Short-Term, Medium-Term and Long-Term EMA Crossover Trading Strategy

Author: ChaoZhang, Date: 2023-11-24 13:33:21Tags:

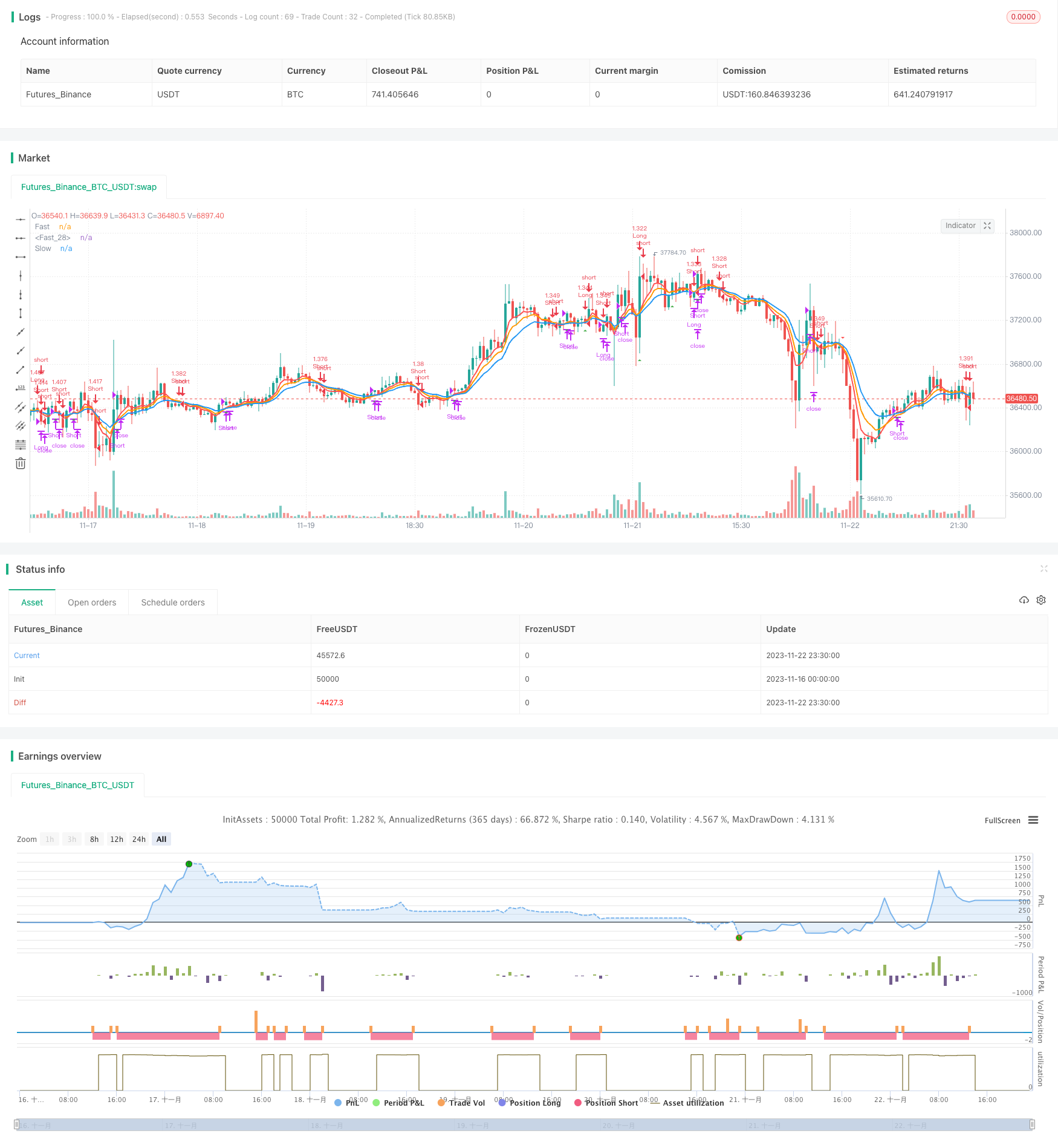

This strategy generates trading signals based on three exponential moving average lines (EMA) with different periods: short-term EMA with 5-day period, medium-term EMA with 8-day period and long-term EMA with 13-day period. It goes long when the short-term EMA crosses over the medium-term and long-term EMAs, and goes short when the short-term EMA crosses under the medium-term and long-term EMAs.

Strategy Logic

This strategy judges the market trend by calculating EMAs of different periods. The short-term EMA reflects the average price of the recent few days while the medium- and long-term EMAs reflect the average price over longer timeframes. The crossover of short-term EMA over medium- and long-term EMAs signals an upward breakout of the price, so a long position is taken. Conversely, when the short-term EMA crosses under the other two, it signals a downward price breakout so a short position is taken.

Specifically, this strategy concurrently computes 5-day, 8-day and 13-day EMAs. It generates long signals when the 5-day EMA crosses over the 8-day and 13-day ones; it generates short signals when the 5-day EMA crosses under the other two. After going long, the position is closed once the 5-day EMA crosses back under the 13-day EMA. Likewise for the short position.

