Overview

This strategy is designed based on the Relative Strength Index (RSI) indicator for buying on RSI low points and taking profit and stop loss on RSI high points. It generates buy signals when RSI drops below the oversold line and sell signals when RSI rises above the overbought line. The strategy is optimized to track trends with effective risk control.

Strategy Logic

The strategy uses the RSI indicator to determine if a stock is overvalued or undervalued. RSI combined with overbought and oversold lines forms buy and sell signals. Specifically, if RSI crosses above the 20 oversold line, a buy signal is generated; if RSI crosses below the 80 overbought line, a sell signal is generated.

After entering a long position, the strategy sets an initial stop loss to control the downside risk. At the same time, two take profit lines with different ratios are set to take profits in batches and lock in profits. Specifically, 50% of the position will take profit first at 3% above the entry price; then the remaining 50% position will take profit at 5% above the entry price.

The strategy effectively utilizes the RSI indicator to determine entry timing. The stop loss and take profit settings are reasonable to effectively control risks.

Advantages

- Utilize RSI indicator to determine long/short positions and avoid trading blindly

- Optimized RSI parameters for better indicator effect

- Reasonable dual take profit design allows taking profits in batches to lock in more profits

- Initial stop loss and trailing stop loss prevent huge losses

Risks

- Poor performance in a bull market that cannot sustain profits

- Probability of incorrect signals from RSI exists and can increase losses from improper signal judgement

- Risk that stops cannot be triggered if stop loss points are set too deep

- Risk of magnified losses without limit on pyramiding times and ratio

Improvements

- Add other indicators to filter RSI signals and improve accuracy

- Set limits on pyramiding times and ratios

- Test effects of different RSI parameters

- Optimize stop loss and take profit points to lower risks

Summary

The strategy utilizes RSI to judge market condition and has reasonable stop loss and take profit configuration. It can effectively determine market trend and control trading risks, suitable as a bullish trend following strategy. Signal filtering, parameter testing, stop loss optimization etc. can further improve the stability of the strategy.

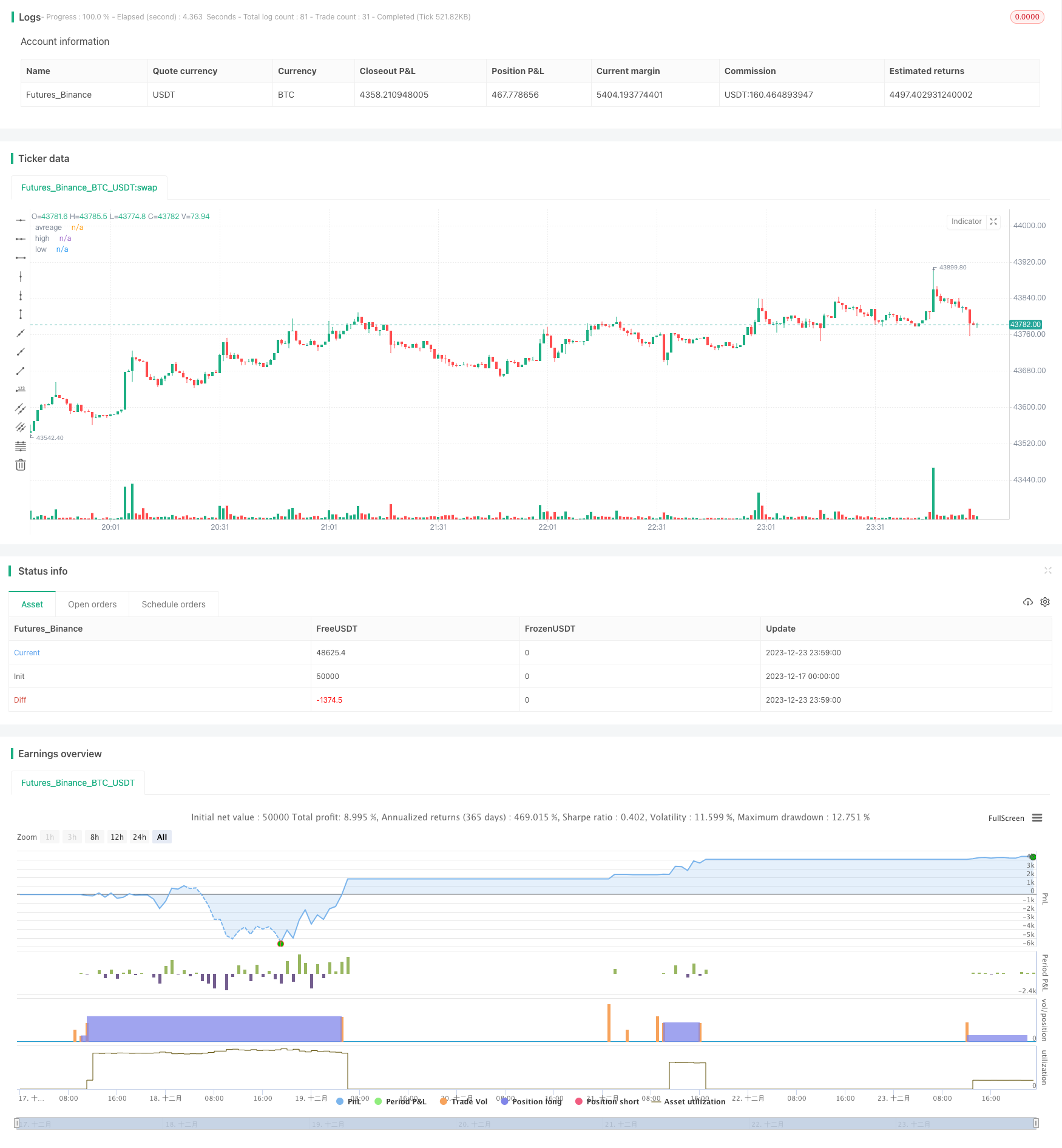

/*backtest

start: 2023-12-17 00:00:00

end: 2023-12-24 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

//@version=5

strategy(title='RSI Long Strategy', overlay=true, pyramiding=5, initial_capital=10000, default_qty_type=strategy.percent_of_equity, default_qty_value=100, calc_on_order_fills=false, slippage=0, commission_type=strategy.commission.percent, commission_value=0.075)

