X48 - DayLight Hunter Strategy Optimization and Adaptation

Author: ChaoZhang, Date: 2023-12-18 12:19:41Tags:

Overview

This strategy combines the classic Stochastic indicator and SMA indicator to achieve strong trend tracking capability. The core idea of the strategy is to identify trend direction signals with Stochastic indicator and filter with SMA indicator to improve signal quality. It also provides different risk modes to dynamically adjust risk and reward. In addition, the multi-timeframe judgement is utilized to optimize the entry timing and control trading risk.

Strategy Logic

- The strategy adopts an enhanced version of Stochastic indicator. The parameters include %K period, %K smoothing and %D smoothing to control the sensitivity.

- The SMA indicator parameters include Upper SMA and Lower SMA to filter signals for higher quality.

- Three risk modes are provided for selection based on risk preference, including Low Risk, Medium Risk and High Risk. The risk mode will impact the crossover threshold of Stochastic indicator to dynamically adjust risk and reward.

- Long signal is identified when Stoch crosses up the threshold and close price is below Lower SMA. Short signal is identified when Stoch crosses down the threshold and close price is above Upper SMA.

- Multi-timeframe judgement module verifies the signals across different time ranges to optimize entry timing and control trading risk.

Advantages

- The enhanced Stochastic indicator improves sensitivity for capturing market changes quickly.

- The dual SMA rail filtering mechanism effectively avoids fake signals and improves signal quality.

- Multiple risk modes allow users to flexibly adjust parameters based on their risk appetite.

- Multi-timeframe judgement optimizes the entry timing selection to reduce trading risk.

- The overall strategy framework is scientific, stable and adaptive.

Risks

- The strategy does not have a stop loss mechanism itself. Manual stop loss is needed to control the downside risk.

- High signal frequency may lead to over trading and increased transaction costs.

- The strategy is sensitive to parameters and risk mode settings which need optimization for best results.

- Large drawdowns may happen. It may not suitable for full position trading. Proper position sizing is important.

Solutions:

- Set proper stop loss ratio based on market volatility to maximize risk control.

- Adjust Stoch parameters to reduce signal frequency, or set minimum take profit to avoid unnecessary trades.

- Low Risk mode is recommended as baseline. Adjust other parameters based on backtest results.

- Control position sizing and average up exposure to reduce per trade risk.

Enhancement Opportunities

- Comprehensive parametric optimization on Stoch and SMA to find the optimal parameter combination.

- Increase the number of multi-timeframe judgements for more reference and better entry decisions.

- Introduce dynamic stop loss mechanisms like ATR Trailing Stop to better limit downside risk.

- Build signal filtration and confirmation mechanisms like volume to avoid traps.

- Add position sizing module to actively adjust position size based on market conditions to lower per trade risk exposure.

Summary

This strategy combines the strengths of Stochastic and SMA indicators to achieve strong trend tracking capability. The framework is solid and indicator application is fluid. By controlling parameters and risk modes, the nature of the indicators is restored for better stability. The multi-timeframe judgement also enhances adaptiveness across products and timeframes. Overall it has good versatility and huge potential for further optimizations and enhancements.

