Overview

This strategy incorporates multiple ATR trailing stops and an improved Renko bricks to capture intraday trending moves. It combines trend indicators and brick charts to enable multi-timeframe analysis and identify trend direction for effective stops.

Strategy Logic

The core of this strategy lies in the multiple ATR stop loss mechanism. It sets 3 groups of ATR stops - 5 ATR, 10 ATR and 15 ATR. When price breaks these 3 stops downward, it indicates a trend reversal, prompting position exit. Such triple stop setting effectively filters out false signals from short-term noises.

Another key component is the improved Renko bricks. They are partitioned based on ATR values and incorporate SMA to determine trend bias. It is more sensitive than regular Renko bricks in capturing early trend changes. Brick color flip signals stops.

Entry signal triggers when price breaks above 3 ATR stops. Exit when price hits any ATR stop or Renko brick color changes.

Advantages

- Triple stops effectively control risks

- Improved Renko bricks enable early stops

- Combining trend and brick charts ensures catching trends

- Multi-timeframe analysis makes trend identification more reliable

- Adjustable parameters suit different market regimes

Risks and Enhancement

Main risk is stop loss penetration causing extended losses. Can optimize via:

- Adjust ATR stop multiples - relax in strong trends and tighten in weak trends

- Fine-tune Renko brick ATR periods to balance sensitivity and stability

- Add other stop indicators e.g. Donchian Channel for reliability

- Implement filters to avoid whipsaws during consolidations

Conclusion

This strategy works well for strong intraday trends. Its scientific stop loss mechanism and early trend change detection by improved Renko bricks are noteworthy. Fine-tuned parameters can adapt it to varying market conditions. Worth live testing as a trend following system.

