Overview

The Trend Filter Moving Average Crossover Quantitative Strategy is a medium-to-long term quantitative trading strategy. It determines the trend direction of the market through the crossover of fast and slow moving averages, and enters the market under the premise of identifying an effective trend. At the same time, this strategy also sets a longer cycle moving average as a trend filter, so that valid trading signals may only be generated when prices break through that moving average.

Strategy Logic

This strategy is mainly based on the principle of moving average crossover. Specifically, two moving averages with different periods are calculated, typically set at 20-day and 50-day lines. A buy signal is generated when the 20-day line breaks above the 50-day line from the bottom up, and a sell signal is generated when the 20-day line breaks the 50-day line from the top down. These simple crossover signals are considered to capture breakouts in the medium-to-long term.

In addition, the strategy also sets a 200-day moving average as the overall trend benchmark. Only when the price breaks through the 200-day line, the aforementioned simple crossover signals are considered valid. This constitutes a trend filtering mechanism to avoid generating a lot of invalid signals in a range-bound market.

Advantage Analysis

Medium-to-long-term trading frequency avoids excessive trading, reducing trading costs and slippage risks.

Moving average crossover determination is clear and easy to understand and implement.

The trend filtering mechanism can filter out most invalid signals and improve win rate.

Flexible adjustment of moving average parameters is applicable to different varieties and time cycles.

Stop loss and take profit can be set to control single profit and loss.

Risk Analysis

When the price oscillates around the moving averages, multiple invalid signals may be generated resulting in over trading.

Long-cycle moving averages may lag the market, thus missing trend reversal points.

Relatively long historical data is required to establish moving average benchmarks, rendering new varieties or short cycles inapplicable.

Strategy parameters need repeated testing and optimization, improper settings may cause strategy failure.

Risk Mitigations:

Adopt longer cycle moving averages, or increase trend filtering conditions.

Incorporate other indicators to determine the major trend, such as energy indicators, volatility indicators, etc.

Improve adaptiveness of moving average cycle parameters.

Increase parameter optimization and feedback mechanisms to dynamically adjust strategy parameters.

Strategy Optimization

Attempt different types of moving averages, such as Linear Weighted Moving Average.

Increase adaptive moving average cycle functionality.

Incorporate volatility indicators to determine trend stages, improving the validity of moving average crossovers.

Introduce machine learning algorithms to automatically optimize strategy parameters.

Explore multi-asset combinational strategies by utilizing inter-asset correlations for profit.

Summary

The Trend Filter Moving Average Crossover Strategy is overall a simple and practical medium-to-long term quantitative strategy. It determines the medium-to-long term trend through moving average crossover, and then uses trend filtering to reduce invalid signals. This strategy has the advantage of being easy to understand and implement, suitable for beginners of quantitative trading. Potential areas of improvement lie in optimization of the moving averages, as well as integration with other indicators and machine learning algorithms. As a basic strategy, it can provide trading signals for more advanced quantitative arbitrage algorithms.