strat_dir_input = input.string(title='Strategy Direction', defval='long', options=['long', 'short', 'all'])

strat_dir_value = strat_dir_input == 'long' ? strategy.direction.long : strat_dir_input == 'short' ? strategy.direction.short : strategy.direction.all

strategy.risk.allow_entry_in(strat_dir_value)

//INPUTS

length = input(21)

overSold = input(20)

overBought = input(80)

p = close

vrsi = ta.rsi(p, length)

price = close

var bool long = na

var bool short = na

long := ta.crossover(vrsi, overSold)

short := ta.crossunder(vrsi, overBought)

var float last_open_long = na

var float last_open_short = na

last_open_long := long ? close : nz(last_open_long[1])

last_open_short := short ? close : nz(last_open_short[1])

mpoint=(last_open_long+last_open_short)/2

entry_value = last_open_long

entry_value1 = last_open_short

// Rounding levels to min tick

nround(x) =>

n = math.round(x / syminfo.mintick) * syminfo.mintick

n

//

disp_panels = input(true, title='Display info panels?')

fibs_label_off = input(40, title='fibs label offset')

fibs_label_size = input.string(size.normal, options=[size.tiny, size.small, size.normal, size.large, size.huge], title='fibs label size')

r1_x = timenow + math.round(ta.change(time) * fibs_label_off)

r1_y = last_open_short

text1 = 'High : ' + str.tostring(nround(last_open_short))

s1_y = last_open_long

text3 = 'low : ' + str.tostring(nround(last_open_long))

R1_label = disp_panels ? label.new(x=r1_x, y=r1_y, text=text1, xloc=xloc.bar_time, yloc=yloc.price, color=color.orange, style=label.style_label_down, textcolor=color.black, size=fibs_label_size) : na

S1_label = disp_panels ? label.new(x=r1_x, y=s1_y, text=text3, xloc=xloc.bar_time, yloc=yloc.price, color=color.lime, style=label.style_label_up, textcolor=color.black, size=fibs_label_size) : na

label.delete(R1_label[1])

label.delete(S1_label[1])

//

plot(mpoint, title='avreage', color=color.new(color.red, 40), style=plot.style_linebr, linewidth=3, trackprice=true, offset=-9999)

plot(last_open_short, title='high', color=color.new(color.red, 40), style=plot.style_linebr, linewidth=3, trackprice=true, offset=-9999)

plot(last_open_long, title='low', color=color.new(color.blue, 40), style=plot.style_linebr, linewidth=3, trackprice=true, offset=-9999)

//

trend = input(false)

if barstate.islast and trend == true

line z = line.new(bar_index[1], last_open_short[1], bar_index, last_open_short, extend=extend.both, color=color.red, style=line.style_dashed, width=1)

line f = line.new(bar_index[1], mpoint[1], bar_index, mpoint, extend=extend.both, color=color.blue, style=line.style_dashed, width=1)

line w = line.new(bar_index[1], last_open_long[1], bar_index, last_open_long, extend=extend.both, color=color.green, style=line.style_dashed, width=1)

line.delete(z[1])

line.delete(f[1])

line.delete(w[1])

//bu = ta.crossover(close, mpoint)

//sz = ta.crossunder(close, mpoint)

//bu1 = ta.crossover(close, last_open_short)

sz1 = ta.crossunder(close, last_open_short)

bu2 = ta.crossover(close, last_open_long)

//sz2 = ta.crossunder(close, last_open_long)

//plotshape(sz, style=shape.triangledown, location=location.abovebar, color=color.new(color.orange, 0), size=size.tiny)

//plotshape(bu, style=shape.triangleup, location=location.belowbar, color=color.new(color.blue, 0), size=size.tiny)

//plotshape(sz1, style=shape.triangledown, location=location.abovebar, color=color.new(color.red, 0), size=size.tiny)

//plotshape(bu1, style=shape.triangleup, location=location.belowbar, color=color.new(color.green, 0), size=size.tiny)

//plotshape(sz2, style=shape.triangledown, location=location.abovebar, color=color.new(color.red, 0), size=size.tiny)

//plotshape(bu2, style=shape.triangleup, location=location.belowbar, color=color.new(color.green, 0), size=size.tiny)

l = bu2

s = sz1

if l

strategy.entry('buy', strategy.long)

if s

strategy.entry('sell', strategy.short)

per(pcnt) =>

strategy.position_size != 0 ? math.round(pcnt / 100 * strategy.position_avg_price / syminfo.mintick) : float(na)

stoploss = input.float(title=' stop loss', defval=5, minval=0.01)

los = per(stoploss)

q1 = input.int(title=' qty_percent1', defval=50, minval=1)

q2 = input.int(title=' qty_percent2', defval=50, minval=1)

tp1 = input.float(title=' Take profit1', defval=3, minval=0.01)

tp2 = input.float(title=' Take profit2', defval=5, minval=0.01)

//tp4 = input.float(title=' Take profit4', defval=5, minval=0.01)

strategy.exit('x1', qty_percent=q1, profit=per(tp1), loss=los)

strategy.exit('x2', qty_percent=q2, profit=per(tp2), loss=los)