Three Bar and Four Bar Breakout Reversion Strategy

Author: ChaoZhang, Date: 2023-12-18 10:39:53Tags:

Overview

The Three Bar and Four Bar Breakout Reversion strategy identifies three or four K-line bars with strong momentum, and takes counter-trend trades after several small-range K-bars form support/resistance levels and reversal signals emerge. It belongs to mean-reversion strategy.

Strategy Logic

The core identification logic of this strategy includes:

-

Recognize large-range bars (Gap Bars): Break 1.5 x ATR, with a body percentage above 65%. They are considered to have strong momentum.

-

Recognize low-range bars (Collecting Bars): One or two subsequent small-range bars following Gap Bars, with high/low levels close to those of Gap Bars. They represent slowing momentum and consolidation, forming support/resistance levels.

-

Recognize reversal signal bars: If a bar breaks through the high/low of previous bars after consolidation, it can be considered a reversal signal. We take positions based on the direction of the signal bar.

-

Stop loss and take profit: Set stop loss below/above Gap Bar’s low/high points. Take profit is determined by multiplying risk-reward ratio with stop loss distance.

Advantage Analysis

The main advantages of this strategy:

-

Identify trends and reversals using raw price action, no indicators needed.

-

Strict rules on Gap Bars and Collecting Bars ensure accuracy in capturing real trends and consolidations.

-

Judging reversal bars by bodies reduces false signals.

-

Each trade only takes 3-4 bars. High frequency with short holding period.

-

Clear rules on stop loss and take profit makes risk management easier.

Risk Analysis

The main risks:

-

Relying on parameter settings. Loose parameters increase false signals and losing trades.

-

Vulnerable to fake breakouts and unable to filter out all false signals.

-

Risk of being trapped in consolidations after failed breakout attempts. Difficult to cut loss in such cases.

-

Wide stop loss range means large losses on occasion when trapped.

To reduce risks:

-

Optimize parameters for Gap Bars and Collecting Bars identification.

-

Add filters such as confirmation bars before entering positions.

-

Optimize stop loss algorithms to make them more adaptive.

Optimization Directions

Main optimization directions:

-

Add composite filters to avoid false breakouts, e.g. requiring increase in volume.

-

Combine with moving averages, only taking signals when key MA levels are broken.

-

Require agreement across multiple timeframes before entering trades.

-

Dynamically adjust profit targets based on market volatility and risk preference.

-

Combine with market regime identification system, only enable strategy in trending environments.

These optimizations can further improve stability and profitability.

Conclusion

The Three Bar and Four Bar Breakout Reversion strategy aims to capture high-quality trending moves and reversal trades. It has the advantage of short holding periods and high frequency. There are also inherent risks that need to be reduced through continued optimization. By effectively identifying self-contained trend and reversal signals from raw price action, this strategy warrants further research and application.

