RSI Based Quantitative Trading Strategy

Author: ChaoZhang, Date: 2023-12-06 17:17:16Tags:

Overview

The strategy is named “Dual Timeframe RSI Reversal”. It is a quantitative trading strategy based on Relative Strength Index (RSI). The strategy uses two RSI with different periods to generate buy and sell signals, aiming to buy low and sell high by capturing price reversal opportunities.

Strategy Logic

The strategy constructs trading signals by comparing a fast period RSI (default 55 days) and a slow period RSI (default 126 days). When the fast RSI crosses above the slow RSI, a buy signal is generated. When the fast RSI falls below the slow RSI, a sell signal is triggered. By comparing the relative strength between two different timeframes, it detects opportunities when short-term and long-term trends reversing.

After entering a position, profit target and stop loss will be set. Default profit target is 0.9 times the entry price. Default stop loss is 3% below the entry price. Positions will also be closed if a reverse signal is triggered.

Advantages

- Catch short-term price reversals by comparing dual RSIs

- Filter out false signals using dual confirmation

- Limit loss on single bet with stop loss

Risks

- Frequent reverse signals during high volatility

- Stop loss too tight, easily knocked out by small fluctuations

- Miss major reversals with poorly configured parameters

Enhancement

- Test more RSI parameter combinations to find optimum

- Add other indicators to filter false signals

- Dynamic stop loss and take profit ratio for better profitability

Summary

The “Dual Timeframe RSI Reversal” strategy generates trading signals by comparing crossovers between fast and slow RSI periods. It aims to capture short-term price reversals. Profit and stop loss rules are set to limit risks. This is a typical strategy of using multi-timeframe indicator comparisons to trade reversals. Enhancement areas include parameter tuning and risk control rules.

