The Smooth Moving Average Ribbon Strategy

Author: ChaoZhang, Date: 2023-12-11 14:48:35Tags:

Overview

This strategy constructs a smooth price band using smooth moving averages and integrates various smooth moving averages to filter the trend in real time. It belongs to a typical trend following strategy.

Strategy Principle

- Construct a smooth price band to track price changes using smooth moving averages.

- The strategy supports various moving average types as the calculation method for smooth moving averages, such as EMA, SMMA, KAMA, etc.

- It supports 1-5 layers of stacking smoothness on these moving averages to obtain an even smoother price band.

- It also supports adding Bollinger Bands between prices and moving averages to better capture price changes.

- By enabling an additional moving average filter, it can filter out fluctuations better and identify trend directions. The filter also supports multiple moving average types.

- Combined with pattern recognition indicators, it can automatically identify buy and sell signals.

By constructing a smooth price band to capture price trends, and integrating a moving average filter to confirm trend directions, this strategy belongs to a typical trend following strategy. By adjusting parameters, it can be flexibly adapted to different products and timeframes.

Advantages

- Constructing price bands can track price trend changes more smoothly, reducing the probability of missing opportunities.

- Supporting multiple moving average types allows selecting suitable moving averages based on different timeframes and products, improving the adaptability of the strategy.

- 1-5 layers of stacking smoothness can significantly improve the tracking capability of price changes and capture trend reversal points more precisely.

- The moving average filter can effectively reduce invalid signals and improve win rate.

- By adjusting moving average lengths, it can be adapted to different timeframes. Multi-timeframe verification can further improve strategy performance.

- Supporting black glass display enables clear and intuitive observation of price band trends.

Risks

- Strong in tracking long-term trends, but poor in tracking and reacting to short-term fluctuations, tending to generate more invalid signals in range-bound markets.

- In violent price surges and plunges, the lagging of smooth moving averages may miss the best entry timing.

- Excessive stacking of moving averages may overly smooth price changes and cause inaccurate identifications of buy and sell points.

- If the enabled moving average length parameters are improperly set, it may generate a large number of false signals.

Solutions:

- Appropriately shorten moving average lengths to accelerate reaction to price changes.

- Adjust stacking times to reduce over-smoothness.

- Optimize and test moving average combinations to select optimal parameters.

- Use multi-timeframe verification with other indicators to reduce false signals.

Optimization Directions

- Test and optimize combinations of moving average types to select optimal parameters.

- Test and optimize moving average length parameters to adapt to more products and timeframes.

- Try different stacking smoothness times to find the optimal balance point.

- Try adding Bollinger Bands as an auxiliary indicator.

- Test different additional moving averages as filters.

- Use multi-timeframe verification with other indicators.

Conclusion

This strategy belongs to a typical trend following strategy that continuously tracks price trends by constructing smooth moving average bands and avoids invalid signals with assisting filters. Its advantage lies in constructing smooth price bands to better capture turns in price trends. It also has certain risks of lagging. By parameter optimization and indicator optimization, the strategy performance can be continuously improved and is worth further research.

