Super scalping strategy based on RSI and ATR channels

Author: ChaoZhang, Date: 2023-11-28 15:15:14Tags:

Super Scalping Strategy Based on RSI and ATR Channel

Overview

This strategy is based on Relative Strength Index (RSI) and Average True Range (ATR) channel, suitable for 5-min and 15-min timeframes, belonging to super scalping strategy type. It determines long/short direction entry points through RSI indicator and utilizes ATR channel to set stop loss and take profit, realizing high frequency trading.

Strategy Principle

- Use 21-day Exponential Moving Average (EMA) and 65-day EMA to form golden cross and dead cross, judging the major trend direction.

- When RSI is below 50, it is bearish; when above 50, it is bullish, sending out buy and sell signals.

- The upper and lower bands of ATR channel are: close+ATR and close-ATR. Sell when close breaks through the upper band of ATR and buy when it breaks through the lower band.

- Set stop loss at 2 times ATR and take profit at 5 times ATR.

Advantage Analysis

- Using golden cross and dead cross to determine major trend, avoiding trading against the trend.

- RSI can identify better entry timing.

- ATR channel sets stop loss and take profit points effectively, greatly improving profit-loss ratio.

- Suitable for high frequency scalping trading with quick profits.

Risk Analysis

- Need to watch the market closely, otherwise missing entry or stop loss points may lead to huge loss.

- In trending market, multiple add-on positions may occur, needing good control of position sizing.

- Enough capital is required to support frequent trading.

Optimization Direction

- Optimize ATR parameters for more reasonable stop loss and take profit.

- Add other indicator filters to improve entry quality.

- Add auto stop loss and take profit functions.

- Include capital management and position sizing control modules.

Summary

This strategy belongs to high frequency scalping trading type. It sets entry and exit points through RSI indicator and ATR channel for quick trades. The advantages are quick profit with good risk control, suitable for trading along the trend. However, close market watch is needed with enough capital supporting frequent trades. Overall speaking, this strategy performs well for trend trading and could be further improved on profitability through optimization.

