Volume Weighted Average Price Strategy

Author: ChaoZhang, Date: 2023-12-29 16:31:33Tags:

Overview

The Volume Weighted Average Price (VWAP) strategy is a strategy that tracks the average price of a stock over a specified time. The strategy uses VWAP as a benchmark and takes long or short positions when the price crosses above or below VWAP. It also sets stop loss and take profit conditions to manage trades.

Strategy Logic

The strategy first calculates the typical price (average of high, low and close prices) multiplied by volume, and the sum of volume. Then VWAP is calculated by dividing the sum of typical price-volume product by the sum of volume. When price crosses over VWAP, go long. When price crosses below, go short.

The profit taking condition for long positions is to close when price rises 3% above the entry price. The stop loss condition is when price drops 1% below entry price. Similar conditions apply for short positions.

Advantage Analysis

The main advantages of the VWAP strategy are:

-

Uses the well-recognized VWAP statistic as benchmark for trade signals, making the strategy more effective.

-

Utilizes both vwap signals and stop loss/profit taking, able to profit from trends and limit losses.

-

Simple and clear logic, easy to understand and implement.

Risk Analysis

There are also some risks with this strategy:

-

VWAP cannot predict future prices, so signals may lag.

-

Stop loss may be too wide, increasing potential loss.

-

Longer backtests means more signals, actual performance may differ.

These risks may be reduced through parameter tuning, optimizing stop loss algorithms etc.

Optimization Directions

Some ways to optimize the strategy include:

-

Optimize VWAP parameters to find best calculation period.

-

Test other tracking stop algorithms e.g. moving average stop, parabolic SAR.

-

Combine other indicators to filter VWAP signals, e.g. volume, Bollinger Bands.

Conclusion

In summary, the VWAP strategy utilizes the predictive power of this important statistic, with stop loss/profit taking to achieve long-term positive expectancy. But further optimizations and combination with other strategies are needed to reduce market fluctuation risks for larger profitability.