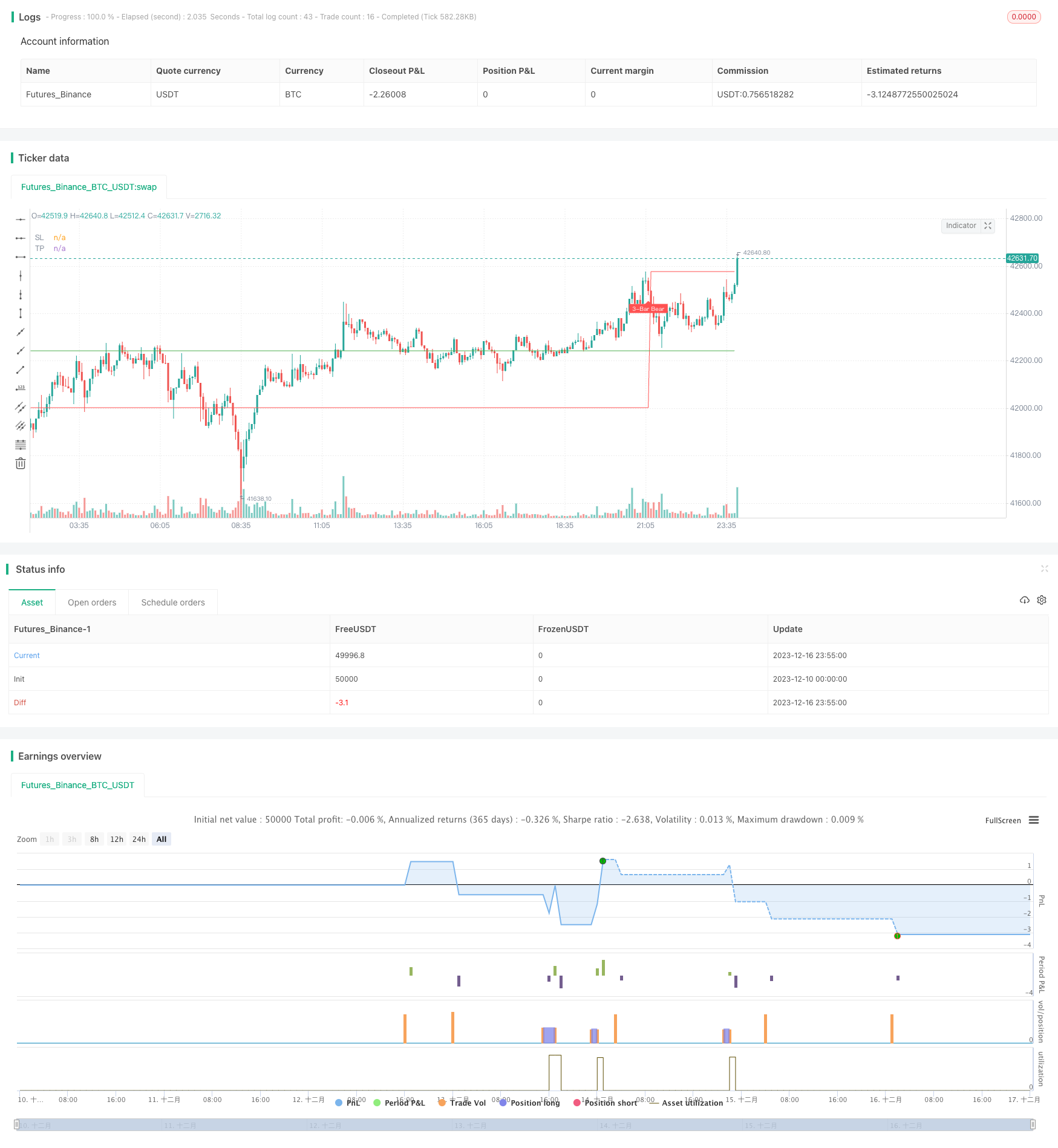

/*backtest

start: 2023-12-10 00:00:00

end: 2023-12-17 00:00:00

period: 5m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title="Three (3)-Bar and Four (4)-Bar Plays Strategy", shorttitle="Three (3)-Bar and Four (4)-Bar Plays Strategy", overlay=true, calc_on_every_tick=true, currency=currency.USD, default_qty_value=1.0,initial_capital=30000.00,default_qty_type=strategy.percent_of_equity)

frommonth = input(defval = 1, minval = 01, maxval = 12, title = "From Month")

fromday = input(defval = 1, minval = 01, maxval = 31, title = "From day")

fromyear = input(defval = 2021, minval = 1900, maxval = 2100, title = "From Year")

tomonth = input(defval = 12, minval = 01, maxval = 12, title = "To Month")

today = input(defval = 31, minval = 01, maxval = 31, title = "To day")

toyear = input(defval = 2100, minval = 1900, maxval = 2100, title = "To Year")

garBarSetting1 = input(defval = 1.5, minval = 0.0, maxval = 100.0, title = "Gap Bar Size", type = input.float)

garBarSetting2 = input(defval = 0.65, minval = 0.0, maxval = 100.0, title = "Gap Bar Body Size", type = input.float)

TopSetting = input(defval = 0.10, minval = 0.0, maxval = 100.0, title = "Bull Top Bar Size", type = input.float)

profitMultiplier = input(defval = 2.0, minval = 1.0, maxval = 100.0, title = "Profit Multiplier", type = input.float)

// ========== 3-Bar and 4-Bar Play Setup ==========

barSize = abs(high - low)

bodySize = abs(open - close)

gapBar = (barSize > (atr(1000) * garBarSetting1)) and (bodySize >= (barSize * garBarSetting2)) // find a wide ranging bar that is more than 2.5x the size of the average bar size and body is at least 65% of bar size

bullTop = close > close[1] + barSize[1] * TopSetting ? false : true // check if top of bar is relatively equal to top of the gap bar (first collecting bull bar)

bullTop2 = close > close[2] + barSize[2] * TopSetting ? false : true // check if top of bar is relatively equal to top of the gap bar (first collecting bear bar)

bearTop = close < close[1] - barSize[1] * TopSetting ? false : true // check if top of bar is relatively equal to top of the gap bar (second collecting bull bar)

bearTop2 = close < close[2] - barSize[2] * TopSetting ? false : true // check if top of bar is relatively equal to top of the gap bar (second collecting bear bar)

collectingBarBull = barSize < barSize[1] / 2 and low > close[1] - barSize[1] / 2 and bullTop // find a collecting bull bar

collectingBarBear = barSize < barSize[1] / 2 and high < close[1] + barSize[1] / 2 and bearTop // find a collecting bear bar

collectingBarBull2 = barSize < barSize[2] / 2 and low > close[2] - barSize[2] / 2 and bullTop2 // find a second collecting bull bar

collectingBarBear2 = barSize < barSize[2] / 2 and high < close[2] + barSize[2] / 2 and bearTop2 // find a second collecting bear bar

triggerThreeBarBull = close > close[1] and close > close[2] and high > high[1] and high > high[2] // find a bull trigger bar in a 3 bar play

