Overview

The High Low Breaker Backtest strategy is a trend-following strategy that uses the historical highs and lows of a stock to determine if the price breaks out of these high-low ranges. It calculates the highest price and lowest price over a certain period, and generates buy signals when the current period’s price exceeds the highest price over a recent period, and sell signals when the price breaks below the lowest price over a recent period. As a type of trend-following strategy, it can capture some trending characteristics of stock prices and has practical value for live trading.

Strategy Logic

The core logic of this strategy is to calculate the highest price and lowest price over a certain number of bars (default 50 bars). When calculating highest/lowest prices, it allows using close prices or actual high/low prices (default to use high/low prices). Then it checks if the current bar’s closing price or high price exceeds the highest price over the recent period. If yes and it’s been more than a minimum number of bars (default 30 bars) since the last highest price bar, it generates a buy signal. Likewise, if the current bar’s closing price or low price breaks the lowest price over the recent period and a minimum number of bars passed since last lowest price bar, it generates a sell signal.

Upon generating buy signals, the strategy enters long positions at that price, with a stop loss price and take profit price set. It exits the position with a stop loss when stop loss price is touched, and exits with a take profit when take profit price is touched. The logic for sell signals is similar.

Advantage Analysis

This high low breaker backtest strategy has the following advantages:

- The logic is simple and easy to understand/implement.

- It can capture some trending characteristics of stock prices.

- Parameters can be optimized to find best parameter combinations.

- Built-in stop loss and take profit controls risk.

- Visualizations greatly facilitate parameter tuning and results analysis.

Risk Analysis

This strategy also has some risks:

- Prone to multiple flip-flop trades and over-trading.

- Frequent position opening when price oscillates.

- Missing major trend opportunities if parameters not properly set.

- Not considering price fluctuations frequency and magnitude.

- No signal validation with other indicators.

The following aspects can help mitigate these risks:

- Reduce stop loss distance to increase holding time.

- Add more entry criteria to avoid frequent entries.

- Optimize parameters to find optimum combinations.

- Add filter conditions with other indicators.

Optimization Directions

This strategy can be improved in the following ways:

- Parameter optimization using more systematic testing.

- Add signal filters with other indicators e.g. moving averages.

- Consider price volatility using ATR to adapt breakout thresholds.

- Differentiate trending vs oscillating markets to adapt parameters.

- Enhance position sizing rules e.g. stop opening new positions after significant loss.

Summary

In summary, the High Low Breaker Backtest Strategy is a simple and practical trend-following strategy. It generates trading signals based on price breaking periodic highest/lowest prices. The strategy has advantages like simplicity, trend-following, and parameter optimizability, but also risks like over-trading and inability to handle oscillating markets. Further optimizations can be done around parameters, signal filters, position sizing etc. to improve its performance.

