TSLA Quantitative Trading System Across Multiple Timeframes

Author: ChaoZhang, Date: 2023-12-22 12:50:55Tags:

This strategy utilizes two different types of technical indicators, RSI and Estocastic, across the 5-minute chart of TSLA and 1-minute chart of S&P 100 index to design trading rules and build an automated trading system for TSLA stocks.

Strategy Overview

The core idea of this strategy is to monitor both the price technical indicators of TSLA itself and the technical indicators of the US stock market index. It sends out trading signals when both sides reach the extremely overbought or oversold status at the same time. The strategy adopts technical indicators across two timeframes, the 5-minute and 1-minute, which can help filter out some noisy trading signals effectively.

Strategy Logic

Firstly, the strategy calculates the 5-day RSI on the 5-minute chart of TSLA, and the 14-day RSI on the 1-minute chart of the S&P 100 index. When the 5-day RSI of TSLA is below 30 and the 14-day RSI of the S&P 100 index is below 30 at the same time, it is considered that TSLA price reaches an extremely oversold level and a buy signal is triggered.

After buying in, the strategy keeps monitoring the 14-day Estocastic indicator on the 1-minute chart of TSLA. When the Estocastic indicator surpasses 78, it is viewed as TSLA price bounces back to the upper band and a sell signal is triggered.

In addition, a 3% stop loss is set in the strategy. When the price drops below the stop loss level, the position will be closed with a stop loss.

Advantages of the Strategy

- Adopting multiple timeframes can help filter out noisy signals effectively

- RSI and Estocastic indicators verify each other and improve signal quality

- Stop loss mechanism limits the loss per trade

- Backtesting data includes the minute bars of TSLA and S&P 100 index which is representative

- The strategy logic is simple and easy to understand as well as optimize

Risks of the Strategy

- Combining multiple timeframes and indicators may miss some opportunities

- Overly aggressive stop loss setting may lead to unnecessary slippage loss

- S&P 100 index as a auxiliary tool also introduces some systemic risk

- The quality of backtesting data and changing market environments may influence the results

Directions for Strategy Optimization

- Test more parameter combinations to find the optimal indicator configuration

- Add adaptive stop loss algorithms

- Add position sizing module to lock in more profits

- Add machine learning algorithms to train indicator weights

- Search for trading turns in longer timeframes

Conclusion

To conclude, this is a typical mean-reversion strategy based on overbought and oversold signals, with additional features like multiple timeframe validation and stop loss to make it more robust. The advantage lies in its simplicity to understand and implement. The next step is to acquire more alpha while controlling risks, which requires custom optimization work around the indicators and models. Overall, this strategy establishes a solid foundation for building quantitative trading systems.

