The Multi-Period Trading Strategy Based on Volatility Index and Stochastic Oscillator

Author: ChaoZhang, Date: 2023-12-21 14:34:42Tags:

Overview This strategy combines the volatility index VIX and stochastic oscillator RSI through a composition of indicators across different time periods, in order to achieve efficient breakout entries and overbought/oversold exits. The strategy has large room for optimizations and can be adapted to different market environments.

Principles

-

Calculate the VIX volatility index: take the highest and lowest prices over the past 20 days to compute volatility. High VIX indicates market panic while low VIX suggests market complacency.

-

Compute the RSI oscillator: take the price changes over the past 14 days. RSI above 70 suggests overbought conditions and RSI below 30 suggests oversold conditions.

-

Combine the two indicators. Go long when VIX breaches the upper band or the highest percentile. Close longs when RSI goes above 70.

Advantages

- Integrates multiple indicators for comprehensive market timing assessment.

- Indicators across timeframes verify each other and improves decision accuracy.

- Customizable parameters can be optimized for different trading instruments.

Risks

- Improper parameter tuning may cause multiple false signals.

- A single exit indicator may miss price reversals.

Optimization Suggestions

- Incorporate more confirming indicators like moving averages and Bollinger bands to time entries.

- Add more exit indicators such as reversal candlestick patterns.

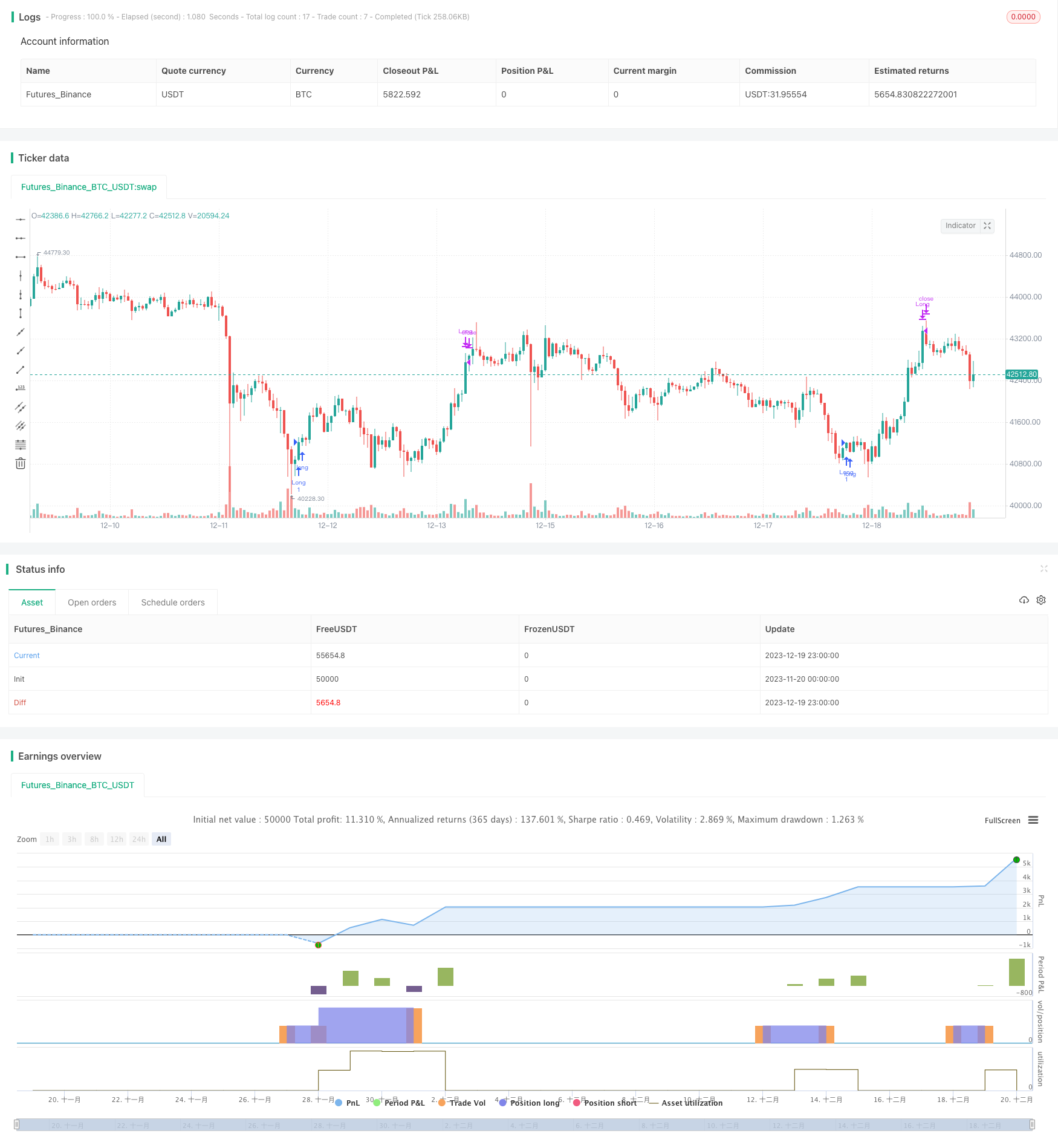

Summary This strategy utilizes the VIX to gauge market timing and risk levels, and filters out unfavorable trades using overbought/oversold readings from the RSI, in order to enter at opportune moments and exit timely with stops. There is ample room for optimization to suit wider market conditions.