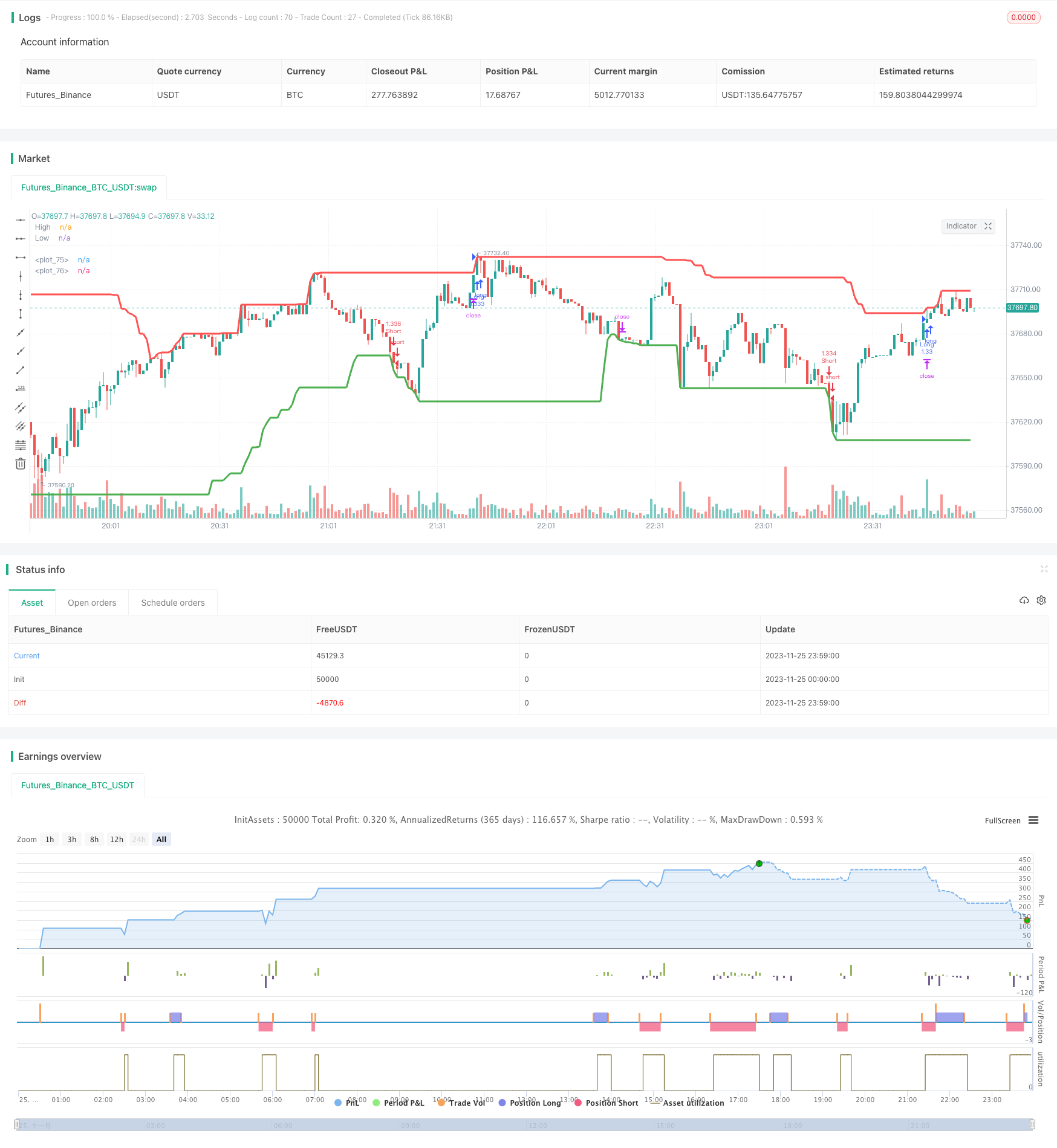

/*backtest

start: 2023-11-25 00:00:00

end: 2023-11-26 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("High/Low Breaker Backtest 1.0", overlay=true, initial_capital=1000, default_qty_type=strategy.percent_of_equity, default_qty_value=100, max_bars_back=700)

// Strategy Settings

takeProfitPercentageLong = input(.1, title='Take Profit Percentage Long', type=float)/100

stopLossPercentageLong = input(0.15, title='Stop Loss Percentage Long', type=float)/100

takeProfitPercentageShort = input(.1, title='Take Profit Percentage Short', type=float)/100

stopLossPercentageShort = input(0.15, title='Stop Loss Percentage Short', type=float)/100

candlesBack = input(title="Number of candles back", defval=50)

useHighAndLows = input(true, title="Use high and lows (uncheck to use close)", defval=true)

lastBarsBackMinimum = input(title="Number of candles back to ignore for last high/low", defval=30)

showHighsAndLows = input(true, title="Show high/low lines", defval=true)

getIndexOfLowestInSeries(series, period) =>

index = 0

current = series

for i = 1 to period

if series[i] <= current

index := i

current := series[i]

index

getIndexOfHighestInSeries(series, period) =>

index = 0

current = series

for i = 1 to period

if series[i] >= current

index := i

current := series[i]

index

indexOfHighestInRange = getIndexOfHighestInSeries(useHighAndLows ? high : close, candlesBack)

indexOfLowestInRange = getIndexOfLowestInSeries(useHighAndLows ? low : close, candlesBack)

max = useHighAndLows ? high[indexOfHighestInRange] : close[indexOfHighestInRange]

min = useHighAndLows ? low[indexOfLowestInRange] : close[indexOfLowestInRange]

barsSinceLastHigh = indexOfHighestInRange

barsSinceLastLow = indexOfLowestInRange

isNewHigh = (useHighAndLows ? high > max[1] : close > max[1]) and (barsSinceLastHigh[1] + 1 > lastBarsBackMinimum)

isNewLow = (useHighAndLows ? low < min[1] : close < min[1]) and (barsSinceLastLow[1] + 1 > lastBarsBackMinimum)

alertcondition(condition=isNewHigh, title="New High", message="Last High Broken")

alertcondition(condition=isNewLow, title="New Low", message="Last Low Broken")

if high > max

max := high

barsSinceLastHigh := 0

if low < min

min := low

barsSinceLastLow := 0

plot( showHighsAndLows ? max : na, color=red, style=line, title="High", linewidth=3)

plot( showHighsAndLows ? min : na, color=green, style=line, title="Low", linewidth=3)

// Strategy Entry/Exit Logic

goLong =isNewHigh

longStopLevel = strategy.position_avg_price * (1 - stopLossPercentageLong)

longTakeProfitLevel = strategy.position_avg_price * (1 + takeProfitPercentageLong)

goShort = isNewLow

shortStopLevel = strategy.position_avg_price * (1 + stopLossPercentageShort)

shortTakeProfitLevel = strategy.position_avg_price * (1 - takeProfitPercentageShort)

strategy.entry("Long", strategy.long, when=goLong)

strategy.exit("Long Exit", "Long", stop=longStopLevel, limit=longTakeProfitLevel)

strategy.entry("Short", strategy.short, when=goShort)

strategy.exit("Short Exit", "Short", stop=shortStopLevel, limit=shortTakeProfitLevel)

plot(goShort ? shortStopLevel : na, color=yellow, style=linebr, linewidth=2)

plot(goShort ? shortTakeProfitLevel : na, color=blue, style=linebr, linewidth=2)

plot(goLong ? longStopLevel : na, color=yellow, style=linebr, linewidth=2)

plot(goLong ? longTakeProfitLevel : na, color=blue, style=linebr, linewidth=2)