2015/06/25/hodrick-prescott-filter-in-excel/

ll1 = leng-1

ll2 = leng-2

for i = 0 to ll1

array.set(a,i, lambda*(-4))

array.set(b,i, src[i])

array.set(c,i, lambda*(-4))

array.set(d,i, lambda*6 + 1)

array.set(e,i, lambda)

array.set(f,i, lambda)

array.set(d, 0, lambda + 1.0)

array.set(d, ll1, lambda + 1.0)

array.set(d, 1, lambda * 5.0 + 1.0)

array.set(d, ll2, lambda * 5.0 + 1.0)

array.set(c, 0 , lambda * (-2.0))

array.set(c, ll2, lambda * (-2.0))

array.set(a, 0 , lambda * (-2.0))

array.set(a, ll2, lambda * (-2.0))

//////////////Solve the optimization issue/////////////////////

float r = array.get(a, 0)

float s = array.get(a, 1)

float t = array.get(e, 0)

float xmult = 0.0

for i = 1 to ll2

xmult := r / array.get(d, i-1)

array.set(d, i, array.get(d, i) - xmult * array.get(c, i-1))

array.set(c, i, array.get(c, i) - xmult * array.get(f, i-1))

array.set(b, i, array.get(b, i) - xmult * array.get(b, i-1))

xmult := t / array.get(d, i-1)

r := s - xmult*array.get(c, i-1)

array.set(d, i+1, array.get(d, i+1) - xmult * array.get(f, i-1))

array.set(b, i+1, array.get(b, i+1) - xmult * array.get(b, i-1))

s := array.get(a, i+1)

t := array.get(e, i)

xmult := r / array.get(d, ll2)

array.set(d, ll1, array.get(d, ll1) - xmult * array.get(c, ll2))

x = array.new_float(leng, 0)

array.set(x, ll1, (array.get(b, ll1) - xmult * array.get(b, ll2)) / array.get(d, ll1))

array.set(x, ll2, (array.get(b, ll2) - array.get(c, ll2) * array.get(x, ll1)) / array.get(d, ll2))

for j = 0 to leng-3

i = leng-3 - j

array.set(x, i, (array.get(b,i) - array.get(f,i)*array.get(x,i+2) - array.get(c,i)*array.get(x,i+1)) / array.get(d, i))

//////////////Construct the output///////////////////

o5 = array.get(x,0)

////////////////////Plottingd///////////////////////

TimeFrame = input('1', type=input.resolution)

start = security(syminfo.tickerid, TimeFrame, time)

//------------------------------------------------

newSession = iff(change(start), 1, 0)

//------------------------------------------------

vwapsum = 0.0

vwapsum := iff(newSession, o5*volume, vwapsum[1]+o5*volume)

volumesum = 0.0

volumesum := iff(newSession, volume, volumesum[1]+volume)

v2sum = 0.0

v2sum := iff(newSession, volume*o5*o5, v2sum[1]+volume*o5*o5)

myvwap = vwapsum/volumesum

dev2 = sqrt(max(v2sum/volumesum - myvwap*myvwap, 0))

Coloring=close>myvwap?color.green:color.red

av=myvwap

showBcol = input(false, type=input.bool, title="Show barcolors")

showPrevVWAP = input(false, type=input.bool, title="Show previous VWAP close")

prevwap = 0.0

prevwap := iff(newSession, myvwap[1], prevwap[1])

nprevwap= normalize(prevwap, 0, 1)

l1= input(20, minval=1)

src2 = close

mult1 = input(2.0, minval=0.001, maxval=50, title="StdDev")

basis1 = sma(src2, l1)

dev1 = mult1 * stdev(src2, l1)

upper1 = basis1 + dev1

lower1 = basis1 - dev1

bbr1 = (src - lower1)/(upper1 - lower1)

az = plot(bbr, "Δ(OBV-PVT)", color.rgb(0,153,0,0), style=plot.style_columns)

bz = plot(bbr1, "BB%B", color.rgb(0,125,125,50), style=plot.style_columns)

fill(az, bz, color=color.white)

deltabbr = bbr1 - bbr

oneline = hline(1)

twoline = hline(1.2)

zline = hline(0)

xx = input(.3)

yy = input(.7)

zz = input(-1)

xxx = hline(xx)

yyy = hline(yy)

zzz = hline(zz)

fill(oneline, twoline, color=color.red, title="Sell Zone")

fill(yyy, oneline, color=color.orange, title="Slightly Overbought")

fill(yyy, zline, color=color.white, title="DO NOTHING ZONE")

fill(zzz, zline, color=color.green, title="GO LONG ZONE")

l20 = crossover(deltabbr, 0)

l30 = crossunder(deltabbr, 0)

l40 = crossover(o5, 0)

l50 = crossunder(o5, 0)

z1 = bbr1 >= 1

z2 = bbr1 < 1 and bbr1 >= .7

z3 = bbr1 < .7 and bbr1 >= .3

z4 = bbr1 < .3 and bbr1 >= 0

z5 = bbr1 < 0

a1 = bbr >= 1

a2 = bbr < 1 and bbr >= .7

a4 = bbr < .3 and bbr >= 0

a5 = bbr < 0

b4 = deltabbr < .3 and deltabbr >= 0

b5 = deltabbr < 0

c4 = o5 < .3 and o5 >= 0

c5 = o5 < 0

b1 = deltabbr >= 1

b2 = deltabbr < 1 and o5 >= .7

c1 = o5 >= 1

c2 = o5 < 1 and o5 >= .7

///

n = input(16,"Period")

H = highest(hl2,n)

L = lowest(hl2,n)

hi = H[1]

lo = L[1]

up = high>hi

dn = low<lo

lowerbbh = lowest(10)[1]

bbh = (low == open ? open < lowerbbh ? open < close ? close > ((high[1] - low[1]) / 2) + low[1] :na : na : na)

plot(normalize(av,-1,1), linewidth=2, title="Trendline", color=color.yellow)

long5 = close < av and av[0] > av[1]

sell5 = close > av

cancel = false

if open >= high[1]

cancel = true

long = (long5 or z5 or a5) and (icreturn or bbh or up)

sell = ((z1 or a1) or (l40 and l20)) and (icreturn or dn) and (c1 or b1)

short = ((z1 or z2 or a1 or sell5) and (l40 or l20)) and icreturn

buy= (z5 or z4 or a5 or long5) and (icreturn or dn)

plotshape(long and not sell ? -0.5 : na, title="Long", location=location.absolute, style=shape.circle, size=size.tiny, color=color.green, transp=0)

plotshape(short and not sell? 1 : na, title="Short", location=location.absolute, style=shape.circle, size=size.tiny, color=color.red, transp=0)

if (inDateRange)

strategy.entry("long", true, when = long )

if (inDateRange) and (strategy.position_size > 0)

strategy.close_all(when = sell or cancel)

if (inDateRange)

strategy.entry("short", false, when = short )

if (inDateRange) and (strategy.position_size < 0)

strategy.close_all(when = buy)