Advantages of the Strategy

- Using multiple-period EMAs avoids missing key trend reversal points that could occur with overly short or long single EMA periods

- Combining three EMAs of short, medium and long terms enhances reliability of trading signals

- Smoothed pricing via EMAs filters out some market noise and prevents unnecessary entries

Risks of the Strategy

- All three EMAs are lagging trend indicators, inherently containing some time delays before actual price breakouts, risking late signals

- EMAs cannot effectively distinguish real trends versus short-term corrections, apt to yield false signals

- Fixed EMA periods cannot adapt to varying market regimes across different timeframes

Improvement ideas:

- Adding other indicators like MACD to better gauge real trend, avoiding false signals

- Flexibly tuning EMA period parameters for different products and market environments

- Adding moving stop loss to lock in profits and control risks

Summary

This is a typical breakout system that judges trend reversals by comparing crossovers between short, medium and long-period EMAs. Its simplicity in signaling facilitates ease of trading, but also suffers from EMAs’ inherent lagging and inability to filter real trends from temporary corrections. Future enhancements may integrate other technical indicators or adaptive parameter tuning to optimize it.

/*backtest

start: 2023-11-16 00:00:00

end: 2023-11-23 00:00:00

period: 30m

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

//

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © gregoirejohnb

// @It is modified by ttsaadet.

// Moving average crossover systems measure drift in the market. They are great strategies for time-limited people.

// So, why don't more people use them?

//

//

strategy(title="EMA Crossover Strategy", shorttitle="EMA-5-8-13 COS by TTS", overlay=true, pyramiding=0, default_qty_type=strategy.percent_of_equity, default_qty_value=100, currency=currency.TRY,commission_type=strategy.commission.percent,commission_value=0.04, process_orders_on_close = true, initial_capital = 100000)

// === GENERAL INPUTS ===

//strategy start date

start_year = input(defval=2020, title="Backtest Start Year")

// === LOGIC ===

short_period = input(type=input.integer,defval=5,minval=1,title="Length")

mid_period = input(type=input.integer,defval=8,minval=1,title="Length")

long_period = input(type=input.integer,defval=13,minval=1,title="Length")

longOnly = input(type=input.bool,defval=false,title="Long Only")

shortEma = ema(hl2,short_period)

midEma = ema(hl2,mid_period)

longEma = ema(hl2,long_period)

plot(shortEma,linewidth=2,color=color.red,title="Fast")

plot(midEma,linewidth=2,color=color.orange,title="Fast")

plot(longEma,linewidth=2,color=color.blue,title="Slow")

longEntry = ((shortEma > midEma) and crossover(shortEma,longEma)) or ((shortEma > longEma) and crossover(shortEma,midEma))

shortEntry =((shortEma < midEma) and crossunder(shortEma,longEma)) or ((shortEma < longEma) and crossunder(shortEma,midEma))

plotshape(longEntry ? close : na,style=shape.triangleup,color=color.green,location=location.belowbar,size=size.small,title="Long Triangle")

plotshape(shortEntry and not longOnly ? close : na,style=shape.triangledown,color=color.red,location=location.abovebar,size=size.small,title="Short Triangle")

plotshape(shortEntry and longOnly ? close : na,style=shape.xcross,color=color.black,location=location.abovebar,size=size.small,title="Exit Sign")

// === STRATEGY - LONG POSITION EXECUTION ===

enterLong() =>

longEntry

exitLong() =>

crossunder(shortEma,longEma)

strategy.entry(id="Long", long=strategy.long, when=enterLong())

strategy.close(id="Long", when=exitLong())

// === STRATEGY - SHORT POSITION EXECUTION ===

enterShort() =>

not longOnly and shortEntry

exitShort() =>

crossover(shortEma,longEma)

strategy.entry(id="Short", long=strategy.short, when=enterShort())

strategy.close(id="Short", when=exitShort())

- Solid Moving Average System Strategy

- Advanced Bollinger Band Moving Average Grid Trend Tracking Strategy

- Ichimoku Kinko Hyo indicator Balancing Trend Strategy

- Volume Price Indicator Balanced Trading Strategy

- Twisted SMA Adaptive Crossover Long Line Strategy

- Dual Moving Average Arbitrage Strategy

- Quantitative Investment Strategy Based on Monthly Buy Date

- Weighted Standard Deviation Trading Strategy

- Triple Moving Average Quantitative Trading Strategy

- EMA Crossover Strategy

- Trend Following Strategy Based on Time Series Decomposition and Volume Weighted Bollinger Bands

- Detrended Price Oscillator Quantitative Trading Strategy

- Multi-indicator Trend Following Strategy

- CCI Dual Timeframe Trend Following Strategy

- T3-CCI Trend Tracking Strategy

- Cross Timeframe SuperTrend Breakout Strategy

- Momentum Reversal Moving Average Combination Strategy

- Dynamic Moving Average Retracement Martin Strategy

- Combo Momentum Reversal Dual-Rail Matching Strategy

- Ichimoku Cloud Quant Strategy