Overview

The strategy is named “Liquidity Driven Trend Strategy”. It aims to identify the price trend direction across different time frames and make corresponding long or short decisions. The strategy employs a dual moving average system to determine the trend and uses the difference between Relative Strength Index (RSI) values across multiple time frames to respond timely to trend changes.

Strategy Logic

The core logic of this strategy is based on the CHOP indicator, where the moving average system judges the overall trend direction. Specifically, the strategy calculates the RSI values of a fast line (Length = 20) and a slow line (Length = 50) on higher time frames, and computes the difference between the two RSI lines. When the fast line RSI crosses above the slow line RSI, it signals an upward trend and triggers long signals. On the contrary, if the fast line RSI crosses below the slow line RSI, it indicates a downward trend and generates short signals. The varying RSI difference driven by price rises and falls can sensitively identify trend changing points.

The strategy also introduces a multi-timeframe mechanism: it computes the RSI difference on higher time frames (e.g. daily) to determine the overall trend direction, and then executes actual buy and sell orders on lower time frames (e.g. 5 mins) based on the higher timeframe trend judgment. Such combination of multiple time frames takes into account both high-timeframe trend decisions and the flexibility of low-timeframe execution.

Advantages of the Strategy

- Sensitively capture potential trend reversals ahead of time using RSI divergence

- Apply multi-timeframe concept to determine trend on higher TF and execute orders on lower TF

- RSI reflects price and volume changes, indicating market liquidity and participation

- Simple parameter settings, easy to understand, explain and tune

Risks & Solutions

- False breakout may happen with dual MA system

- Failed breakout can cause unnecessary losses

Solutions:

- Adjust MA parameters to reduce false breakout probability

- Add filters to avoid unnecessary entry

Optimization Directions

- Optimize RSI parameters using Kalman Filter algorithms

- Add MACD and other indicators to assist judgement

- Set dynamic exit positions based on trading volume changes

Conclusion

This strategy leverages RSI divergence to sensitively capture potential turning points of the trend. The multi-timeframe application ensures judging the overall trend while keeping specific trade execution flexible. Compared to other trend following strategies, this strategy is more straightforward, intuitive in parameter adjustments and easy to optimize. In conclusion, the strategy forms an efficient and practical trend trading system worth further exploration and application.