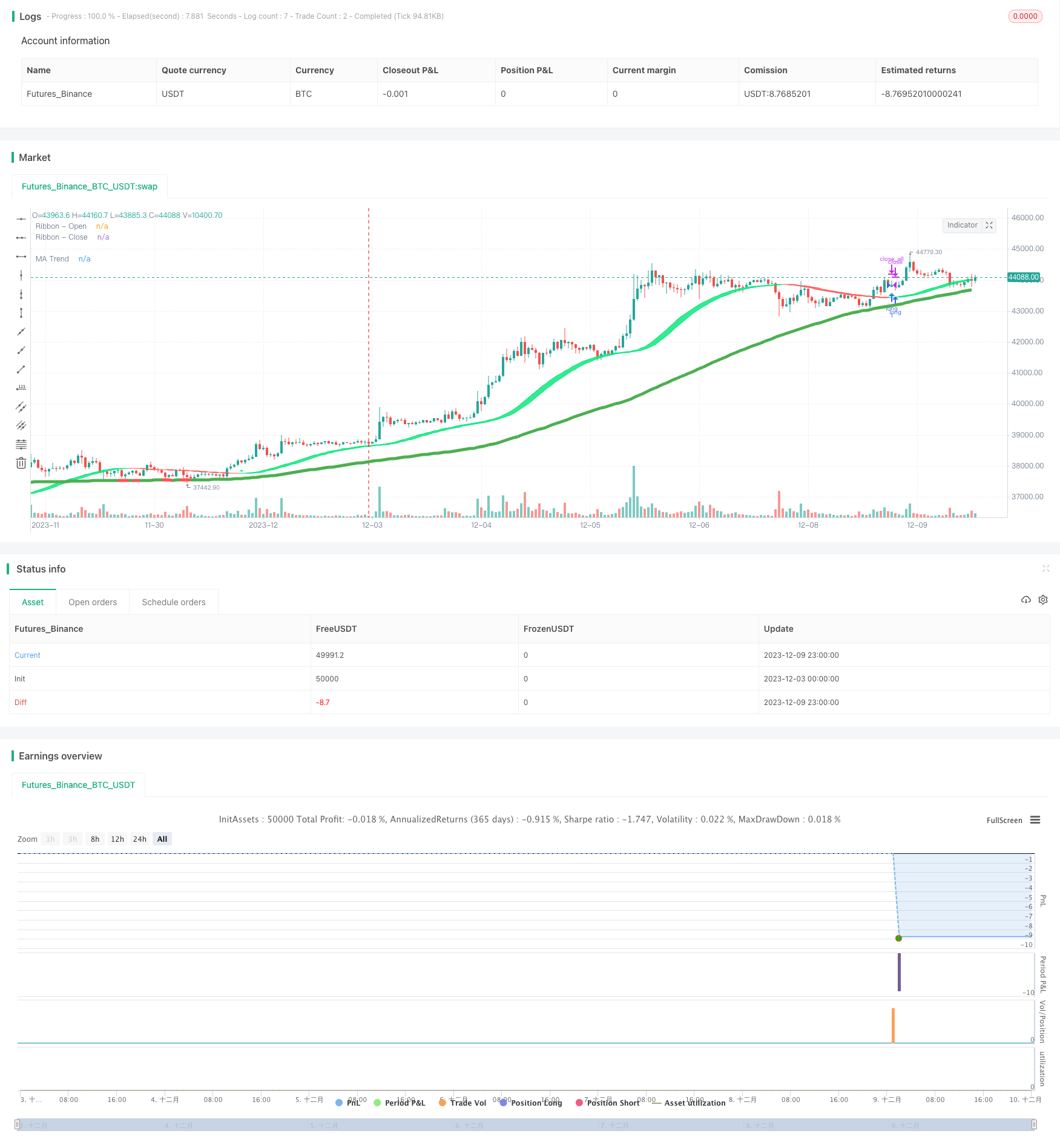

/*backtest

start: 2023-12-03 00:00:00

end: 2023-12-10 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

// Copyright (c) 2007-present Jurik Research and Consulting. All rights reserved.

// Copyright (c) 2018-present, Alex Orekhov (everget)

// Thanks to everget for code for more advanced moving averages

// Smooth Moving Average Ribbon [STRATEGY] @PuppyTherapy script may be freely distributed under the MIT license.

strategy( title="Smooth Moving Average Ribbon [STRATEGY] @PuppyTherapy", overlay=true )

// ---- CONSTANTS ----

lsmaOffset = 1

almaOffset = 0.85

almaSigma = 6

phase = 2

power = 2

// ---- GLOBAL FUNCTIONS ----

kama(src, len)=>

xvnoise = abs(src - src[1])

nfastend = 0.666

nslowend = 0.0645

nsignal = abs(src - src[len])

nnoise = sum(xvnoise, len)

nefratio = iff(nnoise != 0, nsignal / nnoise, 0)

nsmooth = pow(nefratio * (nfastend - nslowend) + nslowend, 2)

nAMA = 0.0

nAMA := nz(nAMA[1]) + nsmooth * (src - nz(nAMA[1]))

