Honey Trend ATR Breakout Strategy

Author: ChaoZhang, Date: 2023-12-06 18:03:38Tags:

Overview

The Honey Trend ATR Breakout Strategy is a medium-term breakout strategy based on ATR indicator and Bollinger Bands for trading signal generation. It mainly monitors the trend changes of stock prices within a certain width of upper and lower ATR channels. When prices break through the lower or upper rail, combined with trend filtering, it makes trading decisions.

Strategy Principle

The strategy consists of three main parts:

-

ATR Channel: Calculate the fluctuation range of stock prices through ATR indicator and form a channel up and down within this range. The channel width is controlled by ATR lookback period and ATRdivisor factor.

-

Bee Line: Take the midline of stock prices as the baseline. The calculation method of midline is: the average value of yesterday’s high, low and close prices.

-

Trend Filtering: Calculate the price trend through DMI indicator and set signal cycle. When pricesig ‘>’: pricesig[3], the trend is up. When pricesig ‘<’ pricesig[3], the trend is down.

The specific logic for generating trading signals is:

Long signal: pricesig ‘>’ pricesig[3] and price break through the lower rail of channel.

Short signal: pricesig ‘<’ pricesig[3] and price break through the upper rail of channel.

No trading in other situations.

The strategy also sets stop profit and stop loss conditions to control trading risks.

Advantage Analysis

The Honey Trend ATR Breakout Strategy has the following advantages:

-

Use ATR indicator to calculate the fluctuation range of stock prices, which can dynamically capture market changes;

-

Combine the midline to evaluate the sideways of stock prices and set the channel breakout trading points to avoid chasing highs and killing lows;

-

DMI indicator is used to determine the trend and avoid trading against the trend, improving the win rate;

-

Set stop profit and stop loss conditions to control the risk of single trade;

-

The strategy parameters are flexible enough to optimize the strategy by adjusting the channel width, ATR cycle and other factors.

Risk Analysis

The strategy also has some risks:

-

Medium-term trading has relatively large fluctuations and high risks. Prudent money management is required.

-

ATR channel range calculation may be inaccurate when stock prices fluctuate sharply, which easily leads to wrong trades.

-

DMI indicator may also make mistakes in trend judgment, thus affecting the accuracy of trading signals.

In response to the above risks, parameters like ATR channel can be adjusted and signal cycles can be increased for optimization and improvement.

Optimization Directions

The strategy can be optimized in the following aspects:

-

Adjust ATR channel width by modifying atrDivisor up or down to compress or expand the channel range.

-

Adjust ATR lookback cycle parameter to change the sensitivity of channel to recent fluctuations.

-

Adjust trend signal cycle parameter to improve the accuracy of bullish and bearish trend judgments.

-

Add other indicators for multi-factor verification to improve signal quality.

-

Optimize stop profit and stop loss algorithms to improve risk control.

Conclusion

The Honey Trend ATR Breakout Strategy integrates the analysis of price fluctuation range and trend judgment indicators. While capturing market hotspots, it also controls trading risks. It is a flexible and adaptable quantitative strategy. This strategy can be continuously improved through parameter adjustment and signal optimization, with broad application prospects.

