Empirical Mode Decomposition Based Quantitative Trading Strategy

Author: ChaoZhang, Date: 2023-12-22 14:41:34Tags:

Overview

This strategy is based on the Empirical Mode Decomposition (EMD) method to decompose the price series and extract features from different frequency bands, combined with the mean to generate trading signals. It is mainly applicable for medium and long term holdings.

Strategy Logic

- Use the EMD method to bandpass filter the price and extract price fluctuations

- Calculate the moving average of peak and trough sequences

- Generate trading signals when the mean line exceeds a certain percentage of peak and trough lines

- Long or short based on trading signals

Advantage Analysis

- The EMD method can effectively decompose the price series and extract useful features

- The peak and trough lines control the strategy to trade only when the price fluctuation is greater than a certain amplitude

- Combined with the mean line, it can effectively filter out false breakouts

Risk Analysis

- Improper selection of EMD method parameters may lead to overfitting

- It takes a long cycle to form a transaction signal and cannot adapt to high frequency trading

- Unable to cope with market conditions with dramatic price fluctuations

Optimization Directions

- Optimize the parameters of the EMD model to improve adaptability to the market

- Combine other indicators as stop loss and take profit signals

- Try different price series as strategy input

Summary

This strategy uses the empirical mode decomposition method to extract features from the price series and generates trading signals based on the extracted features, realizing a stable medium and long term trading strategy. The advantage of this strategy is that it can effectively identify periodic features in prices and issue trading orders during large fluctuations. But there are also certain risks, and further optimization is needed to adapt to more complex market environments.

