Moving Average Crossover Long-Short Trading Strategy

Author: ChaoZhang, Date: 2023-12-22 15:13:50Tags:

Overview

This strategy is a long-short trading strategy based on moving average crossover. It uses fast simple moving average (SMA) and slow SMA. When fast SMA crosses above slow SMA, go long. When fast SMA crosses below slow SMA, go short.

Strategy Logic

The strategy uses two SMA indicators: a 20-day fast SMA and a 50-day slow SMA. When short-term fast SMA crosses above long-term slow SMA from below, it indicates the market trend is turning bullish, so go long. When fast SMA crosses below slow SMA from above, it indicates the market trend is turning bearish, so go short.

Specifically, if fast SMA crosses above slow SMA, open long position. If fast SMA crosses below slow SMA, open short position. Close position when the opposite SMA crossover occurs.

Advantage Analysis

This SMA crossover strategy is simple to use and understand. Compared to other technical indicators, SMA has smaller lagging and can capture trend changes more sensitively.

Using double fast and slow SMA acts as a filter. Fast SMA captures short-term moves while slow SMA filters out noises. Their crossover helps capture mid-long term trend turning points.

The strategy has relatively low trading frequency suitable for long-term investors. It only opens position on SMA crossovers, avoiding unnecessary trades.

Risk Analysis

The strategy may have some lagging. Due to the lagging nature of SMA itself, there can be certain delay in the timing of signal generation. This may lead to loss of some profits.

When price gaps or short-term reversal occurs, fast and slow SMA may give out false signals, resulting in unnecessary losses. This tests investor’s psychological quality.

Optimization

The strategy can be optimized from the following aspects:

- Adjust fast and slow SMA periods to optimize crossover effect

- Add other technical indicator filters e.g. MACD, KD to improve signal accuracy

- Add stop loss to control single trade loss

- Adjust parameters based on individual stock characteristics

Conclusion

Overall this is a simple and practical long term trading strategy. It gives trading signals around major trend turning points based on the principle of moving average crossover. Coupling fast and slow double SMA acts as effective filter to reduce false signals. The strategy is easy to understand and implement, suitable for most long-term investors. It is a recommended quantitative trading strategy. Further improvements can be made through parameter tuning and adding complementary technical indicators. ]