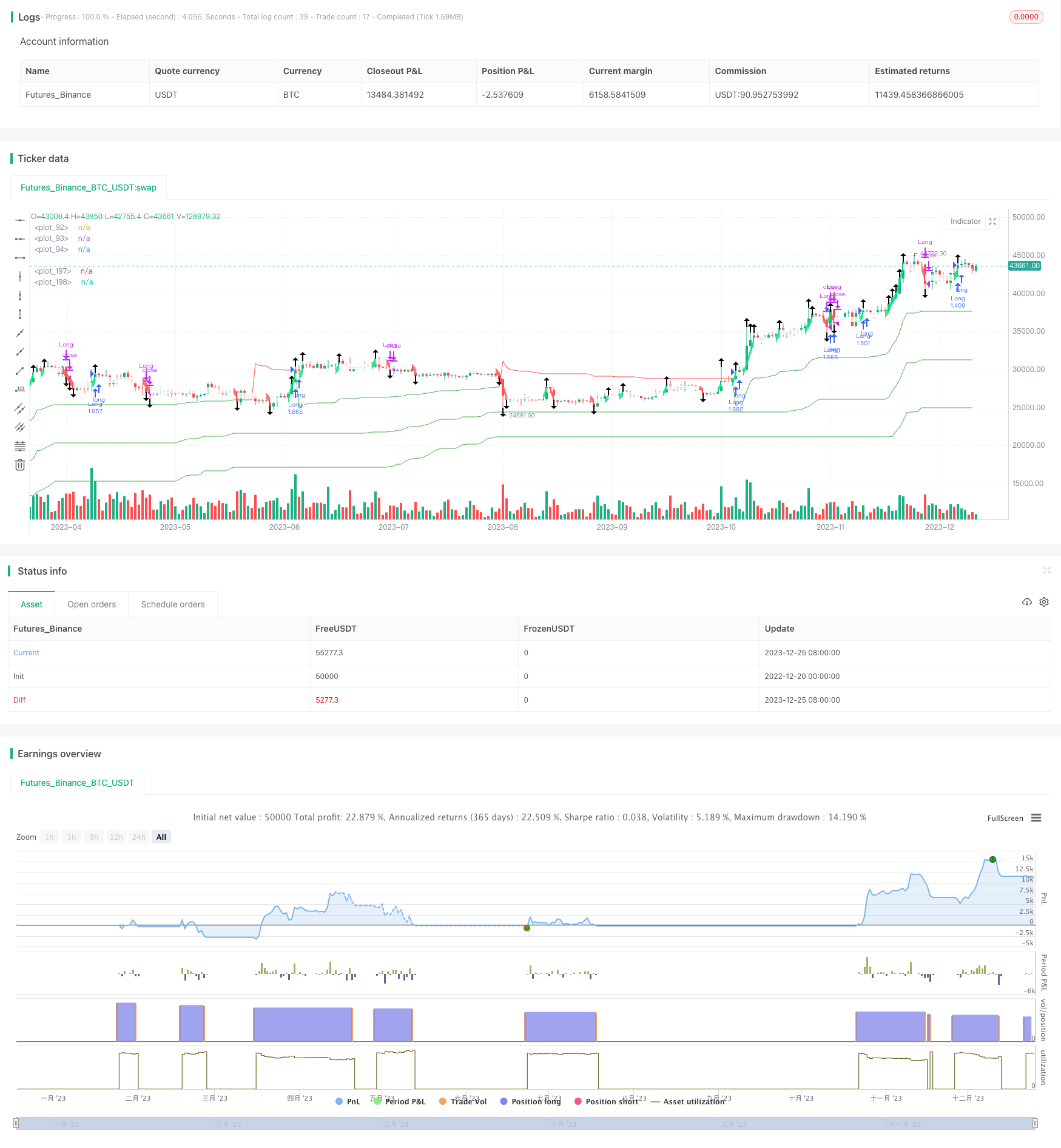

/*backtest

start: 2022-12-20 00:00:00

end: 2023-12-26 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Lancelot vstop intraday strategy", overlay=true, currency=currency.NONE, initial_capital = 100, commission_type=strategy.commission.percent,

commission_value=0.075, default_qty_type = strategy.percent_of_equity, default_qty_value = 100)

///Volatility Stop///

lengtha = input(title="Vstop length", type=input.integer, defval=26, minval=1)

mult1a = 5

atr_a = atr(lengtha)

max1a = 0.0

min1a = 0.0

is_uptrend_preva = false

stopa = 0.0

vstop_preva = 0.0

vstop1a = 0.0

is_uptrenda = false

is_trend_changeda = false

max_a = 0.0

min_a = 0.0

vstopa = 0.0

max1a := max(nz(max_a[1]), ohlc4)

min1a := min(nz(min_a[1]), ohlc4)

is_uptrend_preva := nz(is_uptrenda[1], true)

stopa := is_uptrend_preva ? max1a - mult1a * atr_a : min1a + mult1a * atr_a

vstop_preva := nz(vstopa[1])

vstop1a := is_uptrend_preva ? max(vstop_preva, stopa) : min(vstop_preva, stopa)

is_uptrenda := ohlc4 - vstop1a >= 0

is_trend_changeda := is_uptrenda != is_uptrend_preva

max_a := is_trend_changeda ? ohlc4 : max1a

min_a := is_trend_changeda ? ohlc4 : min1a

vstopa := is_trend_changeda ? is_uptrenda ? max_a - mult1a * atr_a : min_a + mult1a * atr_a :

vstop1a

///Volatility Stop///

lengthb = input(title="Vstop length", type=input.integer, defval=26, minval=1)

mult1b = 10

atr_b = atr(lengthb)

max1b = 0.0

min1b = 0.0

is_uptrend_prevb = false

stopb = 0.0

vstop_prevb = 0.0

vstop1b = 0.0

is_uptrendb = false

is_trend_changedb = false

max_b = 0.0

min_b = 0.0

vstopb = 0.0

max1b := max(nz(max_b[1]), ohlc4)

min1b := min(nz(min_b[1]), ohlc4)

is_uptrend_prevb := nz(is_uptrendb[1], true)

stopb := is_uptrend_prevb ? max1b - mult1b * atr_b : min1b + mult1b * atr_b

vstop_prevb := nz(vstopb[1])

vstop1b := is_uptrend_prevb ? max(vstop_prevb, stopb) : min(vstop_prevb, stopb)

is_uptrendb := ohlc4 - vstop1b >= 0

is_trend_changedb := is_uptrendb != is_uptrend_prevb

max_b := is_trend_changedb ? ohlc4 : max1b

min_b := is_trend_changedb ? ohlc4 : min1b

vstopb := is_trend_changedb ? is_uptrendb ? max_b - mult1b * atr_b : min_b + mult1b * atr_b :

vstop1b

///Volatility Stop///

lengthc = input(title="Vstop length", type=input.integer, defval=26, minval=1)

mult1c = 15

atr_c = atr(lengthc)

max1c = 0.0

min1c = 0.0

is_uptrend_prevc = false

stopc = 0.0

vstop_prevc = 0.0

vstop1c = 0.0

is_uptrendc = false

is_trend_changedc = false

max_c = 0.0

min_c = 0.0

vstopc = 0.0

max1c := max(nz(max_c[1]), ohlc4)

min1c := min(nz(min_c[1]), ohlc4)

is_uptrend_prevc := nz(is_uptrendc[1], true)

stopc := is_uptrend_prevc ? max1c - mult1c * atr_c : min1c + mult1c * atr_c

vstop_prevc := nz(vstopc[1])

vstop1c := is_uptrend_prevc ? max(vstop_prevc, stopc) : min(vstop_prevc, stopc)

is_uptrendc := ohlc4 - vstop1c >= 0

is_trend_changedc := is_uptrendc != is_uptrend_prevc

max_c := is_trend_changedc ? ohlc4 : max1c

min_c := is_trend_changedc ? ohlc4 : min1c

vstopc := is_trend_changedc ? is_uptrendc ? max_c - mult1c * atr_c : min_c + mult1c * atr_c :

vstop1c

plot(vstopa, color=is_uptrenda ? color.green : color.red, style=plot.style_line, linewidth=1)

plot(vstopb, color=is_uptrendb ? color.green : color.red, style=plot.style_line, linewidth=1)

plot(vstopc, color=is_uptrendc ? color.green : color.red, style=plot.style_line, linewidth=1)

vstoplongcondition = close > vstopa and close > vstopb and close > vstopc and vstopa > vstopb and vstopa > vstopc and vstopb > vstopc

vstoplongclosecondition = crossunder(close, vstopa)

vstopshortcondition = close < vstopa and close < vstopb and close < vstopc and vstopa < vstopb and vstopa < vstopc and vstopb < vstopc

vstopshortclosecondition = crossover(close, vstopa)