/*backtest

start: 2023-11-20 00:00:00

end: 2023-12-20 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © timj

strategy('Vix FIX / StochRSI Strategy', overlay=true, pyramiding=9, margin_long=100, margin_short=100)

Stochlength = input.int(14, minval=1, title="lookback length of Stochastic")

StochOverBought = input.int(80, title="Stochastic overbought condition")

StochOverSold = input.int(20, title="Stochastic oversold condition")

smoothK = input(3, title="smoothing of Stochastic %K ")

smoothD = input(3, title="moving average of Stochastic %K")

k = ta.sma(ta.stoch(close, high, low, Stochlength), smoothK)

d = ta.sma(k, smoothD)

///////////// RSI

RSIlength = input.int( 14, minval=1 , title="lookback length of RSI")

RSIOverBought = input.int( 70 , title="RSI overbought condition")

RSIOverSold = input.int( 30 , title="RSI oversold condition")

RSIprice = close

vrsi = ta.rsi(RSIprice, RSIlength)

///////////// Double strategy: RSI strategy + Stochastic strategy

pd = input(22, title="LookBack Period Standard Deviation High")

bbl = input(20, title="Bolinger Band Length")

mult = input.float(2.0 , minval=1, maxval=5, title="Bollinger Band Standard Devaition Up")

lb = input(50 , title="Look Back Period Percentile High")

ph = input(.85, title="Highest Percentile - 0.90=90%, 0.95=95%, 0.99=99%")

new = input(false, title="-------Text Plots Below Use Original Criteria-------" )

sbc = input(false, title="Show Text Plot if WVF WAS True and IS Now False")

sbcc = input(false, title="Show Text Plot if WVF IS True")

new2 = input(false, title="-------Text Plots Below Use FILTERED Criteria-------" )

sbcFilt = input(true, title="Show Text Plot For Filtered Entry")

sbcAggr = input(true, title="Show Text Plot For AGGRESSIVE Filtered Entry")

ltLB = input.float(40, minval=25, maxval=99, title="Long-Term Look Back Current Bar Has To Close Below This Value OR Medium Term--Default=40")

mtLB = input.float(14, minval=10, maxval=20, title="Medium-Term Look Back Current Bar Has To Close Below This Value OR Long Term--Default=14")

str = input.int(3, minval=1, maxval=9, title="Entry Price Action Strength--Close > X Bars Back---Default=3")

//Alerts Instructions and Options Below...Inputs Tab

new4 = input(false, title="-------------------------Turn On/Off ALERTS Below---------------------" )

new5 = input(false, title="----To Activate Alerts You HAVE To Check The Boxes Below For Any Alert Criteria You Want----")

sa1 = input(false, title="Show Alert WVF = True?")

sa2 = input(false, title="Show Alert WVF Was True Now False?")

sa3 = input(false, title="Show Alert WVF Filtered?")

sa4 = input(false, title="Show Alert WVF AGGRESSIVE Filter?")

//Williams Vix Fix Formula

wvf = ((ta.highest(close, pd)-low)/(ta.highest(close, pd)))*100

sDev = mult * ta.stdev(wvf, bbl)

midLine = ta.sma(wvf, bbl)

lowerBand = midLine - sDev

upperBand = midLine + sDev

rangeHigh = (ta.highest(wvf, lb)) * ph

//Filtered Bar Criteria

upRange = low > low[1] and close > high[1]

upRange_Aggr = close > close[1] and close > open[1]

//Filtered Criteria

filtered = ((wvf[1] >= upperBand[1] or wvf[1] >= rangeHigh[1]) and (wvf < upperBand and wvf < rangeHigh))

filtered_Aggr = (wvf[1] >= upperBand[1] or wvf[1] >= rangeHigh[1]) and not (wvf < upperBand and wvf < rangeHigh)

//Alerts Criteria

alert1 = wvf >= upperBand or wvf >= rangeHigh ? 1 : 0

alert2 = (wvf[1] >= upperBand[1] or wvf[1] >= rangeHigh[1]) and (wvf < upperBand and wvf < rangeHigh) ? 1 : 0

alert3 = upRange and close > close[str] and (close < close[ltLB] or close < close[mtLB]) and filtered ? 1 : 0

alert4 = upRange_Aggr and close > close[str] and (close < close[ltLB] or close < close[mtLB]) and filtered_Aggr ? 1 : 0

//Coloring Criteria of Williams Vix Fix

col = wvf >= upperBand or wvf >= rangeHigh ? color.lime : color.gray

isOverBought = (ta.crossover(k,d) and k > StochOverBought) ? 1 : 0

isOverBoughtv2 = k > StochOverBought ? 1 : 0

filteredAlert = alert3 ? 1 : 0

aggressiveAlert = alert4 ? 1 : 0

if (filteredAlert or aggressiveAlert)

strategy.entry("Long", strategy.long)

if (isOverBought)

strategy.close("Long")

- Short-term Trading Strategy Based on Chaikin Volatility Indicator

- Dual MA Crossover Trend Tracking Strategy

- Super Trend Triple Strategy

- Dynamic Trailing Stop Loss Strategy

- Moving Average Crossover Strategy with Stop-Loss and Take-Profit

- Mean Reversion Reverse Strategy Based on Moving Average

- Bollinger Bands Based High Frequency Trading Strategy

- A Quantitative Ichimoku Cloud Trading Strategy

- Momentum Strategy Based on Double Bottom Breakout Model

- Stochastic Vortex Strategy

- Extended Adaptive CCI Bottom Fishing Trading Strategy for Commodities

- Momentum Strategy Based on LazyBear's Squeeze

- Floor-Crossing Sawtooth Profit Stop Strategy Based on Moving Average

- Dynamic Weighted Moving Average Trading Strategy

- Last Candle Strategy

- Quantitative Strategy of Negative Volume Index Reversal

- Triple Supertrend Breakout Strategy

- MACD of Relative Strength Strategy

- Triple Dragon System

- Top Trading Only Based on Weekly EMA8 Strategy