Momentum Analysis Ichimoku Cloud Fog Lightning Trading Strategy

Author: ChaoZhang, Date: 2023-11-24 15:49:06Tags:

Overview

The Momentum Analysis Ichimoku Cloud Fog Lightning Trading Strategy is a swift, momentum-based trading approach that utilizes the Ichimoku Cloud components but with tailored parameters suited for the 5-minute timeframe. This strategy is designed to capitalize on small price movements that are frequent and more pronounced.

Strategy Principle

The strategy uses the Conversion Line, Base Line and Cloud Fog as momentum and trend signals. Specifically:

- Conversion Line: Represents the midpoint of the highest and lowest prices over the past 9 periods, used to gauge momentum.

- Base Line: Reflects the midpoint of the highest and lowest prices over the past 26 periods, indicating longer-term price trends.

- Cloud Fog: Plots support and resistance levels 26 periods ahead, representing overall market sentiment.

The long entry condition is when the Conversion Line crosses above the Base Line and the closing price is above both edges of the Cloud Fog. The short entry condition is the opposite.

The long exit condition is when the Conversion Line crosses below the Base Line or the price falls below the Cloud Fog. The short exit condition is the opposite.

Advantage Analysis

The greatest advantage of this strategy is that the Ichimoku Cloud provides clear and visual momentum and trend signals. Combined with strict risk management rules, losses can be cut quickly and profits allowed to run, a cornerstone of successful lightning trading strategies.

In addition, substantial overall profits can be accumulated through making a large number of small profitable trades.

Risk Analysis

Lightning trading strategies, including this one, require quick decision-making, often automated trading systems, and are more sensitive to transaction costs. As such, they may be more suitable for experienced traders, or those with the ability to closely monitor and execute trades rapidly.

In addition, if losses are not cut quickly, small losses can also accumulate into large losses.

Optimization Directions

The strategy can be optimized by adjusting the periods of the Conversion Line and Base Line to adapt to different market environments. For example, shorten the periods in more volatile markets; lengthen the periods in more trending markets.

In addition, different combinations of parameters can be tested to find the optimal settings. For example, the 5-minute, 15-minute, 30-minute and other timeframes can be examined.

Finally, other indicators can also be incorporated for optimization. For example, combine with the momentum indicator to gauge trend strength; also combine with the ATR indicator to set stop loss ranges.

Summary

The Momentum Analysis Ichimoku Cloud Fog Lightning Trading Strategy utilizes the Ichimoku Cloud to determine changes in momentum and trends, capturing short-term fluctuations in prices on the hourly and minute levels. Characteristics include high trading frequency and smaller per trade profit targets. The biggest advantage of this strategy is the Ichimoku Cloud provides clear and intuitive signals, which when combined with strict stop loss principles, can achieve relatively safe and steady profits. But as a lightning trading strategy, also beware of the risk of accumulated small losses leading to larger drawdowns, therefore it is only suitable for experienced traders who can closely monitor the markets. Through continual testing and optimization of parameters, even better results can be achieved with this strategy.

