Overview

This article mainly introduces a quantitative trading strategy based on Fibonacci Zones and DCA setup with ADX indicators. The strategy uses Fibonacci Zones to determine trend and volatility, combines with ADX indicators to measure trend strength, enters trades following the major trend direction in strong trending markets, avoids trading in sideways markets, to maximize profits while minimizing risks.

Principles

-

- Uses Fibonacci Zones formed with Donchian Channels to determine market trend direction. The zones divide into uptrend, ranging and downtrend zones.

-

- Uses ADX and DI indicators to measure trend strength and direction. ADX above 25 indicates a trending market.

-

- Enters long trades when price breaks into uptrend Fibonacci zone according to trend strength and direction. Add subsequent safety orders to average down.

-

- Sets initial stop loss based on entry price and safety order formula. Moves stop loss up to lock in profits.

-

- Exits strategy with profit target by percentage or touching price levels related to Fibonacci zone borders.

Advantages

Captures big trending moves while avoiding whipsaws in choppy markets.

Fibonacci zones work as dynamic support/resistance levels to identify turning points.

DCA allows better entries and maximizes profit potential from trends.

ADX gauges trend strength to avoid bad trades. DI shows bullish/bearish bias.

All components like TP, SO and SL prices update dynamically and automatically.

Risks

ADX and DI can give false signals without additional indicator confirmation.

Areas in Fibonacci zones are subjective and may miss opportunities.

DCA fails if the price trends strongly against position before SO triggered.

Trail stop or profit target may exit before reaching full potential.

Backtest bias and curve fitting risks may not replicate live performance.

Enhancements

Add more indicators like RSI, stochastics to confirm signals.

Optimize ADX and Fibonacci input parameters for better performance.

Experiment with more intelligent trailing stop loss algorithms.

Expand testing on more symbols and timeframes to ensure robustness.

Use machine learning predictions for dynamic stop loss and take profit.

Conclusion

This strategy combines Fibonacci statistics and indicators like ADX for identifying high probability setups to go long or avoid trading altogether. The dynamic DCA position sizing ensures good entries while managing risks. With further optimizations, it has the potential to be a robust mechanical trading system. We look forward to more advanced versions in future.

