Low Volatility Directional Buy with Profit Taking and Stop Loss

Author: ChaoZhang, Date: 2023-12-18 12:00:07Tags:

Overview

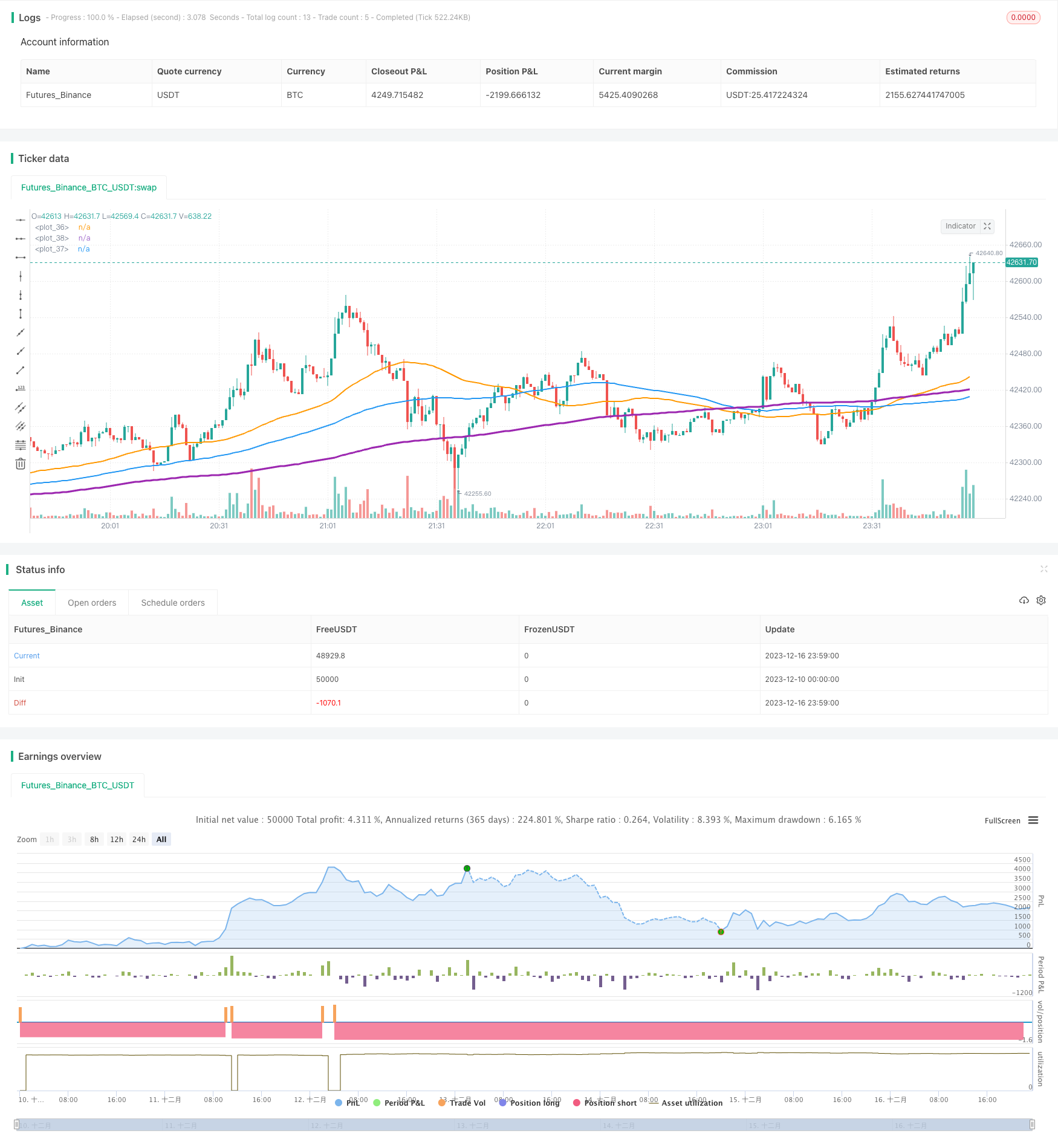

The strategy is named “Low Volatility Directional Buy with Profit Taking and Stop Loss”. It utilizes moving average crossover as buy signals and combines profit taking and stop loss to lock in profit. It is suitable for low volatility coins.

Strategy Logic

The strategy uses 3 moving averages with different periods: 50-period, 100-period and 200-period. The buy logic is: when 50-period MA crosses over 100-period MA and 100-period MA crosses over 200-period MA, go long.

This signals a breakout from low volatility range and the start of a trend. 50-period MA’s fast rise represents strengthening of short term momentum; 100-period MA also turning up indicates mid term force joining in to stabilize the up trend.

