MACD 200 Day Moving Average Crossover Trading Strategy

Author: ChaoZhang, Date: 2024-01-03 11:50:56Tags:

Overview

This trading strategy is a quantitative strategy based on the MACD indicator’s 200-day moving average crossover operation. It combines the dual functions of the MACD indicator to judge market buy and sell signals and the 200-day moving average to judge market trends, aiming to discover more precise entry and exit timing.

Strategy Principle

There are two key points to this strategy:

-

MACD indicator’s fast and slow line crossovers generate buy and sell signals. When the fast line breaks through the slow line upward, a buy signal is generated. When the fast line breaks through the slow line downward, a sell signal is generated.

-

The 200-day moving average judges the overall market trend. Prices above the 200-day moving average indicate a bull market, and below indicate a bear market. Buy signals are only acted upon in a bull market, and sell signals only in a bear market.

According to these two points, the specific trading rules of this strategy are:

When the MACD fast line breaks through the MACD slow line upward, the histogram is negative, and the price is above the 200-day moving average, a buy operation is made. When the MACD fast line breaks downward through the slow line, the histogram is positive, and the price is below the 200-day moving average, a sell operation is made.

Advantage Analysis

-

The dual confirmation improves the stability and success rate of the strategy. MACD judges the buy and sell signals, and the 200-day moving average judges the market trend. The dual confirmation can filter out some trading signals with greater uncertainty.

-

In a strongly trending market, this strategy can bring relatively high profits. Especially in a bull market, it can quickly capture price upside opportunities.

-

The MACD indicator is also relatively sensitive to getting out of consolidation phases. When the price ends a long period of consolidation and enters a trending phase, this strategy can quickly capture the new trend direction.

Risk Analysis

-

This strategy is quite sensitive to parameter settings. Improper MACD indicator parameter settings may cause false signals.

-

Near trend turning points, MACD signals tend to produce more errors. At this time, there may be a larger drawdown in the strategy’s profitability.

-

When prices are in a long period of consolidation, this strategy cannot determine a clear trend direction, which leads to increased fluctuation in profit/loss and longer drawdown times.

Optimization

-

Different parameter combinations can be tested to find MACD parameters that produce more accurate signals.

-

Consider adding confirmation from other technical indicators like RSI and KD to form a consensus of multiple indicators, thereby increasing the reliability of the strategy.

-

Set stop loss points to control maximum drawdown. Immediately stop loss when prices make a significant reversal, which can effectively avoid enlarging losses.

Conclusion

The MACD 200-day moving average crossover strategy combines the dual functions of trend judgment and trading signal judgment, which can effectively improve profitability probability. It is a relatively robust and reliable quantitative trading strategy. But this strategy also relies somewhat on parameters and market conditions. Continued optimization and testing can further enhance the stable profit-generating ability of the strategy.

