Trailing Stop Loss Strategy Based on Price Gaps

Author: ChaoZhang, Date: 2023-11-28 13:53:16Tags:

Overview

This strategy adopts the price gap principle to go long when price breaks recent lows, with stop loss and take profit orders to trail the lowest price for profit taking.

Strategy Logic

It identifies gaps when price breaks below the lowest price in recent N hours, goes long based on configured percentage, with stop loss and take profit orders. Stop loss line and take profit line move according to price action. The logic is:

- Calculate lowest price in recent N hours as binding price

- Go long when realtime price is below binding price * buy percent

- Set take profit based on entry price * sell percent

- Set stop loss based on entry price - entry price * stop loss percent

- Position size is percent of strategy equity

- Trail stop loss line with lowest price

- Close position when take profit or stop loss is triggered

Advantage Analysis

The advantages of this strategy:

- Utilize price gap concept, improve winning rate

- Automatic trailing stop loss to lock in most profits

- Customizable stop loss and take profit percentage for different markets

- Works well for instruments with obvious rebounds

- Simple logic and easy to implement

Risk Analysis

There are also some risks:

- Breakout of gaps may fail with lower lows

- Improper stop loss or take profit settings may cause premature exit

- Require periodic parameter tuning for market changes

- Limited applicable instruments, may not work for some

- Manual intervention needed from time to time

Optimization Directions

The strategy can be improved in the following aspects:

- Add machine learning models for automatic parameter tuning

- Add more types of stop loss/take profit, e.g. trailing stop loss, bracket orders

- Optimize stop loss/take profit logic for smarter exits

- Incorporate more indicators to filter out false signals

- Expand to more instruments to improve universality

Conclusion

In conclusion, this is a simple and effective trailing stop loss strategy based on price gaps. It reduces false entries and locks in profits effectively. There is still much room for improvements in parameters tuning and signal filtering. It is worth further research and refinement.

