SMA and PSAR Strategy for Spot Trading

Author: ChaoZhang, Date: 2023-12-18 10:31:31Tags:

Overview

This strategy is named “SMA and PSAR Spot Trading Strategy”. It combines the advantages of Simple Moving Average (SMA) and Parabolic SAR (PSAR) to determine market trend direction and generate trading signals. When SMA shows an upward trend and PSAR is below price, it is considered as a buy timing. When SMA shows a downward trend and PSAR is above price, it is considered as a sell timing.

Strategy Logic

The strategy uses 100-period SMA to determine the overall trend direction. When close price breaks through SMA 100 upwards, it is defined as an upward trend. When close price breaks through SMA 100 downwards, it is defined as a downward trend.

At the same time, PSAR indicator is calculated to determine detailed entry points. PSAR initial value is set at 0.02, increment value is 0.01, and maximum value is 0.2. When in an upward trend, if PSAR is below close price, a buy signal is generated. While in a downward trend, if PSAR is above close price, a sell signal is generated.

In summary, when judged as an upward trend, if PSAR is lower than close price, a buy signal is generated. When judged as a downward trend, if PSAR is higher than close price, a sell signal is generated.

To reduce trading risk, the strategy also sets time exits to close positions after 5 minutes.

Advantage Analysis

This strategy combines SMA and PSAR indicators to determine trends and entry points, which can effectively utilize the advantages of both indicators to improve decision accuracy. SMA can be used to determine major trends, while PSAR is more sensitive to detailed entry points. Using both complements each other and makes the strategy more robust.

In addition, setting time exits helps control risks of individual trades and avoid excessive losses. Overall, this strategy is stable and reliable, suitable for most market environments.

Risk Analysis

-

SMA and PSAR may generate incorrect signals, leading to unnecessary trading losses.

-

The time exit setting is short, may not fully capture trending moves.

-

Parameter settings (like SMA period, PSAR parameters etc.) may not suit some specific products, needing optimization.

-

Backtest curve fitting risks. Market environments change in live trading, strategy performance may not be as good as backtest.

Optimization Directions

-

Test different SMA period parameters to find more suitable values for specific products.

-

Test and optimize PSAR parameters to make it judge detailed entries more accurately.

-

Extend time exit parameters, appropriately increasing holding time on the premise of taking sufficient profits.

-

Add stop loss strategies to better control maximum loss per trade.

Conclusion

This strategy comprehensively uses indicators like SMA and PSAR to determine market trends and entry points, which is stable and reliable, suitable for most market environments. Meanwhile, setting time exits helps control risks. This strategy can be further improved through parameter optimization, stop loss strategies etc. to obtain better live performance.

