Dual Moving Average Bollinger Band MACD Trading Strategy

Author: ChaoZhang, Date: 2023-12-29 16:43:01Tags:

Overview

This strategy combines dual moving averages, Bollinger bands and the MACD indicator to set buy and sell conditions for trading the Bank Nifty index on a 5-minute timeframe. It goes long when the MACD line crosses above the signal line and the closing price breaks above the Bollinger band upper line, and goes short when the MACD line crosses below the signal line and the closing price falls below the Bollinger band lower line. By integrating the advantages of multiple indicators, this strategy can identify trends and locate extremum points for efficient trading.

Trading Logic

- Set MACD parameters: Fast length 12, Slow length 26, Signal length 9

- Calculate MACD value: Fast line - Slow line

- Set Bollinger band parameters: Middle band period 20, Standard deviation multiplier 2

- Calculate Bollinger band upper and lower lines: Middle band ± Standard deviation * Multiplier

- Buy condition: MACD line crosses above signal line (golden cross) and close > Upper band

- Sell condition: MACD line crosses below signal line (dead cross) and close < Lower band

- Set take profit and stop loss

- Enter long position: when buy condition holds

- Close long position: take profit or stop loss

- Enter short position: when sell condition holds

- Close short position: take profit or stop loss

The above summarizes the overall trading logic of this strategy.

Advantage Analysis

This is a very practical trend-following strategy with the advantages below:

- MACD identifies trend direction and momentum

- Bollinger band determines overbought and oversold zones, complementing MACD

- Dual moving averages improve judgment accuracy

- Combining multiple indicators improves reliability

- Implementing take profit and stop loss manages risks

- Adjustable parameters adapt to changing market dynamics

In summary, this strategy leverages the strengths of various indicators for accurate judgments and disciplined execution, making it a reliable and controllable trend trading system.

Risk Analysis

Despite its merits, this strategy has certain risks to note:

- Violent market swings may penetrate stops

- Multiple parameters combinations increase misjudgment risks

- High trading frequency from short-term operations increases costs

- Suboptimal parameter tuning fails to capture best entry/exit points

The solutions are:

- Strict stop loss controls single trade loss

- Optimize parameters to improve judgment accuracy

- Adjust timeframe to reduce trade frequency

- Backtest to find optimal parameter combinations

Enhancement Opportunities

There is room for improving this strategy:

- Utilize machine learning to find optimum parameters

- Incorporate adaptive techniques to auto tune parameters

- Integrate more indicators e.g. momentum, volatility metrics

- Add position sizing module to adjust by capital, risk

- Innovate signal rules with custom indicators or formulae

Overall, this strategy has a robust framework. Further refinements via parameter optimization, indicator innovation, adaptive mechanisms etc. can transform it into an even more powerful and consistent system.

Conclusion

This dual moving average Bollinger MACD strategy effectively identifies entry and exit points by combining trend identification and extremum detection. With disciplined execution, configurable risk controls and optimization potential, this is an efficient and consistent trading approach. As continued innovations enhance its capabilities, this strategy provides investors a valuable tool for achieving steady and manageable profits in financial markets.

