概述

此策略结合使用玻尔带指标和平均真实波幅(ATR)指标,形成具有尾随止损功能的突破交易策略。当价格穿过指定标准差的玻尔带上轨或下轨时,发出交易信号。同时,使用ATR指标计算止损位和止盈位,实现盈亏比例控制。此外,策略还具有时间过滤和参数优化等功能。

策略原理

第一步,计算中轨线、上轨线和下轨线。中轨线为价格的简单移动平均线SMA,上下轨线为价格标准差的整数倍。当价格从下轨线向上突破时,做多;从上轨线向下突破时,做空。

第二步,计算ATR指标。ATR指标反映价格的平均波动幅度。根据ATR数值设定长仓止损位和短仓止损位。同时,根据ATR数值设定止盈位置,实现盈亏比例控制。

第三步,使用时间过滤器,只在指定的时间段交易,避免重大新闻事件的剧烈波动。

第四步, trailing stop机制。根据最新ATR位置,实时调整止损位,锁定更多利润。

优势分析

玻尔带指标本身反映价格中枢,比单一移动平均线更有效;

ATR止损使每单盈亏比例可控,有效控制风险;

trailing stop可根据市场波动自动调整,锁定更多利润;

策略参数丰富,可自定义个性化组合。

风险分析

大盘震荡调整时,容易出现多次小额亏损;

玻尔带突破做反转,可能失败;

夜间和重大新闻时段交易风险大,须注意避开。

对策: 1. 严格遵守风险管理原则,控制单笔亏损; 2. 优化参数,提高胜率; 3. 使用时间过滤器规避高风险时段。

优化方向

- 测试不同参数组合优化配置

- 增加热度指标如OBV选时

- 增加机器学习模块优化

总结

本策略综合运用玻尔带指标判断趋势中枢和突破方向,ATR指标计算止盈止损保证盈亏比,以及尾随止损锁定利润。策略优势在于高度可定制,风险可控,适合短线 Intraday Trading。参数优化和机器学习可进一步提升策略胜率和盈利能力。

