Momentum Breakout Camarilla Support Strategy

Author: ChaoZhang, Date: 2023-12-06 18:09:06Tags:

Overview

This is a breakout trading strategy that combines momentum indicators and key support levels. It utilizes Camarilla pivots, moving average and price breakout to generate trading signals.

Strategy Logic

The core logic of the strategy is: when the price is near the key Camarilla support level and effectively breaks through that level, a buy signal is generated; when the price rises to the key Camarilla resistance level, a sell signal is generated.

Specifically, the strategy uses Camarilla support level L3 as the confirmation level for the buy signal. When the price is below L3 and below the midpoint of L3 and L2, the buy condition will be triggered. This indicates that the price is close to critical support and is likely to rebound. To filter out false breakouts, the strategy also sets the entry criteria that the closing price must be greater than the opening price.

The stop loss method of the strategy is to set a dynamic stop loss level. When the price exceeds the midpoint of the Camarilla resistance levels H1 and H2, the stop loss sell will be triggered. This dynamic stop loss level can trail stop loss based on market volatility.

Advantage Analysis

This is a reliable strategy that combines trends and support levels. Its advantages are:

- Use of key Camarilla levels that are proven important price levels.

- Combining trend filter to reduce being caught in trends. Only go long when EMA is bullish and only go short when EMA is bearish.

- Dynamic stop loss strategy adjusts stop level based on market volatility, with strong fault tolerance.

Risk Analysis

The strategy also has some risks:

- Camarilla levels may fail. These key levels may no longer apply when market structure changes.

- Stop loss is too aggressive. Small stops may be prematurely hit.

- Buy signals may appear on misleading pullbacks in downtrends, with risk of losses.

The counter measures are: adjust Camarilla parameters to better fit current market volatility range; appropriately widen stop loss range to prevent premature stop out; only short when in downtrend to avoid long trap.

Optimization Directions

Further optimization directions for this strategy include:

- Add additional filter conditions such as volume or elasticity indicators to avoid wrong direction entry.

- Optimize Camarilla parameters to make support/resistance levels fit better with current fluctuation range.

- Try different moving average parameters to find best parameter combination.

- Adjust aggressiveness of stops based on characteristics of different products.

Conclusion

This strategy comprehensively utilizes multiple dimensions like trend, support level, breakout to formulate entry and stop rules. It is a relatively robust breakout trading strategy. It combines the verification effectiveness of important Camarilla levels and the trend judgment of momentum indicators. This is aimed to capture trend trading opportunities in high probability areas. Meanwhile, dynamic stops are set to control risks. This strategy can increase our strategy library by an effective trend breakout strategy.