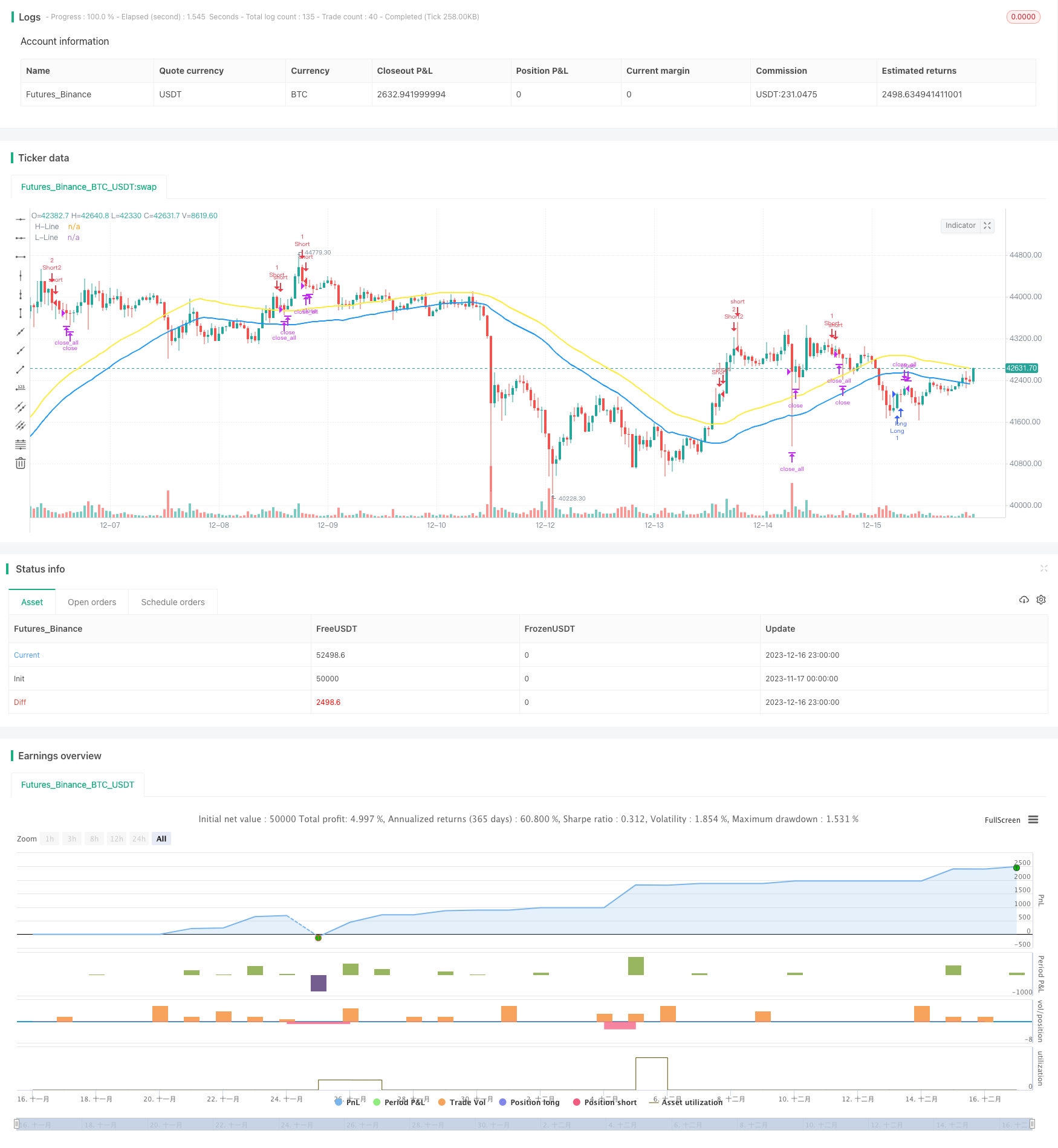

/*backtest

start: 2023-11-17 00:00:00

end: 2023-12-17 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//►►►► Description ►►►►

//1. The Original Pine Script

//- Stochastic

//- SMA

//1.1 Concepts

//- Stochastic crossover and crossunder with range 80/20 or 70/30 or 50/50 from your risk you can adjust it from config

//- Confirm Signal by SMA High and Low Original Range is 50 or you can adjust by your self in config Setting

//1.2 Condition

//- Buy Condition = Stochastic crossover Sto Signal Line and SMA Filter <= 20 or 30 or 50 from your risk

//- Sell Condition = Stochastic crossunder Sto Signal Line and SMA Filter >= 80 or 70 or 50 from your risk

//1.3 Idea For Trading

//- Trend Runing If you use "Trend" Mode is Martingale Your Position Until You Have a Profit

//- Scalping You Can Adjust TP for Little Profit and Increase Your Winrate

//►►►► Strategy results ►►►►

// ►► Use an account size ►►

// - For Newbie i recommend try to use 50$ you can test in MT4 Or MT5 Start With 50$ Leverage : 1000

// - For Some User Have a Exp. Trading : 500$ you can use martingale for help your trading

// - For Expert User : 5000$ or 5000$ (Cent) you can use martingale for help your trading

// ►► realistic commission AND slippage ►►

// - Some Broker Not Have a commission for Gold and Forex.