triggerThreeBarBear = close < close[1] and close < close[2] and high < high[1] and high < high[2] // find a bear trigger bar in a 3 bar play

triggerFourBarBull = close > close[1] and close > close[2] and close > close[3] and high > high[1] and high > high[2] and high > high[3] // find a bull trigger bar in a 4 bar play

triggerFourBarBear = close < close[1] and close < close[2] and close < close[3] and high < high[1] and high < high[2] and high < high[3] // find a bear trigger bar in a 4 bar play

threeBarSetupBull = gapBar[2] and collectingBarBull[1] and triggerThreeBarBull // find 3-bar Bull Setup

threeBarSetupBear = gapBar[2] and collectingBarBear[1] and triggerThreeBarBear // find 3-bar Bear Setup

fourBarSetupBull = gapBar[3] and collectingBarBull[2] and

collectingBarBull2[1] and triggerFourBarBull // find 4-bar Bull Setup

fourBarSetupBear = gapBar[3] and collectingBarBear[2] and

collectingBarBear2[1] and triggerFourBarBear // find 4-bar Bear Setup

labels = input(title="Show Buy/Sell Labels?", type=input.bool, defval=true)

plotshape(threeBarSetupBull and labels, title="3-Bar Bull", text="3-Bar Play", location=location.abovebar, style=shape.labeldown, size=size.tiny, color=color.green, textcolor=color.white, transp=0)

plotshape(threeBarSetupBear and labels, text="3-Bar Bear", title="3-Bar Play", location=location.belowbar, style=shape.labelup, size=size.tiny, color=color.red, textcolor=color.white, transp=0)

plotshape(fourBarSetupBull and labels, title="4-Bar Bull", text="4-Bar Play", location=location.abovebar, style=shape.labeldown, size=size.tiny, color=color.green, textcolor=color.white, transp=0)

plotshape(fourBarSetupBear and labels, text="4-Bar Bear", title="4-Bar Play", location=location.belowbar, style=shape.labelup, size=size.tiny, color=color.red, textcolor=color.white, transp=0)

alertcondition(threeBarSetupBull or threeBarSetupBear or fourBarSetupBull or fourBarSetupBear, title="3-bar or 4-bar Play", message="Potential 3-bar or 4-bar Play")

float sl = na

float tp = na

sl := nz(sl[1], 0.0)

tp := nz(tp[1], 0.0)

plot(sl==0.0?na:sl,title='SL', color = color.red)

plot(tp==0.0?na:tp,title='TP', color = color.green)

if (true)

if threeBarSetupBull and strategy.position_size <=0

strategy.entry("3 Bar Long", strategy.long, when=threeBarSetupBull)

sl :=low[1]

if threeBarSetupBear and strategy.position_size >=0

strategy.entry("3 Bar Short", strategy.short, when=threeBarSetupBull)

sl :=high[1]

if fourBarSetupBull and strategy.position_size <=0

strategy.entry("4 Bar Long", strategy.long, when=fourBarSetupBull)

sl :=min(low[1], low[2])

if fourBarSetupBear and strategy.position_size >=0

strategy.entry("4 Bar Short", strategy.short, when=fourBarSetupBear)

sl :=max(high[1], high[2])

if sl !=0.0

if strategy.position_size > 0

tp := strategy.position_avg_price + ((strategy.position_avg_price - sl) * profitMultiplier)

strategy.exit(id="Exit", limit=tp, stop=sl)

if strategy.position_size < 0

tp := strategy.position_avg_price - ((sl - strategy.position_avg_price) * profitMultiplier)

strategy.exit(id="Exit", limit=tp, stop=sl)

- X48 - DayLight Hunter Strategy Optimization and Adaptation

- Heikin-Ashi - 0.5% Change Short Period Trading Strategy

- Positive Channel EMA Trailing Stop Strategy

- Galileo Galilei's Moving Average Crossover Strategy

- AC Backtest Strategy of Williams Indicator

- Low Volatility Directional Buy with Profit Taking and Stop Loss

- Fixed Percentage Stop Loss and Take Profit Strategy Based on Moving Averages

- Quantitative Trading Strategy Based on Double EMA and Price Volatility Index

- Momentum Breakout Bi-directional Tracking Strategy

- Super Trend LSMA Long Strategy

- Adaptive SMI Ergodic Trading Strategy Based on Adaptive Exponential Moving Average Lines

- SMA and PSAR Strategy for Spot Trading

- SMA and RSI Long Only Strategy

- Dual Moving Average Reversal Breakout Strategy

- Trend Following Strategy Based on Ichimoku Cloud

- High Frequency Trading Strategy Based on Bollinger Bands and StochRSI Indicators

- Dual Reversion Balance Strategy

- HYE Mean Reversion SMA Strategy

- Dual Moving Average Reversal Strategy

- Dual Direction Price Breakthrough Moving Average Timing Trading Strategy