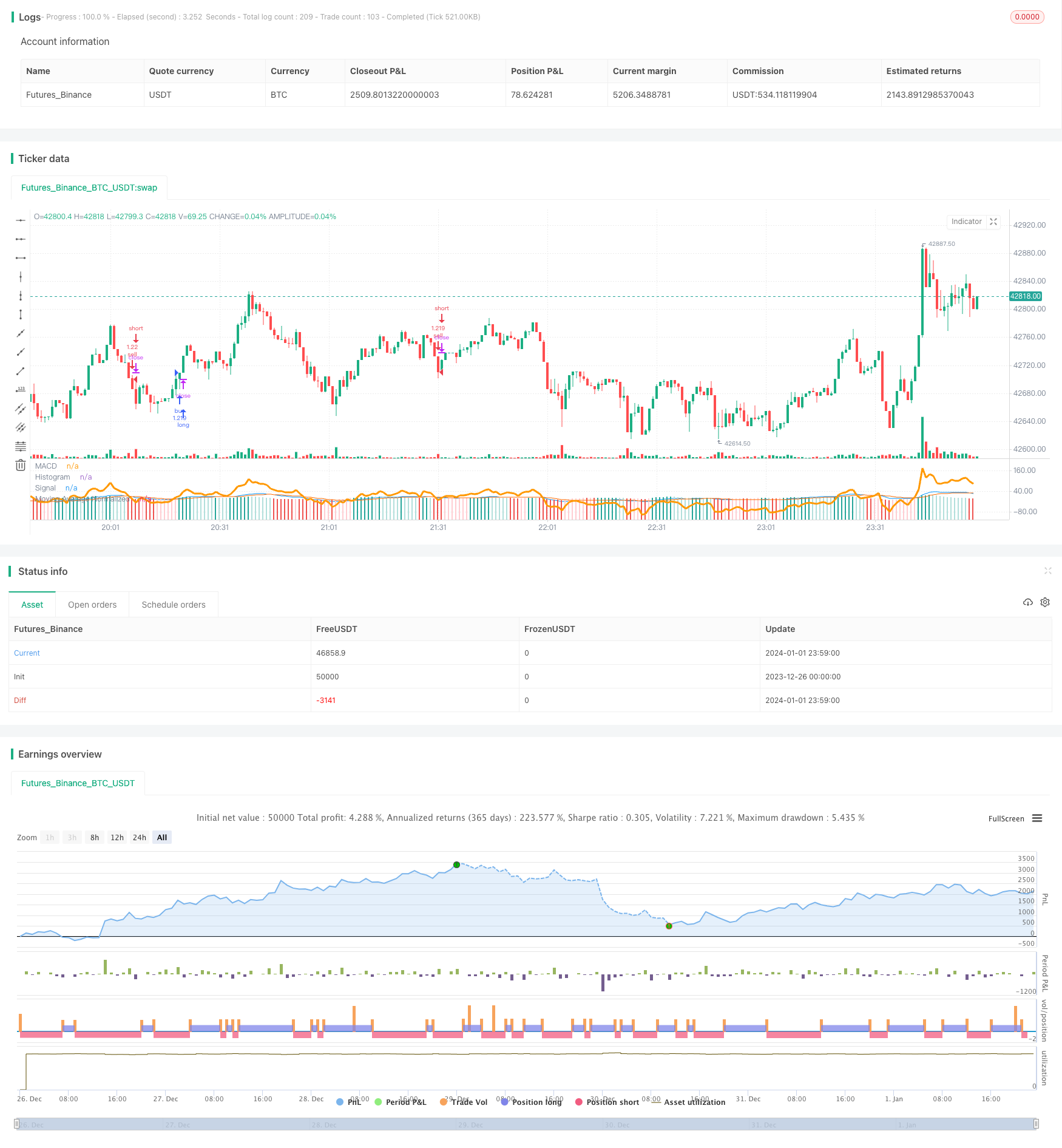

/*backtest

start: 2023-12-26 00:00:00

end: 2024-01-02 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © x11joe

//@version=4

//This strategy is based on a youtube strategy that suggested I do this...so I did!

strategy(title="MacD 200 Day Moving Average Signal Crossover Strategy", overlay=false, precision=2,commission_value=0.26, initial_capital=10000, currency=currency.USD, default_qty_type=strategy.percent_of_equity, default_qty_value=100)

// Getting inputs

fast_length = input(title="Fast Length", type=input.integer, defval=12)

slow_length = input(title="Slow Length", type=input.integer, defval=26)

src = input(title="Source", type=input.source, defval=close)

signal_length = input(title="Signal Smoothing", type=input.integer, minval = 1, maxval = 50, defval = 9)

sma_source = input(title="Simple MA(Oscillator)", type=input.bool, defval=false)

sma_signal = input(title="Simple MA(Signal Line)", type=input.bool, defval=false)

// Plot colors

col_grow_above = #26A69A

col_grow_below = #FFCDD2

col_fall_above = #B2DFDB

col_fall_below = #EF5350

col_macd = #0094ff

col_signal = #ff6a00

// Calculating

fast_ma = sma_source ? sma(src, fast_length) : ema(src, fast_length)

slow_ma = sma_source ? sma(src, slow_length) : ema(src, slow_length)

macd = fast_ma - slow_ma

signal = sma_signal ? sma(macd, signal_length) : ema(macd, signal_length)

hist = macd - signal

moving_avg_length = input(title="Moving Average Length", type=input.integer, defval=200)

moving_avg = sma(close,moving_avg_length)

moving_avg_normalized = close - moving_avg

plot(moving_avg_normalized, title="Moving Average Normalized", style=plot.style_line, color=color.orange,linewidth=3)

plot(hist, title="Histogram", style=plot.style_columns, color=(hist>=0 ? (hist[1] < hist ? col_grow_above : col_fall_above) : (hist[1] < hist ? col_grow_below : col_fall_below) ), transp=0 )

plot(macd, title="MACD", color=col_macd, transp=0)

plot(signal, title="Signal", color=col_signal, transp=0)

if(macd>signal and macd<0 and close>moving_avg)

strategy.entry("buy",strategy.long)

if(close<moving_avg and macd<signal and macd>0)

strategy.entry("sell",strategy.short)

- The Gaussian Moving Average Trading Strategy

- Adaptive Kaufman Moving Average Trend Following Strategy

- Bandpass Filtering Trend Extraction Strategy

- Dual Reversal High-Low Strategy

- Heyping Moving Average Trend Strategy

- Long and Short Opening Strategy Based on Multi Timeframe Moving Average and MACD

- Momentum Indicator RSI Reversal Trading Strategy

- Double Bollinger Band Breakout Strategy

- Automatic Tracking Trend Strategy Based on T3 and ATR

- ATR Channel Breakout Trend-following Strategy

- Golden Cross Uptrend Tracking Strategy

- Dual EMA Crossover Oscillation Tracking Strategy

- Stiffness Breakthrough Strategy

- Sideways Breakthrough Oscillation Strategy

- Quantitative Trading Strategy Based on RSI Indicator and Engulfing Pattern

- Bollinger Bands ATR Trailing Stop Strategy

- Daily Breakout Strategy

- Signal-to-Noise Moving Average Trading Strategy Based on Quantitative Trading

- Momentum Crossover Moving Average and MACD Filter Heikin-Ashi Candlestick Strategy

- Strategy of Synthesis between Multiple Relative Strength Indicators