Signal-to-Noise Moving Average Trading Strategy Based on Quantitative Trading

Author: ChaoZhang, Date: 2024-01-02 12:24:35Tags:

I. Strategy Name

Signal-to-Noise Moving Average Trading Strategy

II. Strategy Overview

This strategy realizes quantitative trading by calculating the signal-to-noise ratio over a certain period and combining it with moving average trading signals. The basic idea is:

- Calculate the signal-to-noise ratio over a certain period (adjustable)

- Apply moving average to smooth the signal-to-noise ratio

- Compare current signal-to-noise ratio with moving average value to generate trading signals

- Long or short based on trading signals

III. Strategy Principle

- The formula for calculating signal-to-noise ratio (StN) is: StN = -10*log(Σ(1/close)/n), where n is the length of the period

- Apply Simple Moving Average (SMA) to the signal-to-noise ratio to obtain smoothed StN

- Compare current StN with smoothed SMAStN: (1) If SMAStN > StN, go short (2) If SMAStN < StN, go long (3) Otherwise, close position

IV. Advantage Analysis

The main advantages of this strategy are:

- StN can judge market fluctuation and risk, SMA has noise reduction capability

- Combining StN to judge market risk and SMA to generate trading signals makes use of the advantages of different indicators

- Adjustable parameters to adapt to different market conditions

- Stdout signals directly indicate long or short, intuitive judgment of market characteristics

V. Risk Analysis

There are also some risks with this strategy:

- Crossing judgment between StN and MA exists deviation risk

- Improper period settings may cause false signals

- Relative fewer short opportunities, optimizable via parameter adjustment

- Extreme fluctuations caused by black swan events may trigger stop loss

Solutions:

- Adjust MA parameters to avoid over-smoothing

- Optimize period parameters and test adaptability in different markets

- Adjust short conditions to provide more short opportunities

- Set stop loss to control maximum losses

VI. Optimization Direction

The strategy can be optimized in the following ways:

- Test combination of more types of moving averages

- Add stop loss mechanism to control risks

- Add position management, adjust positions based on fluctuations

- Incorporate more factors to improve stability

- Use machine learning methods to automatically optimize parameters

VII. Summary

This strategy realizes quantitative trading by judging market risk via signal-to-noise ratio and generating trading signals from moving average. Compared to single technical indicators, this strategy integrates the advantages of both StN and SMA to improve stability while controlling risks. With parameter optimization and machine learning, this strategy has great potential for improvement and is a reliable and effective quantitative trading strategy.