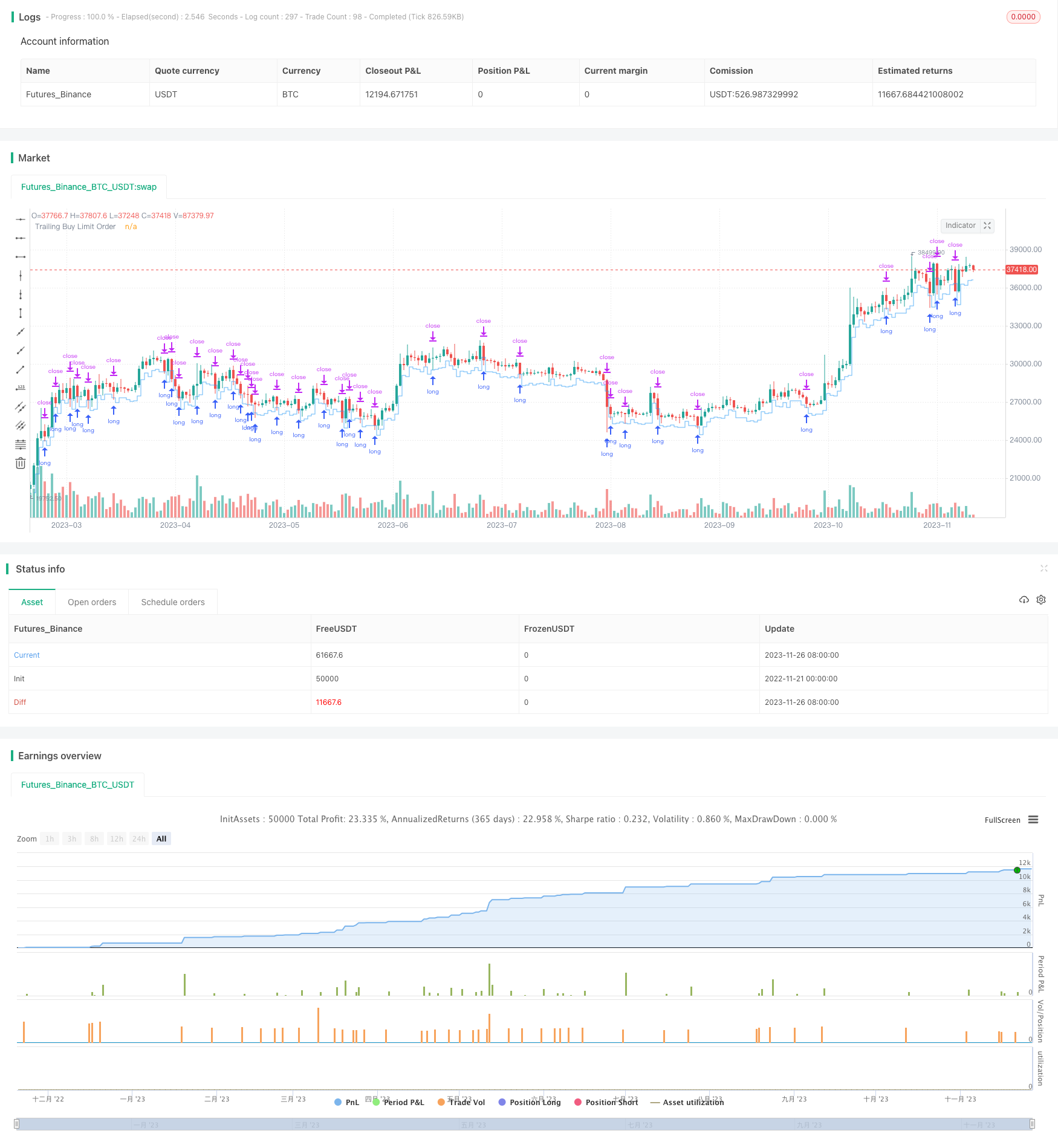

/*backtest

start: 2022-11-21 00:00:00

end: 2023-11-27 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title="Squeeze Backtest by Shaqi v1.0", overlay=true, pyramiding=0, currency="USD", process_orders_on_close=true, commission_type=strategy.commission.percent, commission_value=0.075, default_qty_type=strategy.percent_of_equity, default_qty_value=100, initial_capital=100, backtest_fill_limits_assumption=0)

strategy.risk.allow_entry_in(strategy.direction.long)

R0 = "6 Hours"

R1 = "12 Hours"

R2 = "24 Hours"

R3 = "48 Hours"

R4 = "1 Week"

R5 = "2 Weeks"

R6 = "1 Month"

R7 = "Maximum"

buyPercent = input( title="Buy, %", type=input.float, defval=3, minval=0.01, step=0.01, inline="Percents", group="Squeeze Settings") * 0.01

sellPercent = input(title="Sell, %", type=input.float, defval=1, minval=0.01, step=0.01, inline="Percents", group="Squeeze Settings") * 0.01

stopPercent = input(title="Stop Loss, %", type=input.float, defval=1, minval=0.01, maxval=100, step=0.01, inline="Percents", group="Squeeze Settings") * 0.01

isMaxBars = input( title="Max Bars To Sell", type=input.bool, defval=true , inline="MaxBars", group="Squeeze Settings")

maxBars = input( title="", type=input.integer, defval=2, minval=0, maxval=1000, step=1, inline="MaxBars", group="Squeeze Settings")

bind = input( title="Bind", type=input.source, defval=close, group="Squeeze Settings")

isRange = input( title="Fixed Range", type=input.bool, defval=true, inline="Range", group="Backtesting Period")

rangeStart = input( title="", defval=R4, options=[R0, R1, R2, R3, R4, R5, R6, R7], inline="Range", group="Backtesting Period")

periodStart = input(title="Backtesting Start", type=input.time, defval=timestamp("01 Aug 2021 00:00 +0000"), group="Backtesting Period")