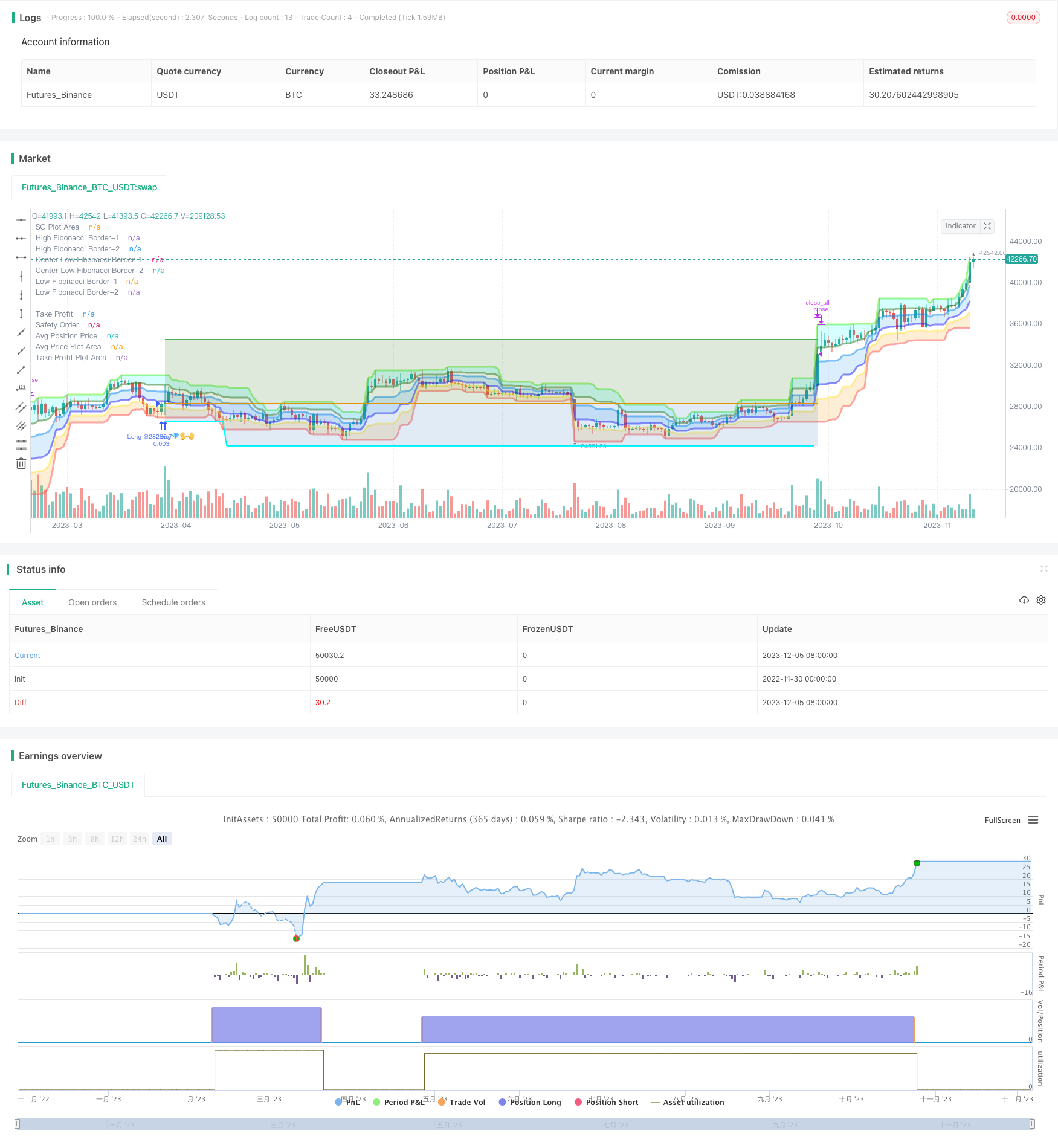

/*backtest

start: 2022-11-30 00:00:00

end: 2023-12-06 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// © Fibonacci Zone DCA Strategy - R3c0nTrader ver 2022-06-12

// For backtesting with 3Commas DCA Bot settings

// Thank you "eykpunter" for granting me permission to use "Fibonacci Zones" to create this strategy

// Thank you "junyou0424" for granting me permission to use "DCA Bot with SuperTrend Emulator" which I used for adding bot inputs, calculations, and strategy

//@version=5

strategy('Fibonacci Zone DCA Strategy - R3c0nTrader', shorttitle='Fibonacci Zone DCA Strategy', overlay=true )

// Strategy Inputs

// Start and End Dates

i_startTime = input(defval=timestamp('01 Jan 2015 00:00 +0000'), title='Start Time', group="Date Range")

i_endTime = input(defval=timestamp('31 Dec 2050 23:59 +0000'), title='End Time', group="Date Range")

inDateRange = true

// Fibonacci Settings

sourceInput = input.source(close, "Source", group="Trade Entry Settings")

per = input(14, title='Fibonacci length', tooltip='Number of bars to look back. Recommended for beginners to set ADX Smoothing and DI Length to the same value as this.', group="Trade Entry Settings")

hl = ta.highest(high, per) //High Line (Border)

ll = ta.lowest(low, per) //Low Line (Border)

dist = hl - ll //range of the channel

hf = hl - dist * 0.236 //Highest Fibonacci line

cfh = hl - dist * 0.382 //Center High Fibonacci line

cfl = hl - dist * 0.618 //Center Low Fibonacci line

lf = hl - dist * 0.764 //Lowest Fibonacci line

// ADX Settings

lensig = input.int(14, title="ADX Smoothing", tooltip='Fibonacci signals work best when market is trending. ADX is used to measure trend strength. Default value is 14. Recommend for beginners to match this with Fibonacci length and DI Length',minval=1, maxval=50, group="Trade Entry Settings")