策略源码

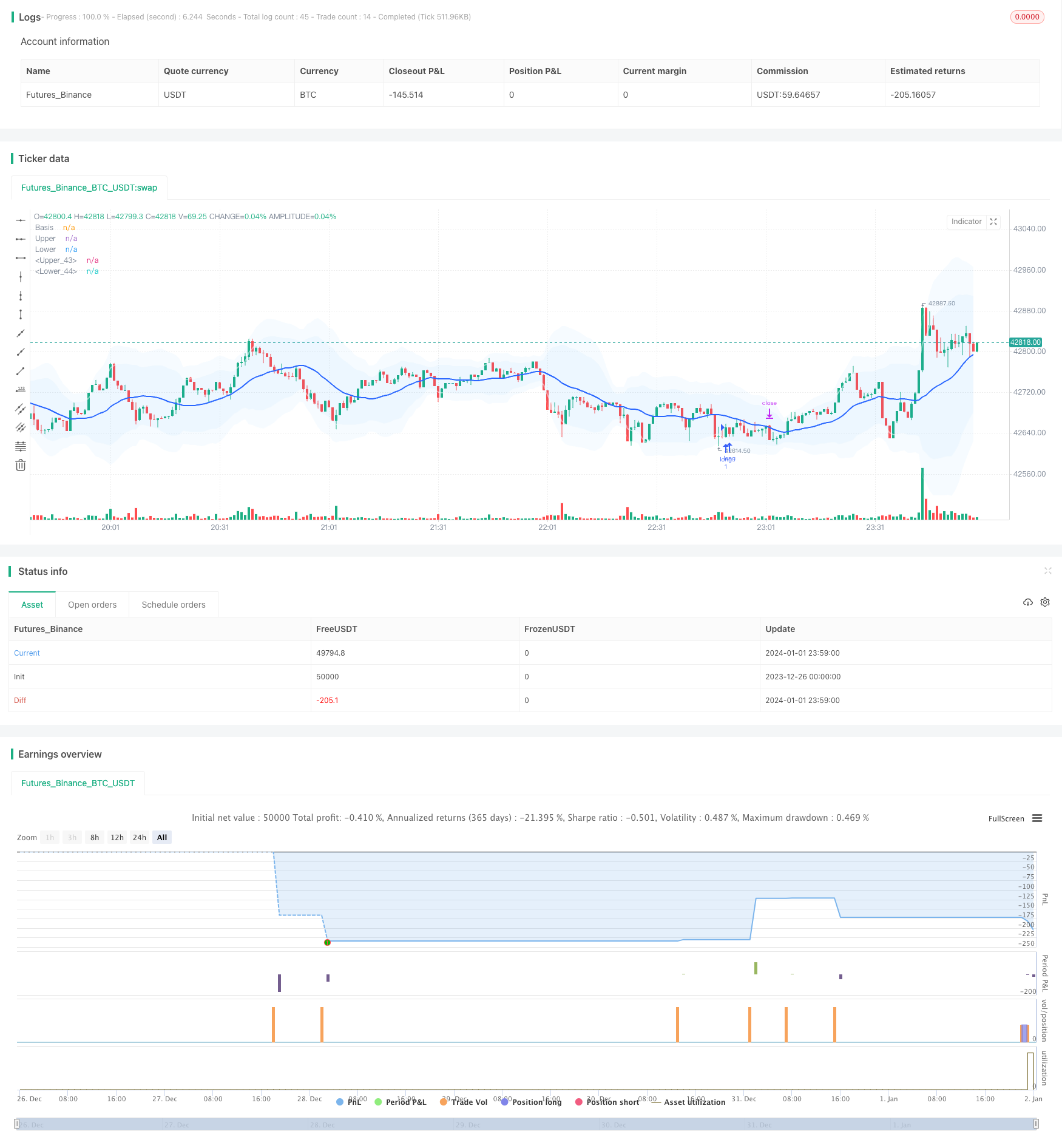

/*backtest

start: 2023-12-26 00:00:00

end: 2024-01-02 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © sadeq_haddadi

//@version=5

strategy('Bollinger Bands + ATR / trail- V2', overlay=true ) // Interactive Brokers rate)

//date and time

startDate = input(title="Start Date", defval=timestamp("01 Aug 2023 00:00 +0000"), tooltip="Date & time to begin analysis",group = 'Time Filter')

endDate = input(title="End Date", defval=timestamp("1 Jan 2099 00:00 +0000"), tooltip="Date & time to stop analysis")

timeSession = input(title="Time Session To Analyze", defval="0300-1700", tooltip="Time session to analyze")

inSession(sess) => true

// indicators

length = input.int(20, minval=1,group = 'Bollinger Band')

maType = input.string("SMA", "Basis MA Type", options = ["SMA", "EMA", "SMMA (RMA)", "WMA", "VWMA"])

src = input(close, title="Source")

mult1 = input.float(2.0, minval=0.001, maxval=50, title="StdDev1")

mult2 = input.float(3.0, minval=0.001, maxval=50, title="StdDev2")

ma(source, length, _type) =>

switch _type

"SMA" => ta.sma(source, length)

"EMA" => ta.ema(source, length)

"SMMA (RMA)" => ta.rma(source, length)

"WMA" => ta.wma(source, length)

"VWMA" => ta.vwma(source, length)

basis = ma(src, length, maType)

dev1 = mult1 * ta.stdev(src, length)

dev2 = mult2 * ta.stdev(src, length)

upper1 = basis + dev1

lower1 = basis - dev1

upper2 = basis + dev2

lower2 = basis - dev2

offset = input.int(0, "Offset", minval = -500, maxval = 500)

plot(basis, "Basis", color=#2962FF, offset = offset,linewidth=2)

p1 = plot(upper1, "Upper", color=color.new(color.white,50), offset = offset,linewidth=2)

p2 = plot(lower1, "Lower", color=color.new(color.white,50), offset = offset,linewidth=2)

p3 = plot(upper2, "Upper", color=color.new(color.white,80), offset = offset,linewidth=1)

p4 = plot(lower2, "Lower", color=color.new(color.white,80), offset = offset,linewidth=1)

fill(p1, p2, title = "Background", color=color.rgb(33, 150, 243, 95))

fill(p3, p4, title = "Background", color=color.rgb(33, 150, 243, 95))

show_crosses = input(false, "Show Cross the Bands?")

plotshape(show_crosses and ta.crossover(close, upper2) ? src : na, "S", style = shape.triangledown, location =location.abovebar, color = color.yellow, size = size.tiny)

plotshape(show_crosses and ta.crossunder(low, lower2) ? src : na ,"L", style = shape.triangleup, location = location.belowbar, color = color.purple, size = size.tiny)

second_entry = input(true, "Show second deviation entry point?")