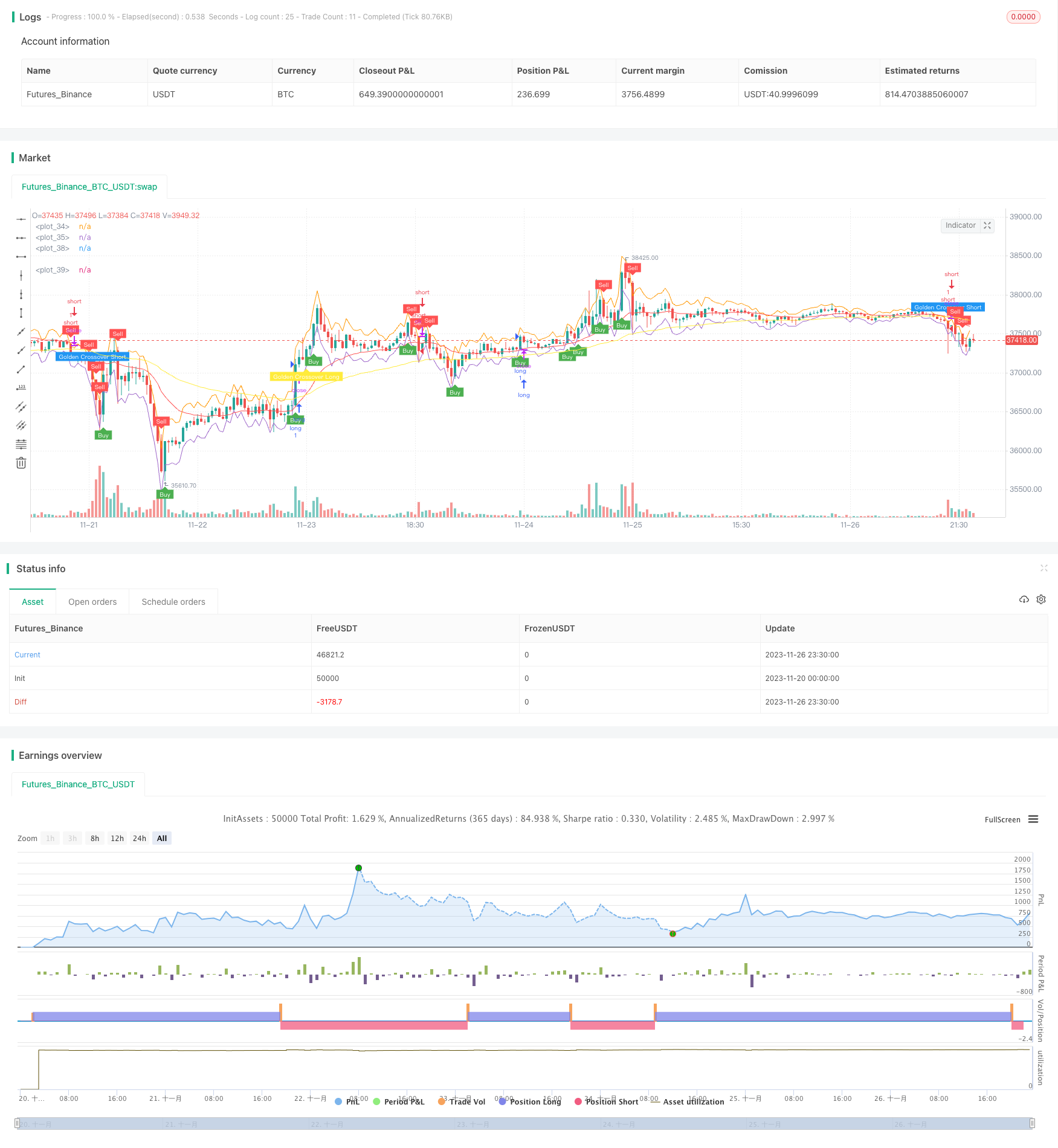

/*backtest

start: 2023-11-20 00:00:00

end: 2023-11-27 00:00:00

period: 30m

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Super Scalper - 5 Min 15 Min", overlay=true)

// Create Indicator's

shortSMA = ema(close, 21)

longSMA = ema(close, 65)

rsi = rsi(close, 14)

atr = atr(14)

// Specify conditions

longCondition = open < close-atr

shortCondition = open > atr+close

GoldenLong = crossover(shortSMA,longSMA)

Goldenshort = crossover(longSMA,shortSMA)

plotshape(shortCondition, title="Sell Label", text="Sell", location=location.abovebar, style=shape.labeldown, size=size.tiny, color=color.red, textcolor=color.white, transp=0)

plotshape(longCondition, title="Buy Label", text="Buy", location=location.belowbar, style=shape.labelup, size=size.tiny, color=color.green, textcolor=color.white, transp=0)

plotshape(Goldenshort, title="Golden Sell Label", text="Golden Crossover Short", location=location.abovebar, style=shape.labeldown, size=size.tiny, color=color.blue, textcolor=color.white, transp=0)

plotshape(GoldenLong, title="Golden Buy Label", text="Golden Crossover Long", location=location.belowbar, style=shape.labelup, size=size.tiny, color=color.yellow, textcolor=color.white, transp=0)

// Execute trade if condition is True

if (longCondition)

stopLoss = low - atr * 2

takeProfit = high + atr * 5

strategy.entry("long", strategy.long, 1, when = rsi > 50)

if (shortCondition)

stopLoss = high + atr * 2

takeProfit = low - atr * 5

strategy.entry("short", strategy.short, 1, when = rsi < 50)

// Plot ATR bands to chart

plot(atr+close)

plot(close-atr)

// Plot Moving Averages

plot(shortSMA, color = color.red)

plot(longSMA, color = color.yellow)

- Commodity Momentum Index Strategy

- Double Turtle Breakthrough Strategy

- Wave Trend Based Quantitative Trading Strategy

- Ichimoku Kumo Twist Gold-Absorbing Strategy

- Stepped Trailing Stop with Partial Profit Taking Strategy

- TSI and CCI Hull Moving Average Trend Tracking Strategy

- Reverse Engineering RSI Strategy

- Dual CCI Quantitative Strategy

- Dual EMA Crossover Breakout Strategy

- Multi Timeframe MACD Strategy

- Donchian Trend Strategy

- Multi-SMA Moving Average Crossover Strategy

- Multi RSI Indicators Trading Strategy

- SuperTrend Strategy with Trailing Stop Loss

- Weighted Moving Average Breakout Reversal Strategy

- Moving Average Relative Strength Index Strategy

- ADX Intelligent Trend Tracking Strategy

- RSI Momentum Aggregation Strategy

- Trailing Stop Loss Strategy Based on Price Gaps

- Moving Average Breakout Strategy