Overview

The Center of Gravity backtesting trading strategy is a trading strategy based on moving averages. It calculates the “center” of the price, i.e. the position of the center of gravity, and constructs price channels as corridors for asset quotes. The strategy can change long to short in the Input Settings.

Strategy Principle

The strategy calculates the center of gravity position through linear regression function. Specifically, it calculates the linear regression value of the closing price over the Length period, which is the “center” of the price. Price channels are then constructed by moving up and down Percent% on this basis. The upper and lower boundaries of the price channel serve as long and short signals respectively. When the price breaks through the upper rail, go long; when the price breaks below the lower rail, go short. The SignalLine parameter is used to select whether to use the first channel or the second channel’s upper and lower rails as trading signals. The reverse parameter is used to reverse long and short.

Advantage Analysis

This is a very simple breakout strategy with the following main advantages:

- The idea is clear and easy to understand and implement.

- Good backtest results with certain practical feasibility.

- Flexible parameter settings to adapt to different market environments.

- Configurable reversal trading, suitable for two-way operation.

Risk Analysis

The strategy also has some risks:

- There may be overfitting risks in the backtest process. Parameters need to be re-optimized for live trading.

- Failed breakouts can lead to large losses.

- The trading frequency may be relatively high, so the capital usage ratio needs to be controlled.

Risks can be controlled by adjusting parameters like Bands, Length, etc. Stop loss can also be set to limit maximum loss.

Optimization Directions

The strategy can be further optimized in the following ways:

- Combine with trend indicators to filter signals and avoid trading against the trend.

- Add stop loss mechanism.

- Optimize parameter settings to increase profit ratio.

- Add position control to reduce risk.

Summary

The Center of Gravity backtesting trading strategy is a simple breakout strategy. It has clear logic, good practicability, and flexible parameter settings. At the same time, there are also certain risks that need to be properly optimized and controlled. The strategy is suitable as a basic strategy for live trading and optimization, and is also very suitable for beginners to learn.

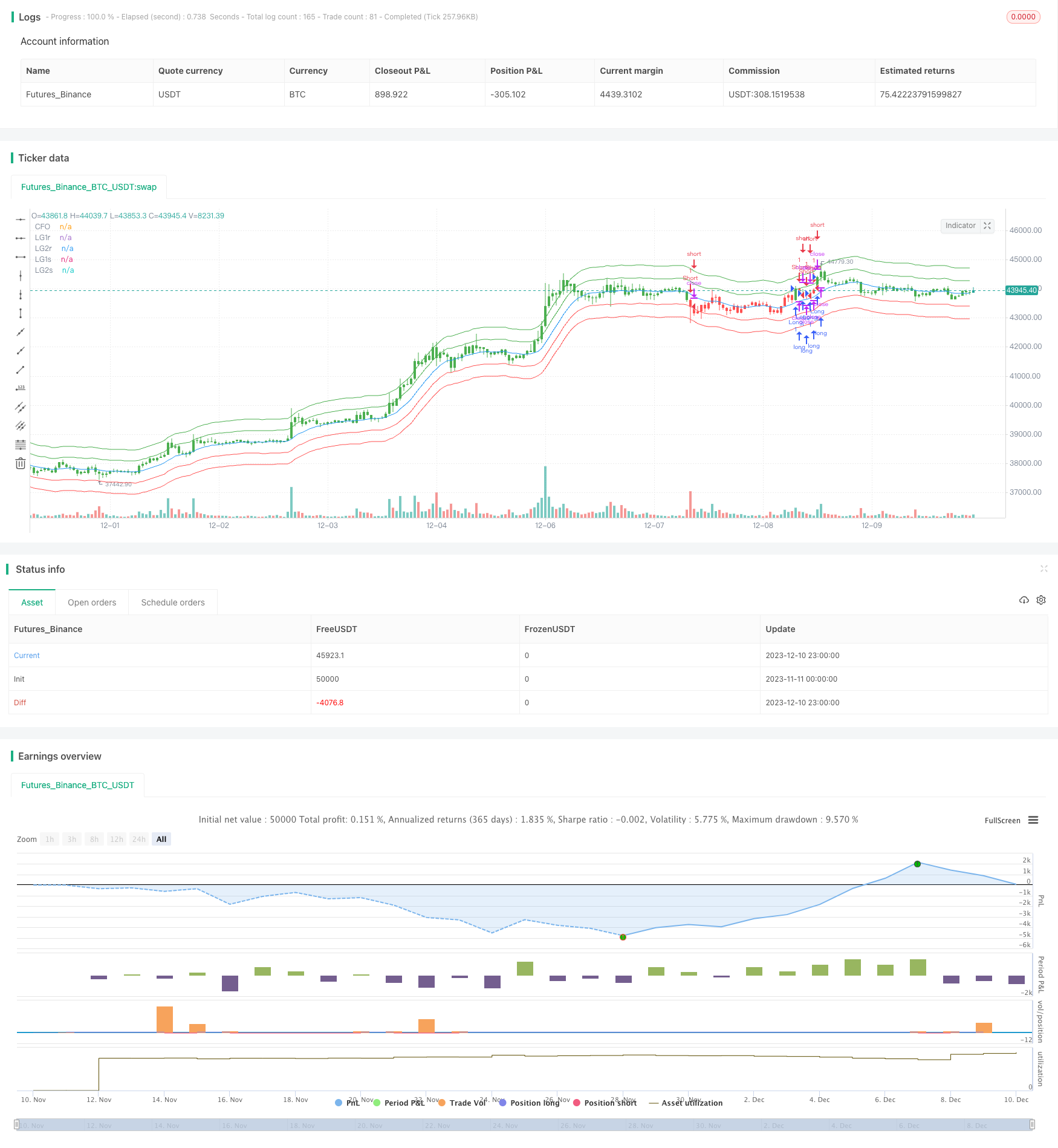

/*backtest

start: 2023-11-11 00:00:00

end: 2023-12-11 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 15/03/2018

// The indicator is based on moving averages. On the basis of these, the

// "center" of the price is calculated, and price channels are also constructed,

// which act as corridors for the asset quotations.

//

// You can change long to short in the Input Settings

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

strategy(title="Center Of Gravity Backtest", shorttitle="CFO", overlay = true)

Length = input(20, minval=1)

m = input(5, minval=0)

Percent = input(1, minval=0)

SignalLine = input(1, minval=1, maxval = 2, title = "Trade from line (1 or 2)")

reverse = input(false, title="Trade reverse")

xLG = linreg(close, Length, m)

xLG1r = xLG + ((close * Percent) / 100)

xLG1s = xLG - ((close * Percent) / 100)

xLG2r = xLG + ((close * Percent) / 100) * 2

xLG2s = xLG - ((close * Percent) / 100) * 2

xSignalR = iff(SignalLine == 1, xLG1r, xLG2r)

xSignalS = iff(SignalLine == 1, xLG1s, xLG2s)

pos = iff(close > xSignalR, 1,

iff(close < xSignalS, -1, nz(pos[1], 0)))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1, 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

barcolor(possig == -1 ? red: possig == 1 ? green : blue )

plot(xLG, color=blue, title="CFO")

plot(xLG1r, color=green, title="LG1r")

plot(xLG2r, color=green, title="LG2r")

plot(xLG1s, color=red, title="LG1s")

plot(xLG2s, color=red, title="LG2s")