Overview

Quant Lights is a combined strategy using the Stochastic indicator and the OTT indicator. The strategy uses the Stochastic indicator to generate buy and sell signals, and combines them with the OTT indicator to filter the signals, trying to catch the big trend and reduce the impact of market fluctuations that cause false signals. This article will evaluate the strategy in detail.

Strategy Principle

The core idea of the strategy is to superimpose the OTT indicator on the Stochastic indicator for signal filtering. The Stochastic indicator compares the price with the highest and lowest prices in the specified time period to judge whether the price is in an extreme area. The OTT indicator uses moving averages and dynamic stops to track trends.

The code sets the high level of Stochastic at 1080 and the low level at 1020. When the Stochastic value is between them, it is a range-bound area. When Stochastic generates buy/sell signals, the code will determine the validity of the signal based on the OTT indicator. If the price crosses above the OTT average line, a buy signal is issued. If the price crosses below the OTT average line, a sell signal is issued.

This combination takes advantage of Stochastic to determine overbought and oversold conditions and generate entry signals, while OTT is responsible for tracking trends and using stops to filter out false signals caused by excessive market fluctuations, thereby optimizing signal accuracy and volatility.

Advantage Analysis

The strategy combines Stochastic and OTT indicators to optimize the following aspects:

- Improved signal accuracy. Stochastic judges overbought and oversold conditions, OTT filters out false signals caused by fluctuating markets.

- Reduced strategy volatility. Limits the current loss through dynamic stops, filtering out many false breakouts.

- Effectively captures major stock trends. Stochastic provides basic signals and OTT tracks major trends.

- Reduces excessive signal interference. Improves signal quality while reducing useless signals.

- Quantifies dynamic stop settings. Qualitatively guarantees the current loss and further reduces strategy volatility.

- System integrates trend and overbought/oversold indicators. Use these 2 types of indicators to optimize each other’s weaknesses.

In summary, by using OTT to filter Stochastic signals, the strategy effectively improves signal quality and investment returns, while reducing the number of transactions and strategy volatility, achieving the effect of low risk, high returns and close tracking of trends.

Risk Analysis

- The scope of application of this strategy is relatively narrow. It is mainly suitable for stocks with obvious trends. It has less impact on stocks with very large price fluctuations or stocks in sideways consolidation.

- Completely relies on technical analysis. The strategy does not consider the fundamentals of the stocks and the macro environment, so there is some blind spot.

- Sensitive parameter settings. Multiple parameters of Stochastic and OTT need professional tuning, otherwise it will affect the profitability of the strategy.

- Stops are too loose. Bearing some potential losses that need further optimization.

- There will be certain losses and signal interference during false breakouts and fluctuating markets. Judgement conditions and stop conditions need to be modified.

Regarding the above risks, the following measures can be taken to improve:

- Use different parameter combinations for different types of stocks.

- Enhance signals by incorporating fundamentals and news.

- Optimize parameters through testing to find the optimal settings.

- Introduce moving stops to further reduce risks.

- Modify judgement conditions and use more rigorous signal confirmation mechanisms.

Optimization Directions

The strategy can be further optimized in the following aspects:

Adjust parameter settings according to different markets and types of stocks. The current default values are universal and can be tested separately for different stocks to find the optimal parameter combinations.

Introduce take profit and moving stop mechanisms. Currently using dynamic fixed stops is unable to dynamically track losses and gains. Testing the introduction of moving stops and take profits for further risk and profit control can be conducted.

Optimize signal judgement logic. The current judgment logic is relatively simple, directly marking buy and sell signals when prices break up or down. More indicators and price patterns can be incorporated to ensure signal reliability.

Increase open position conditions and filtering mechanisms. The current strategy processes every signal indiscriminately. Volume indicators, trading volume indicators and other open position conditions can be introduced, as well as a certain signal time window to filter out false signals.

Test different indicator combinations with OTT. Currently using the Stochastic and OTT combination. Effectiveness of combining other indicators such as MACD and RSI with OTT can be tested.

Integrate capital management and position sizing modules. Currently there are no capital management and position control mechanisms, relying entirely on stops. Different types of capital management and position sizing methods can be tested to further control single and overall risks.

Summary

Quant Lights is a quantitative strategy that organically combines the Stochastic indicator with the OTT indicator. It utilizes the complementary strengths of the two indicators to improve signal accuracy and effectively capture major trends while reducing risks.

The advantages of the strategy include low error rate, clear signals, and small volatility. It enhances signal reliability, optimizes stop levels, reduces trading frequency, and is a recommended quantitative strategy.

At the same time, there is still room for improvement in this strategy. Through parameter optimization, improvement of the stop mechanism, enhancement of signals and filtering mechanisms, etc., the strategy can develop towards a more stable, automated and intelligent direction. This is also the goal of our follow-up work.

