Moment Reversal Strategy Based on Multi-factor Model

Author: ChaoZhang, Date: 2023-12-21 16:26:10Tags:

Overview

The Moment Reversal Strategy Based on Multi-factor Model combines multi-factor model and momentum reversal strategy to achieve more stable and higher returns. The strategy uses the 123 reversal and confluence indicators as two independent signals and establishes a position when the two signals are consistent.

Strategy Principle

The strategy consists of two sub-strategies: 123 reversal strategy and confluence indicator strategy.

The 123 reversal strategy generates trading signals based on whether the price has risen or fallen continuously for 2 days, combined with the STOCH indicator to judge whether the market is overcooled or overheated. Specifically, when the price rises continuously for 2 days and the 9-day STOCH slow line is below 50, it is bullish. When the price falls continuously for 2 days and the 9-day STOCH fast line is above 50, it is bearish.

The confluence indicator strategy utilizes the superposition of moving averages and oscillators of different cycles to determine the trend direction and strength. Including linear weighting, sine addition and other methods to comprehensively judge the long and short momentum. The indicator is graded and returns 1 to 9 indicating strong bullish momentum and -1 to -9 indicating strong bearish momentum.

Finally, the strategy establishes long or short positions when both signals are consistent.

Advantage Analysis

The Moment Reversal Strategy Based on Multi-factor Model combines reversal factors and momentum factors to capture reversal opportunities while following the trend to avoid false breakouts, thus having higher win rates. The advantages of the strategy are specifically reflected in:

-

As a reversal signal source, the 123 reversal strategy can capture excess returns from short-term reversals.

-

The confluence indicator judges the trend direction and strength to avoid the risk of loss caused by too large reversal space.

-

The combination of the two strategies complements each other’s strengths and weaknesses to some extent and improves signal quality.

-

Compared with a single model, the combination of multiple factors can improve the stability of strategies.

Risk Analysis

Although the Moment Reversal Strategy Based on Multi-factor Model has certain advantages, there are still some risks:

-

The risk of loss caused by reversal not being completed and prices turning around again. Appropriate stop loss can be set to guard against this.

-

Unable to determine direction when two signals are inconsistent. Parameter adjustment can be made to increase the matching degree.

-

The model is too complex with too many parameters, which is difficult to adjust and optimize.

-

Multiple submodels need to be monitored simultaneously, resulting in greater difficulty in operation and psychological pressure. Automatic trading elements can be introduced to reduce operational burden.

Optimization Directions

The Moment Reversal Strategy Based on Multi-factor Model can be optimized in the following aspects:

-

Adjust the parameters of the 123 reversal strategy to make reversal signals more accurate and reliable.

-

Adjust the parameters of the confluence indicator to make the determined trends closer to the actual ones.

-

Introduce machine learning algorithms to automatically optimize parameter combinations.

-

Add position management module to make position adjustment more quantitative and systematic.

-

Add stop loss module. Effectively control single loss by presetting stop loss price.

Summary

The Moment Reversal Strategy Based on Multi-factor Model comprehensively employs reversal factors and momentum factors. On the basis of ensuring relatively high signal quality, it obtains higher win rate through multi-factor stacking. The strategy has the dual advantages of capturing reversal opportunities and following the trend. It is an efficient and stable quantitative strategy. Follow-up optimizations can be made in aspects such as parameter adjustment and risk control to further improve the strategy’s risk-reward ratio.