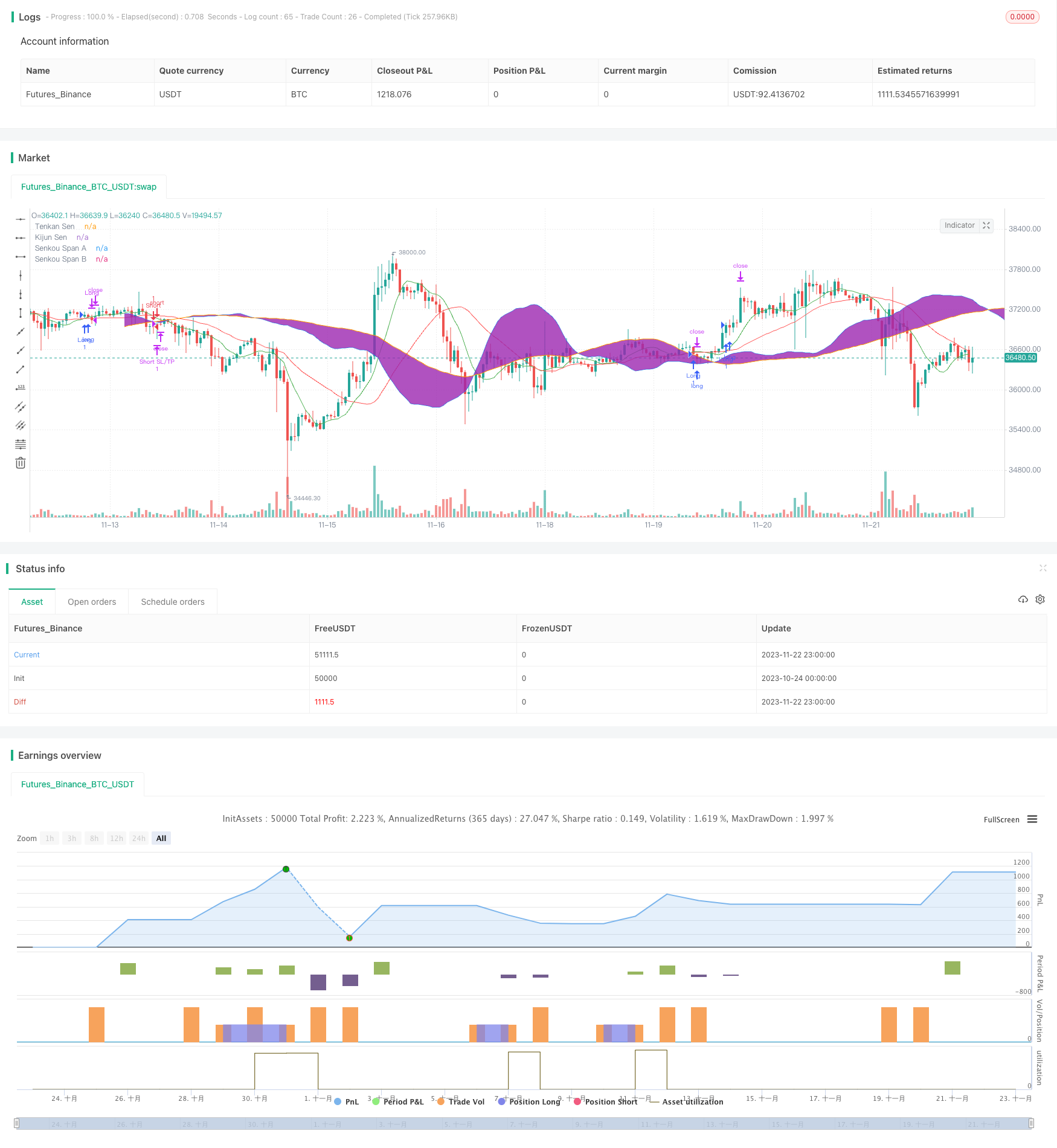

/*backtest

start: 2023-10-24 00:00:00

end: 2023-11-23 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Ichimoku Scalping Strategy", shorttitle="Ichimoku Scalp", overlay=true)

// Define Ichimoku Cloud components with shorter periods for scalping

conversionPeriods = input(9, title="Conversion Line Periods")

basePeriods = input(26, title="Base Line Periods")

laggingSpan2Periods = input(52, title="Lagging Span 2 Periods")

displacement = input(26, title="Displacement")

// Calculate Ichimoku Cloud components

tenkanSen = ta.sma((high + low) / 2, conversionPeriods)

kijunSen = ta.sma((high + low) / 2, basePeriods)

senkouSpanA = (tenkanSen + kijunSen) / 2

senkouSpanB = ta.sma((high + low) / 2, laggingSpan2Periods)

// Plot Ichimoku Cloud components

p1 = plot(tenkanSen, color=color.green, linewidth=1, title="Tenkan Sen")

p2 = plot(kijunSen, color=color.red, linewidth=1, title="Kijun Sen")

p3 = plot(senkouSpanA, color=color.blue, linewidth=1, title="Senkou Span A", offset=displacement)

p4 = plot(senkouSpanB, color=color.orange, linewidth=1, title="Senkou Span B", offset=displacement)

fill(p3, p4, color=color.purple, transp=30, title="Cloud")

// Define strategy conditions for scalping

enterLong = ta.crossover(tenkanSen, kijunSen) and close > senkouSpanA[displacement] and close > senkouSpanB[displacement]

exitLong = ta.crossunder(tenkanSen, kijunSen) or close < senkouSpanA[displacement]

// Enter short condition for scalping

enterShort = ta.crossunder(tenkanSen, kijunSen) and close < senkouSpanA[displacement] and close < senkouSpanB[displacement]

exitShort = ta.crossover(tenkanSen, kijunSen) or close > senkouSpanA[displacement]

// Execute strategy

if (enterLong)

strategy.entry("Long", strategy.long)

if (exitLong)

strategy.close("Long")

if (enterShort)

strategy.entry("Short", strategy.short)

if (exitShort)

strategy.close("Short")

// Risk management: setting a stop loss and take profit for scalping

stopLossPercent = input(1.5, title="Stop Loss (%)")

takeProfitPercent = input(1.0, title="Take Profit (%)")

stopLossPrice = strategy.position_avg_price * (1 - stopLossPercent / 100)

takeProfitPrice = strategy.position_avg_price * (1 + takeProfitPercent / 100)

// Set stop loss and take profit for long positions

if (strategy.position_size > 0)

strategy.exit("Long SL/TP", "Long", stop=stopLossPrice, limit=takeProfitPrice)

// Set stop loss and take profit for short positions

if (strategy.position_size < 0)

strategy.exit("Short SL/TP", "Short", stop=stopLossPrice, limit=takeProfitPrice)

- KDJ RSI Crossover Buy Sell Signals Strategy

- Ichimoku Backtester with TP, SL, and Cloud Confirmation

- Gyroscopic Bands Strategy Based on Multi Time Frame and Average Amplitude

- Dual Moving Average Crossover Reversal Strategy

- Dynamic Moving Average Tracking Strategy

- Reversal-Catcher Strategy

- RSI Gap Reversal Strategy

- 3-Min Short Only Expert Advisor Strategy

- Action Zone ATR Reverse Order Quant Strategy

- MACD Trend Following Strategy

- Traffic Light Trading Strategy Based on EMA

- Dual Moving Average Matching Strategy Based on Bollinger Bands

- Inverse Las Vegas Algorithmic Trading Strategy

- Solid Moving Average System Strategy

- Advanced Bollinger Band Moving Average Grid Trend Tracking Strategy

- Ichimoku Kinko Hyo indicator Balancing Trend Strategy

- Volume Price Indicator Balanced Trading Strategy

- Twisted SMA Adaptive Crossover Long Line Strategy

- Dual Moving Average Arbitrage Strategy

- Quantitative Investment Strategy Based on Monthly Buy Date