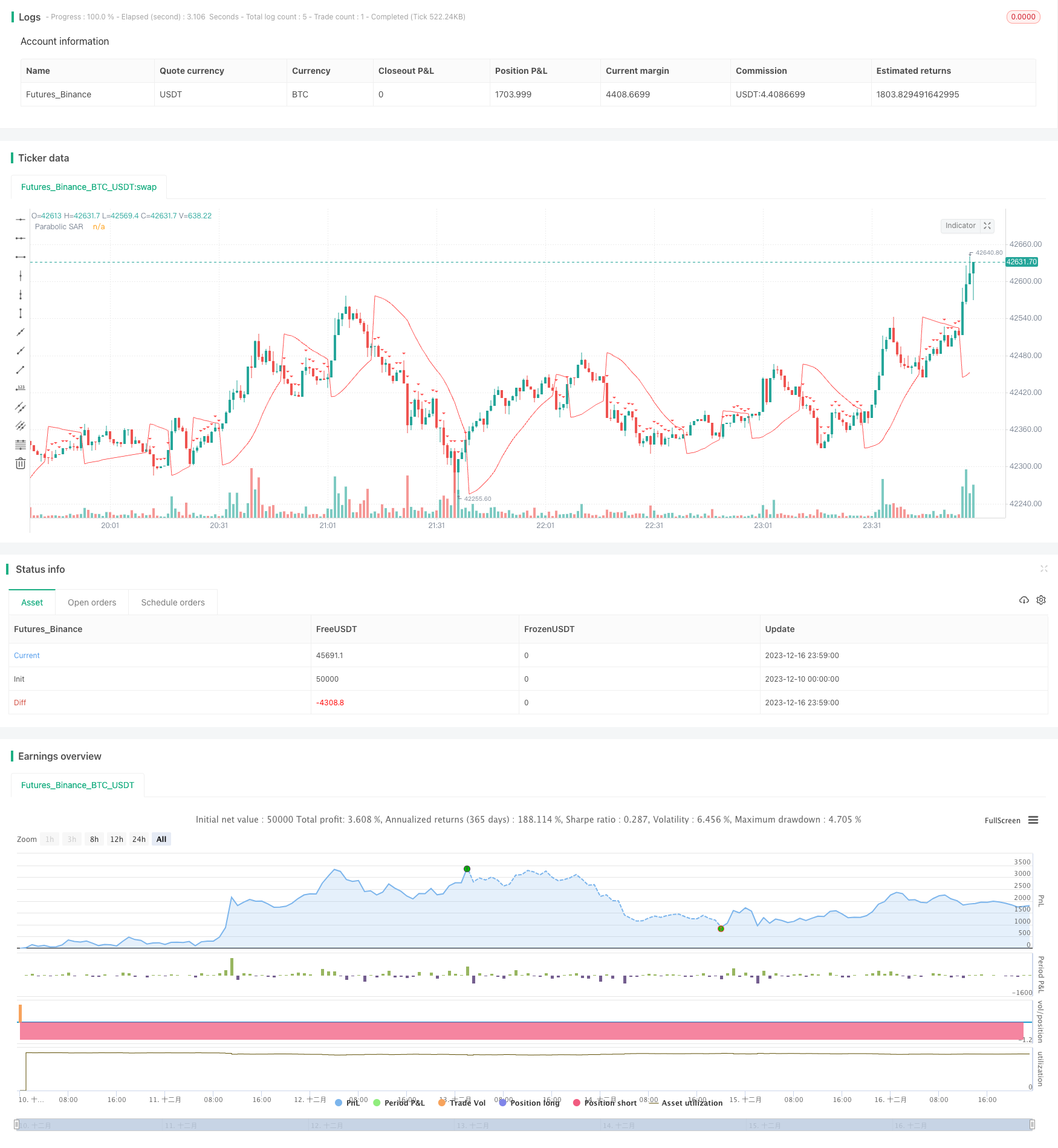

/*backtest

start: 2023-12-10 00:00:00

end: 2023-12-17 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title="SMA and Parabolic SAR Strategy with Time-Based Exit", shorttitle="SMA+PSAR", overlay=true)

// Define the parameters for the Parabolic SAR

psarStart = 0.02

psarIncrement = 0.01

psarMax = 0.2

// Calculate the 100-period SMA

sma100 = sma(close, 1000)

// Calculate the Parabolic SAR

sar = sar(psarStart, psarIncrement, psarMax)

// Determine the trend direction

isUpTrend = close < sma100

// Buy condition: Up trend and SAR below price

buyCondition = isUpTrend and sar < close

// Sell condition: Down trend and SAR above price

sellCondition = not isUpTrend and sar > close

// Plot the SMA and Parabolic SAR

plot(sma100, color=color.blue, title="100-period SMA")

plot(sar, color=color.red, title="Parabolic SAR")

// Plot buy and sell signals

plotshape(series=buyCondition, title="Buy Signal", location=location.belowbar, color=color.green, style=shape.triangleup, size=size.small)

plotshape(series=sellCondition, title="Sell Signal", location=location.abovebar, color=color.red, style=shape.triangledown, size=size.small)

// Strategy entry

strategy.entry("Buy", strategy.long, when = buyCondition)

// Time-based exit after 5 minutes

strategy.exit("Close Buy", from_entry = "Buy", when = time[0] > timestamp(year, month, dayofmonth, hour, minute + 5))

strategy.entry("Sell", strategy.short, when = sellCondition)

// Time-based exit after 5 minutes

strategy.exit("Close Sell", from_entry = "Sell", when = time[0] > timestamp(year, month, dayofmonth, hour, minute + 5))

- Positive Channel EMA Trailing Stop Strategy

- Galileo Galilei's Moving Average Crossover Strategy

- AC Backtest Strategy of Williams Indicator

- Low Volatility Directional Buy with Profit Taking and Stop Loss

- Fixed Percentage Stop Loss and Take Profit Strategy Based on Moving Averages

- Quantitative Trading Strategy Based on Double EMA and Price Volatility Index

- Momentum Breakout Bi-directional Tracking Strategy

- Super Trend LSMA Long Strategy

- Three Bar and Four Bar Breakout Reversion Strategy

- Adaptive SMI Ergodic Trading Strategy Based on Adaptive Exponential Moving Average Lines

- SMA and RSI Long Only Strategy

- Dual Moving Average Reversal Breakout Strategy

- Trend Following Strategy Based on Ichimoku Cloud

- High Frequency Trading Strategy Based on Bollinger Bands and StochRSI Indicators

- Dual Reversion Balance Strategy

- HYE Mean Reversion SMA Strategy

- Dual Moving Average Reversal Strategy

- Dual Direction Price Breakthrough Moving Average Timing Trading Strategy

- Bollinger Breakout Stock Strategy

- Seven Candlestick Oscillation Breakthrough Strategy