// - slippage : default i'm Setting is 350 point, (it's mean 35 pip) it's average or your account is ECN or Zero Spread You can Set = 0

// ►► Size For Trading ►►

// - This strategy is Start From 0.01 lot and use martingale for next position

// - This not perfect strategy. it's have equity drawdown. just try and test your config you like.

// ►► Sample size Dataset Trading ►►

// - This Strategy Recommend For Long-Term Trading Becuase It's Have Martingale Help Your Next Position

//►►►► strategy's default Properties ►►►►

// - From Default Setting : Slippage or Spread Set = 0 (Becuase I don't know your account spread) you can set in Properties

// ** Some Broeker Are 2 Digits or 3 Digit You Must Set By Your Self (like 35 point or 350 point from your account spread)

// - From Default Setting : commission = 0 (Becuase I don't know your account commission) you can set in Properties

// ** Some Broeker Are not commission for forex and gold

//@version=5

var int slippage = 0

strategy("X48 - DayLight Hunter | Strategy | V.01.03", overlay=true)

var int hedge_mode = 0

var int sto_buy = 0

var int sto_sell = 0

Trade_Mode = input.string(defval = "Trend", title = "⚖️ Mode For Trade [Oneway / Hedge / ⭐Trend]", options = ["Oneway", "Hedge", "Trend"], group = "=== Mode Trade [Recommend Mode is ⭐Trend and ⭐Low Risk] ===", tooltip = "Oneway = Switching Position Type With Signal\nHedge Mode = Not Switching Position Type Unitl TP or SL")

Risk_Mode = input.string(defval = "Low Risk", title = "⚖️ Risk Signal Mode [⭐Low / Medium / High]", options = ["Low Risk", "Medium Risk", "High Risk"], group = "=== Mode Trade [Recommend Mode is ⭐Trend and ⭐Low Risk] ===", tooltip = "[[Signal Form Stochastic]]\nLow Risk is >= 80 and <= 20\nMedium Risk is >= 70 and <= 30\nHigh Risk is >= 50 and <=50")

if Trade_Mode == "Oneway"

hedge_mode := 0

else if Trade_Mode == "Hedge"

hedge_mode := 1

else if Trade_Mode == "Trend"

hedge_mode := 2

if Risk_Mode == "Low Risk"

sto_buy := 20

sto_sell := 80

else if Risk_Mode == "Medium Risk"

sto_buy := 30

sto_sell := 70

else if Risk_Mode == "High Risk"

sto_buy := 50

sto_sell := 50

periodK = input.int(15, title="%K Length", minval=1, group = "Stochastic Setting", inline = "Sto0")

smoothK = input.int(3, title="%K Smoothing", minval=1, group = "Stochastic Setting", inline = "Sto0")

periodD = input.int(3, title="%D Smoothing", minval=1, group = "Stochastic Setting", inline = "Sto0")

GRSMA = "=== 🧮 SMA Filter Mode ==="

SMA_Mode = input.bool(defval = true, title = "🧮 SMA High and Low Filter Mode", group = GRSMA, tooltip = "Sell Signal With Open >= SMA High\nBuy Signal With Close <= SMA Low")

SMA_High = input.int(defval = 50, title = "SMA High", group = GRSMA, inline = "SMA1")

