momentum breakout trading strategy

Author: ChaoZhang, Date: 2023-11-28 10:33:31Tags:

This article introduces a momentum breakout trading strategy based on candlestick patterns. The strategy identifies market trends and entry opportunities by recognizing candlestick formations.

Strategy Overview

The momentum breakout strategy mainly judges potential reversal signals by identifying bullish engulfing patterns or bearish engulfing patterns to enter the market. After identifying the signal, it quickly tracks the trend to achieve excess returns.

Strategy Principle

The core logic of the momentum breakout strategy is based on identifying engulfing patterns, including bullish engulfs and bearish engulfs.

A bullish engulfing pattern forms when the current period’s closing price is higher than the opening price, and the previous period’s closing price is lower than the previous period’s opening price. This pattern often signals a reversal in market sentiment from bearish to bullish, making it a good opportunity to chase the uptrend.

A bearish engulfing pattern forms when the current period’s closing price is lower than the opening price, and the previous period’s closing price is higher than the previous period’s opening price. This also signals a change in market sentiment, providing an opportunity to short the market.

After identifying an engulfing pattern, the momentum breakout strategy quickly establishes a position with excess leverage to track the potential reversal trend. It also dynamically adjusts the stop loss and take profit to control risk while locking in profits.

Advantages

- Quickly identify market reversal opportunities

- Balanced risk-reward ratio with proper stop loss and take profit

- Adjustable leverage catering to different risk appetites

- High efficiency with automated trading

Risks

- Engulfing patterns not fully ensuring reversal

- Probability of failed breakout and sideways price action

- Risk of liquidation from excess leverage

- Requiring sufficient capital to support adequate position sizing

Improvements

The strategy can be optimized in the following ways:

- Incorporate other indicators to filter signals

- Adjust leverage to limit risk

- Scale in to lower cost basis

- Optimize stop loss and take profit to lock in profits

Summary

The momentum breakout strategy is a typical mean-reversion strategy. By capturing key candlestick signals, it quickly judges and tracks market trend reversals. Although risks exist, the strategy can be effectively enhanced through multiple optimization techniques to control the risk-reward ratio. It suits aggressive investors seeking arbitrage-like returns.

