Overview

This article mainly describes a trading strategy that combines the Relative Strength Index (RSI) and Fibonacci retracement levels. The strategy first calculates the key Fibonacci retracement levels based on the historical price dynamics over a certain period, and then uses the RSI indicator to judge whether the market is overbought or oversold near the retracement levels to generate trading signals.

Strategy Principle

The main principles behind this strategy are:

Use price data over a certain period (e.g. 200 bars) to calculate the median price, standard deviation and key Fibonacci retracement levels (e.g. 0.764) for that period;

When the price approaches the upper or lower retracement levels, use the RSI indicator to determine if there is overbought or oversold condition around those levels;

If the RSI indicator shows overbought or oversold signals, long or short signals will be generated around the retracement levels;

Set stop loss and take profit to close positions when price exceeds preset levels or stop loss is triggered.

The above is the basic workflow for identifying trading opportunities in this strategy.

Advantage Analysis

Compared to using RSI or Fibonacci alone, this combined strategy has the following advantages:

Double indicator filtering can reduce false signals and improve signal quality;

Trading at Fibonacci retracement levels is a classic technical analysis technique;

With stop loss and take profit in pace, max loss per trade can be effectively controlled;

Parameters can be optimized for different periods and products.

Risk Analysis

There are also some risks to note for this strategy:

Probability for a reversal at key levels is not 100%, need to combine with price action;

Single period RSI may generate false signals from dead cat bounces, consider multiple timeframe validation;

Loose stop loss setting may increase losses;

Stops may be run through during volatile price swings. Wider stops should be considered.

These risks can be managed through parameter tuning, optimizing indicator combinations etc.

Optimization Directions

Areas for further optimizations include:

Add volume indicator to avoid false breakouts with low volume;

Consider Bollinger Bands for signals from band breakouts;

Build machine learning models to automatically detect high quality trading opportunities;

Use genetic algorithms for auto parameter tuning and adjusting stop loss/profit levels.

Summary

This article describes in detail a quantitative trading strategy that combines RSI and Fibonacci retracement analysis. By blending dual indicator analysis and classic technical strategies, the strategy improves signal quality under managed risks. Further performance gains can be achieved through ongoing parameter tuning and model optimization.

