BankNifty Supertrend Trading Strategy

Author: ChaoZhang, Date: 2023-12-29 17:09:57Tags:

Overview

This is a trading strategy based on the 5-minute K-line of BankNifty using the Supertrend indicator. The strategy mainly utilizes the Supertrend indicator to identify trends and combines trading sessions and risk management rules to trade.

Strategy Principle

The strategy first defines input variables such as trading sessions and date ranges. The trading session is set to the Indian trading session from 9:15 am to 3:10 pm.

It then calculates the Supertrend indicator and its direction. The Supertrend indicator can identify the direction of the trend.

At the beginning of each trading session, the strategy waits for 3 candles to form before considering entering a trade. This is to filter false breakouts.

The long signal is when the Supertrend indicator direction changes from down to up; the short signal is when the Supertrend direction changes from up to down.

After entering, stop loss will be set. Both fixed stop loss points and trailing stop loss percentage can be adjusted through input variables.

At the end of the trading session, the strategy will close all open positions.

Advantages of the Strategy

This is a simple trading strategy that uses indicators to identify trends. It has the following advantages:

- Use Supertrend indicator to judge trend direction, which can effectively identify trends

- Combining trading sessions can avoid the most volatile opening and closing session

- Set trailing stop loss to lock in profits

- Many parameters can be adjusted freely through input variables, high adaptability

Risks of the Strategy

The strategy also has some risks:

- Supertrend indicator has lagging, may miss the best entry point

- Single indicator judgment is prone to be affected by false breakouts, win rate may be low

- Does not consider market trend, may diverge from the overall market

- Improper stop loss setting may lead to larger than expected losses

These risks can be reduced by optimizing parameters of the Supertrend indicator or adding other indicator judgments.

Optimization Directions

The strategy can also be optimized in the following aspects:

- Add other indicator judgments to form a combined strategy, improve stability

- Add overall market trend judgment to avoid divergence from the market

- Optimize parameters of Supertrend indicator, find the best length and factor

- Adjust stop loss strategy, like trailing stop loss along with the trend

- Test on different products, find the best match

Conclusion

In summary, this is a Supertrend indicator trading strategy based on the BankNifty 5-minute chart. It utilizes the Supertrend indicator to determine the trend direction and combines trading sessions and risk management rules to trade. Compared to complex quantitative strategies, this strategy has simple and clear rules that are easy to understand and implement. As a sample strategy, it provides a foundation and direction for future optimization and improvement. Through continuous refinement and enhancement, it is hoped that the strategy can become a reliable and profitable quantitative trading strategy.