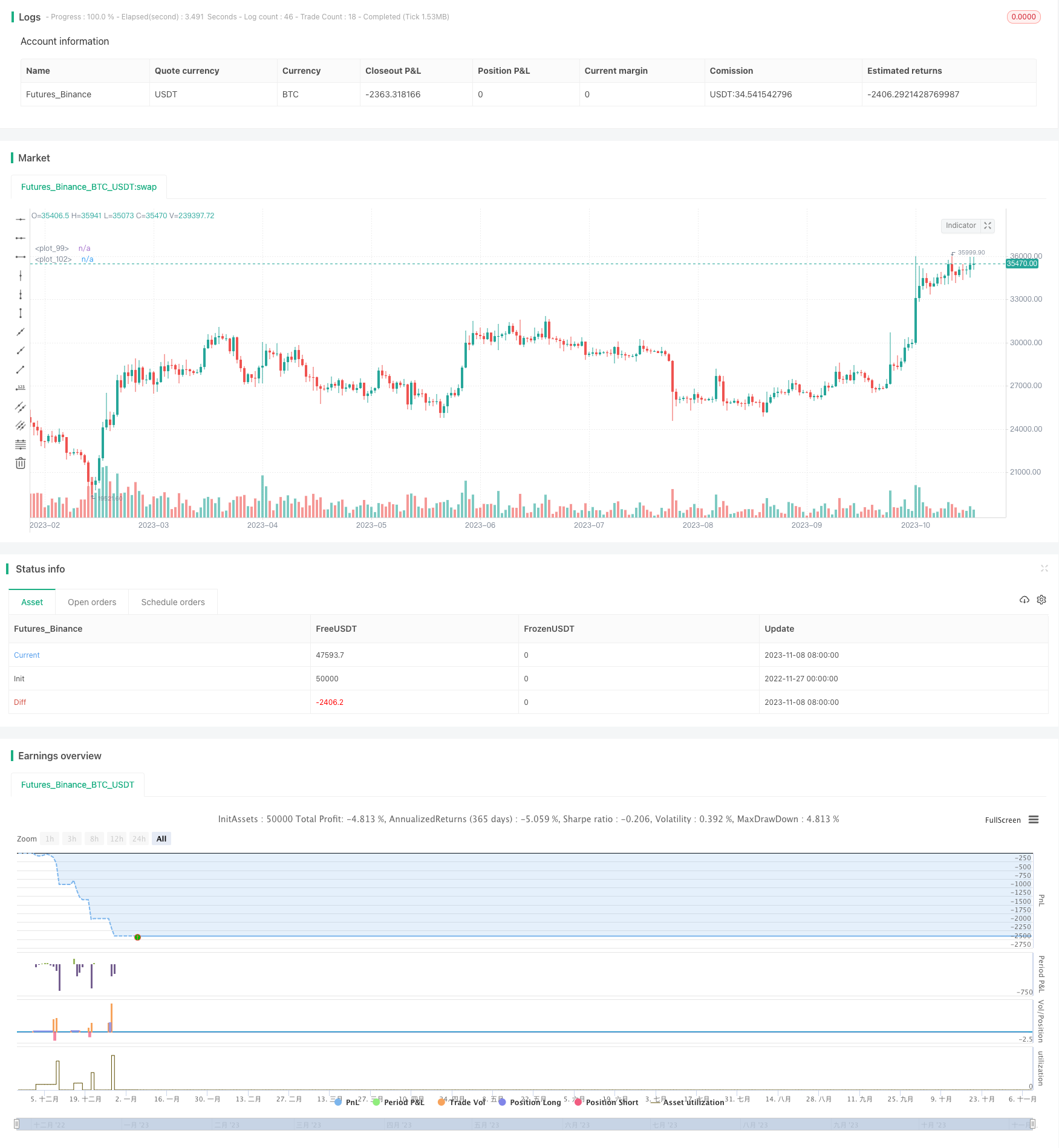

/*backtest

start: 2022-11-27 00:00:00

end: 2023-11-09 05:20:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy(title = "MomGulfing", shorttitle = "MomGulfing", overlay = true, initial_capital=10000, pyramiding=3, calc_on_order_fills=false, calc_on_every_tick=false, currency="USD", default_qty_type=strategy.cash, default_qty_value=1000, commission_type=strategy.commission.percent, commission_value=0.04)

syear = input(2021)

smonth = input(1)

sday = input(1)

fyear = input(2022)

fmonth = input(12)

fday = input(31)

start = timestamp(syear, smonth, sday, 01, 00)

finish = timestamp(fyear, fmonth, fday, 23, 59)

date = time >= start and time <= finish ? true : false

longs = input(true)

shorts = input(true)

rr = input(2.5)

position_risk_percent = input(1)/100

signal_bar_check = input.string(defval="3", options=["1", "2", "3"])

margin_req = input(80)

sl_increase_factor = input(0.2)

tp_decrease_factor = input(0.0)

check_for_volume = input(true)

var long_sl = 0.0

var long_tp = 0.0

var short_sl = 0.0

var short_tp = 0.0

var long_lev = 0.0

var short_lev = 0.0

initial_capital = strategy.equity

position_risk = initial_capital * position_risk_percent

bullishEngulfing_st = close[1] < open[1] and close > open and high[1] < close and (check_for_volume ? volume[1]<volume : true)

bullishEngulfing_nd = close[2] < open[2] and close[1] > open[1] and close > open and high[2] > close[1] and high[2] < close and (check_for_volume ? volume[2]<volume : true)

bullishEngulfing_rd = close[3] < open[3] and close[2] > open[2] and close[1] > open[1] and close > open and high[3] > close[2] and high[3] > close[1] and high[3] < close and (check_for_volume ? volume[3]<volume : true)

bullishEngulfing = signal_bar_check == "1" ? bullishEngulfing_st : signal_bar_check == "2" ? bullishEngulfing_st or bullishEngulfing_nd : bullishEngulfing_st or bullishEngulfing_nd or bullishEngulfing_rd

long_stop_level = bullishEngulfing_st ? math.min(low[1], low) : bullishEngulfing_nd ? math.min(low[2], low[1], low) : bullishEngulfing_rd ? math.min(low[3], low[2], low[1], low) : na

rr_amount_long = close-long_stop_level

long_exit_level = close + rr*rr_amount_long

long_leverage = math.floor(margin_req/math.floor((rr_amount_long/close)*100))

bearishEngulfing_st = close[1] > open[1] and close < open and low[1] > close and (check_for_volume ? volume[1]<volume : true)

bearishEngulfing_nd = close[2] > open[2] and close[1] < open[1] and close < open and low[2] < close[1] and low[2] > close and (check_for_volume ? volume[2]<volume : true)