t3(src, len)=>

xe1_1 = ema(src, len)

xe2_1 = ema(xe1_1, len)

xe3_1 = ema(xe2_1, len)

xe4_1 = ema(xe3_1, len)

xe5_1 = ema(xe4_1, len)

xe6_1 = ema(xe5_1, len)

b_1 = 0.7

c1_1 = -b_1*b_1*b_1

c2_1 = 3*b_1*b_1+3*b_1*b_1*b_1

c3_1 = -6*b_1*b_1-3*b_1-3*b_1*b_1*b_1

c4_1 = 1+3*b_1+b_1*b_1*b_1+3*b_1*b_1

nT3Average_1 = c1_1 * xe6_1 + c2_1 * xe5_1 + c3_1 * xe4_1 + c4_1 * xe3_1

// The general form of the weights of the (2m + 1)-term Henderson Weighted Moving Average

getWeight(m, j) =>

numerator = 315 * (pow(m + 1, 2) - pow(j, 2)) * (pow(m + 2, 2) - pow(j, 2)) * (pow(m + 3, 2) - pow(j, 2)) * (3 * pow(m + 2, 2) - 11 * pow(j, 2) - 16)

denominator = 8 * (m + 2) * (pow(m + 2, 2) - 1) * (4 * pow(m + 2, 2) - 1) * (4 * pow(m + 2, 2) - 9) * (4 * pow(m + 2, 2) - 25)

denominator != 0

? numerator / denominator

: 0

hwma(src, termsNumber) =>

sum = 0.0

weightSum = 0.0

termMult = (termsNumber - 1) / 2

for i = 0 to termsNumber - 1

weight = getWeight(termMult, i - termMult)

sum := sum + nz(src[i]) * weight

weightSum := weightSum + weight

sum / weightSum

get_jurik(length, phase, power, src)=>

phaseRatio = phase < -100 ? 0.5 : phase > 100 ? 2.5 : phase / 100 + 1.5

beta = 0.45 * (length - 1) / (0.45 * (length - 1) + 2)

alpha = pow(beta, power)

jma = 0.0

e0 = 0.0

e0 := (1 - alpha) * src + alpha * nz(e0[1])

e1 = 0.0

e1 := (src - e0) * (1 - beta) + beta * nz(e1[1])

e2 = 0.0

e2 := (e0 + phaseRatio * e1 - nz(jma[1])) * pow(1 - alpha, 2) + pow(alpha, 2) * nz(e2[1])

jma := e2 + nz(jma[1])

variant(src, type, len ) =>

v1 = sma(src, len) // Simple

v2 = ema(src, len) // Exponential

v3 = 2 * v2 - ema(v2, len) // Double Exponential

v4 = 3 * (v2 - ema(v2, len)) + ema(ema(v2, len), len) // Triple Exponential

v5 = wma(src, len) // Weighted

v6 = vwma(src, len) // Volume Weighted

v7 = na(v5[1]) ? sma(src, len) : (v5[1] * (len - 1) + src) / len // Smoothed

v8 = wma(2 * wma(src, len / 2) - wma(src, len), round(sqrt(len))) // Hull

v9 = linreg(src, len, lsmaOffset) // Least Squares

v10 = alma(src, len, almaOffset, almaSigma) // Arnaud Legoux

v11 = kama(src, len) // KAMA

ema1 = ema(src, len)

ema2 = ema(ema1, len)

v13 = t3(src, len) // T3

v14 = ema1+(ema1-ema2) // Zero Lag Exponential

v15 = hwma(src, len) // Henderson Moving average thanks to @everget

ahma = 0.0

ahma := nz(ahma[1]) + (src - (nz(ahma[1]) + nz(ahma[len])) / 2) / len //Ahrens Moving Average

v16 = ahma

v17 = get_jurik( len, phase, power, src)

type=="EMA"?v2 : type=="DEMA"?v3 : type=="TEMA"?v4 : type=="WMA"?v5 : type=="VWMA"?v6 :

type=="SMMA"?v7 : type=="Hull"?v8 : type=="LSMA"?v9 : type=="ALMA"?v10 : type=="KAMA"?v11 :