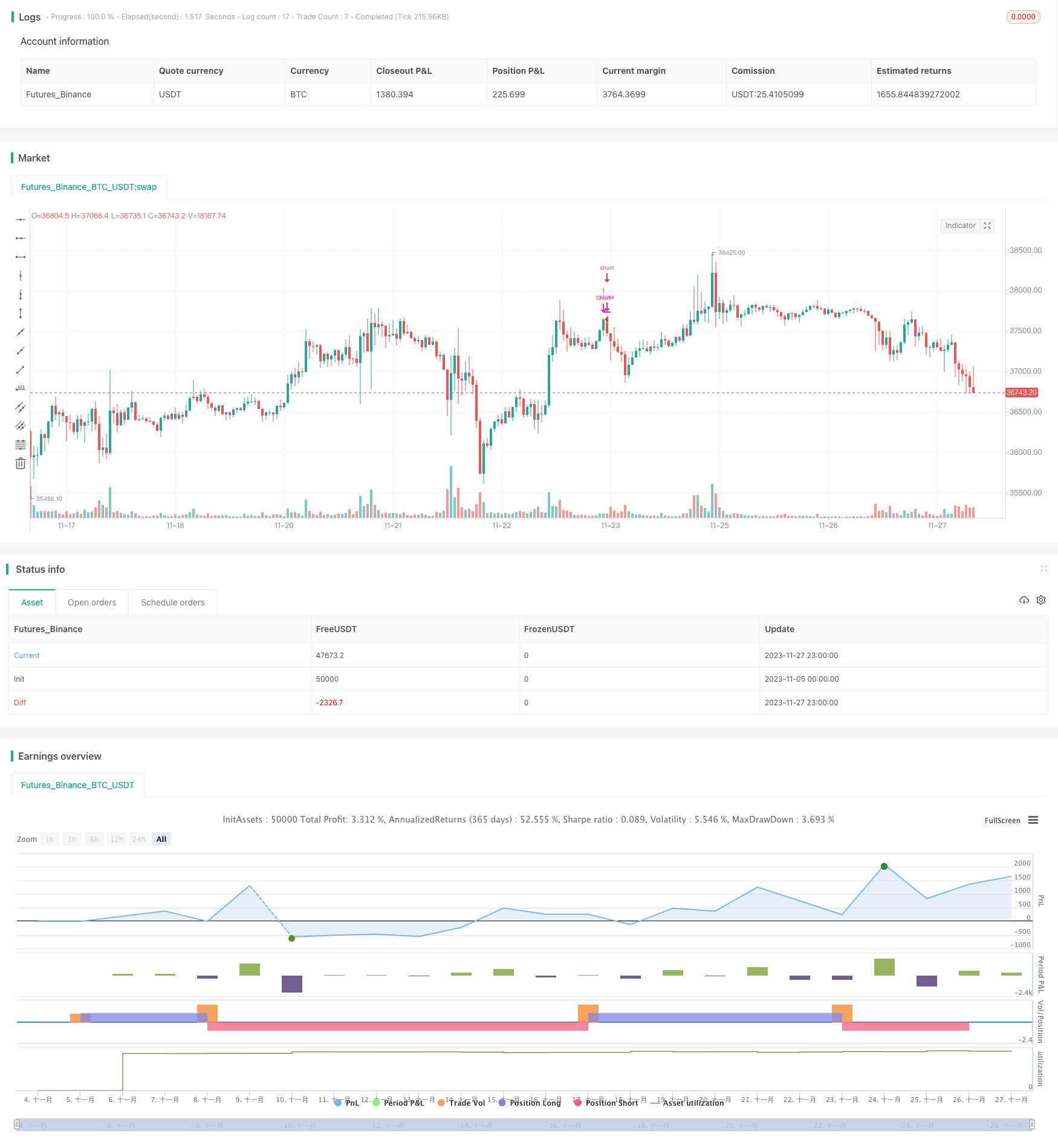

/*backtest

start: 2023-11-05 00:00:00

end: 2023-11-28 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

//Created by CristianD

strategy(title="CamarillaStrategyVhaouri", shorttitle="CD_Camarilla_StrategyV1", overlay=true)

//sd = input(true, title="Show Daily Pivots?")

EMA = ema(close,8)

hh ="X"

//Camarilla

pivot = (high + low + close ) / 3.0

range = high - low

h5 = (high/low) * close

h4 = close + (high - low) * 1.1 / 2.0

h3 = close + (high - low) * 1.1 / 4.0

h2 = close + (high - low) * 1.1 / 6.0

h1 = close + (high - low) * 1.1 / 12.0

l1 = close - (high - low) * 1.1 / 12.0

l2 = close - (high - low) * 1.1 / 6.0

l3 = close - (high - low) * 1.1 / 4.0

l4 = close - (high - low) * 1.1 / 2.0

h6 = h5 + 1.168 * (h5 - h4)

l5 = close - (h5 - close)

l6 = close - (h6 - close)

// Daily line breaks

//sopen = request.security(syminfo.tickerid, "D", open [1])

//shigh = request.security(syminfo.tickerid, "D", high [1])

//slow = request.security(syminfo.tickerid, "D", low [1])

//sclose = request.security(syminfo.tickerid, "D", close [1])

//

// Color

//dcolor=sopen != sopen[1] ? na : black

//dcolor1=sopen != sopen[1] ? na : red

//dcolor2=sopen != sopen[1] ? na : green

//Daily Pivots

dtime_pivot = request.security(syminfo.tickerid, 'W', pivot[1])

dtime_h6 = request.security(syminfo.tickerid, 'W', h6[1])

dtime_h5 = request.security(syminfo.tickerid, 'W', h5[1])

dtime_h4 = request.security(syminfo.tickerid, 'W', h4[1])

dtime_h3 = request.security(syminfo.tickerid, 'W', h3[1])

dtime_h2 = request.security(syminfo.tickerid, 'W', h2[1])

dtime_h1 = request.security(syminfo.tickerid, 'W', h1[1])

dtime_l1 = request.security(syminfo.tickerid, 'W', l1[1])

dtime_l2 = request.security(syminfo.tickerid, 'W', l2[1])

dtime_l3 = request.security(syminfo.tickerid, 'W', l3[1])

dtime_l4 = request.security(syminfo.tickerid, 'W', l4[1])

dtime_l5 = request.security(syminfo.tickerid, 'W', l5[1])

dtime_l6 = request.security(syminfo.tickerid, 'W', l6[1])

men = (dtime_l1-dtime_l2)/7

//plot(sd and dtime_l5 ? dtime_l5 : na, title="Daily L5",color=dcolor2, linewidth=2)

//plot(sd and dtime_l6 ? dtime_l6 : na, title="Daily L6",color=dcolor2, linewidth=2)

longCondition = close <=dtime_l3 and close <= (dtime_l3-men)//close >dtime_h4 and open < dtime_h4 and EMA < close

if (longCondition)

strategy.entry("Long12", strategy.long)

strategy.exit ("Exit Long","Longl2")

if (high >= (dtime_h1-men))

strategy.entry("Short", strategy.short)

strategy.exit ("Exit Short","Short")

- Dual-factor Quant Trading Strategy

- Dual EMA Golden Cross Trading Strategy

- BTC Trading Strategy Based on Moving Average Crossover

- MACD Indicator Bottom Reversal Early Warning Strategy

- Mala's Adaptive Moving Average Strategy

- Golden Ratio Mean Reversion Trend Trading Strategy

- Trend Trading Strategy Based on Multiple Moving Averages

- Dual Indicator Filtered Buy Signal Strategy

- Dual Moving Average Crossover Trading Strategy

- Dual EMA Crossover Strategy

- Honey Trend ATR Breakout Strategy

- Trend Following Strategy with EMA

- Double Reversal Percentage Change Bar Quantitative Strategy

- Bollinger Bands Reversal with MA Trend Filter

- RSI Based Quantitative Trading Strategy

- Multi Moving Average Crossover Trading Strategy

- Moving Average Crossover Strategy

- Auto S/R Breakout Strategy

- Momentum Price Channel Opening and Closing Strategy

- Improved Moving Average Crossover Strategy with Market Trend Guidance