Random Fisher Transform Temporary Stop Reverse STOCH Indicator Quantitative Strategy

Author: ChaoZhang, Date: 2024-01-02 11:14:12Tags:

Overview

The core idea of this strategy is to combine the Random Fisher Transform and the Temporary Stop Reverse STOCH indicator to make buy and sell decisions. This strategy is suitable for medium-term operations and can generate decent returns in stable market conditions.

Strategy Principle

This strategy first calculates the standard STOCH indicator, then performs a Fisher transform on it to obtain INVLine. When INVLine crosses above the lower threshold dl, a buy signal is generated. When INVLine crosses below the upper threshold ul, a sell signal is generated. At the same time, this strategy also sets a trailing stop mechanism to lock in profits and reduce losses.

Specifically, the core logic of this strategy is:

- Calculate the STOCH indicator: Use the standard formula to calculate the fast STOCH value of stock

- Fisher transform: Perform a Fisher transform on the STOCH value to obtain INVLine

- Generate trading signals: Buy when INVLine crosses above dl, sell when crossing below ul

- Trailing stop: Enable a temporary stop tracking mechanism for timely stop loss

Advantage Analysis

The main advantages of this strategy are:

- The Fisher transform effectively improves the sensitivity of the STOCH indicator and can detect trend reversal opportunities earlier

- The temporary trailing stop mechanism can effectively control risks and lock in profits

- It is suitable for medium-term operations, especially the currently popular high-frequency quantitative trading

- It performs well in stable market conditions with steady returns

Risk Analysis

This strategy also has some risks:

- The STOCH indicator is prone to generating false signals, which may cause unnecessary trading

- The Fisher transform also amplifies the noise of the STOCH indicator, resulting in more false signals

- It is easy to stop loss in oscillating markets and fail to make sustainable profits

- Relatively short holding periods are required to obtain Alpha. Long holdings are not suitable

To mitigate these risks, consider optimizing the following aspects:

- Adjust STOCH parameters to smooth the curve and reduce noise

- Optimize threshold line positions to reduce false trading probabilities

- Add filter conditions to avoid trading in oscillating markets

- Adjust holding time length to match operating cycle

Optimization Directions

The main directions for optimizing this strategy include:

- Optimize parameters of Fisher transform to smooth INVLine curve

- Optimize STOCH period length to find optimal parameter combinations

- Optimize threshold line parameters to reduce false trading probabilities

- Add volume price confirmation to avoid unnecessary trailing stop

- Add intraday breakout filters to reduce false signals in oscillating markets

- Incorporate trend indicators to avoid counter trend trading

Conclusion

This strategy combines the Random Fisher Transform and the STOCH indicator to implement a simple and practical short-term quantitative strategy. Its advantage lies in the high operation frequency, which is suitable for the currently popular high-frequency quantitative trading. At the same time, this strategy also has some common technical indicator strategy risks. Parameters and filter conditions need to be optimized to reduce risks and improve stability. In general, this strategy provides a good idea for simple quantitative trading and is worth further in-depth research.