type=="T3"?v13 : type=="ZEMA"?v14 : type=="HWMA"?v15 : type=="AHMA"?v16 : type=="JURIK"?v17 : v1

smoothMA(o, h, l, c, maLoop, type, len) =>

ma_o = 0.0

ma_h = 0.0

ma_l = 0.0

ma_c = 0.0

if maLoop == 1

ma_o := variant(o, type, len)

ma_h := variant(h, type, len)

ma_l := variant(l, type, len)

ma_c := variant(c, type, len)

if maLoop == 2

ma_o := variant(variant(o ,type, len),type, len)

ma_h := variant(variant(h ,type, len),type, len)

ma_l := variant(variant(l ,type, len),type, len)

ma_c := variant(variant(c ,type, len),type, len)

if maLoop == 3

ma_o := variant(variant(variant(o ,type, len),type, len),type, len)

ma_h := variant(variant(variant(h ,type, len),type, len),type, len)

ma_l := variant(variant(variant(l ,type, len),type, len),type, len)

ma_c := variant(variant(variant(c ,type, len),type, len),type, len)

if maLoop == 4

ma_o := variant(variant(variant(variant(o ,type, len),type, len),type, len),type, len)

ma_h := variant(variant(variant(variant(h ,type, len),type, len),type, len),type, len)

ma_l := variant(variant(variant(variant(l ,type, len),type, len),type, len),type, len)

ma_c := variant(variant(variant(variant(c ,type, len),type, len),type, len),type, len)

if maLoop == 5

ma_o := variant(variant(variant(variant(variant(o ,type, len),type, len),type, len),type, len),type, len)

ma_h := variant(variant(variant(variant(variant(h ,type, len),type, len),type, len),type, len),type, len)

ma_l := variant(variant(variant(variant(variant(l ,type, len),type, len),type, len),type, len),type, len)

ma_c := variant(variant(variant(variant(variant(c ,type, len),type, len),type, len),type, len),type, len)

[ma_o, ma_h, ma_l, ma_c]

smoothHA( o, h, l, c ) =>

hao = 0.0

hac = ( o + h + l + c ) / 4

hao := na(hao[1])?(o + c / 2 ):(hao[1] + hac[1])/2

hah = max(h, max(hao, hac))

hal = min(l, min(hao, hac))

[hao, hah, hal, hac]

// ---- Main Ribbon ----

haSmooth = input(true, title=" Use HA as source ? " )

length = input(11, title=" MA1 Length", minval=1, maxval=1000)

maLoop = input(3, title=" Nr. of MA1 Smoothings ", minval=1, maxval=5)

type = input("EMA", title="MA Type", options=["SMA", "EMA", "DEMA", "TEMA", "WMA", "VWMA", "SMMA", "Hull", "LSMA", "ALMA", "KAMA", "ZEMA", "HWMA", "AHMA", "JURIK", "T3"])

haSmooth2 = input(true, title=" Use HA as source ? " )

// ---- Trend ----

ma_use = input(true, title=" ----- Use MA Filter ( For Lower Timeframe Swings / Scalps ) ? ----- " )

ma_source = input(defval = close, title = "MA - Source", type = input.source)

ma_length = input(100,title="MA - Length", minval=1 )

ma_type = input("SMA", title="MA - Type", options=["SMA", "EMA", "DEMA", "TEMA", "WMA", "VWMA", "SMMA", "Hull", "LSMA", "ALMA", "KAMA", "ZEMA", "HWMA", "AHMA", "JURIK", "T3"])

ma_useHA = input(defval = false, title = "Use HA Candles as Source ?")

ma_rsl = input(true, title = "Use Rising / Falling Logic ?" )

// ---- BODY SCRIPT ----

[ ha_open, ha_high, ha_low, ha_close ] = smoothHA(open, high, low, close)

_open_ma = haSmooth ? ha_open : open

_high_ma = haSmooth ? ha_high : high

_low_ma = haSmooth ? ha_low : low

_close_ma = haSmooth ? ha_close : close

[ _open, _high, _low, _close ] = smoothMA( _open_ma, _high_ma, _low_ma, _close_ma, maLoop, type, length)