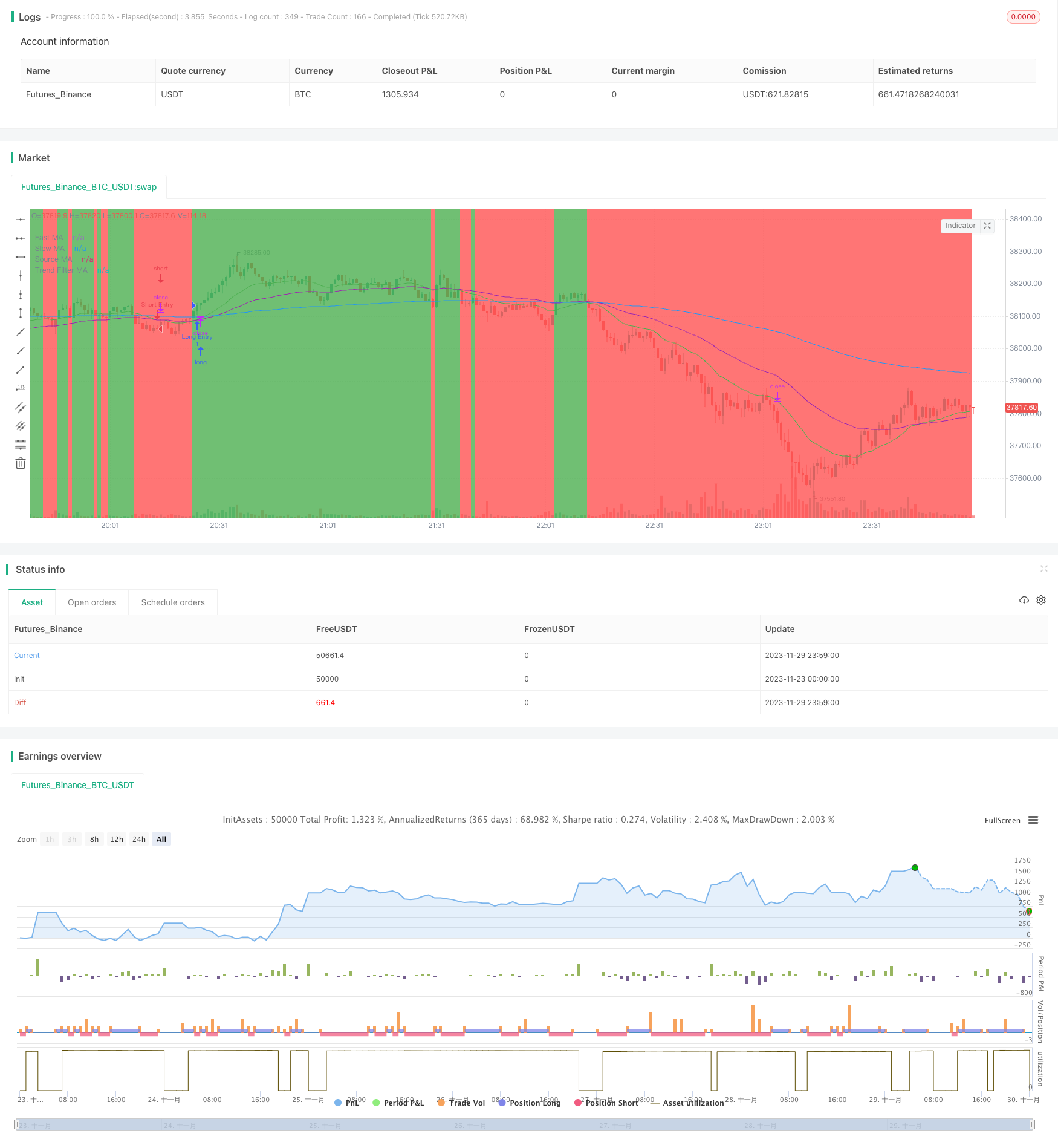

/*backtest

start: 2023-11-23 00:00:00

end: 2023-11-30 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

////////////////////////////////////////////////////////////////////////////////

// Booz Strategy

// Developed for Godstime

// Version 1.1

// 11/28/2021

////////////////////////////////////////////////////////////////////////////////

//@version=4

strategy("Booz Strategy", "", true)

// ----------------------------- Inputs ------------------------------------- //

source_ma_type = input("EMA", "Source MA Type", options=["SMA", "EMA"])

source_ma_length = input(50, "Source MA Length")

fast_ma_length = input(20, "Fast MA Length")

slow_ma_length = input(50, "Slow MA Length")

use_trend_filter = input(true, "Trend Filter")

trend_filter_ma_type = input("EMA", "Trend Filter MA Type", options=["SMA", "EMA"])

trend_filter_ma_length = input(200, "Trend Filter MA Period")

show_mas = input(true, "Show MAs")

swing_trading_mode = input(false, "Swing Trading")

// -------------------------- Calculations ---------------------------------- //

fast_ma = ema(close, fast_ma_length)

slow_ma = ema(close, slow_ma_length)

source_ma = source_ma_type == "EMA"? ema(close, source_ma_length):

sma(close, source_ma_length)

trend_filter_ma = trend_filter_ma_type == "EMA"? ema(close, trend_filter_ma_length):

sma(close, trend_filter_ma_length)

// --------------------------- Conditions ----------------------------------- //

uptrend = not use_trend_filter or close > trend_filter_ma

buy_cond = crossover(fast_ma, slow_ma) and uptrend

downtrend = not use_trend_filter or close < trend_filter_ma

sell_cond = crossunder(fast_ma, slow_ma) and downtrend

// ---------------------------- Plotting ------------------------------------ //

bgcolor(use_trend_filter and downtrend? color.red: use_trend_filter? color.green: na)

plot(show_mas? fast_ma: na, "Fast MA", color.green)

plot(show_mas? slow_ma: na, "Slow MA", color.red)

plot(show_mas? source_ma: na, "Source MA", color.purple)

plot(show_mas? trend_filter_ma: na, "Trend Filter MA", color.blue)

// ---------------------------- Trading ------------------------------------ //

// Inputs

sl_perc = input(1.0, "Stop Loss (in %)", group="Backtest Control")/100

tp_perc = input(1.0, "Take Profit (in %)", group="Backtest Control")/100

leverage = input(10, "Leverage", maxval=100, group="Backtest Control")

bt_start_time = input(timestamp("2021 01 01"), "Backtest Start Time", input.time, group="Backtest Control")

bt_end_time = input(timestamp("2021 12 31"), "Backtest End Time", input.time, group="Backtest Control")

// Trading Window

in_trading_window = true

trade_qty = 1

// Long Side

strategy.entry("Long Entry", strategy.long, trade_qty, when=buy_cond and in_trading_window)

long_tp = strategy.position_avg_price * (1 + tp_perc)

long_sl = strategy.position_avg_price * (1 - sl_perc)

if not swing_trading_mode

strategy.exit("Long Exit", "Long Entry", limit=long_tp, stop=long_sl)

// Short Side

strategy.entry("Short Entry", strategy.short, trade_qty, when=sell_cond and in_trading_window)

short_tp = strategy.position_avg_price * (1 - tp_perc)

short_sl = strategy.position_avg_price * (1 + sl_perc)

if not swing_trading_mode

strategy.exit("Short Exit", "Short Entry", limit=short_tp, stop=short_sl)

// End of trading window close

strategy.close_all(when=not in_trading_window)