bearishEngulfing_rd = close[3] > open[3] and close[2] < open[2] and close[1] < open[1] and close < open and low[3] < close[2] and low[3] < close[1] and low[3] > close and (check_for_volume ? volume[3]<volume : true)

bearishEngulfing = signal_bar_check == "1" ? bearishEngulfing_st : signal_bar_check == "2" ? bearishEngulfing_st or bearishEngulfing_nd : bearishEngulfing_st or bearishEngulfing_nd or bearishEngulfing_rd

short_stop_level = bearishEngulfing_st ? math.max(high[1], high) : bearishEngulfing_nd ? math.max(high[2], high[1], high) : bearishEngulfing_rd ? math.max(high[3], high[2], high[1], high) : na

rr_amount_short = short_stop_level-close

short_exit_level = close - rr*rr_amount_short

short_leverage = math.floor(margin_req/math.floor((rr_amount_short/short_stop_level)*100))

long = longs and date and bullishEngulfing

short = shorts and date and bearishEngulfing

bgcolor(long[1] ? color.new(color.teal, 80) : (short[1] ? color.new(color.purple, 80) : na))

if long and strategy.position_size <= 0

long_lev := long_leverage

if short and strategy.position_size >= 0

short_lev := short_leverage

long_pos_size = long_lev * position_risk

long_pos_qty = long_pos_size/close

short_pos_size = short_lev * position_risk

short_pos_qty = short_pos_size/close

if long

if strategy.position_size <= 0

long_sl := long_stop_level

long_tp := long_exit_level

else if strategy.position_size > 0

long_sl := long_stop_level + sl_increase_factor*rr_amount_long

long_tp := long_exit_level - tp_decrease_factor*rr_amount_long

strategy.entry("L"+str.tostring(long_lev)+"X", strategy.long, qty=long_pos_qty)

label_text = str.tostring(long_lev)+"X\nSL:"+str.tostring(long_sl)+"\nTP:"+str.tostring(long_tp)

label.new(bar_index+1, na, text=label_text, color=color.green, style=label.style_label_up, xloc=xloc.bar_index, yloc=yloc.belowbar)

else if short

if strategy.position_size >= 0

short_sl := short_stop_level

short_tp := short_exit_level

else if strategy.position_size < 0

short_sl := short_stop_level - sl_increase_factor*rr_amount_short

short_tp := short_exit_level + tp_decrease_factor*rr_amount_short

strategy.entry("S"+str.tostring(short_lev)+"X", strategy.short, qty=short_pos_qty)

label_text = str.tostring(short_lev)+"X\nSL:"+str.tostring(short_sl)+"\nTP:"+str.tostring(short_tp)

label.new(bar_index+1, na, text=label_text, color=color.red, style=label.style_label_down, xloc=xloc.bar_index, yloc=yloc.abovebar)

if (strategy.position_size > 0)

strategy.exit(id="L TP/SL", stop=long_sl, limit=long_tp)

if (strategy.position_size < 0)

strategy.exit(id="S TP/SL", stop=short_sl, limit=short_tp)

sl_level = strategy.position_size > 0 ? long_sl : strategy.position_size < 0 ? short_sl : na

plot(sl_level, color=color.red, style=plot.style_linebr)

tp_level = strategy.position_size > 0 ? long_tp : strategy.position_size < 0 ? short_tp : na

plot(tp_level, color=color.green, style=plot.style_linebr)

- ADX Intelligent Trend Tracking Strategy

- RSI Momentum Aggregation Strategy

- Trailing Stop Loss Strategy Based on Price Gaps

- Moving Average Breakout Strategy

- Combo Trend Reversal Moving Average Crossover Strategy

- Pivot-based RSI Divergence Strategy

- Golden Ratio Breakout Long Strategy

- Bollinger Bands Strategy with RSI Filter

- A Trend Following Strategy Based on Keltner Channels

- RSI Moving Average Crossover Strategy

- Dynamic RSI and CCI Combined Multi-factor Quantitative Trading Strategy

- Super Z Quantitative Trend Strategy

- Candlestick Pattern Strategy

- CK Momentum Reversal Stop Loss Strategy

- Dual Moving Average Oscillation Breakthrough Strategy

- Momentum Smooth Moving Average Line and Moving Average Line Crossover Strategy

- Moving Average Crossover Trading Strategy

- Range Breakthrough Dual Moving Average Filtering Strategy

- Cross Moving Average Price Strategy

- No Nonsense SSL Channel Trading Strategy