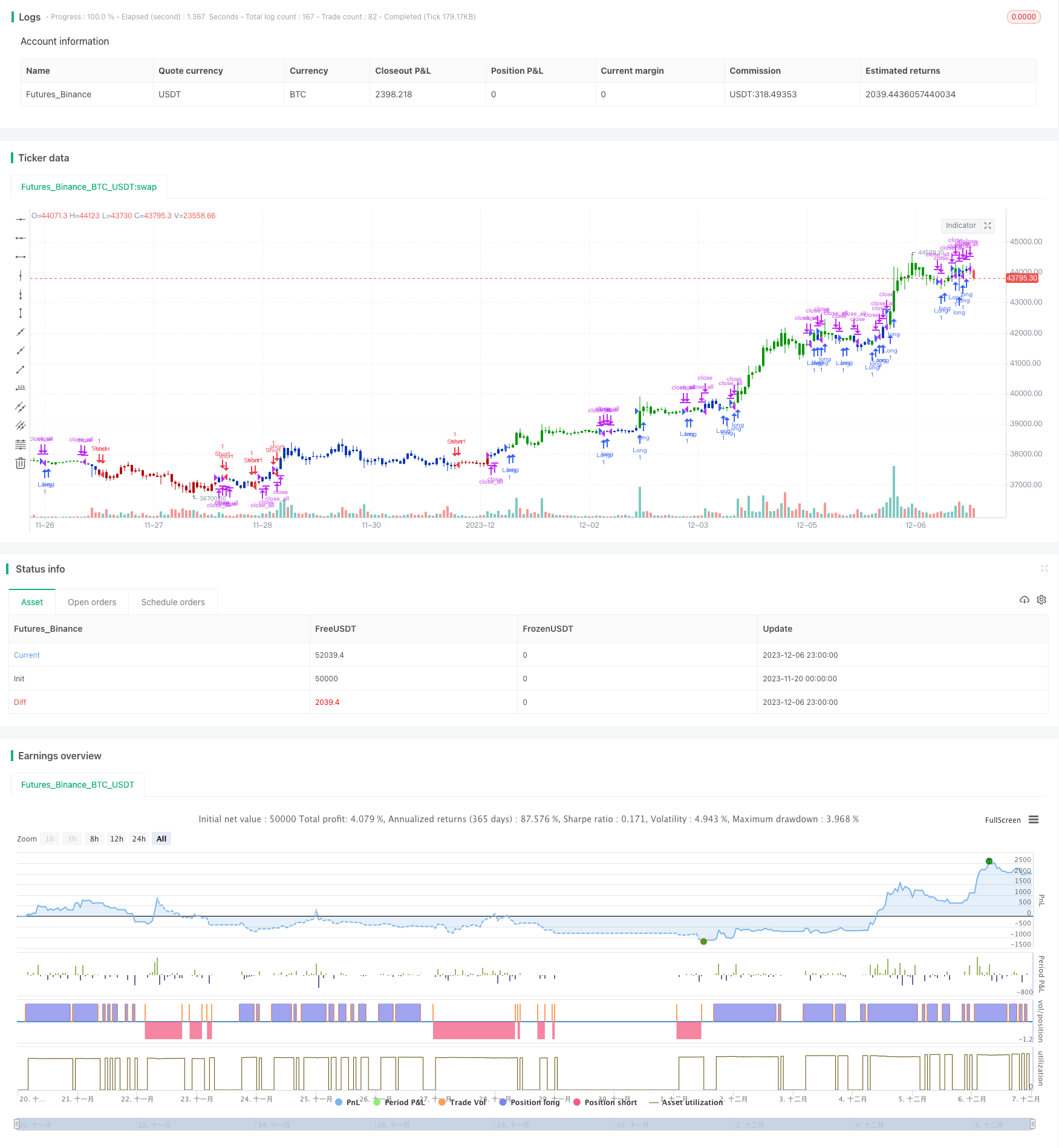

/*backtest

start: 2023-11-20 00:00:00

end: 2023-12-07 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 11/11/2019

// This is combo strategies for get a cumulative signal.

//

// First strategy

// This System was created from the Book "How I Tripled My Money In The

// Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

// The strategy buys at market, if close price is higher than the previous close

// during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

// The strategy sells at market, if close price is lower than the previous close price

// during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

//

// Second strategy

// This is modified version of Dale Legan's "Confluence" indicator written by Gary Fritz.

// ================================================================

// Here is Gary`s commentary:

// Since the Confluence indicator returned several "states" (bull, bear, grey, and zero),

// he modified the return value a bit:

// -9 to -1 = Bearish

// -0.9 to 0.9 = "grey" (and zero)

// 1 to 9 = Bullish

// The "grey" range corresponds to the "grey" values plotted by Dale's indicator, but

// they're divided by 10.