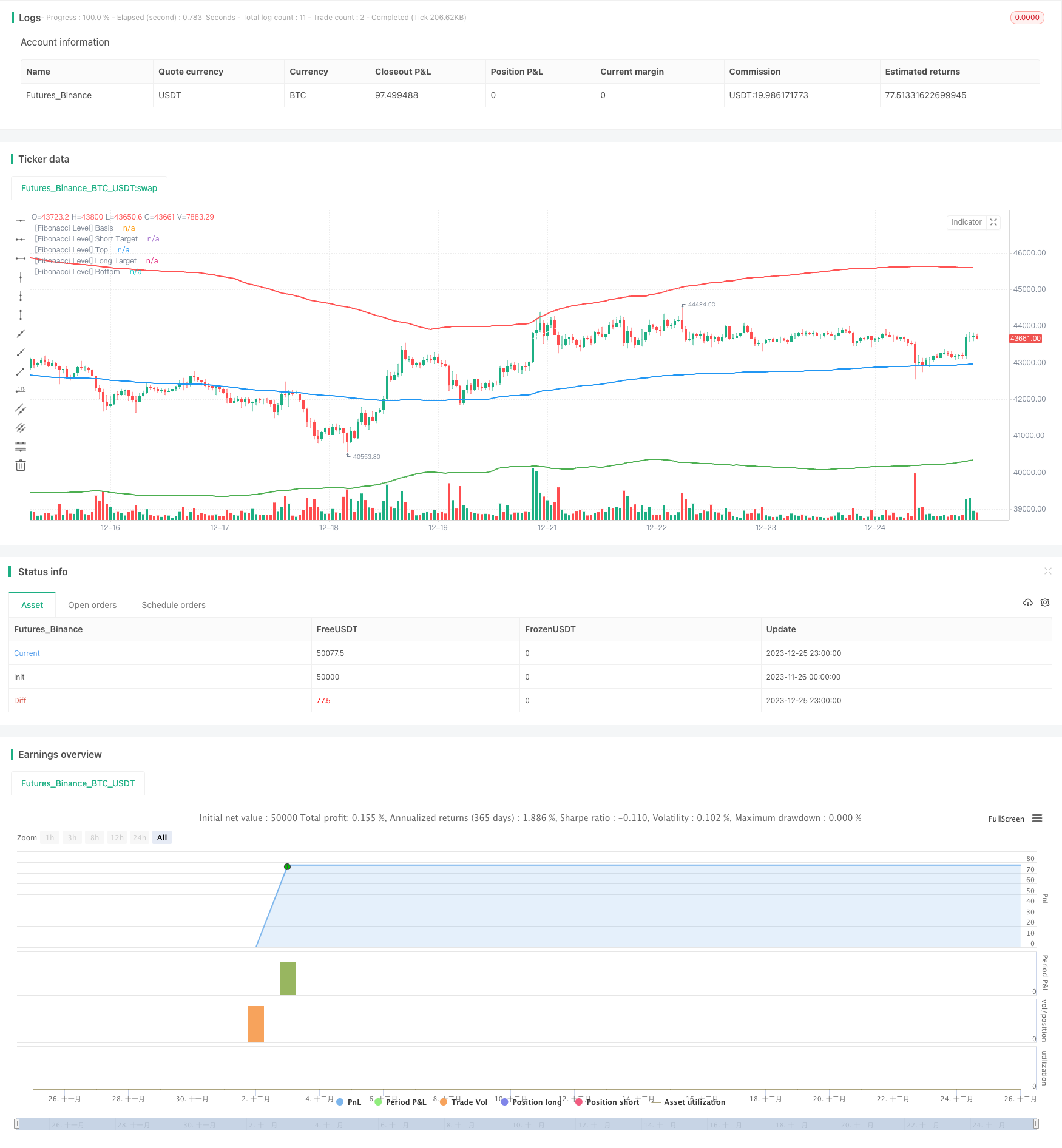

/*backtest

start: 2023-11-26 00:00:00

end: 2023-12-26 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title="Gab Fib + RSI", overlay=true, default_qty_type=strategy.cash, default_qty_value=100000, initial_capital=1000, currency=currency.USD, commission_type=strategy.commission.cash_per_order, commission_value=4)

// Inputs

timeFilter = year >= 2000

// Stop Loss

stop_loss = input(title="SL in % of Instrum. i.e 1.5%=150pips", minval=0, step=0.1, defval=1.5) /100

// RSI Inputs

len = input(title="[RSI] Length", minval=0, step=1, defval=14)

overSold = input(title="[RSI] Over Sold %", defval=30)

overBought = input(title="[RSI] Over Bought %", defval=70)

// Fibonacci Levels

length = input(title="[Fibonacci] Length", defval=200, minval=1)

src = input(hlc3, title="[Fibonacci] Source")

mult = input(title="[Fibonacci] Multiplier", defval=3.0, minval=0.001, maxval=50)

level = input(title="[Fibonacci] Level", defval=764)

// Calculate Fibonacci

basis = vwma(src, length)

dev = mult * stdev(src, length)

fu764= basis + (0.001*level*dev)

fu1= basis + (1*dev)

fd764= basis - (0.001*level*dev)

fd1= basis - (1*dev)

// Calculate RSI

vrsi = rsi(close, len)

// Calculate the Targets

targetUp = fd764

targetDown = fu764

// Actual Targets

bought = strategy.position_size[0] > strategy.position_size[1]

exit_long = valuewhen(bought, targetUp, 0)

sold = strategy.position_size[0] < strategy.position_size[1]

exit_short = valuewhen(sold, targetDown, 0)

// Calculate Stop Losses

sl_long = close * (1-stop_loss)

sl_short = close * (1+stop_loss)

// Conditions to Open Trades

openLong = low < fd1 and crossover(vrsi[1], overSold)

openShort = high > fu1 and crossunder(vrsi[1], overBought)

// Conditions to Close Trades

closeLong = high > exit_long or sl_long

closeShort = low < exit_short or sl_short

//Rounding to MinTick value

roundtargetUp = round_to_mintick(targetUp)

roundtargetDown = round_to_mintick(targetDown)

roundsllong = round_to_mintick(sl_long)

roundslshort = round_to_mintick(sl_short)

// Plots

plot(basis, color=color.blue, linewidth=2, title="[Fibonacci Level] Basis")

plot(fu764, color=color.white, linewidth=1, title="[Fibonacci Level] Short Target")

plot(fu1, color=color.red, linewidth=2, title="[Fibonacci Level] Top")

plot(fd764, color=color.white, linewidth=1, title="[Fibonacci Level] Long Target")

plot(fd1, color=color.green, linewidth=2, title="[Fibonacci Level] Bottom")

// Strategy Orders

if timeFilter

// Entry Orders

strategy.entry(id="buy", long=true, when=openLong and high < targetUp, limit=close, alert_message="buy,"+tostring(syminfo.ticker)+",tp="+tostring(roundtargetUp)+",sl="+tostring(roundsllong))

strategy.entry(id="sell", long=false, when=openShort and low > targetDown, limit=close, alert_message="sell,"+tostring(syminfo.ticker)+",tp="+tostring(roundtargetDown)+",sl="+tostring(roundslshort))

// Exit Orders

strategy.exit(id="closelong", when=closeLong and strategy.position_size > 0, limit=exit_long, stop=sl_long, alert_message="closelong,"+tostring(syminfo.ticker))

strategy.exit(id="closeshort", when=closeShort and strategy.position_size < 0, limit=exit_short, stop=sl_short, alert_message="closeshort,"+tostring(syminfo.ticker))