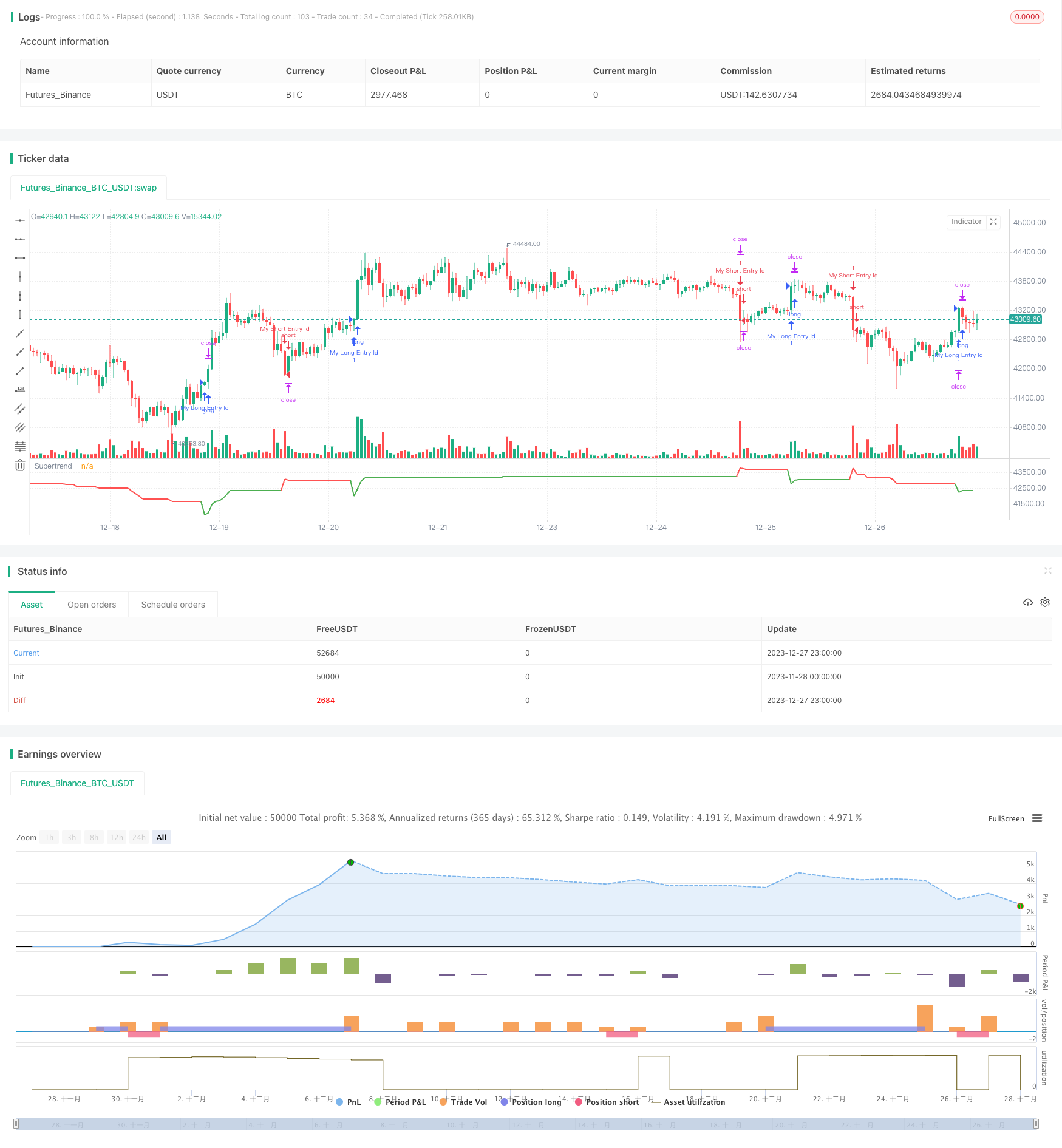

/*backtest

start: 2023-11-28 00:00:00

end: 2023-12-28 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=5

strategy("BankNifty 5min Supertrend Based Strategy, 09:15 Entry with Date Range and Risk Management")

// Session and date range input variables

session = input("0915-1510", "Session", group="Indian Session Time")

start_date = input(title="Start Date", defval=timestamp("01 Jan 2022 00:00:00"), group="Backtest Specific Range")

end_date = input(title="End Date", defval=timestamp("01 Dec 2023 23:59:59"))

atrPeriod = input(50, "ATR Length", group="SuperTrend Setting")

factor = input.float(3.0, "Factor", step=0.1)

useDelay = input(true, "Use Delay?", group="Delay at Session Start")

Delay = useDelay ? input(10, title="Delay N numbers of candle", group="Delay at Session Start") : na

useDelay_stopLoss = input(true, "Use Stoploss Points?", group="Risk Management")

stopLoss = useDelay_stopLoss ? input(100, "Stop Loss Points", group="Risk Management"): na

useDelay_stopLossPerc1 = input(true, "Use Stoploss Trail?", group="Risk Management")

stopLossPerc1 =useDelay_stopLossPerc1 ? input.float(0.1, "Stop Loss Trail%", step=0.1,maxval = 1, group="Risk Management"): na

// Check if current time is within the specified session and date range

inSession = true

[supertrend, direction] = ta.supertrend(factor, atrPeriod)

// Wait for 3 candles to form at the start of every session

var candlesFormed = 0

if inSession and not inSession[1]

candlesFormed := 1

else if inSession and candlesFormed > 0

candlesFormed := candlesFormed + 1

else

candlesFormed := 0

//

// Only enter trades if 3 candles have formed at the start of the session

entryce = (ta.change(direction) < 0) or (candlesFormed >= Delay and direction < 0)

exitce = ta.change(direction) > 0

entrype = (ta.change(direction) > 0) or (candlesFormed >= Delay and direction > 0)

exitpe = ta.change(direction) < 0

var entryPrice = 0.0

if entryce and inSession

// Enter long trade

onePercent = strategy.position_avg_price *stopLossPerc1

entryPrice := close

strategy.entry("My Long Entry Id", strategy.long, comment="long" )

// Set stop loss at x% below entry price

strategy.exit("My Long Exit Id", "My Long Entry Id", stop=(entryPrice - stopLoss),trail_points=onePercent )

if entrype and inSession

onePercent1 = strategy.position_avg_price *stopLossPerc1

entryPrice := close

// Enter short trade

strategy.entry("My Short Entry Id", strategy.short, comment="short")

// Set stop loss at x% above entry price

strategy.exit("My Short Exit Id", "My Short Entry Id", stop=(entryPrice + stopLoss),trail_points=onePercent1)

// Close all trades at end of session

if not inSession and strategy.opentrades > 0

strategy.close_all()

// Plot Supertrend with changing colors

plot(supertrend, title="Supertrend", color=direction == 1 ? color.red : color.green, linewidth=2)

- Bollinger Bands Volume Confirmation Quantitative Trading Strategy

- Parameter Optimized Trend Following Quantitative Strategy

- Moving Vegas Channel Crossover Strategy

- Trend Following Strategy Based on Dynamic Moving Average

- Combo Trend Tracking Strategy

- Nine Types of Moving Average Crossover Strategy

- Binance OKX is a continuous auto hedge

- Dynamic Breakout Trend Following Strategy

- Transitive Ratio Trading Strategy Based on Kalman Filter and Mean Reversion

- Reverse Linear Regression Strategy

- Transient Zones Strategy

- Trailing Stop Loss Dual Moving Average Strategy

- Multi Timeframe Momentum Breakout Strategy

- Pivot Point Golden Ratio Buy High Sell Low Strategy

- Turtle Trading Strategy Based on Simple Moving Average

- Dual Moving Average Bollinger Band MACD Trading Strategy

- Bollinger Bands and RSI Crossover Strategy

- Trend Following Strategy Based on QQE and MA

- Volume Weighted Average Price Strategy

- Quantitative Dual-indicator Strategy