Combo Trend Reversal Moving Average Crossover Strategy

Author: ChaoZhang, Date: 2023-11-28 13:47:05Tags:

Overview

This is a combo strategy that combines trend reversal and moving average crossover strategies to generate more accurate trading signals.

Strategy Logic

The strategy consists of two parts:

-

123 Reversal Strategy: Go long when close price rises for 2 consecutive days and 9-day slow stochastic is below 50; Go short when close price falls for 2 consecutive days and 9-day fast stochastic is above 50.

-

Bill Williams Average Strategy: Calculate 13, 8 and 5 days median price moving averages and go long when faster MAs cross above slower MAs; Go short when faster MAs cross below slower MAs.

Finally, an actual trading signal is generated only when both strategies agree on the direction; otherwise no trade.

Advantage Analysis

The combo strategy filters noise using dual trend validations, thus improving signal accuracy. Additionally, moving averages filter out some noise.

Risk Analysis

Risks are:

- Dual filter may miss some good trades

- Wrong MA settings may incorrectly judge trends

- Reversal strategies itself have loss risks

Risks can be reduced by optimizing MA parameters or entry/exit logic.

Optimization Directions

The strategy can be optimized by:

- Testing different MA combinations to find optimal parameters

- Adding stop loss to limit losses

- Incorporating volume to identify signal quality

- Using machine learning to auto optimize

Conclusion

This strategy combines dual trend filters and MAs to effectively filter noises and improve decision accuracy. But risks exist, which need continuous optimization of logic before stable profitability.