len = input.int(14, minval=1, title="DI Length", tooltip='Fibonacci signals work best when market is trending. DI Length is used to calculate ADX to measure trend strength. Default value is 14. Recommend for beginners to match this with Fibonacci length and ADX Smoothing.', group="Trade Entry Settings")

adx_min = input.int(25, title='Min ADX value to open trade', tooltip='Use this to set the minium ADX value (trend strength) to open trade. 25 or higher is recommended for beginners. 0 to 20 is a weak trend. 25 to 35 is a strong trend. 35 to 45 is a very strong trend. 45 to 100 is an extremely strong trend.', group="Trade Entry Settings")

up = ta.change(high)

down = -ta.change(low)

plusDM = na(up) ? na : (up > down and up > 0 ? up : 0)

minusDM = na(down) ? na : (down > up and down > 0 ? down : 0)

trur = ta.rma(ta.tr, len)

di_plus = fixnan(100 * ta.rma(plusDM, len) / trur)

di_minus = fixnan(100 * ta.rma(minusDM, len) / trur)

sum = di_plus + di_minus

adx = 100 * ta.rma(math.abs(di_plus - di_minus) / (sum == 0 ? 1 : sum), lensig)

fib_choice = input.string("2-Higher than the top of the Downtrend Fib zone", title="Open a trade when the price moves:", options=["1-To the bottom of Downtrend Fib zone", "2-Higher than the top of the Downtrend Fib zone", "3-Higher than the bottom of Ranging Fib Zone", "4-Higher than the top of Ranging Fib Zone", "5-Higher than the bottom of Uptrend Fib Zone", "6-To the top of Uptrend Fib Zone"],

tooltip='There are three fib zones. The options are listed from the bottom zone to the top zone. The bottom zone is the Downtrend zone; the middle zone is the Ranging zone; The top fib zone is the Uptrend zone;',

group="Trade Entry Settings")

di_choice = input.bool(false, title="Only open trades on bullish +DI (Positive Directional Index)? (off for contrarian traders)", tooltip=

'Default is disabled. If you want to be more selective (you want a bullish confirmation), enable this and it will only open trades when the +DI (Positive Directional Index) is higher than the -DI (Negative Directional Index). Contrarian traders (buy the dip) should leave this disabled',

group="Trade Entry Settings")

di_min = input.int(0, title='Min +DI value to open trade',

tooltip='Default is zero. Use this to set the minium +DI value to open the trade. Try incrementing this value if you want to be more selective and filter for more bullish moves (e.g. 20-25). For Contrarian traders, uncheck "Only open trades on bullish DI" option and set Min +DI to zero',

group="Trade Entry Settings")

di_max = input.int(100, title='Max +DI value to open trade', tooltip='Default is 100. Use this to set the maxium +DI value to open trade. For Contrarian traders, uncheck "Only open trades on bullish DI" option and try a Max +DI value no higher than 20 or 25', group="Trade Entry Settings")

di_inrange = di_plus >= di_min and di_plus <= di_max

// Truncate function

truncate(number, decimals) =>

factor = math.pow(10, decimals)

int(number * factor) / factor

//Declare take_profit

take_profit = float(0.22)

// Take Profit Drop-down menu option

tp_choice = input.string("Target Take Profit (%)", title="Take profit using:", options=["Target Take Profit (%)", "High Fibonacci Border-1", "High Fibonacci Border-2"], tooltip=