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

Reversal123(Length, KSmoothing, DLength, Level) =>

vFast = sma(stoch(close, high, low, Length), KSmoothing)

vSlow = sma(vFast, DLength)

pos = 0.0

pos := iff(close[2] < close[1] and close > close[1] and vFast < vSlow and vFast > Level, 1,

iff(close[2] > close[1] and close < close[1] and vFast > vSlow and vFast < Level, -1, nz(pos[1], 0)))

pos

Confluence(Harmonic, BuyBand, SellBand) =>

pos = 0.0

Price = close

STL = round((Harmonic * 2) - 1 - 0.5)

ITL = round((STL * 2) - 1 - 0.5)

LTL = round((ITL * 2) - 1 - 0.5)

HOFF = round(Harmonic / 2 - 0.5)

SOFF = round(STL / 2 - 0.5)

IOFF = round(ITL / 2 - 0.5)

xHavg = sma(Price, Harmonic)

xSavg = sma(Price, STL)

xIavg = sma(Price, ITL)

xLavg = sma(Price, LTL)

xvalue2 = xSavg - xHavg[HOFF]

xvalue3 = xIavg - xSavg[SOFF]

xvalue12 = xLavg - xIavg[IOFF]

xmomsig = xvalue2 + xvalue3 + xvalue12

xLavgOHLC = sma(ohlc4, LTL - 1)

xH2 = sma(Price, Harmonic - 1)

xS2 = sma(Price, STL - 1)

xI2 = sma(Price, ITL - 1)

xL2 = sma(Price, LTL - 1)

DerivH = (xHavg * 2) - xHavg[1]

DerivS = (xSavg * 2) - xSavg[1]

DerivI = (xIavg * 2) - xIavg[1]

DerivL = (xLavg * 2) - xLavg[1]

SumDH = Harmonic * DerivH

SumDS = STL * DerivS

SumDI = ITL * DerivI

SumDL = LTL * DerivL

LengH = Harmonic - 1

LengS = STL - 1

LengI = ITL - 1

LengL = LTL - 1

N1H = xH2 * LengH

N1S = xS2 * LengS

N1I = xI2 * LengI

N1L = xL2 * LengL

DRH = SumDH - N1H

DRS = SumDS - N1S

DRI = SumDI - N1I

DRL = SumDL - N1L

SumH = xH2 * (Harmonic - 1)

SumS = xS2 * (STL - 1)

SumI = xI2 * (ITL - 1)

SumL = xLavgOHLC * (LTL - 1)

xvalue5 = (SumH + DRH) / Harmonic

xvalue6 = (SumS + DRS) / STL

xvalue7 = (SumI + DRI) / ITL

xvalue13 = (SumL + DRL) / LTL

value9 = xvalue6 - xvalue5[HOFF]

value10 = xvalue7 - xvalue6[SOFF]

value14 = xvalue13 - xvalue7[IOFF]

xmom = value9 + value10 + value14

HT = sin(xvalue5 * 2 * 3.14 / 360) + cos(xvalue5 * 2 * 3.14 / 360)

HTA = sin(xHavg * 2 * 3.14 / 360) + cos(xHavg * 2 * 3.14 / 360)

ST = sin(xvalue6 * 2 * 3.14 / 360) + cos(xvalue6 * 2 * 3.14 / 360)

STA = sin(xSavg * 2 * 3.14 / 360) + cos(xSavg * 2 * 3.14 / 360)

IT = sin(xvalue7 * 2 * 3.14 / 360) + cos(xvalue7 * 2 * 3.14 / 360)

ITA = sin(xIavg * 2 * 3.14 / 360) + cos(xIavg * 2 * 3.14 / 360)

xSum = HT + ST + IT

xErr = HTA + STA + ITA

Condition2 = (((xSum > xSum[SOFF]) and (xHavg < xHavg[SOFF])) or ((xSum < xSum[SOFF]) and (xHavg > xHavg[SOFF])))

Phase = iff(Condition2 , -1 , 1)

xErrSum = (xSum - xErr) * Phase

xErrSig = sma(xErrSum, SOFF)

xvalue70 = xvalue5 - xvalue13

xvalue71 = sma(xvalue70, Harmonic)

ErrNum = iff (xErrSum > 0 and xErrSum < xErrSum[1] and xErrSum < xErrSig, 1,

iff (xErrSum > 0 and xErrSum < xErrSum[1] and xErrSum > xErrSig, 2,

iff (xErrSum > 0 and xErrSum > xErrSum[1] and xErrSum < xErrSig, 2,

iff (xErrSum > 0 and xErrSum > xErrSum[1] and xErrSum > xErrSig, 3,

iff (xErrSum < 0 and xErrSum > xErrSum[1] and xErrSum > xErrSig, -1,

iff (xErrSum < 0 and xErrSum < xErrSum[1] and xErrSum > xErrSig, -2,

iff (xErrSum < 0 and xErrSum > xErrSum[1] and xErrSum < xErrSig, -2,

iff (xErrSum < 0 and xErrSum < xErrSum[1] and xErrSum < xErrSig, -3, 0))))))))