periodEnd = input( title="Backtesting End", type=input.time, defval=timestamp("01 Aug 2022 00:00 +0000"), group="Backtesting Period")

int startDate = na

int endDate = na

if isRange

if rangeStart == R0

startDate := timenow - 21600000

endDate := timenow

else if rangeStart == R1

startDate := timenow - 43200000

endDate := timenow

else if rangeStart == R2

startDate := timenow - 86400000

endDate := timenow

else if rangeStart == R3

startDate := timenow - 172800000

endDate := timenow

else if rangeStart == R4

startDate := timenow - 604800000

endDate := timenow

else if rangeStart == R5

startDate := timenow - 1209600000

endDate := timenow

else if rangeStart == R6

startDate := timenow - 2592000000

endDate := timenow

else if rangeStart == R7

startDate := time

endDate := timenow

else

startDate := periodStart

endDate := periodEnd

afterStartDate = (time >= startDate)

beforeEndDate = (time <= endDate)

notInTrade = strategy.position_size == 0

inTrade = strategy.position_size > 0

barsFromEntry = barssince(strategy.position_size[0] > strategy.position_size[1])

entry = strategy.position_size[0] > strategy.position_size[1]

entryBar = barsFromEntry == 0

notEntryBar = barsFromEntry != 0

buyLimitPrice = bind - bind * buyPercent

buyLimitFilled = low <= buyLimitPrice

sellLimitPriceEntry = buyLimitPrice * (1 + sellPercent)

sellLimitPrice = strategy.position_avg_price * (1 + sellPercent)

stopLimitPriceEntry = buyLimitPrice - buyLimitPrice * stopPercent

stopLimitPrice = strategy.position_avg_price - strategy.position_avg_price * stopPercent

if afterStartDate and beforeEndDate and notInTrade

strategy.entry("BUY", true, limit = buyLimitPrice)

strategy.exit("INSTANT", limit = sellLimitPriceEntry, stop = stopLimitPriceEntry)

strategy.cancel("INSTANT", when = inTrade)

if isMaxBars

strategy.close("BUY", when = barsFromEntry >= maxBars, comment = "Don't Sell")

strategy.exit("SELL", limit = sellLimitPrice, stop = stopLimitPrice)

showStop = stopPercent <= 0.03

plot(showStop ? stopLimitPrice : na, title="Stop Loss Limit Order", style=plot.style_linebr, color=color.red, linewidth=1)

plot(sellLimitPrice, title="Take Profit Limit Order", style=plot.style_linebr, color=color.purple, linewidth=1)

plot(strategy.position_avg_price, title="Buy Order Filled Price", style=plot.style_linebr, color=color.blue, linewidth=1)

plot(buyLimitPrice, title="Trailing Buy Limit Order", style=plot.style_stepline, color=color.new(color.blue, 30), offset=1)

- Multi Timeframe MACD Strategy

- Super scalping strategy based on RSI and ATR channels

- Donchian Trend Strategy

- Multi-SMA Moving Average Crossover Strategy

- Multi RSI Indicators Trading Strategy

- SuperTrend Strategy with Trailing Stop Loss

- Weighted Moving Average Breakout Reversal Strategy

- Moving Average Relative Strength Index Strategy

- ADX Intelligent Trend Tracking Strategy

- RSI Momentum Aggregation Strategy

- Moving Average Breakout Strategy

- Combo Trend Reversal Moving Average Crossover Strategy

- Pivot-based RSI Divergence Strategy

- Golden Ratio Breakout Long Strategy

- Bollinger Bands Strategy with RSI Filter

- A Trend Following Strategy Based on Keltner Channels

- RSI Moving Average Crossover Strategy

- momentum breakout trading strategy

- Dynamic RSI and CCI Combined Multi-factor Quantitative Trading Strategy

- Super Z Quantitative Trend Strategy