Overview

This strategy is based on the dynamic moving average indicator to track the price trend in real time and generate trading signals when the moving average is broken through. The advantage of this strategy lies in its simple parameter settings, clear signal rules, and suitability for medium-to-long-term holding.

Strategy Logic

This strategy utilizes dynamic moving average indicators including ALMA, EMA, SMA and more. The principle is to go long when the price breaks above the moving average and go short when it breaks below. That is, the moving average serves as a barometer for the price trend, and signals can be generated when a trend reversal occurs.

Specifically, the strategy uses moving averages formed by high and low prices. The low price MA serves as the signal line for long signals, while the high price MA serves as the line for shorts. When the closing price rises above the low price MA, go long. When the close drops below the high price MA, go short.

By judging the price trend with MA and combining with the breakout principle to generate signals, a simple and practical trend following strategy is formed.

Advantages

- Simple parameter settings with MA indicator, easy to operate

- Clear signal rules without false signals

- Flexible MA types to adapt to market changes

- Adjustable MA periods suit different trend cycles

- Multi-timeframe signal validation improves reliability

Risks and Solutions

- MA lag may miss some opportunities

- Shorten MA period or use EMA

- Large swing risks in short term

- Widen stop loss room for flexibility

- Long holding risks, unable to lock profit in time

- Combine other indicators, avoid chasing highs and killing lows

- Combine other indicators, avoid chasing highs and killing lows

Optimization Directions

- Adjust MA type and parameters based on symbol characteristics

- Add auxiliary indicators to improve strategy

- Add stop loss and take profit mechanisms

- Evaluate signal reliability across timeframes

- Utilize machine learning to find better parameters

Conclusion

This strategy judges the trend direction with MA and generates signals based on the breakout principles. It is simple to use and suitable for medium-to-long-term holding. The parameters can also be adjusted to adapt to market changes. Risks from short-term fluctuations and long holding need to be managed with stop loss/profit taking. There is room for improvement by incorporating more indicators and finding optimal parameters through machine learning.