SMA_Low = input.int(defval = 50, title = "SMA Low", group = GRSMA, inline = "SMA1")

k = ta.sma(ta.stoch(close, high, low, periodK), smoothK)

d = ta.sma(k, periodD)

high_line = ta.sma(high, SMA_High)

low_line = ta.sma(low, SMA_Low)

plot(SMA_Mode ? high_line : na, "H-Line", color = color.yellow, linewidth = 2)

plot(SMA_Mode ? low_line : na, "L-Line", color = color.blue, linewidth = 2)

entrybuyprice = strategy.position_avg_price

var bool longcondition = na

var bool shortcondition = na

if SMA_Mode == true

longcondition := ta.crossover(k,d) and d <= sto_buy and close < low_line and open < low_line// or ta.crossover(k, 20)// and close <= low_line

shortcondition := ta.crossunder(k,d) and d >= sto_sell and close > high_line and open > high_line// or ta.crossunder(k, 80)// and close >= high_line

else

longcondition := ta.crossover(k,d) and d <= sto_buy

shortcondition := ta.crossunder(k,d) and d >= sto_sell

//longcondition_double = ta.crossover(d,20) and close < low_line// and strategy.position_size > 0

//shortcondition_double = ta.crossunder(d,80) and close > high_line// and strategy.position_size < 0

//=============== TAKE PROFIT and STOP LOSS by % =================

tpsl(percent) =>

strategy.position_avg_price * percent / 100 / syminfo.mintick

GR4 = "=====🆘🆘🆘 TAKE PROFIT & STOP LOSS BY [%] 🆘🆘🆘====="

mode= input.bool(title="🆘 Take Profit & Stop Loss By Percent (%)", defval=true, group=GR4, tooltip = "Take Profit & Stop Loss by % Change\n0 = Disable")

tp_l = tpsl(input.float(0, title='🆘 TP [LONG] % >> [OneWay Only]', group=GR4, tooltip = "0 = Disable"))

tp_s = tpsl(input.float(0, title='🆘 TP [SHORT] % >> [OneWay Only]', group=GR4, tooltip = "0 = Disable"))

sl = tpsl(input.float(0, title='🆘 Stop Loss % [All Mode / 1st Position]', group=GR4, tooltip = "0 = Disable"))

tp_pnl = input.float(defval = 1, title = "🆘 TakeProfit by PNL ($) eg. (0.1 = 0.1$)", group = GR4, tooltip = "All Mode TP by PNL")

spread_size = input.float(defval = 0.350, title = "🆘 Spread Point Size(Eg. 35 Point or 350 Point From Your Broker Digits)", tooltip = "Spread Point Form Your Broker \nEg. 1920.124 - 1920.135 or 1920.12 - 1920.13\nPlease Check From Your Broker", group = GR4)

GR5 = "===💮💮💮 Hedge / Martingale Mode 💮💮💮==="

//hedge_mode = input.bool(defval = true, title = "⚖️ Hedge / Martingale Mode", group = GR5)

hedge_point = input.int(defval = 500, title = "💯 Hedge Point Range / Martingale Range", group = GR5, tooltip = "After Entry Last Position And Current Price More Than Point Range Are Open New Hedge Position")

hedge_gale = input.float(defval = 2.0, title = "✳️ Martingale For Hedge Multiply [default = 2]", tooltip = "Martingale For Multiply Hedge Order", group = GR5)

hedge_point_size = hedge_point/100

calcStopLossPrice(OffsetPts) =>

if strategy.position_size > 0

strategy.position_avg_price - OffsetPts * syminfo.mintick

else if strategy.position_size < 0

strategy.position_avg_price + OffsetPts * syminfo.mintick

else

na

calcStopLossL_AlertPrice(OffsetPts) =>

strategy.position_avg_price - OffsetPts * syminfo.mintick

calcStopLossS_AlertPrice(OffsetPts) =>

strategy.position_avg_price + OffsetPts * syminfo.mintick

calcTakeProfitPrice(OffsetPts) =>

if strategy.position_size > 0

strategy.position_avg_price + OffsetPts * syminfo.mintick

else if strategy.position_size < 0

strategy.position_avg_price - OffsetPts * syminfo.mintick

else

na

calcTakeProfitL_AlertPrice(OffsetPts) =>

strategy.position_avg_price + OffsetPts * syminfo.mintick

calcTakeProfitS_AlertPrice(OffsetPts) =>

strategy.position_avg_price - OffsetPts * syminfo.mintick

var stoploss = 0.