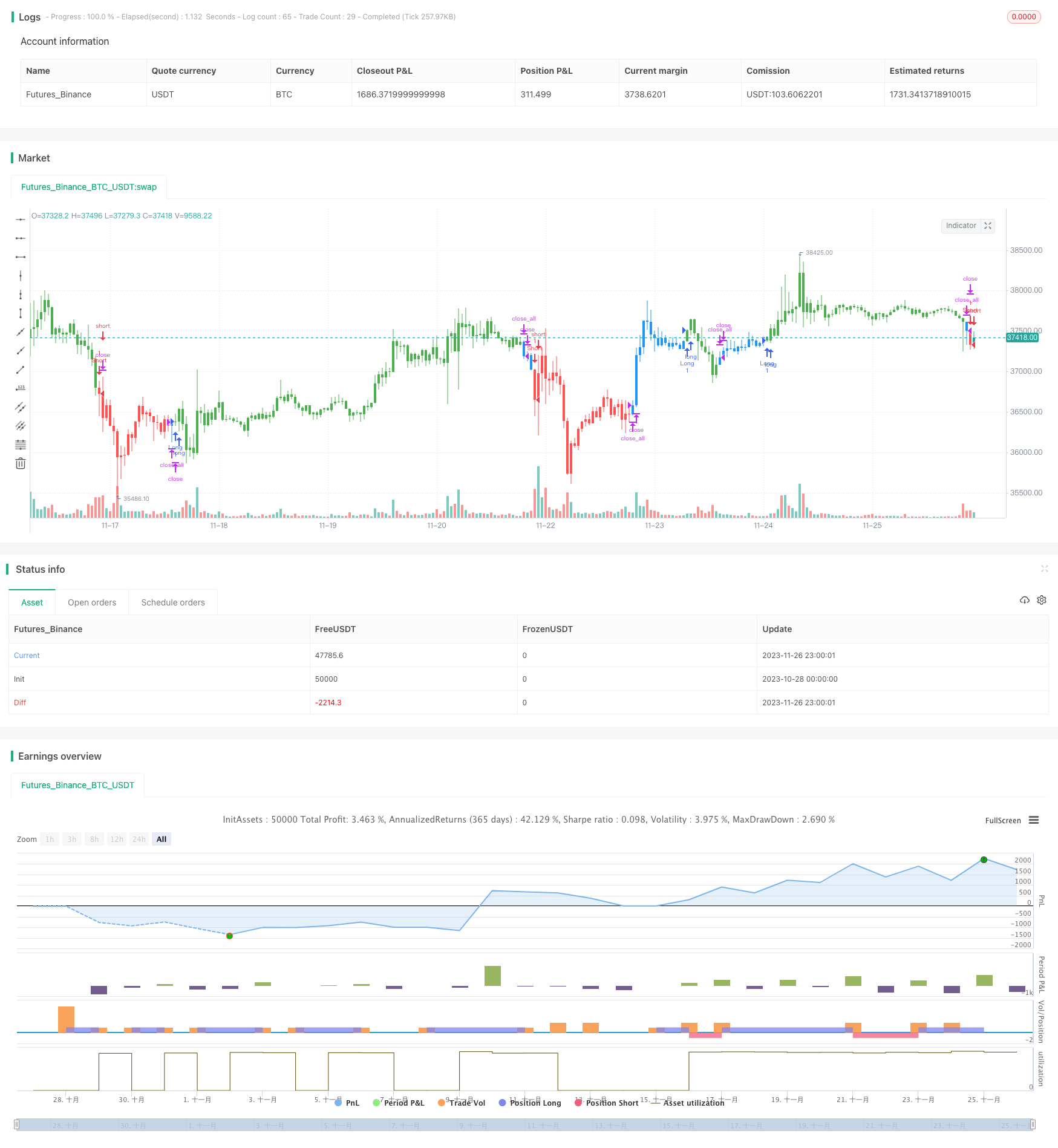

/*backtest

start: 2023-10-28 00:00:00

end: 2023-11-27 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 18/06/2019

// This is combo strategies for get

// a cumulative signal. Result signal will return 1 if two strategies

// is long, -1 if all strategies is short and 0 if signals of strategies is not equal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// This indicator calculates 3 Moving Averages for default values of

// 13, 8 and 5 days, with displacement 8, 5 and 3 days: Median Price (High+Low/2).

// The most popular method of interpreting a moving average is to compare

// the relationship between a moving average of the security's price with

// the security's price itself (or between several moving averages).

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

BillWilliamsAverages(LLength, MLength,SLength, LOffset,MOffset, SOffset ) =>

xLSma = sma(hl2, LLength)[LOffset]

xMSma = sma(hl2, MLength)[MOffset]

xSSma = sma(hl2, SLength)[SOffset]

pos = 0

pos := iff(close < xSSma and xSSma < xMSma and xMSma < xLSma, -1,

iff(close > xSSma and xSSma > xMSma and xMSma > xLSma, 1, nz(pos[1], 0)))

pos

strategy(title="Combo Backtest 123 Reversal & Bill Williams Averages. 3Lines", shorttitle="Combo", overlay = true)

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

LLength = input(13, minval=1)

MLength = input(8,minval=1)

SLength = input(5,minval=1)

LOffset = input(8,minval=1)

MOffset = input(5,minval=1)

SOffset = input(3,minval=1)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posBillWilliamsAverages = BillWilliamsAverages(LLength, MLength,SLength, LOffset, MOffset, SOffset)

pos = iff(posReversal123 == 1 and posBillWilliamsAverages == 1 , 1,

iff(posReversal123 == -1 and posBillWilliamsAverages == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1, 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? red: possig == 1 ? green : blue )

- Donchian Trend Strategy

- Multi-SMA Moving Average Crossover Strategy

- Multi RSI Indicators Trading Strategy

- SuperTrend Strategy with Trailing Stop Loss

- Weighted Moving Average Breakout Reversal Strategy

- Moving Average Relative Strength Index Strategy

- ADX Intelligent Trend Tracking Strategy

- RSI Momentum Aggregation Strategy

- Trailing Stop Loss Strategy Based on Price Gaps

- Moving Average Breakout Strategy

- Pivot-based RSI Divergence Strategy

- Golden Ratio Breakout Long Strategy

- Bollinger Bands Strategy with RSI Filter

- A Trend Following Strategy Based on Keltner Channels

- RSI Moving Average Crossover Strategy

- momentum breakout trading strategy

- Dynamic RSI and CCI Combined Multi-factor Quantitative Trading Strategy

- Super Z Quantitative Trend Strategy

- Candlestick Pattern Strategy

- CK Momentum Reversal Stop Loss Strategy