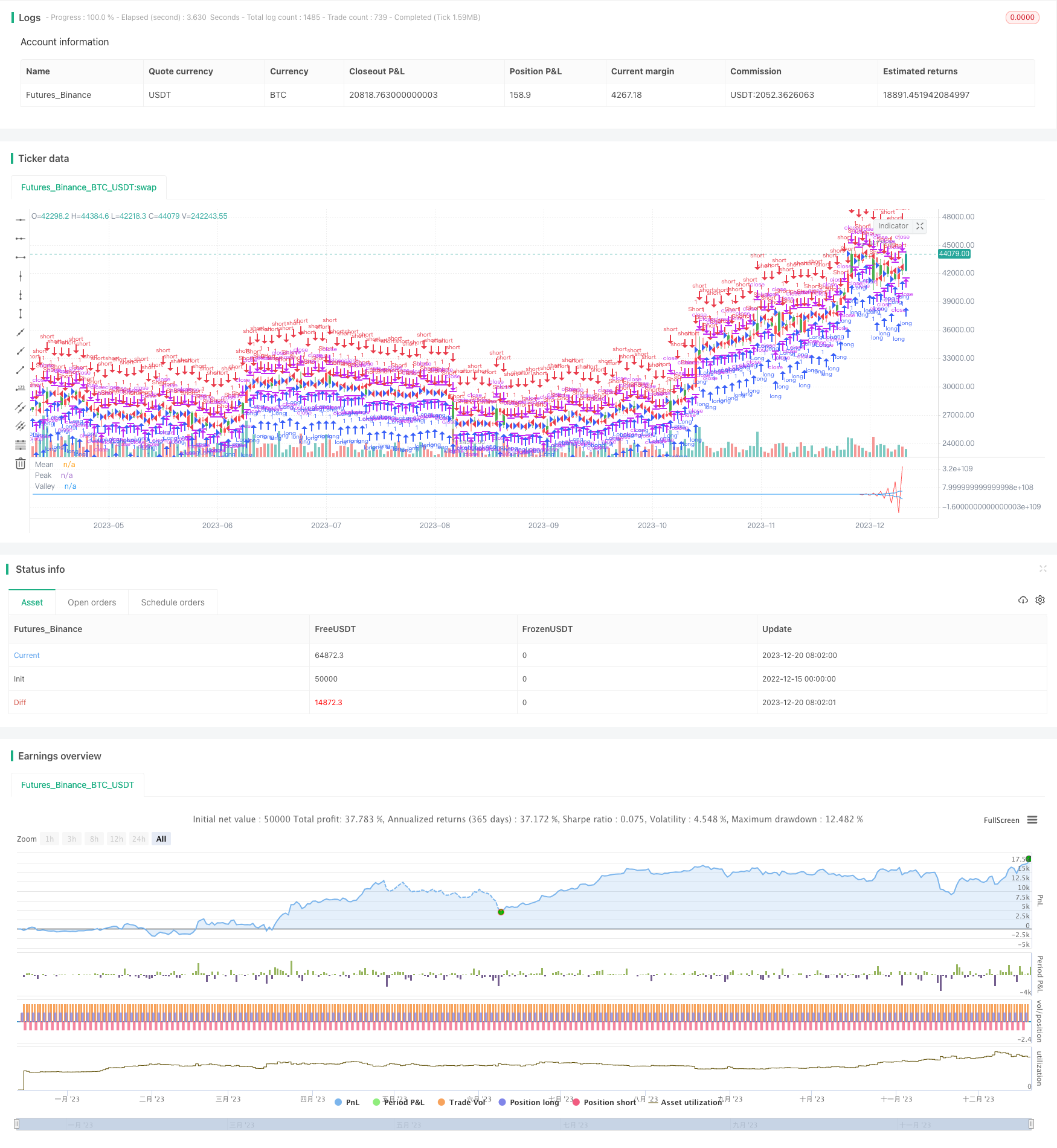

/*backtest

start: 2022-12-15 00:00:00

end: 2023-12-21 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=2

////////////////////////////////////////////////////////////

// Copyright by HPotter v1.0 12/04/2017

// The related article is copyrighted material from Stocks & Commodities Mar 2010

// You can use in the xPrice any series: Open, High, Low, Close, HL2, HLC3, OHLC4 and ect...

//

// You can change long to short in the Input Settings

// Please, use it only for learning or paper trading. Do not for real trading.

////////////////////////////////////////////////////////////

strategy(title="Empirical Mode Decomposition")

Length = input(20, minval=1)

Delta = input(0.5)

Fraction = input(0.1)

reverse = input(false, title="Trade reverse")

xPrice = hl2

beta = cos(3.1415 * (360 / Length) / 180)

gamma = 1 / cos(3.1415 * (720 * Delta / Length) / 180)

alpha = gamma - sqrt(gamma * gamma - 1)

xBandpassFilter = 0.5 * (1 - alpha) * (xPrice - xPrice[2]) + beta * (1 + alpha) * nz(xBandpassFilter[1]) - alpha * nz(xBandpassFilter[2])

xMean = sma(xBandpassFilter, 2 * Length)

xPeak = iff (xBandpassFilter[1] > xBandpassFilter and xBandpassFilter[1] > xBandpassFilter[2], xBandpassFilter[1], nz(xPeak[1]))

xValley = iff (xBandpassFilter[1] < xBandpassFilter and xBandpassFilter[1] < xBandpassFilter[2], xBandpassFilter[1], nz(xValley[1]))

xAvrPeak = sma(xPeak, 50)

xAvrValley = sma(xValley, 50)

nAvrPeak = Fraction * xAvrPeak

nAvrValley = Fraction * xAvrValley

pos = iff(xMean > nAvrPeak and xMean > nAvrValley, 1,

iff(xMean < nAvrPeak and xMean < nAvrValley, -1, nz(pos[1], 0)))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1, 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

barcolor(possig == -1 ? red: possig == 1 ? green : blue )

plot(xMean, color=red, title="Mean")

plot(nAvrPeak, color=blue, title="Peak")

plot(nAvrValley, color=blue, title="Valley")

More

- EMA Crossover Intraday Trading Strategy Based on AO Oscillator

- The Ichimoku Oscillator [ChartPrime] indicator is the most commonly used indicator.

- FRAMA and Moving Average Crossover Trading Strategy Based on Dual Moving Average

- Moving Average Crossover Long-Short Trading Strategy

- Fast Scalping RSI Switching Strategy v1.7

- Moving Average Crossover Quantitative Strategy

- Reversal Breakout Oversold RSI Strategy

- Dual Moving Average Bollinger Band Trend Tracking Strategy

- Sentiment Based XBT Futures Trading Strategy

- Parabolic SAR Momentum Reversal Strategy

- Dynamic Pyramiding Strategy

- YinYang RSI Volume Trend Trading Strategy

- Quad MA Trend Scalper Strategy

- Oscillator Index Transformation Strategy

- Golden Cross Dead Cross Dual Moving Average MACD Trend Tracking Strategy

- This is an experimental quantitative trading strategy

- Single Moving Average Crossover Bollinger Bands Strategy

- The RSI breakout strategy is a quantitative trading strategy

- The moving average crossover strategy is a quantitative trading strategy

- Momentum Breakout Moving Average Trading Strategy