var stoploss_l = 0.

var stoploss_s = 0.

var takeprofit = 0.

var takeprofit_l = 0.

var takeprofit_s = 0.

var takeprofit_ll = 0.

var takeprofit_ss = 0.

if mode == true

if (strategy.position_size > 0)

if sl > 0

stoploss := calcStopLossPrice(sl)

stoploss_l := stoploss

else if sl <= 0

stoploss := na

if tp_l > 0

takeprofit := tp_l

takeprofit_ll := close + ((close/100)*tp_l)

//takeprofit_s := na

else if tp_l <= 0

takeprofit := na

if (strategy.position_size < 0)

if sl > 0

stoploss := calcStopLossPrice(sl)

stoploss_s := stoploss

else if sl <= 0

stoploss := na

if tp_s > 0

takeprofit := tp_s

takeprofit_ss := close - ((close/100)*tp_s)

//takeprofit_l := na

else if tp_s <= 0

takeprofit := na

else if strategy.position_size == 0

stoploss := na

takeprofit := na

//takeprofit_l := calcTakeProfitL_AlertPrice(tp_l)

//takeprofit_s := calcTakeProfitS_AlertPrice(tp_s)

//stoploss_l := calcStopLossL_AlertPrice(sl)

//stoploss_s := calcStopLossS_AlertPrice(sl)

//////////// INPUT BACKTEST RANGE ////////////////////////////////////////////////////

var string BTR1 = '════════⌚⌚ INPUT BACKTEST TIME RANGE ⌚⌚════════'

i_startTime = input(defval = timestamp("01 Jan 1945 00:00 +0000"), title = "Start", inline="timestart", group=BTR1, tooltip = 'Start Backtest YYYY/MM/DD')

i_endTime = input(defval = timestamp("01 Jan 2074 23:59 +0000"), title = "End", inline="timeend", group=BTR1, tooltip = 'End Backtest YYYY/MM/DD')

//////////////// Strategy Alert For X4815162342 BOT //////////////////////

Text_Alert_Future = '{{strategy.order.alert_message}}'

copy_Fu = input( defval= Text_Alert_Future , title="Alert Message for BOT", inline = '00' ,group = '═ Bot Setting ═ \n >> If You Dont Use Bot Just Pass It' ,tooltip = 'Alert For X48-BOT > Copy and Paste To Alert Function')

TimeFrame_input = input(defval= 'Input Your TimeFrame [1m, 15m, 1h, 4h, 1d ,1w]' , title="TimeFrame Text Alert", inline = '01' ,group = '═ Bot Setting ═ \n >> If You Dont Use Bot Just Pass It', tooltip = "[1m, 15m, 1h, 4h, 1d ,1w]")

string Alert_EntryL = '🪙 Asset : {{ticker}} \n💱 Status : {{strategy.market_position}}\n🕛 TimeFrame : '+str.tostring(TimeFrame_input)+'\n💸 Price : {{strategy.order.price}} $\n✅ TP : '+str.tostring(takeprofit_ll)+' $\n❌ SL : '+str.tostring(stoploss_l)+' $\n⏰ Time : {{timenow}}'

string Alert_EntryS = '🪙 Asset : {{ticker}} \n💱 Status : {{strategy.market_position}}\n🕛 TimeFrame : '+str.tostring(TimeFrame_input)+'\n💸 Price : {{strategy.order.price}} $\n✅ TP : '+str.tostring(takeprofit_ss)+' $\n❌ SL : '+str.tostring(stoploss_s)+' $\n⏰ Time : {{timenow}}'

string Alert_TPSL = '🪙 Asset : {{ticker}}\n🕛 TimeFrame : '+str.tostring(TimeFrame_input)+'\n💹 {{strategy.order.comment}}\n💸 Price : {{strategy.order.price}} $\n⏰ Time : {{timenow}}'

if true

if (longcondition and strategy.position_size == 0) or (longcondition and strategy.position_size < 0 and hedge_mode == 0)

strategy.entry("Long", strategy.long, comment = "🌙", alert_message = Alert_EntryL)