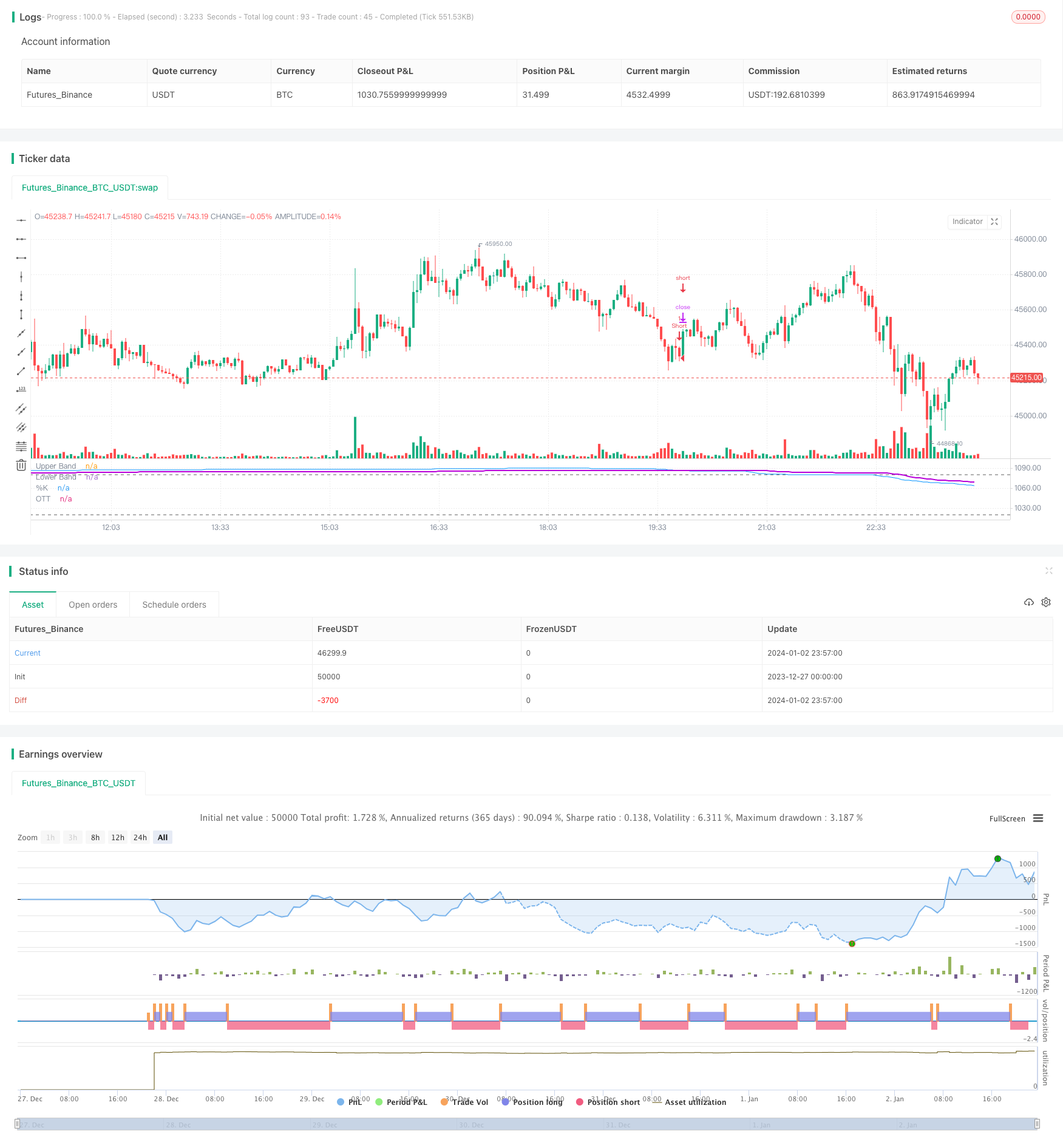

/*backtest

start: 2023-12-27 00:00:00

end: 2024-01-03 00:00:00

period: 3m

basePeriod: 1m

exchanges: [{"eid":"Futures_Binance","currency":"BTC_USDT"}]

*/

//@version=4

// This source code is subject to the terms of the Mozilla Public License 2.0 at https://mozilla.org/MPL/2.0/