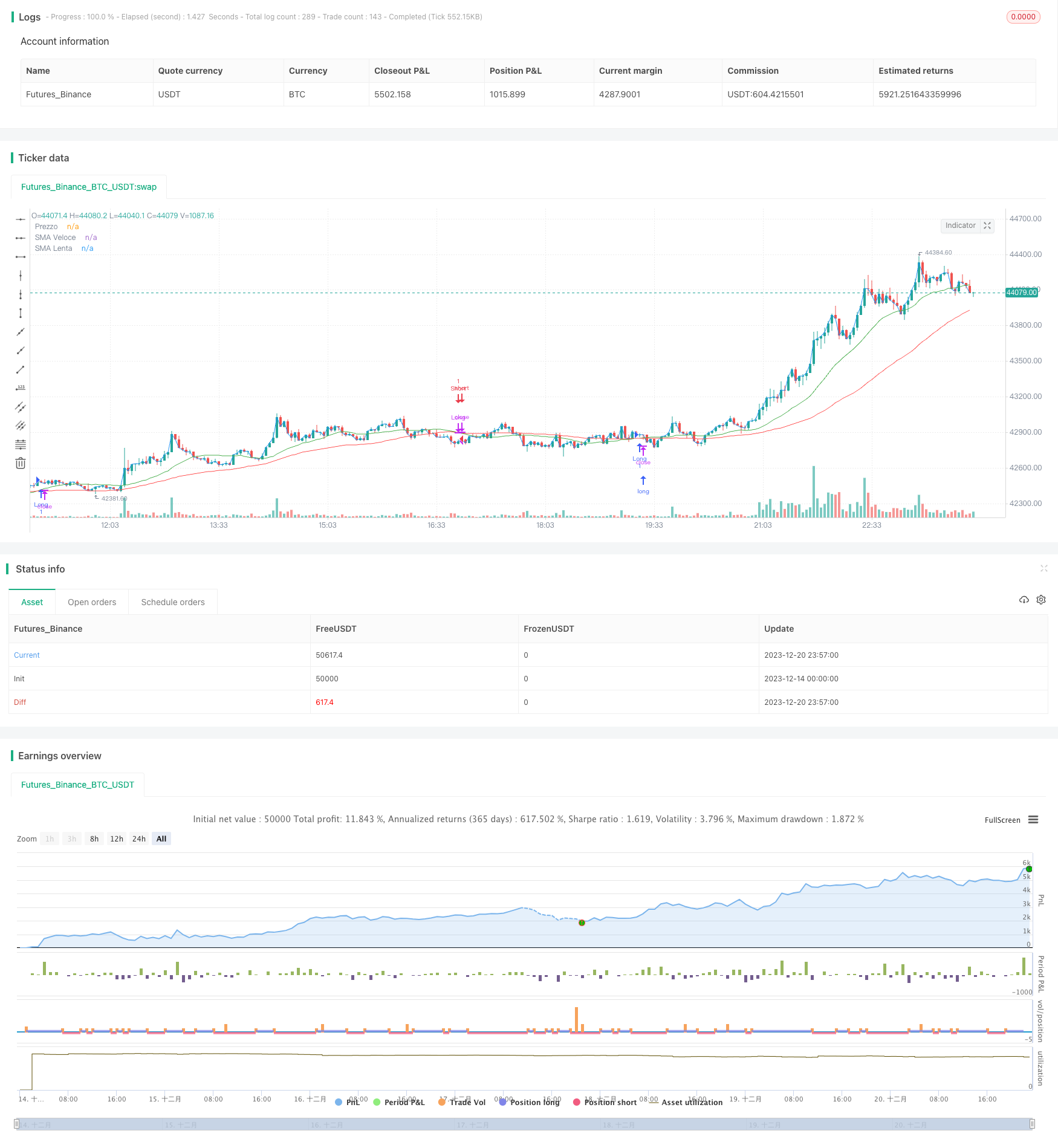

/*backtest

start: 2023-12-14 00:00:00

end: 2023-12-21 00:00:00

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This Pine Script™ code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © forsakenMaster81726

//@version=5

strategy("Il mio script", overlay=true)

// Imposta le medie mobili

fastLength = input(20, title="SMA Veloce")

slowLength = input(50, title="SMA Lenta")

smaFast = ta.sma(close, fastLength)

smaSlow = ta.sma(close, slowLength)

// Crossover SMA (Veloce sopra Lenta)

bullishCrossover = ta.crossover(smaFast, smaSlow)

// Crossunder SMA (Veloce sotto Lenta)

bearishCrossover = ta.crossunder(smaFast, smaSlow)

// Regole di trading

strategy.entry("Long", strategy.long, when=bullishCrossover)

strategy.close("Long", when=bearishCrossover)

strategy.entry("Short", strategy.short, when=bearishCrossover)

strategy.close("Short", when=bullishCrossover)

// Plot delle medie mobili sul grafico

plot(smaFast, color=color.green, title="SMA Veloce")

plot(smaSlow, color=color.red, title="SMA Lenta")

// Plot del prezzo

plot(close, color=color.blue, title="Prezzo")

- Quantitative Trading Strategy Based on RSI Indicator and Moving Average

- BBMA Breakthrough Strategy

- An Enhanced Flag Pattern Recognition Strategy Integrating with SuperTrend

- Dynamic Filter Quant Trading Strategy

- Dual MA Crossover Strategy

- Heikin Ashi Percentile Interpolation Trading Strategy

- Turtle Trading Strategy Based on Donchian Channels

- EMA Crossover Intraday Trading Strategy Based on AO Oscillator

- The Ichimoku Oscillator [ChartPrime] indicator is the most commonly used indicator.

- FRAMA and Moving Average Crossover Trading Strategy Based on Dual Moving Average

- Fast Scalping RSI Switching Strategy v1.7

- Moving Average Crossover Quantitative Strategy

- Reversal Breakout Oversold RSI Strategy

- Dual Moving Average Bollinger Band Trend Tracking Strategy

- Sentiment Based XBT Futures Trading Strategy

- Parabolic SAR Momentum Reversal Strategy

- Empirical Mode Decomposition Based Quantitative Trading Strategy

- Dynamic Pyramiding Strategy

- YinYang RSI Volume Trend Trading Strategy

- Quad MA Trend Scalper Strategy