//if longcondition_double

// //strategy.cancel_all()

// strategy.entry("Long2", strategy.long, comment = "🌙🌙")

// //strategy.exit("Exit",'Long', qty_percent = 100 , profit = takeprofit, stop = stoploss, comment_profit = "TP💚L", comment_loss = "SL💚L")

if (shortcondition and strategy.position_size == 0) or (shortcondition and strategy.position_size > 0 and hedge_mode == 0)

strategy.entry("Short", strategy.short, comment = "👻", alert_message = Alert_EntryS)

//strategy.exit("Exit",'Short', qty_percent = 100, profit = takeprofit, stop = stoploss, comment_profit = "TP❤️️S", comment_loss = "SL❤️️S")

//if shortcondition_double

// //strategy.cancel_all()

// strategy.entry("Short2", strategy.short, comment = "👻👻")

if strategy.position_size > 0 and strategy.opentrades >= 1 and hedge_mode == 1

entrypricel = strategy.opentrades.entry_price(strategy.opentrades - 1)

callpointsize = entrypricel - close

lastsize = strategy.position_size

if callpointsize >= hedge_point_size and longcondition

strategy.order("Long2", strategy.long, qty = lastsize * hedge_gale, comment = "🌙⌛", alert_message = Alert_EntryL)

if shortcondition

strategy.order("Short2", strategy.short, qty = lastsize * hedge_gale, comment = "👻⌛", alert_message = Alert_EntryS)

else if strategy.position_size < 0 and strategy.opentrades >= 1 and hedge_mode == 1

entryprices = strategy.opentrades.entry_price(strategy.opentrades - 1)

callpointsize = (entryprices - close)* -1

lastsize = (strategy.position_size) * -1

if callpointsize >= hedge_point_size and shortcondition

strategy.order("Short2", strategy.short, qty = lastsize * hedge_gale, comment = "👻⌛", alert_message = Alert_EntryS)

if longcondition

strategy.order("Long2", strategy.long, qty = lastsize * hedge_gale, comment = "🌙⌛", alert_message = Alert_EntryL)

if strategy.position_size > 0 and strategy.opentrades >= 1 and hedge_mode == 2

entrypricel = strategy.opentrades.entry_price(strategy.opentrades - 1)

callpointsize = entrypricel - close

lastsize = strategy.position_size

if callpointsize >= hedge_point_size and longcondition

strategy.order("Long2", strategy.long, qty = lastsize * hedge_gale, comment = "🌙⌛", alert_message = Alert_EntryL)

else if strategy.position_size < 0 and strategy.opentrades >= 1 and hedge_mode == 2

entryprices = strategy.opentrades.entry_price(strategy.opentrades - 1)

callpointsize = (entryprices - close)* -1

lastsize = (strategy.position_size) * -1

if callpointsize >= hedge_point_size and shortcondition

strategy.order("Short2", strategy.short, qty = lastsize * hedge_gale, comment = "👻⌛", alert_message = Alert_EntryS)

last_price_l = (strategy.opentrades.entry_price(strategy.opentrades - 1) + (strategy.opentrades.entry_price(strategy.opentrades - 1)/100) * takeprofit) + spread_size

last_price_s = (strategy.opentrades.entry_price(strategy.opentrades - 1) - (strategy.opentrades.entry_price(strategy.opentrades - 1)/100) * takeprofit) - spread_size

current_price = request.security(syminfo.tickerid, "1", close)

current_pricel = request.security(syminfo.tickerid, "1", close) + spread_size

current_prices = request.security(syminfo.tickerid, "1", close) - spread_size

//if mode == true

if strategy.position_size > 0 and strategy.openprofit >= tp_pnl and mode == true and hedge_mode == 1

lastsize = strategy.position_size

lastprofitorder = strategy.openprofit

//if lastprofitorder >= 0.07

//strategy.close('Long', qty = lastsize, comment = "TP💚L", alert_message = Alert_TPSL, immediately = true)

strategy.cancel_all()

strategy.close_all(comment = "TP💚PNL", alert_message = Alert_TPSL, immediately = true)