// © KivancOzbilgic

//created by: @Anil_Ozeksi

//developer: ANIL ÖZEKŞİ

//author: @kivancozbilgic

strategy(title="Stochastic Optimized Trend Tracker", shorttitle="SOTT", format=format.price, precision=2)

periodK = input(250, title="%K Length", minval=1)

smoothK = input(50, title="%K Smoothing", minval=1)

src1 = input(close, title="Source")

length=input(3, "OTT Period", minval=1)

percent=input(0.618, "OTT Percent", type=input.float, step=0.1, minval=0)

showsupport = input(title="Show Support Line?", type=input.bool, defval=false)

showsignalsc = input(title="Show Stochastic/OTT Crossing Signals?", type=input.bool, defval=false)

Var_Func1(src1,length)=>

valpha1=2/(length+1)

vud11=src1>src1[1] ? src1-src1[1] : 0

vdd11=src1<src1[1] ? src1[1]-src1 : 0

vUD1=sum(vud11,9)

vDD1=sum(vdd11,9)

vCMO1=nz((vUD1-vDD1)/(vUD1+vDD1))

VAR1=0.0

VAR1:=nz(valpha1*abs(vCMO1)*src1)+(1-valpha1*abs(vCMO1))*nz(VAR1[1])

VAR1=Var_Func1(src1,length)

k = Var_Func1(stoch(close, high, low, periodK), smoothK)

src=k+1000

Var_Func(src,length)=>

valpha=2/(length+1)

vud1=src>src[1] ? src-src[1] : 0

vdd1=src<src[1] ? src[1]-src : 0

vUD=sum(vud1,9)

vDD=sum(vdd1,9)

vCMO=nz((vUD-vDD)/(vUD+vDD))

VAR=0.0

VAR:=nz(valpha*abs(vCMO)*src)+(1-valpha*abs(vCMO))*nz(VAR[1])

VAR=Var_Func(src,length)

h0 = hline(1080, "Upper Band", color=#606060)

h1 = hline(1020, "Lower Band", color=#606060)

fill(h0, h1, color=#9915FF, transp=80, title="Background")

plot(k+1000, title="%K", color=#0094FF)

MAvg=Var_Func(src, length)

fark=MAvg*percent*0.01

longStop = MAvg - fark

longStopPrev = nz(longStop[1], longStop)

longStop := MAvg > longStopPrev ? max(longStop, longStopPrev) : longStop

shortStop = MAvg + fark

shortStopPrev = nz(shortStop[1], shortStop)

shortStop := MAvg < shortStopPrev ? min(shortStop, shortStopPrev) : shortStop

dir = 1

dir := nz(dir[1], dir)

dir := dir == -1 and MAvg > shortStopPrev ? 1 : dir == 1 and MAvg < longStopPrev ? -1 : dir

MT = dir==1 ? longStop: shortStop

OTT=MAvg>MT ? MT*(200+percent)/200 : MT*(200-percent)/200

plot(showsupport ? MAvg : na, color=#0585E1, linewidth=2, title="Support Line")

OTTC = #B800D9

pALL=plot(nz(OTT[2]), color=OTTC, linewidth=2, title="OTT", transp=0)

alertcondition(cross(src, OTT[2]), title="Price Cross Alert", message="OTT - Price Crossing!")

alertcondition(crossover(src, OTT[2]), title="Price Crossover Alarm", message="PRICE OVER OTT - BUY SIGNAL!")

alertcondition(crossunder(src, OTT[2]), title="Price Crossunder Alarm", message="PRICE UNDER OTT - SELL SIGNAL!")

buySignalc = crossover(src, OTT[2])

plotshape(buySignalc and showsignalsc ? OTT*0.995 : na, title="Buy", text="Buy", location=location.absolute, style=shape.labelup, size=size.tiny, color=color.green, textcolor=color.white, transp=0)

sellSignallc = crossunder(src, OTT[2])

plotshape(sellSignallc and showsignalsc ? OTT*1.005 : na, title="Sell", text="Sell", location=location.absolute, style=shape.labeldown, size=size.tiny, color=color.red, textcolor=color.white, transp=0)

dummy0 = input(true, title = "=Backtest Inputs=")

FromDay = input(defval = 1, title = "From Day", minval = 1, maxval = 31)

FromMonth = input(defval = 1, title = "From Month", minval = 1, maxval = 12)

FromYear = input(defval = 2005, title = "From Year", minval = 2005)

ToDay = input(defval = 1, title = "To Day", minval = 1, maxval = 31)

ToMonth = input(defval = 1, title = "To Month", minval = 1, maxval = 12)

ToYear = input(defval = 9999, title = "To Year", minval = 2006)

Start = timestamp(FromYear, FromMonth, FromDay, 00, 00)

Finish = timestamp(ToYear, ToMonth, ToDay, 23, 59)

Timerange() =>

time >= Start and time <= Finish ? true : false

if buySignalc

strategy.entry("Long", strategy.long,when=Timerange())

if sellSignallc

strategy.entry("Short", strategy.short,when=Timerange())