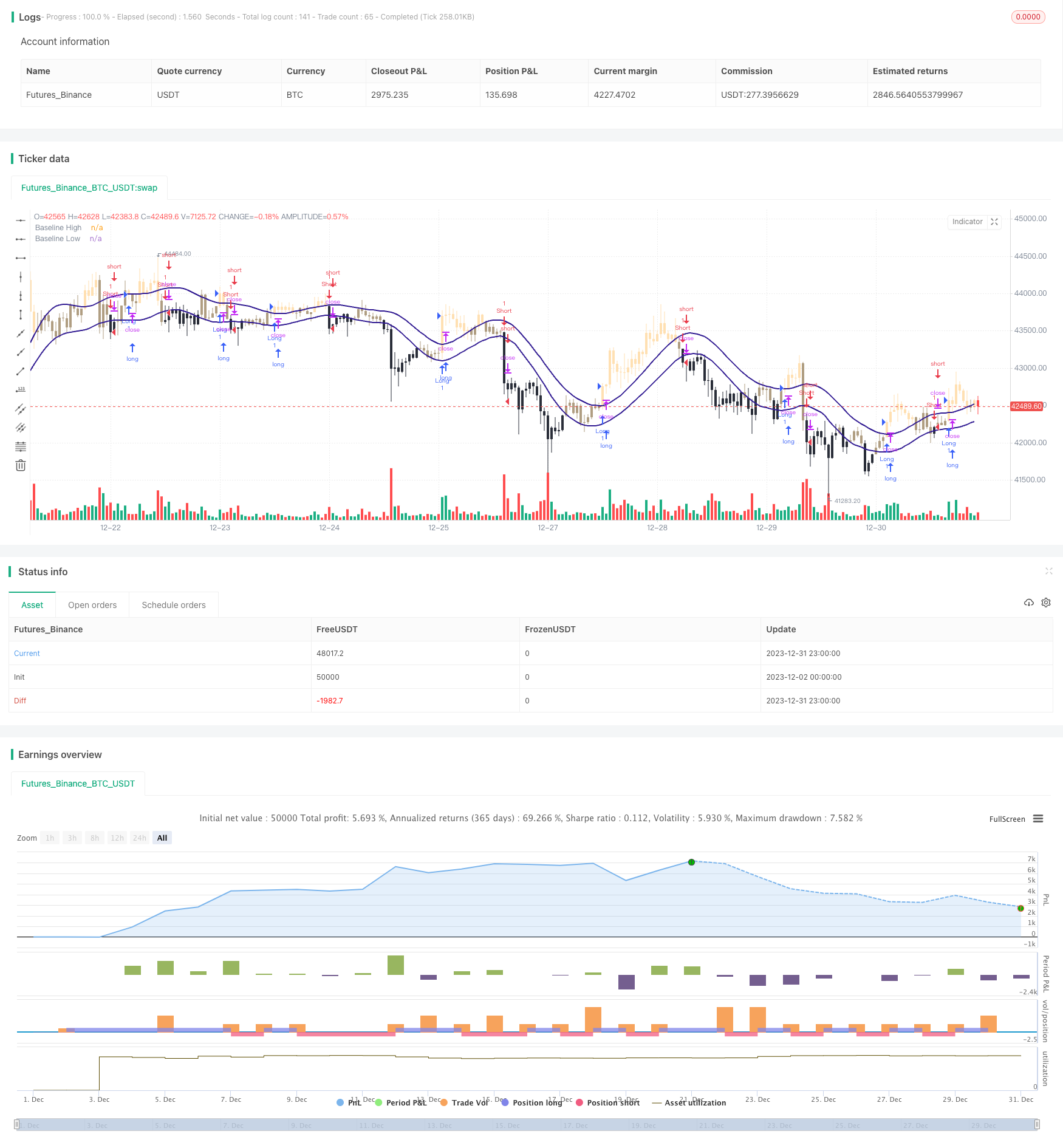

/*backtest

start: 2023-12-02 00:00:00

end: 2024-01-01 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

strategy(title="Baseline Strategy - evo", shorttitle="Baseline", overlay=true)

//INPUTS

mat = input("ALMA", "MA Type", options=["SMA", "EMA", "WMA", "HMA", "VWMA", "RMA", "ALMA"])

baseline = input(55, title="MA Length")

src = input(ohlc4, title="Closing Source")

offset = input(0.85, step=0.05, title="Offset (alma only)")

sigma = input(10, title="Sigma (alma only)")

useCurrentRes = input(true, title="Use Current Resolution")

resCustom = input("1440", title="Timeframe")

showsignals = input(false, title="Show Signals ?")

//BASELINE

baselinehigh =

mat=="SMA" ? sma(high,baseline) :

mat=="EMA" ? ema(high,baseline) :

mat=="WMA" ? wma(high,baseline) :

mat=="HMA" ? wma(2*wma(high, baseline/2)-wma(high, baseline), round(sqrt(baseline))) :

mat=="VWMA" ? vwma(high,baseline) :

mat=="RMA" ? rma(high,baseline) :

mat=="ALMA" ? alma(high, baseline, offset, sigma) : na

baselinelow =

mat=="SMA" ? sma(low,baseline) :

mat=="EMA" ? ema(low,baseline) :

mat=="WMA" ? wma(low,baseline) :

mat=="HMA" ? wma(2*wma(low, baseline/2)-wma(low, baseline), round(sqrt(baseline))) :

mat=="VWMA" ? vwma(low,baseline) :

mat=="RMA" ? rma(low,baseline) :

mat=="ALMA" ? alma(low, baseline, offset, sigma) : na

//RESOLUTION

res = useCurrentRes ? timeframe.period : resCustom

mtfhigh = security(syminfo.tickerid, res, baselinehigh)

mtflow = security(syminfo.tickerid, res, baselinelow)

//PLOTS

plot(mtfhigh, color=color.navy, linewidth=2, transp=0, title="Baseline High")

plot(mtflow, color=color.navy, linewidth=2, transp=0, title="Baseline Low")

long = src > mtfhigh

short = src < mtflow

barcolor(long ? #ffe0b2 : short ? #2a2e39 : not long and not short ? #b09e82 : na, title="BaseLine BarColor")

signal = 0

signal := long ? 1 : short ? 2 : nz(signal[1])

plotshape(showsignals ? (signal != signal[1] and long ? mtflow : na) : na, title="Long", location=location.absolute, size=size.small, style=shape.labelup, text="Long", textcolor=color.black, transp=40, color=#00ff00)

plotshape(showsignals ? (signal != signal[1] and short ? mtfhigh : na) : na, title="Short", location=location.absolute, size=size.small, style=shape.labeldown, text="Short", textcolor=color.white, transp=40, color=#ff0000)

alertcondition(signal != signal[1], title="Trend Change !", message="Trend Change !")

if (long)

strategy.entry("Long", strategy.long)

if (short)

strategy.entry("Short", strategy.short)