//atr

length_ATR = input.int(title="Length", defval=5, minval=1,group = 'ATR')

smoothing = input.string(title="Smoothing", defval="RMA", options=["RMA", "SMA", "EMA", "WMA"])

m = input.float(1, "Multiplier")

src1 = input(high)

src2 = input(low)

pline = input.bool(title = 'show ATR lines ?', defval=false)

ma_function(source, length_ATR) =>

if smoothing == "RMA"

ta.rma(source, length_ATR)

else

if smoothing == "SMA"

ta.sma(source, length_ATR)

else

if smoothing == "EMA"

ta.ema(source, length_ATR)

else

ta.wma(source, length_ATR)

a = ma_function(ta.tr(true), length_ATR) * m

x = ma_function(ta.tr(true), length_ATR) * m + src1

x2 = src2 - ma_function(ta.tr(true), length_ATR) * m

PP1 = plot(pline ? x :na , title = "ATR Short Stop Loss", color= color.new(color.red,20) )

PP2 = plot(pline ? x2:na , title = "ATR Long Stop Loss", color=color.new(color.green,20) )

Tp_to_Sl = input.float(1.5, "TP/SL")

candle_size = input.float(10, "candle/pip")

distance_source = input.float(1.5, "distance to midline/pip")

//strategy

buyCondition = low[2] < lower1 and ta.crossover(close[1], lower1) and strategy.position_size == 0 and (close[1] - open[1]) < candle_size * 0.0001 and close > open and ( basis - close) > distance_source * 0.0001

sellCondition = high[2] > upper1 and ta.crossunder(close[1], upper1) and strategy.position_size == 0 and (open[1] - close[1]) < candle_size * 0.0001 and close < open and (close - basis) > distance_source * 0.0001

//

buyCondition2 = low[2] < lower2 and ta.crossover(close[1], lower2) and (close[1] - open[1]) < candle_size * 0.0001 and close > open and ( basis - close) > distance_source * 0.0001

sellCondition2 = high[2] > upper2 and ta.crossunder(close[1], upper2) and (open[1] - close[1]) < candle_size * 0.0001 and close < open and (close - basis) > distance_source * 0.0001

plotshape(second_entry and sellCondition2 ? src : na, "S", style = shape.triangledown, location =location.abovebar, color = color.rgb(241, 153, 177), size = size.tiny)

plotshape(second_entry and buyCondition2 ? src : na ,"L", style = shape.triangleup, location = location.belowbar, color = color.rgb(177, 230, 168), size = size.tiny)

//

since_buy =ta.barssince(buyCondition)

since_sell =ta.barssince(sellCondition)

entry_price = ta.valuewhen(buyCondition or sellCondition, src, 0)

sl_long = ta.valuewhen(buyCondition, x2[1], 0)

sl_short = ta.valuewhen(sellCondition, x[1], 0)

buyprofit = entry_price + (Tp_to_Sl*( entry_price - sl_long))

sellprofit= entry_price + (Tp_to_Sl*( entry_price - sl_short))

//alert_massage = "new strategy position is {{strategy.position_size}}"

//prof = ta.crossover(high,upper1)

//buyexit=ta.valuewhen(prof,upper1,0)

if buyCondition and inSession(timeSession)

strategy.entry( id = "long", direction = strategy.long , alert_message='Open Long Position' )

if sellCondition and inSession(timeSession)

strategy.entry(id= "short", direction = strategy.short, alert_message='Open Short Position')

//trail-stop loss

use_trailing = input.bool(title = 'use trailing stop loss?', defval=true)

pricestop_long=0.00

pricestop_short=100000.00

if (strategy.position_size > 0)

if use_trailing == false

pricestop_long := sl_long

else

pricestop_long := math.max (x2, pricestop_long[1]) //trail - long

if (strategy.position_size < 0)

if use_trailing == false

pricestop_short := sl_short

else

pricestop_short := math.min (x, pricestop_short[1]) // trail - short

if strategy.position_size > 0

strategy.exit(id = 'close', limit = buyprofit , stop = pricestop_long )

if strategy.position_size < 0

strategy.exit(id = 'close', limit = sellprofit , stop = pricestop_short )

alertcondition(buyCondition or sellCondition, 'Enter_position')

更多内容

- 动量指标RSI捕捉反转交易策略

- 双波动带截断策略

- 基于 T3 和 ATR 的自动跟踪趋势策略

- 基于ATR通道的破口踏入趋势策略

- MacD200日均线信号交叉交易策略

- 黄金交叉多头趋势跟踪策略

- 双EMA黄金交叉震荡追踪策略

- 刚性突破策略

- 双边突破震荡策略

- 基于RSI指标和包容涨跌形态的量化交易策略

- 日K线突破策略

- 基于信噪比和均线的量化交易策略

- 动量均线交叉和MACD过滤的海肯阿什蜡烛策略

- 多重RSI指标聚合策略

- 随机Fisher变换临时停止反转STOCH指标量化策略

- 自适应止损轨道策略

- 基于布林带和交易量的双重确认量化交易策略

- 基于参数优化的趋势跟踪型量化策略

- 移動的Vegas通道穿越策略

- 基于动态均线的趋势跟踪策略