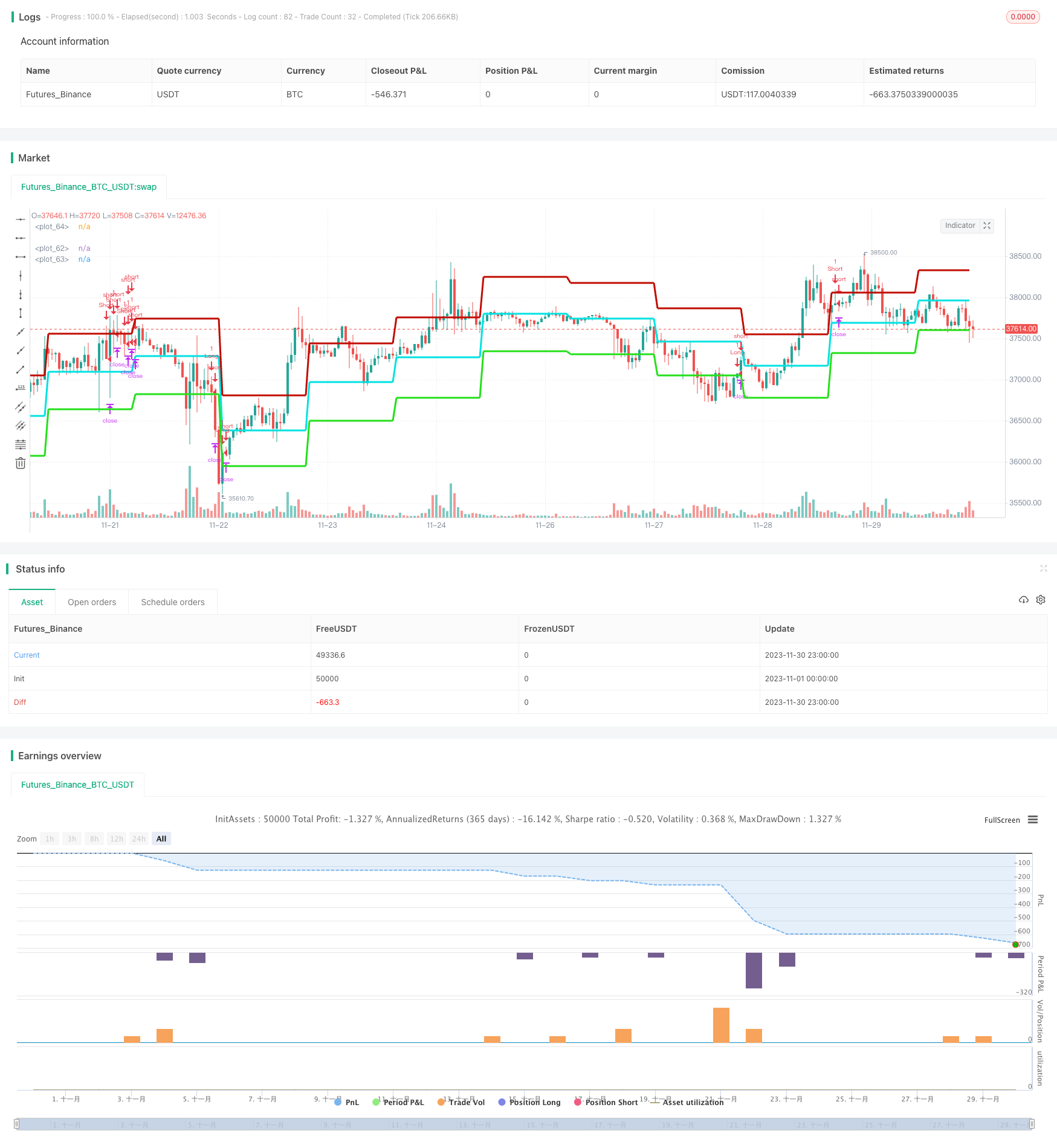

/*backtest

start: 2023-11-01 00:00:00

end: 2023-11-30 23:59:59

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

strategy(title="Strategy - Bobo PATR Swing", overlay=true, default_qty_type = strategy.fixed, default_qty_value = 1, initial_capital = 10000)

// === STRATEGY RELATED INPUTS AND LOGIC ===

PivottimeFrame = input(title="Pivot Timeframe", defval="D")

ATRSDtimeFrame = input(title="ATR Band Timeframe (Lower timeframe = wider bands)", defval="D")

len = input(title="ATR lookback (Lower = bands more responsive to recent price action)", defval=13)

myatr = atr(len)

dailyatr = request.security(syminfo.tickerid, ATRSDtimeFrame, myatr[1])

atrdiv = input(title="ATR divisor (Lower = wider bands)", type=float, defval=2)

pivot0 = (high[1] + low[1] + close[1]) / 3

pivot = request.security(syminfo.tickerid, PivottimeFrame, pivot0)

upperband1 = (dailyatr / atrdiv) + pivot

lowerband1 = pivot - (dailyatr / atrdiv)