//strategy.close_all(comment = "TP💚LH", alert_message = Alert_TPSL)

//strategy.exit("Exit",'Long2', qty_percent = 100, profit = last_price_l, stop = stoploss, comment_profit = "TP💚LH", comment_loss = "SL💚LH", alert_message = Alert_TPSL)

//strategy.exit("Exit",'Long', qty_percent = 100, profit = last_price_l, stop = stoploss, comment_profit = "TP💚L", comment_loss = "SL💚L", alert_message = Alert_TPSL)

else if strategy.position_size > 0 and strategy.openprofit < tp_pnl and mode == true and hedge_mode == 1

strategy.exit("Exit",'Long', qty_percent = 100, stop = stoploss, comment_loss = "SL💚%L", alert_message = Alert_TPSL)

if strategy.position_size > 0 and strategy.openprofit >= tp_pnl and mode == true and hedge_mode == 2

lastsize = strategy.position_size

lastprofitorder = strategy.openprofit

//if lastprofitorder >= 0.07

//strategy.close('Long', qty = lastsize, comment = "TP💚L", alert_message = Alert_TPSL, immediately = true)

strategy.cancel_all()

strategy.close_all(comment = "TP💚PNL", alert_message = Alert_TPSL, immediately = true)

//strategy.close_all(comment = "TP💚LH", alert_message = Alert_TPSL)

//strategy.exit("Exit",'Long2', qty_percent = 100, profit = last_price_l, stop = stoploss, comment_profit = "TP💚LH", comment_loss = "SL💚LH", alert_message = Alert_TPSL)

//strategy.exit("Exit",'Long', qty_percent = 100, profit = last_price_l, stop = stoploss, comment_profit = "TP💚L", comment_loss = "SL💚L", alert_message = Alert_TPSL)

else if strategy.position_size > 0 and strategy.openprofit < tp_pnl and mode == true and hedge_mode == 2

strategy.exit("Exit",'Long', qty_percent = 100, stop = stoploss, comment_loss = "SL💚%L", alert_message = Alert_TPSL)

if strategy.position_size > 0 and mode == true and hedge_mode == 0

//strategy.close_all(comment = "TP💚LH", alert_message = Alert_TPSL, immediately = true)

strategy.exit("Exit",'Long', qty_percent = 100, profit = takeprofit, stop = stoploss, comment_profit = "TP💚%L", comment_loss = "SL💚%L", alert_message = Alert_TPSL)

//strategy.exit("Exit",'Long', qty_percent = 100, profit = takeprofit, stop = stoploss, comment_profit = "TP💚LL", comment_loss = "SL💚L", alert_message = Alert_TPSL)

if strategy.position_size < 0 and strategy.openprofit >= tp_pnl and mode == true and hedge_mode == 1

lastsize = (strategy.position_size) * -1

lastprofitorder = strategy.openprofit

//if lastprofitorder >= 0.07

//strategy.close('Short', qty = lastsize, comment = "TP❤️️S", alert_message = Alert_TPSL, immediately = true)

strategy.cancel_all()

strategy.close_all(comment = "TP❤️️PNL", alert_message = Alert_TPSL, immediately = true)

//strategy.close_all(comment = "TP❤️️SH", alert_message = Alert_TPSL)

//strategy.exit("Exit",'Short2', qty_percent = 100, profit = last_price_s, stop = stoploss, comment_profit = "TP❤️️SH", comment_loss = "SL❤️️SH", alert_message = Alert_TPSL)

//strategy.exit("Exit",'Short', qty_percent = 100, profit = last_price_s, stop = stoploss, comment_profit = "TP❤️️S", comment_loss = "SL❤️️S", alert_message = Alert_TPSL)

else if strategy.position_size < 0 and strategy.openprofit < tp_pnl and mode == true and hedge_mode == 1

strategy.exit("Exit",'Short', qty_percent = 100, stop = stoploss, comment_loss = "SL❤️️%S", alert_message = Alert_TPSL)

if strategy.position_size < 0 and mode == true and hedge_mode == 0

//strategy.close_all(comment = "TP❤️️SH", alert_message = Alert_TPSL, immediately = true)

strategy.exit("Exit",'Short', qty_percent = 100, profit = takeprofit, stop = stoploss, comment_profit = "TP❤️️%S", comment_loss = "SL❤️️%S", alert_message = Alert_TPSL)