///Renko///

TF = input(title='TimeFrame', type=input.resolution, defval="240")

ATRlength = input(title="ATR length", type=input.integer, defval=60, minval=2, maxval=100)

SMAlength = input(title="SMA length", type=input.integer, defval=5, minval=2, maxval=100)

SMACurTFlength = input(title="SMA CurTF length", type=input.integer, defval=20, minval=2, maxval=100)

HIGH = security(syminfo.tickerid, TF, high)

LOW = security(syminfo.tickerid, TF, low)

CLOSE = security(syminfo.tickerid, TF, close)

ATR = security(syminfo.tickerid, TF, atr(ATRlength))

SMA = security(syminfo.tickerid, TF, sma(close, SMAlength))

SMACurTF = sma(close, SMACurTFlength)

RENKOUP = float(na)

RENKODN = float(na)

H = float(na)

COLOR = color(na)

BUY = int(na)

SELL = int(na)

UP = bool(na)

DN = bool(na)

CHANGE = bool(na)

RENKOUP := na(RENKOUP[1]) ? (HIGH + LOW) / 2 + ATR / 2 : RENKOUP[1]

RENKODN := na(RENKOUP[1]) ? (HIGH + LOW) / 2 - ATR / 2 : RENKODN[1]

H := na(RENKOUP[1]) or na(RENKODN[1]) ? RENKOUP - RENKODN : RENKOUP[1] - RENKODN[1]

COLOR := na(COLOR[1]) ? color.white : COLOR[1]

BUY := na(BUY[1]) ? 0 : BUY[1]

SELL := na(SELL[1]) ? 0 : SELL[1]

UP := false

DN := false

CHANGE := false

if not CHANGE and close >= RENKOUP[1] + H * 3

CHANGE := true

UP := true

RENKOUP := RENKOUP[1] + ATR * 3

RENKODN := RENKOUP[1] + ATR * 2

COLOR := color.lime

SELL := 0

BUY := BUY + 3

BUY

if not CHANGE and close >= RENKOUP[1] + H * 2

CHANGE := true

UP := true

RENKOUP := RENKOUP[1] + ATR * 2

RENKODN := RENKOUP[1] + ATR

COLOR := color.lime

SELL := 0

BUY := BUY + 2

BUY

if not CHANGE and close >= RENKOUP[1] + H

CHANGE := true

UP := true

RENKOUP := RENKOUP[1] + ATR

RENKODN := RENKOUP[1]

COLOR := color.lime

SELL := 0

BUY := BUY + 1

BUY

if not CHANGE and close <= RENKODN[1] - H * 3

CHANGE := true

DN := true

RENKODN := RENKODN[1] - ATR * 3

RENKOUP := RENKODN[1] - ATR * 2

COLOR := color.red

BUY := 0

SELL := SELL + 3

SELL

if not CHANGE and close <= RENKODN[1] - H * 2

CHANGE := true

DN := true

RENKODN := RENKODN[1] - ATR * 2

RENKOUP := RENKODN[1] - ATR

COLOR := color.red

BUY := 0

SELL := SELL + 2

SELL

if not CHANGE and close <= RENKODN[1] - H

CHANGE := true

DN := true

RENKODN := RENKODN[1] - ATR

RENKOUP := RENKODN[1]

COLOR := color.red

BUY := 0

SELL := SELL + 1

SELL

plotshape(UP, style=shape.arrowup, location=location.abovebar, size=size.normal)

plotshape(DN, style=shape.arrowdown, location=location.belowbar, size=size.normal)

p1 = plot(RENKOUP, style=plot.style_line, linewidth=1, color=COLOR)

p2 = plot(RENKODN, style=plot.style_line, linewidth=1, color=COLOR)

fill(p1, p2, color=COLOR, transp=80)

///Long Entry///

longcondition = vstoplongcondition and UP

if (longcondition)

strategy.entry("Long", strategy.long)

///Long exit///

closeconditionlong = vstoplongclosecondition or DN

if (closeconditionlong)

strategy.close("Long")

// ///Short Entry///

// shortcondition = vstopshortcondition and DN

// if (shortcondition)

// strategy.entry("Short", strategy.short)

// ///Short exit///

// closeconditionshort = vstopshortclosecondition or UP

// if (closeconditionshort)

// strategy.close("Short")