'Select how to exit your trade and take profit. Then specify below this option the condition to exit. "High Fibonacci Border-1" is the top-most Fibonacci line in the green uptrend zone. "High Fibonacci Border-2" is the bottom Fibonacci line in the green uptrend zone. You can find these lines on the "Style" tab and toggle them off/on to locate these lines for more clarity',

group="Trade Exit Settings")

if tp_choice == "Target Take Profit (%)"

take_profit := input.float(22.0, title='Target Take Profit (%)', step=0.5, minval=0.0, tooltip='Only used if "Target Take Profit (%)" is selected above.', group="Trade Exit Settings") / 100

take_profit

else if tp_choice == "High Fibonacci Border-1"

take_profit := float(hl)

take_profit

else if tp_choice == "High Fibonacci Border-2"

take_profit := float(hf)

take_profit

trailing = input.float(0.0, title='Trailing deviation. Default= 0.0 (%)', step=0.5, minval=0.0, group="Trade Exit Settings") / 100

base_order = input(100.0, title='Base order', group="Trade Entry Settings")

safe_order = input(200.0, title='Safety order', group="Trade Entry Settings")

price_deviation = input.float(6.0, title='Price deviation to open safety orders (%)', step=0.25, minval=0.0, group="Trade Entry Settings") / 100

safe_order_volume_scale = input.float(2.0, step=0.5, title='Safety order volume scale', group="Trade Entry Settings")

safe_order_step_scale = input.float(1.4, step=0.1, title='Safety order step scale', group="Trade Entry Settings")

max_safe_order = input(5, title='Max safety orders', group="Trade Entry Settings")

var current_so = 0

var initial_order = 0.0

var previous_high_value = 0.0

var original_ttp_value = 0.0

// Calculate our key levels

take_profit_level = strategy.position_avg_price * (1 + take_profit)

if tp_choice == "Target Take Profit (%)"

take_profit_level := strategy.position_avg_price * (1 + take_profit)

else

take_profit_level := take_profit

fib_trigger = bool(false)

if fib_choice == "2-Higher than the top of the Downtrend Fib zone"

fib_trigger := ta.crossover(sourceInput, lf)

else if fib_choice == "1-To the bottom of Downtrend Fib zone"

fib_trigger := sourceInput <= ll

else if fib_choice == "3-Higher than the bottom of Ranging Fib Zone"

fib_trigger := ta.crossover(sourceInput, cfl)

else if fib_choice == "4-Higher than the top of Ranging Fib Zone"

fib_trigger := ta.crossover(sourceInput, cfh)

else if fib_choice == "5-Higher than the bottom of Uptrend Fib Zone"

fib_trigger := ta.crossover(sourceInput, hf)

else if fib_choice == "6-To the top of Uptrend Fib Zone"

fib_trigger := sourceInput >= hl

// If option enabled for enter trades only when DI is positive, then open trade based on user settings

if di_choice == true and strategy.position_size == 0 and sourceInput > 0 and inDateRange and fib_trigger and adx >= adx_min and di_plus > di_minus and di_inrange

strategy.entry('Long @' + str.tostring(sourceInput)+'💎✋🤚', strategy.long, qty=base_order / sourceInput)

initial_order := sourceInput

current_so := 1

previous_high_value := 0.0

fib_trigger := false

original_ttp_value := 0

original_ttp_value

// Open First Position when candle source value crosses above the 'Low Fibonacci Border-1'

else if di_choice == false and strategy.position_size == 0 and sourceInput > 0 and inDateRange and fib_trigger and adx >= adx_min and di_inrange

strategy.entry('Long @' + str.tostring(sourceInput)+'💎✋🤚', strategy.long, qty=base_order / sourceInput)

initial_order := sourceInput

current_so := 1

previous_high_value := 0.0

fib_trigger := false

original_ttp_value := 0

original_ttp_value

threshold = 0.0

if safe_order_step_scale == 1.0

threshold := initial_order - initial_order * price_deviation * safe_order_step_scale * current_so

threshold

else if current_so <= max_safe_order

threshold := initial_order - initial_order * ((price_deviation * math.pow(safe_order_step_scale, current_so) - price_deviation) / (safe_order_step_scale - 1))

threshold

else if current_so > max_safe_order

threshold := initial_order - initial_order * ((price_deviation * math.pow(safe_order_step_scale, max_safe_order) - price_deviation) / (safe_order_step_scale - 1))

threshold

// Average down when lowest candle value crosses below threshold

if current_so > 0 and low <= threshold and current_so <= max_safe_order and previous_high_value == 0.0

// Trigger a safety order at the Safety Order "threshold" price

strategy.entry('😨🙏 SO ' + str.tostring(current_so) + '@' + str.tostring(threshold), direction=strategy.long, qty=safe_order * math.pow(safe_order_volume_scale, current_so - 1) / threshold)

current_so += 1

current_so

// Take Profit!