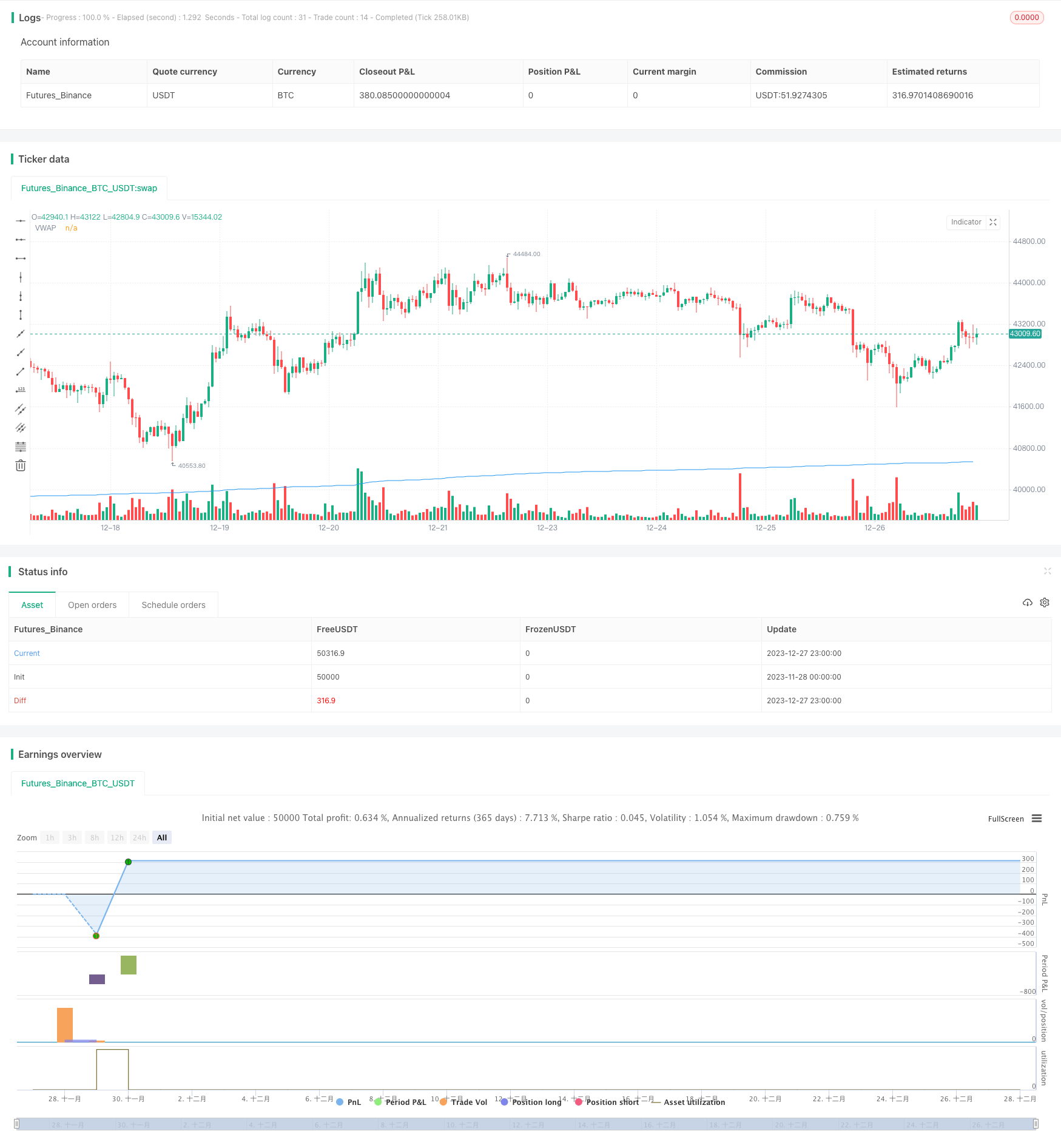

/*backtest

start: 2023-11-28 00:00:00

end: 2023-12-28 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("VWAP Strategy by Royce Mars", overlay=true)

cumulativePeriod = input(14, "Period")

var float cumulativeTypicalPriceVolume = 0.0

var float cumulativeVolume = 0.0

typicalPrice = (high + low + close) / 3

typicalPriceVolume = typicalPrice * volume

cumulativeTypicalPriceVolume := cumulativeTypicalPriceVolume + typicalPriceVolume

cumulativeVolume := cumulativeVolume + volume

vwapValue = cumulativeTypicalPriceVolume / cumulativeVolume

// Buy condition: Price crosses over VWAP

buyCondition = crossover(close, vwapValue)

// Short condition: Price crosses below VWAP

shortCondition = crossunder(close, vwapValue)

// Profit-taking condition for long positions: Sell long position when profit reaches 3%

profitTakingLongCondition = close / strategy.position_avg_price >= 1.03

// Profit-taking condition for short positions: Cover short position when profit reaches 3%

profitTakingShortCondition = close / strategy.position_avg_price <= 0.97

// Stop loss condition for long positions: Sell long position when loss reaches 1%

stopLossLongCondition = close / strategy.position_avg_price <= 0.99

// Stop loss condition for short positions: Cover short position when loss reaches 1%

stopLossShortCondition = close / strategy.position_avg_price >= 1.01

// Strategy Execution

strategy.entry("Buy", strategy.long, when=buyCondition)

strategy.close("Buy", when=shortCondition or profitTakingLongCondition or stopLossLongCondition)

strategy.entry("Short", strategy.short, when=shortCondition)

strategy.close("Short", when=buyCondition or profitTakingShortCondition or stopLossShortCondition)

// Plot VWAP on the chart

plot(vwapValue, color=color.blue, title="VWAP")

- Reverse Linear Regression Strategy

- BankNifty Supertrend Trading Strategy

- Transient Zones Strategy

- Trailing Stop Loss Dual Moving Average Strategy

- Multi Timeframe Momentum Breakout Strategy

- Pivot Point Golden Ratio Buy High Sell Low Strategy

- Turtle Trading Strategy Based on Simple Moving Average

- Dual Moving Average Bollinger Band MACD Trading Strategy

- Bollinger Bands and RSI Crossover Strategy

- Trend Following Strategy Based on QQE and MA

- Quantitative Dual-indicator Strategy

- Momentum Tracking Strategy

- RSI Indicator Improvement Trading Strategy

- Trend Reversal Momentum Indicators Crossover Tracking Strategy

- Multi Timeframe Breakout Strategy

- Momentum and Money Flow Crossroad Cashing Strategy

- Dynamic Take Profit Following Trend Strategy

- 10EMA Double Cross Trend Tracking Strategy

- Dynamic Pivot Point Backtest Strategy

- Dual EMA Crossover Trend Strategy