[ ha_open2, ha_high2, ha_low2, ha_close2 ] = smoothHA(_open, _high, _low, _close)

_open_ma2 = haSmooth2 ? ha_open2 : _open

_high_ma2 = haSmooth2 ? ha_high2 : _high

_low_ma2 = haSmooth2 ? ha_low2 : _low

_close_ma2 = haSmooth2 ? ha_close2 : _close

ribbonColor = _close_ma2 > _open_ma2 ? color.lime : color.red

p_open = plot(_open_ma2, title="Ribbon - Open", color=ribbonColor, transp=70)

p_close = plot(_close_ma2, title="Ribbon - Close", color=ribbonColor, transp=70)

fill(p_open, p_close, color = ribbonColor, transp = 40 )

// ----- FILTER

ma = 0.0

if ma_use == true

ma := variant( ma_useHA ? ha_close : ma_source, ma_type, ma_length )

maFilterShort = ma_use ? ma_rsl ? falling(ma,1) : ma_useHA ? ha_close : close < ma : true

maFilterLong = ma_use ? ma_rsl ? rising(ma,1) : ma_useHA ? ha_close : close > ma : true

colorTrend = rising(ma,1) ? color.green : color.red

plot( ma_use ? ma : na, title="MA Trend", color=colorTrend, transp=80, transp=70, linewidth = 5)

long = crossover(_close_ma2, _open_ma2 ) and maFilterLong

short = crossunder(_close_ma2, _open_ma2 ) and maFilterShort

closeAll = cross(_close_ma2, _open_ma2 )

plotshape( short , title="Short", color=color.red, transp=80, style=shape.triangledown, location=location.abovebar, size=size.small)

plotshape( long , title="Long", color=color.lime, transp=80, style=shape.triangleup, location=location.belowbar, size=size.small)

//* Backtesting Period Selector | Component *//

//* Source: https://www.tradingview.com/script/eCC1cvxQ-Backtesting-Period-Selector-Component *//

testStartYear = input(2018, "Backtest Start Year",minval=1980)

testStartMonth = input(1, "Backtest Start Month",minval=1,maxval=12)

testStartDay = input(1, "Backtest Start Day",minval=1,maxval=31)

testPeriodStart = timestamp(testStartYear,testStartMonth,testStartDay,0,0)

testStopYear = 9999 //input(9999, "Backtest Stop Year",minval=1980)

testStopMonth = 12 // input(12, "Backtest Stop Month",minval=1,maxval=12)

testStopDay = 31 //input(31, "Backtest Stop Day",minval=1,maxval=31)

testPeriodStop = timestamp(testStopYear,testStopMonth,testStopDay,0,0)

testPeriod() => time >= testPeriodStart and time <= testPeriodStop ? true : false

if testPeriod() and long

strategy.entry( "long", strategy.long )

if testPeriod() and short

strategy.entry( "short", strategy.short )

if closeAll

strategy.close_all( when = closeAll )

- EMA and SuperTrend Combined Trend Following Strategy

- Dynamic Trend Following Strategy

- ATR Channel Mean Reversion Quantitative Trading Strategy

- Double Moving Average Crossover Strategy

- Inside Bar Range Breakout Strategy

- Dual Moving Average Bollinger Band Trend Tracking Strategy

- Moving Average Trend Following Trading Strategy

- Ichimoku Trend Following Strategy

- MACD Trend Following Strategy

- Octa-EMA and Ichimoku Cloud Quantitative Trading Strategy

- 52 Week High Low Box Trading Strategy

- Oscillation Trading Strategy Between Moving Averages

- RSI Breakout Strategy

- Dynamic ATR Trailing Stop Loss Strategy

- Volatility Breakout Trading Strategy

- Momentum Reversal Trend Tracking Strategy

- Stochastic Oversold and Overbought Range RSI Strategy

- Trend Trader Bands Backtest Strategy Based on Trend Trader Moving Average

- MACD Stochastics Range Breakout Strategy

- Reversal Closing Price Breakout Strategy with Oscillating Stop Loss