middleband = pivot

// == TREND CALC ===

i1=input(2, "Momentum Period", minval=1) //Keep at 2 usually

i2=input(20, "Slow Period", minval=1)

i3=input(5, "Fast Period", minval=1)

i4=input(3, "Smoothing Period", minval=1)

i5=input(4, "Signal Period", minval=1)

i6=input(50, "Extreme Value", minval=1)

hiDif = high - high[1]

loDif = low[1] - low

uDM = hiDif > loDif and hiDif > 0 ? hiDif : 0

dDM = loDif > hiDif and loDif > 0 ? loDif : 0

ATR = rma(tr(true), i1)

DIu = 100 * rma(uDM, i1) / ATR

DId = 100 * rma(dDM, i1) / ATR

HLM2 = DIu - DId

DTI = (100 * ema(ema(ema(HLM2, i2), i3), i4)) / ema(ema(ema(abs(HLM2), i2), i3), i4)

signal = ema(DTI, i5)

// === RISK MANAGEMENT INPUTS ===

inpTakeProfit = input(defval = 0, title = "Take Profit (In Market MinTick Value)", minval = 0)

inpStopLoss = input(defval = 100, title = "Stop Loss (In Market MinTick Value)", minval = 0)

// === RISK MANAGEMENT VALUE PREP ===

// if an input is less than 1, assuming not wanted so we assign 'na' value to disable it.

useTakeProfit = inpTakeProfit >= 1 ? inpTakeProfit : na

useStopLoss = inpStopLoss >= 1 ? inpStopLoss : na

// === STRATEGY - LONG POSITION EXECUTION ===

enterLong = (((low<=lowerband1) and (close >lowerband1)) or ((open <= lowerband1) and (close > lowerband1))) and (strategy.opentrades <1) and (atr(3) > atr(50)) and (signal>signal[3])

exitLong = (high > middleband)

strategy.entry(id = "Long", long = true, when = enterLong)

strategy.close(id = "Long", when = exitLong)

// === STRATEGY - SHORT POSITION EXECUTION ===

enterShort = (((high>=upperband1) and (close < upperband1)) or ((open >= upperband1) and (close < upperband1))) and (strategy.opentrades <1) and (atr(3) > atr(50)) and (signal<signal[3])

exitShort = (low < middleband)

strategy.entry(id = "Short", long = false, when = enterShort)

strategy.close(id = "Short", when = exitShort)

// === STRATEGY RISK MANAGEMENT EXECUTION ===

strategy.exit("Exit Long", from_entry = "Long", profit = useTakeProfit, loss = useStopLoss)

strategy.exit("Exit Short", from_entry = "Short", profit = useTakeProfit, loss = useStopLoss)

// === CHART OVERLAY ===

plot(upperband1, color=#C10C00, linewidth=3)

plot(lowerband1, color=#23E019, linewidth=3)

plot(middleband, color=#00E2E2, linewidth=3)

//plot(strategy.equity, title="equity", color=red, linewidth=2, style=areabr)

- Dual EMA Golden Cross Trading Strategy

- BTC Trading Strategy Based on Moving Average Crossover

- MACD Indicator Bottom Reversal Early Warning Strategy

- Mala's Adaptive Moving Average Strategy

- Golden Ratio Mean Reversion Trend Trading Strategy

- Trend Trading Strategy Based on Multiple Moving Averages

- Dual Indicator Filtered Buy Signal Strategy

- Dual Moving Average Crossover Trading Strategy

- Dual EMA Crossover Strategy

- Momentum Breakout Camarilla Support Strategy

- Trend Following Strategy with EMA

- Double Reversal Percentage Change Bar Quantitative Strategy

- Bollinger Bands Reversal with MA Trend Filter

- RSI Based Quantitative Trading Strategy

- Multi Moving Average Crossover Trading Strategy

- Moving Average Crossover Strategy

- Auto S/R Breakout Strategy

- Momentum Price Channel Opening and Closing Strategy

- Improved Moving Average Crossover Strategy with Market Trend Guidance

- Dynamic Candlestick Big Yang Line Trading Strategy