//strategy.exit("Exit",'Short', qty_percent = 100, profit = takeprofit, stop = stoploss, comment_profit = "TP❤️️S", comment_loss = "SL❤️️S", alert_message = Alert_TPSL)

if strategy.position_size < 0 and strategy.openprofit >= tp_pnl and mode == true and hedge_mode == 2

lastsize = (strategy.position_size) * -1

lastprofitorder = strategy.openprofit

//if lastprofitorder >= 0.07

//strategy.close('Short', qty = lastsize, comment = "TP❤️️S", alert_message = Alert_TPSL, immediately = true)

strategy.cancel_all()

strategy.close_all(comment = "TP❤️️PNL", alert_message = Alert_TPSL, immediately = true)

//strategy.close_all(comment = "TP❤️️SH", alert_message = Alert_TPSL)

//strategy.exit("Exit",'Short2', qty_percent = 100, profit = last_price_s, stop = stoploss, comment_profit = "TP❤️️SH", comment_loss = "SL❤️️SH", alert_message = Alert_TPSL)

//strategy.exit("Exit",'Short', qty_percent = 100, profit = last_price_s, stop = stoploss, comment_profit = "TP❤️️S", comment_loss = "SL❤️️S", alert_message = Alert_TPSL)

else if strategy.position_size < 0 and strategy.openprofit < tp_pnl and mode == true and hedge_mode == 2

strategy.exit("Exit",'Short', qty_percent = 100, stop = stoploss, comment_loss = "SL❤️️%S", alert_message = Alert_TPSL)

//else if strategy.position_size < 0 and strategy.opentrades > 1

// lastsize = (strategy.position_size) * -1

// lastprofitorder = strategy.openprofit

// if lastprofitorder >= 0.07

// strategy.close_all(comment = "TP❤️️SS", alert_message = Alert_TPSL)

//===================== เรียกใช้ library =========================

import X4815162342/X48_LibaryStrategyStatus/2 as fuLi

//แสดงผล Backtest

show_Net = input.bool(true,'Monitor Profit&Loss', inline = 'Lnet', group = '= PNL MONITOR SETTING =')

position_ = input.string('bottom_center','Position', options = ['top_right','middle_right','bottom_right','top_center','middle_center','bottom_center','middle_left','bottom_left'] , inline = 'Lnet')

size_i = input.string('auto','size', options = ['auto','tiny','small','normal'] , inline = 'Lnet')

color_Net = input.color(color.blue,"" , inline = 'Lnet')

// fuLi.NetProfit_Show(show_Net , position_ , size_i, color_Net )

- MACD Robot Trading Strategy

- Bollinger Bands Dual Standard Deviation Trading Strategy

- Trading Strategy Based on MACD and RSI Crossover Signals

- Bayesian Condition RSI Trading Strategy

- Pivot Reversal Strategy

- Quantitative Trading Strategy Based on TSI Indicator and Hull Moving Average

- Channel Trend Strategy

- CCI Long Only Strategy

- Moving Average Ribbon Strategy

- MACD Dual Moving Average Tracking Strategy

- Heikin-Ashi - 0.5% Change Short Period Trading Strategy

- Positive Channel EMA Trailing Stop Strategy

- Galileo Galilei's Moving Average Crossover Strategy

- AC Backtest Strategy of Williams Indicator

- Low Volatility Directional Buy with Profit Taking and Stop Loss

- Fixed Percentage Stop Loss and Take Profit Strategy Based on Moving Averages

- Quantitative Trading Strategy Based on Double EMA and Price Volatility Index

- Momentum Breakout Bi-directional Tracking Strategy

- Super Trend LSMA Long Strategy

- Three Bar and Four Bar Breakout Reversion Strategy