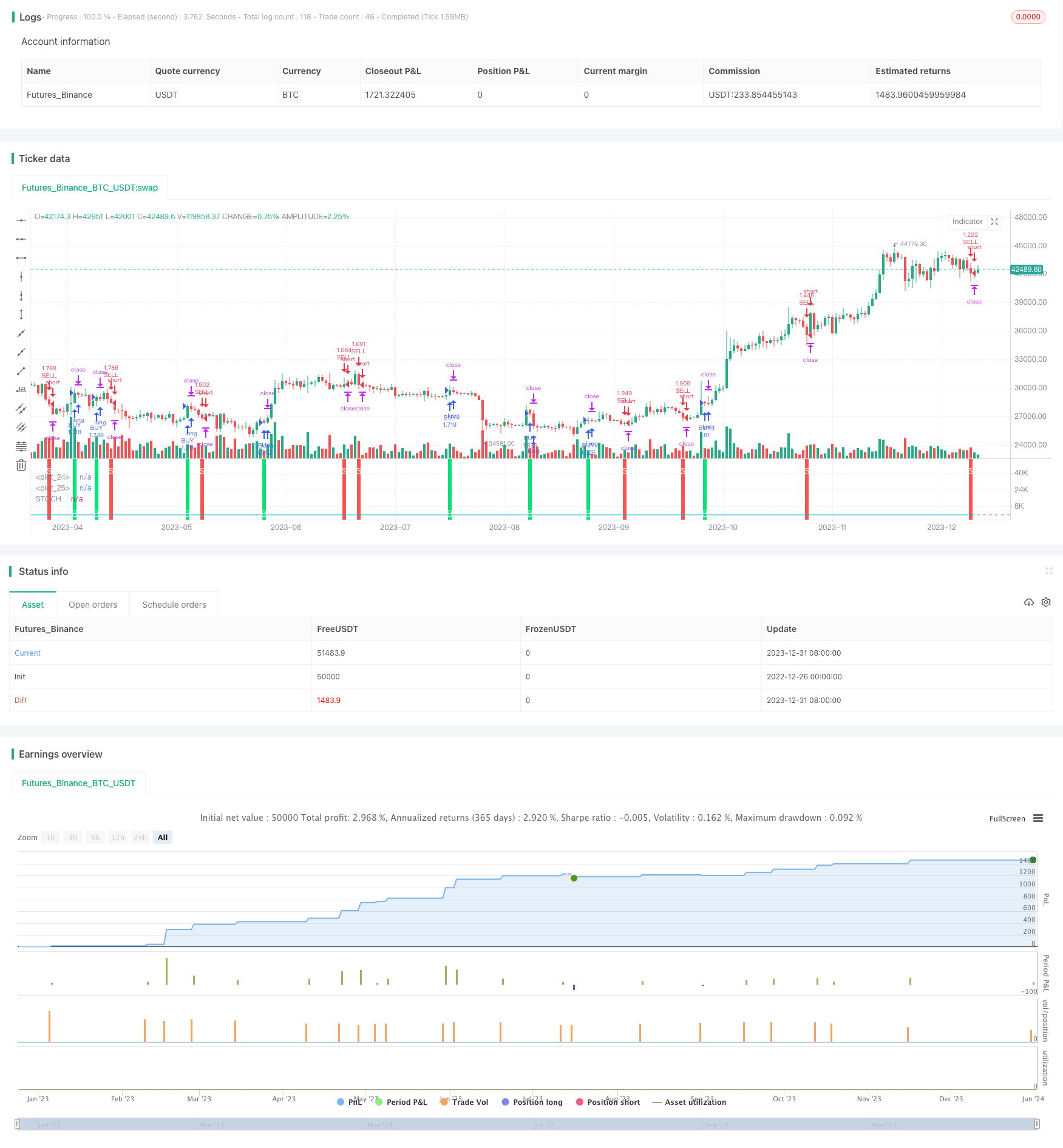

/*backtest

start: 2022-12-26 00:00:00

end: 2024-01-01 00:00:00

period: 1d

basePeriod: 1h

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=3

strategy("IFT Stochastic + Trailing Stop", overlay=false, pyramiding = 0, calc_on_order_fills = false, commission_type = strategy.commission.percent, commission_value = 0.0454, default_qty_type = strategy.percent_of_equity, default_qty_value = 100)

//INPUTS

stochlength=input(19, "STOCH Length")

wmalength=input(4, title="Smooth")

ul = input(0.64,step=0.01, title="UP line")

dl = input(-0.62,step=0.01, title="DOWN line")

uts = input(true, title="Use trailing stop")

tsi = input(title="trailing stop actiation pips",defval=245)

tso = input(title="trailing stop offset pips",defval=20)

//CALCULATIONS

v1=0.1*(stoch(close, high, low, stochlength)-50)

v2=wma(v1, wmalength)

INVLine=(exp(2*v2)-1)/(exp(2*v2)+1)

//CONDITIONS

sell = crossunder(INVLine,ul)? 1 : 0

buy = crossover(INVLine,dl)? 1 : 0

//PLOTS

plot(INVLine, color=aqua, linewidth=1, title="STOCH")

hline(ul, color=red)

hline(dl, color=green)

bgcolor(sell==1? red : na, transp=30, title = "sell signal")

bgcolor(buy==1? lime : na, transp=30, title = "buy signal")

plotchar(buy==1, title="Buy Signal", char='B', location=location.bottom, color=white, transp=0, offset=0)

plotchar(sell==1, title="Sell Signal", char='S', location=location.top, color=white, transp=0, offset=0)

//STRATEGY

strategy.entry("BUY", strategy.long, when = buy==1)

strategy.entry("SELL", strategy.short, when = sell==1)

if (uts)

strategy.entry("BUY", strategy.long, when = buy)

strategy.entry("SELL", strategy.short, when = sell)

strategy.exit("Close BUY with TS","BUY", trail_points = tsi, trail_offset = tso)

strategy.exit("Close SELL with TS","SELL", trail_points = tsi, trail_offset = tso)

- Golden Cross Uptrend Tracking Strategy

- Dual EMA Crossover Oscillation Tracking Strategy

- Stiffness Breakthrough Strategy

- Sideways Breakthrough Oscillation Strategy

- Quantitative Trading Strategy Based on RSI Indicator and Engulfing Pattern

- Bollinger Bands ATR Trailing Stop Strategy

- Daily Breakout Strategy

- Signal-to-Noise Moving Average Trading Strategy Based on Quantitative Trading

- Momentum Crossover Moving Average and MACD Filter Heikin-Ashi Candlestick Strategy

- Strategy of Synthesis between Multiple Relative Strength Indicators

- Adaptive Stop Loss Rail Strategy

- Bollinger Bands Volume Confirmation Quantitative Trading Strategy

- Parameter Optimized Trend Following Quantitative Strategy

- Moving Vegas Channel Crossover Strategy

- Trend Following Strategy Based on Dynamic Moving Average

- Combo Trend Tracking Strategy

- Nine Types of Moving Average Crossover Strategy

- Binance OKX is a continuous auto hedge

- Dynamic Breakout Trend Following Strategy

- Transitive Ratio Trading Strategy Based on Kalman Filter and Mean Reversion