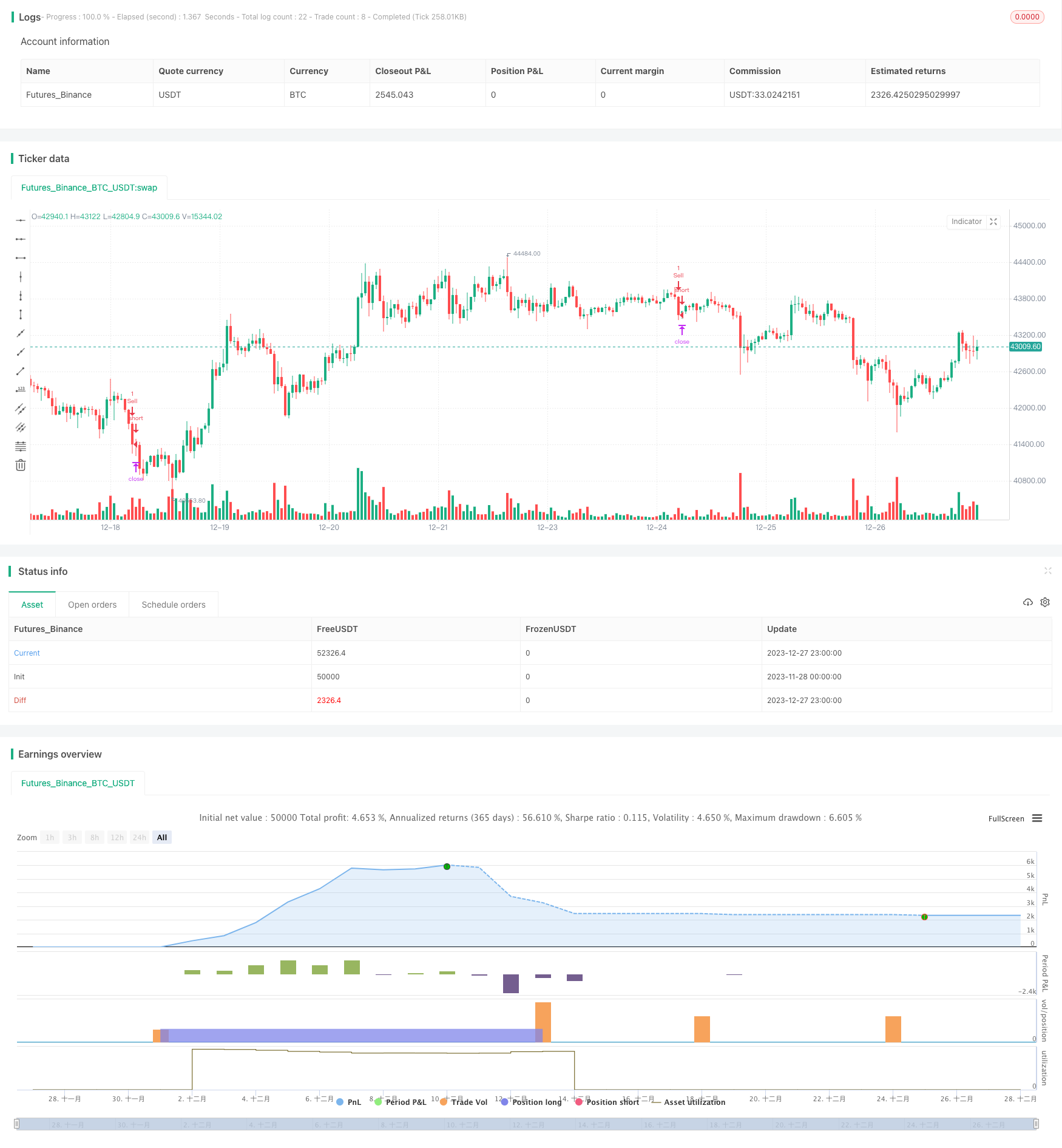

/*backtest

start: 2023-11-28 00:00:00

end: 2023-12-28 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy("Modified MACD and Bollinger Band Strategy", shorttitle="Mod_MACD_BB", overlay=true)

var bool open_buy_position = na

var bool open_sell_position = na

// MACD settings

fast_length = input(12, title="Fast Length")

slow_length = input(26, title="Slow Length")

signal_length = input(9, title="Signal Length")

src = close

[macdLine, signalLine, _] = macd(src, fast_length, slow_length, signal_length)

// Bollinger Band settings

bb_length = input(20, title="Bollinger Band Length")

bb_mult = input(2, title="Bollinger Band Multiplier")

basis = sma(src, bb_length)

dev = bb_mult * stdev(src, bb_length)

upper_band = basis + dev

lower_band = basis - dev

// Define profit target and stop loss

profit_target = input(60, title="Profit Target (Points)")

stop_loss = input(30, title="Stop Loss (Points")

// Buy condition: MACD crosses up the signal line and close is above upper Bollinger Band

buy_condition = crossover(macdLine, signalLine) and close > upper_band

// Sell condition: MACD crosses below the signal line and close is below the lower Bollinger Band

sell_condition = crossunder(macdLine, signalLine) and close < lower_band

// Check for open positions

if (buy_condition)

open_buy_position := true

if (sell_condition)

open_sell_position := true

// Strategy Orders

strategy.entry("Buy", strategy.long, when = buy_condition and not open_sell_position)

strategy.exit("Take Profit/Stop Loss", from_entry = "Buy", limit = close + profit_target, stop = close - stop_loss)

strategy.entry("Sell", strategy.short, when = sell_condition and not open_buy_position)

strategy.exit("Take Profit/Stop Loss", from_entry = "Sell", limit = close - profit_target, stop = close + stop_loss)

// Reset open position status

if (sell_condition)

open_buy_position := na

if (buy_condition)

open_sell_position := na

- Binance OKX is a continuous auto hedge

- Dynamic Breakout Trend Following Strategy

- Transitive Ratio Trading Strategy Based on Kalman Filter and Mean Reversion

- Reverse Linear Regression Strategy

- BankNifty Supertrend Trading Strategy

- Transient Zones Strategy

- Trailing Stop Loss Dual Moving Average Strategy

- Multi Timeframe Momentum Breakout Strategy

- Pivot Point Golden Ratio Buy High Sell Low Strategy

- Turtle Trading Strategy Based on Simple Moving Average

- Bollinger Bands and RSI Crossover Strategy

- Trend Following Strategy Based on QQE and MA

- Volume Weighted Average Price Strategy

- Quantitative Dual-indicator Strategy

- Momentum Tracking Strategy

- RSI Indicator Improvement Trading Strategy

- Trend Reversal Momentum Indicators Crossover Tracking Strategy

- Multi Timeframe Breakout Strategy

- Momentum and Money Flow Crossroad Cashing Strategy

- Dynamic Take Profit Following Trend Strategy