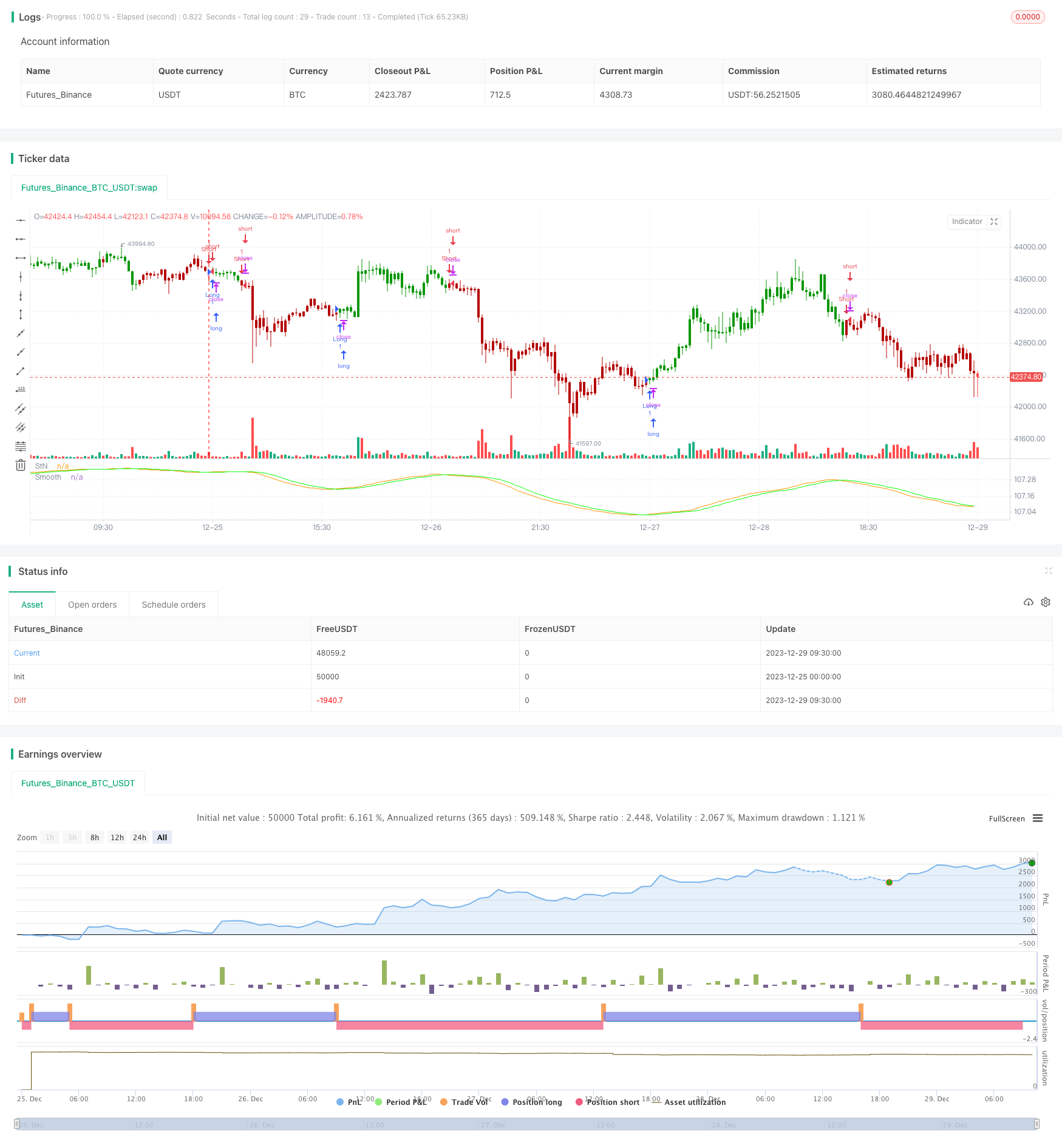

/*backtest

start: 2023-12-25 00:00:00

end: 2023-12-29 10:00:00

period: 30m

basePeriod: 15m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

////////////////////////////////////////////////////////////

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © HPotter 05/01/2021

// The signal-to-noise (S/N) ratio.

// And Simple Moving Average.

// Thank you for idea BlockchainYahoo

//

// WARNING:

// - For purpose educate only

// - This script to change bars colors.

////////////////////////////////////////////////////////////

SignalToNoise(length) =>

StN = 0.0

for i = 1 to length-1

StN := StN + (1/close[i])/length

StN := -10*log(StN)

strategy(title="Backtest Signal To Noise ", shorttitle="StoN", overlay=false)

length = input(title="Days", type=input.integer, defval=21, minval=2)

Smooth = input(title="Smooth", type=input.integer, defval=7, minval=2)

reverse = input(false, title="Trade reverse")

StN = SignalToNoise(length)

SMAStN = sma(StN, Smooth)

pos = iff(SMAStN[1] > StN[1] , -1,

iff(SMAStN[1] < StN[1], 1, 0))

possig = iff(reverse and pos == 1, -1,

iff(reverse and pos == -1 , 1, pos))

if (possig == 1)

strategy.entry("Long", strategy.long)

if (possig == -1)

strategy.entry("Short", strategy.short)

if (possig == 0)

strategy.close_all()

barcolor(possig == -1 ? #b50404: possig == 1 ? #079605 : #0536b3 )

plot(StN, title='StN' )

plot(SMAStN, title='Smooth', color=#00ff00)

- Automatic Tracking Trend Strategy Based on T3 and ATR

- ATR Channel Breakout Trend-following Strategy

- MACD 200 Day Moving Average Crossover Trading Strategy

- Golden Cross Uptrend Tracking Strategy

- Dual EMA Crossover Oscillation Tracking Strategy

- Stiffness Breakthrough Strategy

- Sideways Breakthrough Oscillation Strategy

- Quantitative Trading Strategy Based on RSI Indicator and Engulfing Pattern

- Bollinger Bands ATR Trailing Stop Strategy

- Daily Breakout Strategy

- Momentum Crossover Moving Average and MACD Filter Heikin-Ashi Candlestick Strategy

- Strategy of Synthesis between Multiple Relative Strength Indicators

- Random Fisher Transform Temporary Stop Reverse STOCH Indicator Quantitative Strategy

- Adaptive Stop Loss Rail Strategy

- Bollinger Bands Volume Confirmation Quantitative Trading Strategy

- Parameter Optimized Trend Following Quantitative Strategy

- Moving Vegas Channel Crossover Strategy

- Trend Following Strategy Based on Dynamic Moving Average

- Combo Trend Tracking Strategy

- Nine Types of Moving Average Crossover Strategy