After entry, the strategy uses profit taking and stop loss to lock in gains. Take profit is set at 8% of entry price. Stop loss is set at 4% of entry price. With higher take profit over stop loss, it ensures the strategy stays profitable overall.

Advantage Analysis

The advantages of this strategy:

- Accurately capture trend opportunity from low volatility breakouts.

- Simple and clear logic with moving averages that are easy to calculate and backtest.

- Reasonable profit taking and stop loss settings ensure stable gains.

- Flexible configurable parameters make optimizations easy.

Risk Analysis

There are also some risks:

- Wrong breakout signals may cause losses.

- Hard to stop loss when markets reverse.

- Improper profit taking and stop loss parameter settings affect profitability.

Solutions:

- Add other indicators to filter signals and ensure breakout validity.

- Shorten stop loss period to reduce losses from reversals.

- Test different profit taking and stop loss ratios to find optimum.

Optimization Directions

Optimizations can be made in below areas:

- Test different moving average periods to find best combination.

- Add volume etc. to confirm trend breakouts.

- Dynamically adjust profit taking and stop loss percentage.

- Incorporate machine learning etc. to predict breakout success rate.

- Adjust parameters based on different market conditions and coins.

In summary, the strategy has clear logic overall, obtains low risk profit through configuring moving average periods and profit taking/stop loss percentage. It can be flexibly applied in quantitative trading. Further optimizations can be made in areas like entry signals and stop loss methods, combined with parameter tuning to achieve best results.

/*backtest

start: 2023-12-10 00:00:00

end: 2023-12-17 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(shorttitle='Low volatility Buy w/ TP & SL (by Coinrule)',title='Low volatility Buy w/ TP & SL', overlay=true, initial_capital = 1000, process_orders_on_close=true, default_qty_type = strategy.percent_of_equity, default_qty_value = 100)

//Backtest dates

fromMonth = input(defval = 1, title = "From Month", type = input.integer, minval = 1, maxval = 12)

fromDay = input(defval = 10, title = "From Day", type = input.integer, minval = 1, maxval = 31)

fromYear = input(defval = 2019, title = "From Year", type = input.integer, minval = 1970)

thruMonth = input(defval = 1, title = "Thru Month", type = input.integer, minval = 1, maxval = 12)

thruDay = input(defval = 1, title = "Thru Day", type = input.integer, minval = 1, maxval = 31)

thruYear = input(defval = 2112, title = "Thru Year", type = input.integer, minval = 1970)

showDate = input(defval = true, title = "Show Date Range", type = input.bool)

start = timestamp(fromYear, fromMonth, fromDay, 00, 00) // backtest start window

finish = timestamp(thruYear, thruMonth, thruDay, 23, 59) // backtest finish window

window() => time >= start and time <= finish ? true : false // create function "within window of time"

//MA inputs and calculations

movingaverage_fast = sma(close, input(50))

movingaverage_slow = sma(close, input(200))

movingaverage_normal= sma(close, input(100))

//Entry

strategy.entry(id="long", long = true, when = movingaverage_slow > movingaverage_normal and movingaverage_fast > movingaverage_normal)

//Exit

longStopPrice = strategy.position_avg_price * (1 - 0.04)

longTakeProfit = strategy.position_avg_price * (1 + 0.08)

strategy.close("long", when = close < longStopPrice or close > longTakeProfit and window())

//PLOT

plot(movingaverage_fast, color=color.orange, linewidth=2)

plot(movingaverage_slow, color=color.purple, linewidth=3)

plot(movingaverage_normal, color=color.blue, linewidth=2)

- Quantitative Trading Strategy Based on TSI Indicator and Hull Moving Average

- Channel Trend Strategy

- CCI Long Only Strategy

- Moving Average Ribbon Strategy

- MACD Dual Moving Average Tracking Strategy

- X48 - DayLight Hunter Strategy Optimization and Adaptation

- Heikin-Ashi - 0.5% Change Short Period Trading Strategy

- Positive Channel EMA Trailing Stop Strategy

- Galileo Galilei's Moving Average Crossover Strategy

- AC Backtest Strategy of Williams Indicator

- Fixed Percentage Stop Loss and Take Profit Strategy Based on Moving Averages

- Quantitative Trading Strategy Based on Double EMA and Price Volatility Index

- Momentum Breakout Bi-directional Tracking Strategy

- Super Trend LSMA Long Strategy

- Three Bar and Four Bar Breakout Reversion Strategy

- Adaptive SMI Ergodic Trading Strategy Based on Adaptive Exponential Moving Average Lines

- SMA and PSAR Strategy for Spot Trading

- SMA and RSI Long Only Strategy

- Dual Moving Average Reversal Breakout Strategy

- Trend Following Strategy Based on Ichimoku Cloud