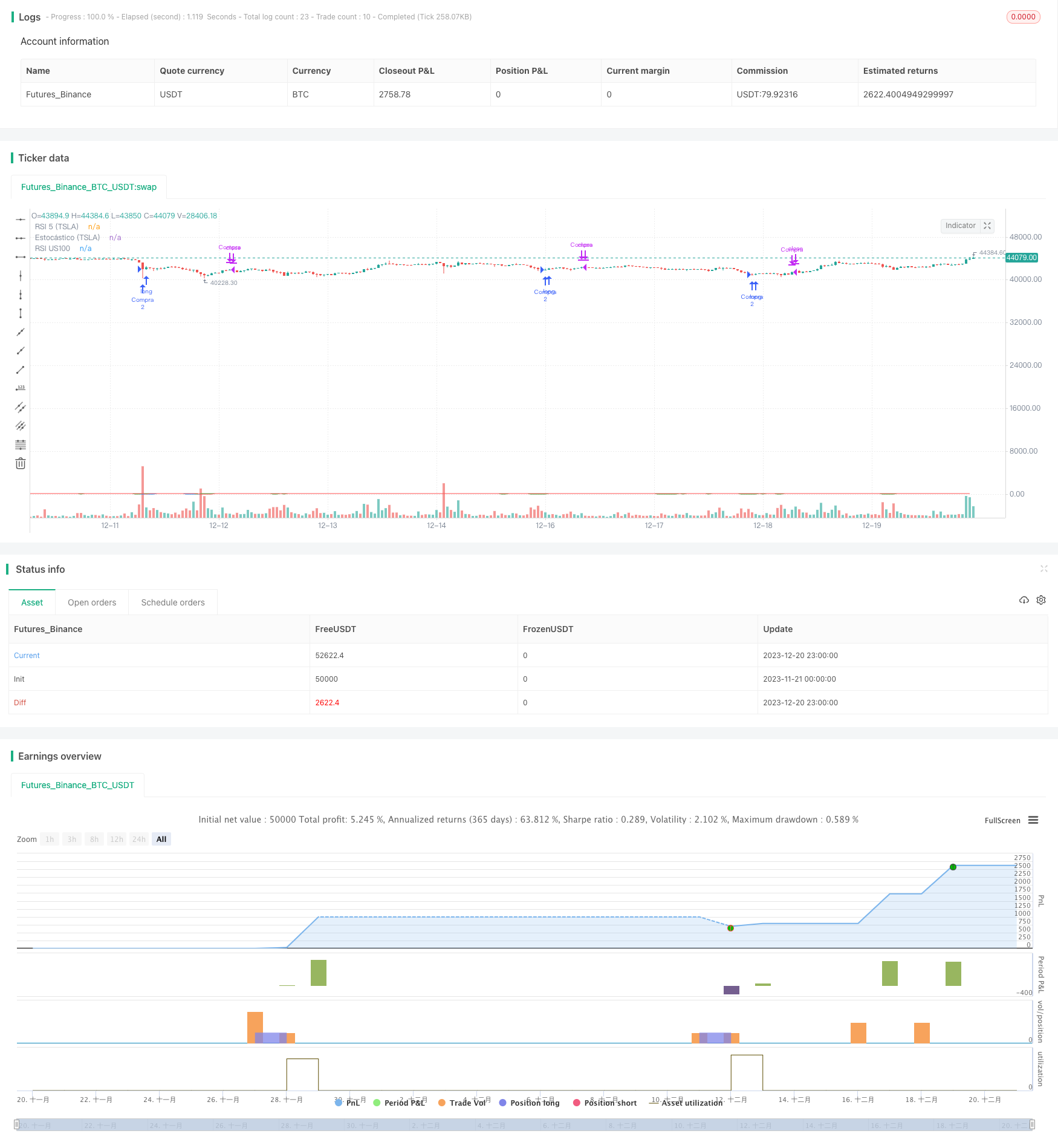

/*backtest

start: 2023-11-21 00:00:00

end: 2023-12-21 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("Estrategia de Trading TSLA", overlay=true)

// Condiciones de entrada

rsi5 = ta.rsi(close, 5) // RSI en el gráfico de TSLA de 5 minutos

rsiUS100 = ta.rsi(request.security(syminfo.tickerid, "1", close), 14) // RSI en el gráfico de US100 de 1 minuto

// Condiciones de entrada

condicion_entrada = rsi5 < 30 and rsiUS100 < 30

// Cantidad de acciones a comprar

cantidad_compra = 2

// Condiciones de salida

estocastico = ta.stoch(close, high, low, 14) // Estocástico en el gráfico de TSLA de 1 minuto

condicion_salida = estocastico > 78

// Stop loss

stop_loss = strategy.position_avg_price * 0.03

// Ejecutar la estrategia

if condicion_entrada

strategy.entry("Compra", strategy.long, qty = cantidad_compra)

if condicion_salida or ta.highest(high, 10) <= stop_loss

strategy.close("Compra")

// Mostrar indicadores en el gráfico

plot(rsi5, "RSI 5 (TSLA)", color=color.blue)

plot(rsiUS100, "RSI US100", color=color.red)

plot(estocastico, "Estocástico (TSLA)", color=color.green)

- Single Moving Average Crossover Bollinger Bands Strategy

- The RSI breakout strategy is a quantitative trading strategy

- The moving average crossover strategy is a quantitative trading strategy

- Momentum Breakout Moving Average Trading Strategy

- Slow Heiken Ashi Exponential Moving Average Trading Strategy

- High-Performance Algorithmic Trading Strategy Based on Quantitative Models

- Bollinger Momentum Breakout Strategy

- Parabolic SAR and EMA Trend Tracking Strategy

- Broken High/Low Strategy

- Low Pyramid Risk Tracking Strategy

- Customizable Non-Repainting HTF MACD MFI Scalable Bot Strategy

- Double Exponential Moving Average and ALMA Strategy

- Quantitative Trading Price Breakthrough Strategy

- Ehlers Fisher Stochastic Relative Vigor Index Strategy

- Dual Momentum Breakthrough and Volatility Filtering Algorithmic Trading Strategy

- Multiple Moving Average Comprehensive Strategy

- Price Reversal RSI Combo Strategy

- Cloud Nebula Dual Moving Average Breakthrough Strategy

- MACD Golden Cross Death Cross Trend Following Strategy

- Turtle-trend Following Strategy