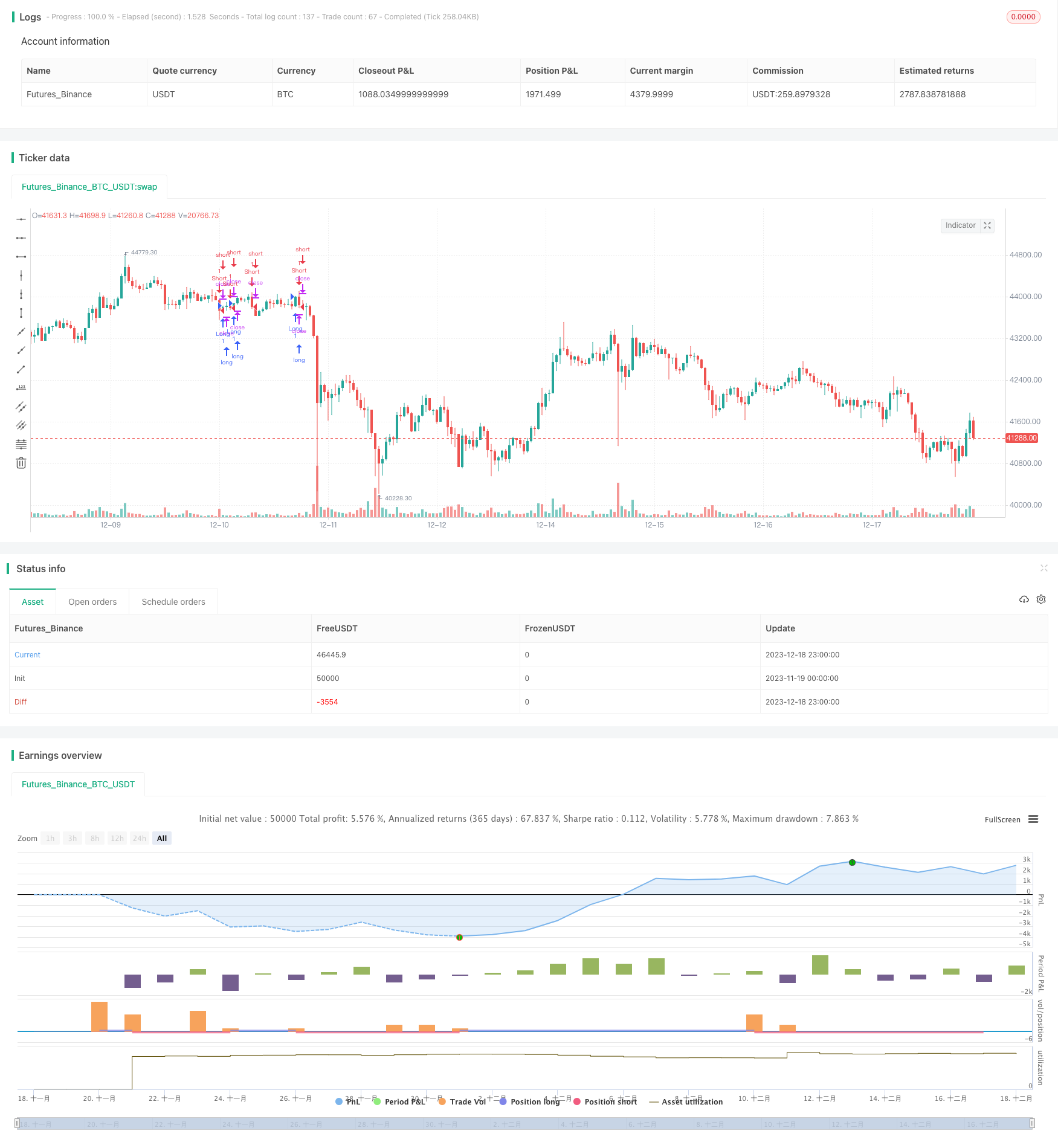

/*backtest

start: 2023-11-19 00:00:00

end: 2023-12-19 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("Flow Trend Indicator Strategy", "FlowTI", overlay=true, calc_on_every_tick=true)

isTimeFrame(timeFrame) =>

timeFrame == timeframe.period ? true : false

Htf() =>

isTimeFrame("12") ? "60" : isTimeFrame("60") ? "300" : isTimeFrame("300") ? "D" : isTimeFrame("D") ? "W" : isTimeFrame("W") ? "M" : isTimeFrame("M") ? "5M" : "D"

TrendIndication() =>

trendFastLength = 20

trendSlowLength = 50

upFastHtf = request.security(syminfo.tickerid, Htf(), rma(max(change(close), 0), trendFastLength), barmerge.gaps_off, barmerge.lookahead_on)

downFastHtf = request.security(syminfo.tickerid, Htf(), rma(-min(change(close), 0), trendFastLength), barmerge.gaps_off, barmerge.lookahead_on)

rsiFastHtf = downFastHtf == 0 ? 100 : upFastHtf == 0 ? 0 : 100 - (100 / (1 + upFastHtf / downFastHtf))

upSlowHtf = request.security(syminfo.tickerid, Htf(), rma(max(change(close), 0), trendSlowLength), barmerge.gaps_off, barmerge.lookahead_on)

downSlowHtf = request.security(syminfo.tickerid, Htf(), rma(-min(change(close), 0), trendSlowLength), barmerge.gaps_off, barmerge.lookahead_on)

rsiSlowHtf = downSlowHtf == 0 ? 100 : upSlowHtf == 0 ? 0 : 100 - (100 / (1 + upSlowHtf / downSlowHtf))

rsiDiff = rsiFastHtf - rsiSlowHtf

crossover(rsiDiff, 0) ? true : crossunder(rsiDiff, 0) ? false : na

if (TrendIndication() == true)

strategy.entry("Long", strategy.long)

if (TrendIndication() == false)

strategy.entry("Short", strategy.short)