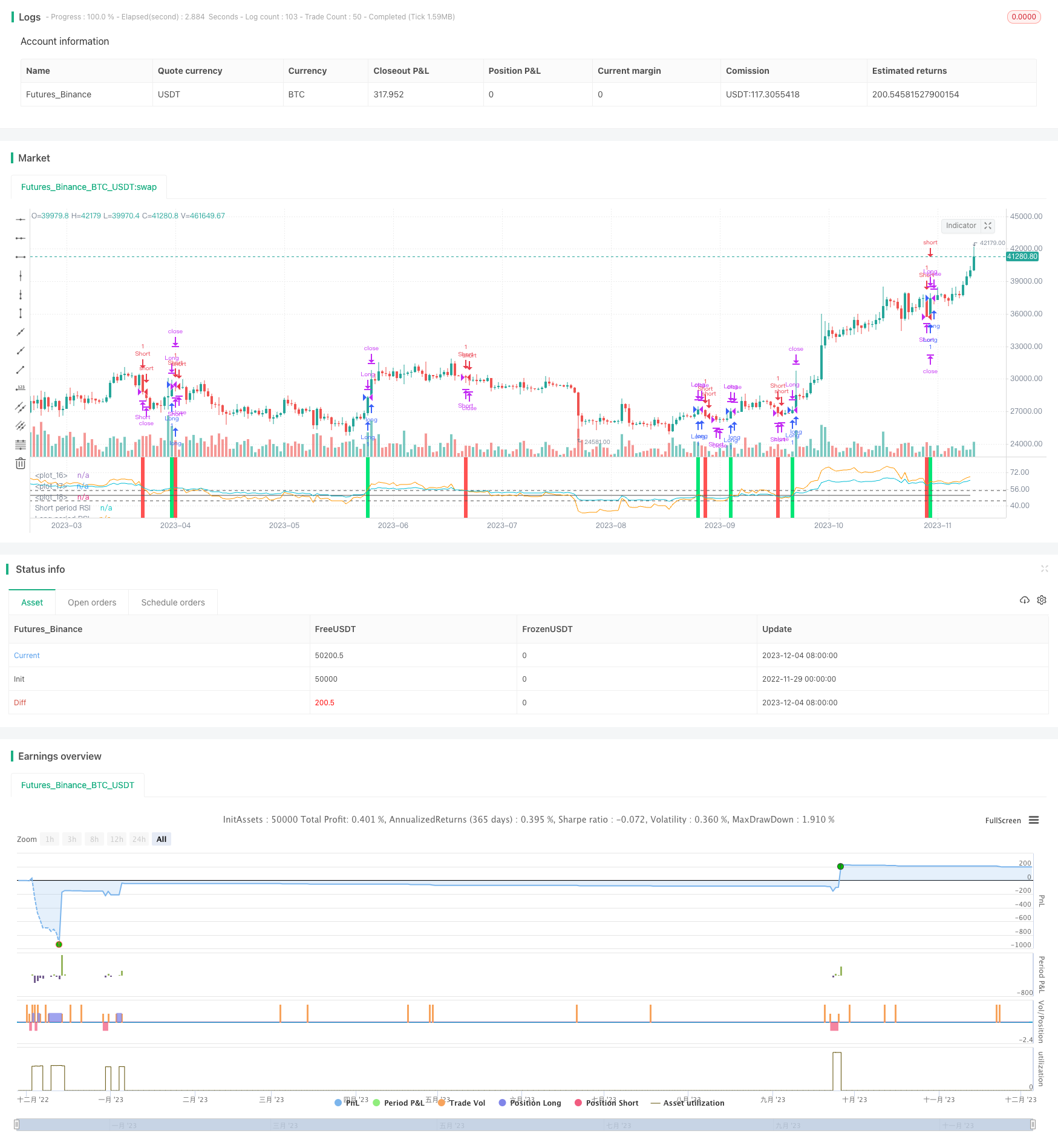

/*backtest

start: 2022-11-29 00:00:00

end: 2023-12-05 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy(title="Relative Strength Index", shorttitle="RSI")

slen = input(55, title="Short length")

llen = input(126, title="Long length")

sup = ema(max(change(close), 0), slen)

sdown = ema(-min(change(close), 0), slen)

rsi1 = sdown == 0 ? 100 : sup == 0 ? 0 : 100 - (100 / (1 + sup / sdown))

lup = ema(max(change(close), 0), llen)

ldown = ema(-min(change(close), 0), llen)

rsi2 = ldown == 0 ? 100 : lup == 0 ? 0 : 100 - (100 / (1 + lup / ldown))

ob = input(55, title="Overbought")

os = input(45, title="Oversold")

tp = input(.9, title="Take profit level %")*.01

sl = input(3, title="Stoploss level %")*.01

mid = avg(ob,os)

plot (mid, color=#4f4f4f, transp=0)

hline (ob, color=#4f4f4f)

hline (os, color=#4f4f4f)

long = crossover(rsi1,rsi2)

short = crossunder(rsi1,rsi2)

vall = valuewhen(long,close,0)

lexit1 = high>=(vall*tp)+vall

lexit2 = low<=vall-(vall*sl)

vals = valuewhen(short,close,0)

sexit1 = low<=vals - (vals*tp)

sexit2 = high>=vals + (vals*sl)

bgcolor (color=long?lime:na,transp=50)

bgcolor (color=short?red:na, transp=50)

strategy.entry("Long", strategy.long, when=long)

strategy.close("Long", when=lexit1)

strategy.close("Long", when=lexit2)

strategy.close("Long", when=short)

strategy.entry("Short", strategy.short, when=short)

strategy.close("Short", when=sexit1)

strategy.close("Short", when=sexit2)

strategy.close("Short", when=long)

plot (rsi1, color=orange, transp=0,linewidth=1, title="Short period RSI")

plot (rsi2, color=aqua , transp=0,linewidth=1, title="Long period RSI")

- Golden Ratio Mean Reversion Trend Trading Strategy

- Trend Trading Strategy Based on Multiple Moving Averages

- Dual Indicator Filtered Buy Signal Strategy

- Dual Moving Average Crossover Trading Strategy

- Dual EMA Crossover Strategy

- Momentum Breakout Camarilla Support Strategy

- Honey Trend ATR Breakout Strategy

- Trend Following Strategy with EMA

- Double Reversal Percentage Change Bar Quantitative Strategy

- Bollinger Bands Reversal with MA Trend Filter

- Multi Moving Average Crossover Trading Strategy

- Moving Average Crossover Strategy

- Auto S/R Breakout Strategy

- Momentum Price Channel Opening and Closing Strategy

- Improved Moving Average Crossover Strategy with Market Trend Guidance

- Dynamic Candlestick Big Yang Line Trading Strategy

- SSL Hybrid Exit Arrow Quant Strategy

- Dual Moving Average ADX Timing Strategy

- BB Percentage Index Trend Fading Strategy

- MACD Bollinger Turtle Trading Strategy