// Take profit when take profit level is equal to or higher than the high of the candle

if take_profit_level <= high and strategy.position_size > 0 or previous_high_value > 0.0

if trailing > 0.0

if previous_high_value > 0.0

if high >= previous_high_value

previous_high_value := sourceInput

previous_high_value

else

previous_high_percent = (previous_high_value - original_ttp_value) * 1.0 / original_ttp_value

current_high_percent = (high - original_ttp_value) * 1.0 / original_ttp_value

if previous_high_percent - current_high_percent >= trailing

strategy.close_all(comment='Close (trailing) @' + str.tostring(truncate(current_high_percent * 100, 3)) + '%')

current_so := 0

previous_high_value := 0

original_ttp_value := 0

original_ttp_value

else

previous_high_value := high

original_ttp_value := high

original_ttp_value

else

strategy.close_all(comment='💰 Close @' + str.tostring(high))

current_so := 0

previous_high_value := 0

original_ttp_value := 0

original_ttp_value

// Plot Fibonacci Areas

fill(plot(hl, title='High Fibonacci Border-1', color=color.new(#53ed0f, 50), linewidth=3), plot(hf, title='High Fibonacci Border-2', color=color.new(#38761d, 50), linewidth=3), color=color.new(#00FFFF, 80), title='Uptrend Fibonacci Zone @ 23.6%') //uptrend zone

fill(plot(cfh, title='Center Low Fibonacci Border-1', color=color.new(#0589f4, 50), linewidth=3), plot(cfl, title='Center Low Fibonacci Border-2', color=color.new(#2018ff, 50), linewidth=3), color=color.new(color.blue, 80), title='Ranging Fibonacci Zone @ 61.8%') // ranging zone

fill(plot(lf, title='Low Fibonacci Border-1', color=color.new(color.yellow, 50), linewidth=3), plot(ll, title='Low Fibonacci Border-2', color=color.new(color.red, 50), linewidth=3), color=color.new(color.orange, 80), title='Downtrend Fibonacci Zone @ 76.4%') //down trend zone

// Plot TP

plot(strategy.position_size > 0 ? take_profit_level : na, style=plot.style_linebr, color=color.green, linewidth=2, title="Take Profit")

// Plot All Safety Order lines except for last one as bright blue

plot(strategy.position_size > 0 and current_so <= max_safe_order and current_so > 0 ? threshold : na, style=plot.style_linebr, color=color.new(#00ffff,0), linewidth=2, title="Safety Order")

// Plot Last Safety Order Line as Red

plot(strategy.position_size > 0 and current_so > max_safe_order ? threshold : na, style=plot.style_linebr, color=color.red, linewidth=2, title="No Safety Orders Left")

// Plot Average Position Price Line as Orange

plot(strategy.position_size > 0 ? strategy.position_avg_price : na, style=plot.style_linebr, color=color.orange, linewidth=2, title="Avg Position Price")

// Fill TP Area and SO Area

h1 = plot(strategy.position_avg_price, color=color.new(#000000,100), title="Avg Price Plot Area", display=display.none, editable=false)

h2 = plot(take_profit_level, color=color.new(#000000,100), title="Take Profit Plot Area", display=display.none, editable=false)

h3 = plot(threshold, color=color.new(#000000,100), title="SO Plot Area", display=display.none, editable=false)

// Fill TP Area and SO Area

fill(h1,h2,color=color.new(#38761d,80), title="Take Profit Plot Area")

// Current SO Area

fill(h1,h3,color=color.new(#3d85c6,80), title="SO Plot Area")