momNum = iff (xmom > 0 and xmom < xmom[1] and xmom < xmomsig , 1,

iff (xmom > 0 and xmom < xmom[1] and xmom > xmomsig, 2,

iff (xmom > 0 and xmom > xmom[1] and xmom < xmomsig, 2,

iff (xmom > 0 and xmom > xmom[1] and xmom > xmomsig, 3,

iff (xmom < 0 and xmom > xmom[1] and xmom > xmomsig, -1,

iff (xmom < 0 and xmom < xmom[1] and xmom > xmomsig, -2,

iff (xmom < 0 and xmom > xmom[1] and xmom < xmomsig, -2,

iff (xmom < 0 and xmom < xmom[1] and xmom < xmomsig, -3, 0))))))))

TCNum = iff (xvalue70 > 0 and xvalue70 < xvalue70[1] and xvalue70 < xvalue71, 1,

iff (xvalue70 > 0 and xvalue70 < xvalue70[1] and xvalue70 > xvalue71, 2,

iff (xvalue70 > 0 and xvalue70 > xvalue70[1] and xvalue70 < xvalue71, 2,

iff (xvalue70 > 0 and xvalue70 > xvalue70[1] and xvalue70 > xvalue71, 3,

iff (xvalue70 < 0 and xvalue70 > xvalue70[1] and xvalue70 > xvalue71, -1,

iff (xvalue70 < 0 and xvalue70 < xvalue70[1] and xvalue70 > xvalue71, -2,

iff (xvalue70 < 0 and xvalue70 > xvalue70[1] and xvalue70 < xvalue71, -2,

iff (xvalue70 < 0 and xvalue70 < xvalue70[1] and xvalue70 < xvalue71, -3,0))))))))

value42 = ErrNum + momNum + TCNum

Confluence = iff (value42 > 0 and xvalue70 > 0, value42,

iff (value42 < 0 and xvalue70 < 0, value42,

iff ((value42 > 0 and xvalue70 < 0) or (value42 < 0 and xvalue70 > 0), value42 / 10, 0)))

Res1 = iff (Confluence >= 1, Confluence, 0)

Res2 = iff (Confluence <= -1, Confluence, 0)

Res3 = iff (Confluence == 0, 0, iff (Confluence > -1 and Confluence < 1, 10 * Confluence, 0))

pos := iff(Res2 >= SellBand and Res2 != 0, -1,

iff(Res1 <= BuyBand and Res1 != 0, 1,

iff(Res3 != 0, 2, nz(pos[1], 0))))

pos

strategy(title="Combo Backtest 123 Reversal & Confluence", shorttitle="Combo", overlay = true)

Length = input(14, minval=1)

KSmoothing = input(1, minval=1)

DLength = input(3, minval=1)

Level = input(50, minval=1)

//-------------------------

Harmonic = input(10, minval=1)

BuyBand = input(9)

SellBand = input(-9)

reverse = input(false, title="Trade reverse")

posReversal123 = Reversal123(Length, KSmoothing, DLength, Level)

posConfluence = Confluence(Harmonic, BuyBand, SellBand)

pos = iff(posReversal123 == 1 and posConfluence == 1 , 1,

iff(posReversal123 == -1 and posConfluence == -1, -1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )

- Double Exponential Moving Average and ALMA Strategy

- Quantitative Trading Price Breakthrough Strategy

- Ehlers Fisher Stochastic Relative Vigor Index Strategy

- Dual Momentum Breakthrough and Volatility Filtering Algorithmic Trading Strategy

- Multiple Moving Average Comprehensive Strategy

- Price Reversal RSI Combo Strategy

- Cloud Nebula Dual Moving Average Breakthrough Strategy

- MACD Golden Cross Death Cross Trend Following Strategy

- Turtle-trend Following Strategy

- Dual Confirmation Donchian Channel Trend Strategy

- Short-term Trading Strategy Based on Chaikin Volatility Indicator

- Dual MA Crossover Trend Tracking Strategy

- Super Trend Triple Strategy

- Dynamic Trailing Stop Loss Strategy

- Moving Average Crossover Strategy with Stop-Loss and Take-Profit

- Mean Reversion Reverse Strategy Based on Moving Average

- Bollinger Bands Based High Frequency Trading Strategy

- A Quantitative Ichimoku Cloud Trading Strategy

- Momentum Strategy Based on Double Bottom Breakout Model

- Stochastic Vortex Strategy